TLDR

The Singapore property market presents unique characteristics that foreign buyers should consider. From the high rate of homeownership to the different rules for foreign buyers, understanding the specifics is crucial. Investing in prime areas like the Core Central Region (CCR) offers distinct rental landscapes but may also have its drawbacks. Factors such as property tenure, transportation costs, and market trends can impact investment decisions. It’s essential for potential investors to weigh these considerations carefully before making a purchase in Singapore’s real estate market.

It’s no wonder why Singapore property is so often highlighted as a secure asset in a low-tax setting – not to mention its impressive record of continual price growth and superb infrastructure. Yet, it’s crucial for buyers from abroad to be aware of the specifics that make the Singapore property market one-of-a-kind. Take note of the following pointers :

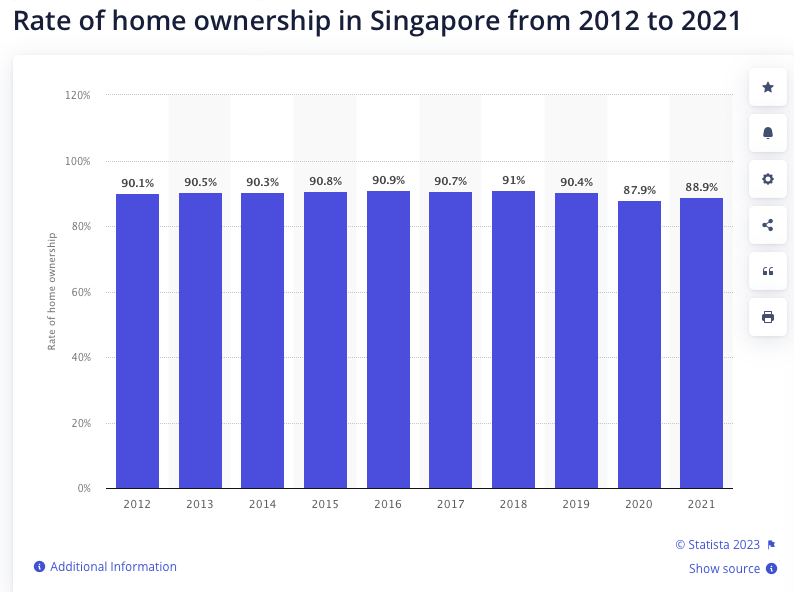

1. In Singapore, Almost Nine Out Of Every Ten People Are Proud Homeowners

Singapore’s real estate rental market relies almost exclusively on foreigners; only a select few Singaporeans involved in temporary rental arrangements. This creates an alternative risk profile compared to other countries, where property owners can benefit from a blend of local and foreign tenants. The stability of the market is then reliant upon government guidelines towards foreign labour.

If levies on foreign labour are increased or quotas tightened, the pool of potential tenants will be significantly reduced compared to markets that can depend on locals for rental income.

2. The ABSD Rate Differs Depending On The Nationality Of Foreign Buyers

If you hold citizenship of the USA, Iceland, Liechtenstein, Norway, or Switzerland, you may be eligible for ABSD remission. You would be treated the same as a Singapore citizen, with no ABSD on your first property and a 17% levy on your second. Taking advantage of a Free Trade Agreement between your country and Singapore could be a great way to save money on your property purchase!

3. Singapore’s Core Central Region (CCR) Offers An Entirely Unique Rental Landscape Compared To The Rest Of The Country

As a foreign investor, a real estate agent will direct you to the Core Central Region (CCR), showcasing some of its most sought-after districts, including:

- District 1 (Boat Quay, Raffles Place)

- District 2 (Anson Road, Shenton Road, Tanjong Pagar)

- District 6 (High Street, City Hall)

- District 9 (Orchard, Cairnhill)

- District 10 (River Valley, Tanglin, Holland Village)

- District 11 (Bukit Timah, Newton)

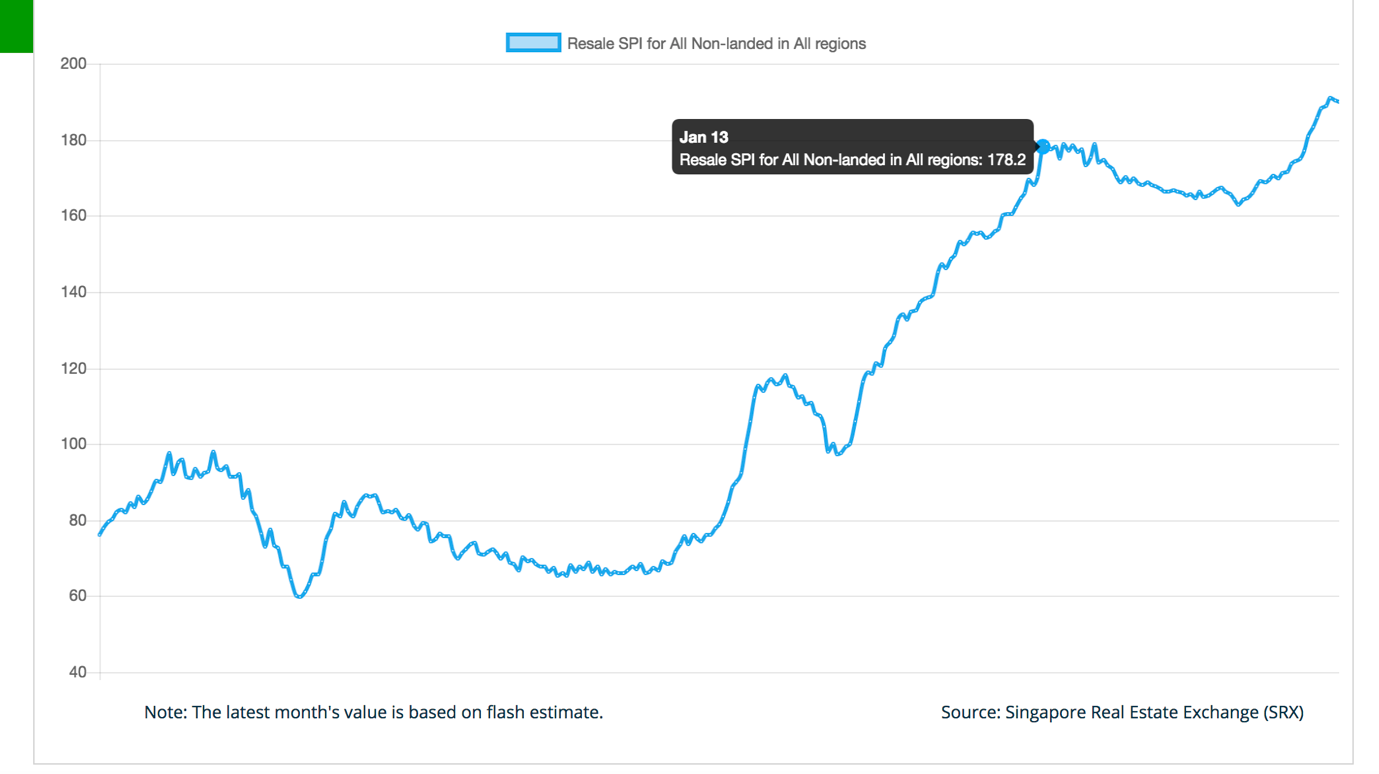

It is important to bear in mind that prime areas in Singapore behave differently from the rest of the market – CCR properties are usually the first to be affected in a downturn.

It is important to note that CCR properties are often rented out on a corporate budget – as businesses scale back and accommodation allowances diminish, renters move to the outskirts. Thus, non-central properties can occasionally outdo their CCR counterparts in downturns.

Furthermore, many CCR properties are small units with a lower price tag yet a higher cost per square foot; this is to attract landlord purchasers. The lower cost and higher rent create seemingly more appealing yields (your net rental yield might be lower because of higher maintenance expenses). However, this too has a downside.

Singapore’s real estate market is largely comprised of upgraders – families who are trading in their HDB flats for condos, or swapping out less luxurious condos for more upscale ones.

Given this large proportion of buyers, one- and two-bedroom units tend to be less desirable. That said, your smaller Central Core Region property may not offer much potential for resale profits, but can still yield a good return in rental income.

4. Investing In Certain “Expat Enclaves” May Not Always Be A Prudent Choice

Holland Village in District 10 provides a compelling case study for how new launches have faced excessive competition. The same can be said for District 15, where you’ll find a plethora of boutique condos on the Katong stretch as well as clusters of condos near Parkway Parade.

If you’re looking to rent out in an area marketed as an expat enclave, be prepared to face fierce competition with existing rental properties in the vicinity.

When it comes to selling, it’s essential to keep in mind that there will likely be just as many rival listings in the future. Additionally, when foreign individuals are forced to return to their homeland due to work or family, they will usually opt to sell the property instead of waiting, despite the potential loss they might experience. Thus, even if it is not an ideal time to sell, they would rather take the plunge to sell.

5. Landlords May Not Find Freehold Properties To Be Their Ideal Choice

Although a freehold or 999-year leasehold property in the Singapore property market may cost 15 to 20% more than a leasehold counterpart, tenants won’t necessarily reap any benefits from this higher price. If the rental rate in the area is $4,500 a month, tenants will likely expect to pay no more than that, whether you own a leasehold condo worth $1.6 million or a freehold condo worth $1.9 million.

Freehold ownership can mean lower rental yields and smaller overall profits if sold quickly, compared to leasehold properties which may yield a higher return. As a foreigner, you may be wary of the idea of “the government taking back the property”, so it’s worth bearing in mind that some agents may exploit this.

It should not be said that freehold is always bad. It can bring an advantage if you plan to keep it for the long term (e.g., 20 years or more or until enblocs offers are made). Furthermore, you will find that many CCR properties are freehold and there may not be a leasehold counterpart nearby.

6. Owning A Car In Singapore Can Be Quite Costly, A Fact Which Can Have A Profound Impact On Singapore’s Real Estate Market

Despite its comprehensive transport network, Singapore is still considered one of the expensive countries to own a car. The government’s reasoning is that cars are not essential in the long run, so real estate agents commonly believe foreign tenants who live in more expensive areas (e.g. near landed housing) are capable of affording private transport or can easily rely on more costly cabs and ride-sharing services.

Rumors suggest that some tenants – even wealthy foreigners – are not fond of the hassle associated with living on Sentosa. The lengthy drives to Vivo City or beyond for necessities such as groceries has led some to swear off the exclusive island altogether, in favor of more convenient locations.

Foreign investors should exercise caution before investing in landed enclaves, as these properties tend to be more distanced from the nation’s public transportation networks. Though a car may be an option for your tenants, there are clear benefits to being close to a train station.

Realtors and locals alike may be prone to placing foreign property buyers into certain categories, which can result in some great options being overlooked. For example, they may think that you are not interested in fringe areas such as Lentor, Changi, or Sengkang – when High Park Residences has proven otherwise with 358 successful transactions and a highest ever of $842,000!

Therefore, don’t limit yourself to just the popular central areas when searching for a property – consider other places too.

Get in touch with me and I’ll show you a whole world of potential! I’m here to also give you detailed reviews of both new and resale properties in Singapore.

You May Also Like …