Singapore, a thriving city-state known for its impressive skyline and robust economy, has one of the most dynamic and competitive real estate markets in the world. With limited land space and a growing population, property prices in Singapore are influenced by a multitude of factors.

We will explore five key factors that significantly impact the property prices in this vibrant nation.

1. Government Policies and Regulations:

The Singapore government plays an active role in regulating the property market through policies such as cooling measures, land supply, and housing grants. These measures aim to maintain a stable and sustainable property market, ensuring affordability for Singaporeans while preventing speculative activities that could lead to a property bubble.

2. Economic Growth:

Economic growth is a crucial factor affecting property prices in Singapore. A strong economy attracts investments, creates job opportunities, and boosts consumer confidence, which in turn drives demand for properties. Conversely, during an economic downturn, property prices may stagnate or decline due to reduced demand and increased financial constraints on potential buyers.

3. Location and Accessibility:

Location is a significant determinant of property prices in Singapore. Properties situated near MRT stations, reputable schools, shopping malls, and other amenities typically command higher prices. Additionally, accessibility to major highways and proximity to the Central Business District (CBD) also contribute to higher property values.

4. Land Scarcity:

With a land area of just 728.3 square kilometers, Singapore faces a unique challenge in managing its limited land resources. This scarcity of land leads to intense competition for available spaces, driving up property prices. The government’s efforts to optimize land use through urban planning and redevelopment projects further influence the value of properties in different regions.

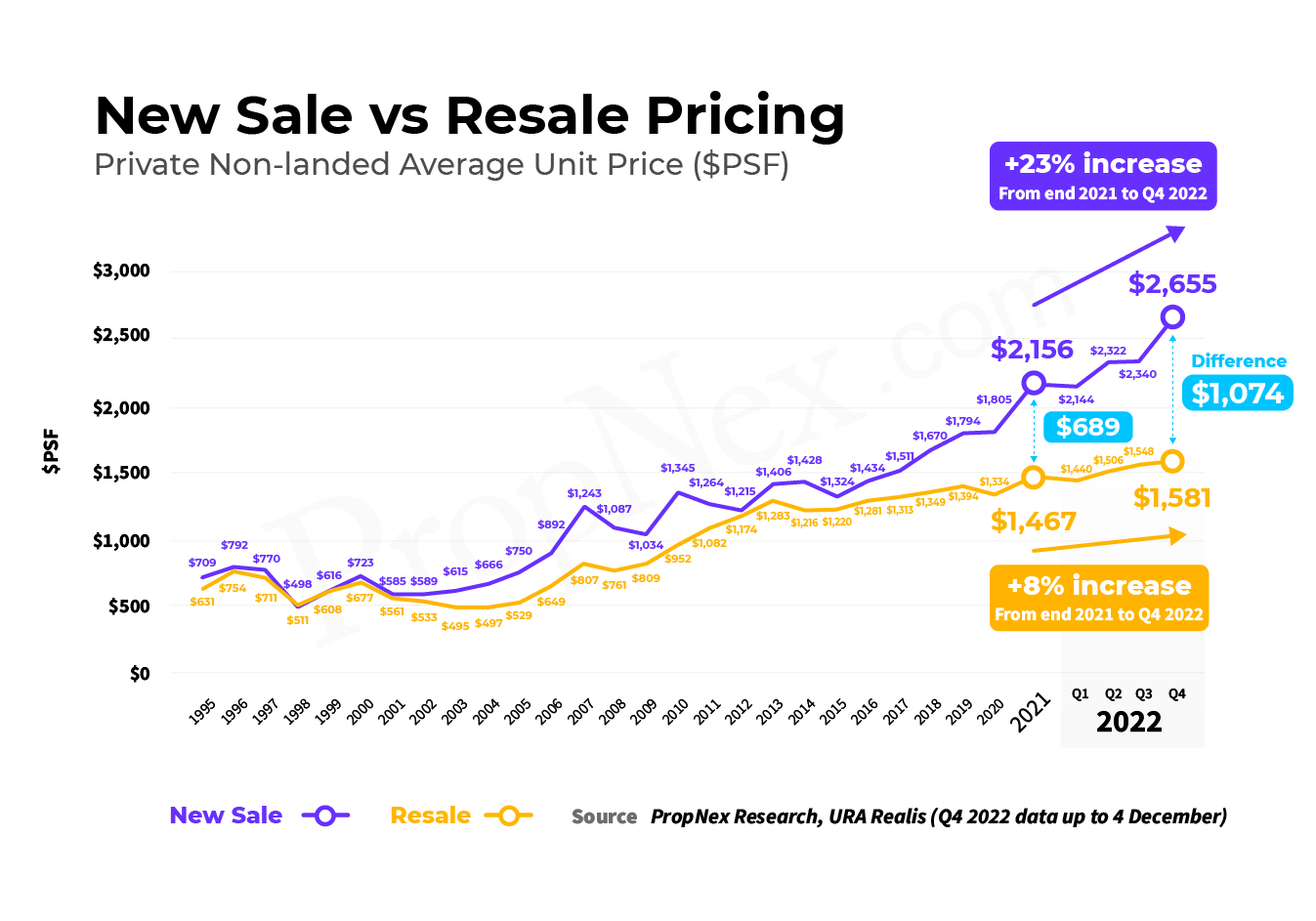

5. Supply and Demand:

The fundamental principle of supply and demand plays a significant role in shaping Singapore’s property prices. An increase in demand for properties, coupled with a limited supply, will result in higher property prices. Factors such as population growth, immigration policies, and investment sentiment can affect the balance between supply and demand in the property market.

In conclusion, Singapore’s property prices are influenced by a complex interplay of factors, including government policies, economic growth, location, land scarcity, and supply-demand dynamics. Understanding these factors is essential for anyone looking to invest or purchase property in Singapore. As the city-state continues to evolve and grow, it will be interesting to observe how these factors shape the future of Singapore’s property market.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …