Selling Tips

Buying Tips

-

1

Property Market: Buyer’s Paradise or Seller’s Dreamland?

Jayson Ang – July 24, 2024 -

2

Is 2024 the Perfect Moment to Refinance Your Home Loan? Discover What Homeowners Should Consider!

Jayson Ang – July 20, 2024 -

3

Market Mistakes in Property Investment: Key Lessons and Strategies for Success

Jayson Ang – July 16, 2024 -

4

Will New Launch Condos See a Drop in Prices Soon?

Jayson Ang – July 12, 2024 -

5

Why Some New Condo Releases Outperform Others

Jayson Ang – July 9, 2024 -

6

5 Exciting Trends Shaping Singapore’s Property Market for Future Buyers After 2024

Jayson Ang – July 5, 2024 -

7

What If Sellers Back Out of a Deal?

Jayson Ang – July 1, 2024 -

8

When to Strike Gold: The Ultimate Guide to Selling Your House in Singapore!

Jayson Ang – June 28, 2024 -

9

Say Goodbye to “Sell One, Buy Two” Approach in 2024

Jayson Ang – June 24, 2024 -

10

3 Exciting Residential Sites Coming Soon!

Jayson Ang – June 20, 2024 -

11

Can You Make the Leap to a Condo Upgrade in 2024?

Jayson Ang – June 12, 2024 -

12

44 Exciting New Condo Launches in 2024 Starting at $1,402!

Jayson Ang – June 4, 2024 -

13

Exciting News: Affordable Housing in Singapore by 2024?

Jayson Ang – May 31, 2024 -

14

6 Hot Property Market Trends in Singapore 2024: What Buyers Should Anticipate

Jayson Ang – May 27, 2024 -

15

Pitfalls of Owning a Boutique Condo: 5 Insider Insights You’ll Wish You Knew Earlier

Jayson Ang – May 19, 2024 -

16

5 Smart Techniques That Resourceful Homebuyers Utilize to Overcome Restrictions on Home Loans

Jayson Ang – May 16, 2024 -

17

Using CPF Funds to Finance Your HDB Flat or Private Property in Singapore: A Comprehensive Guide

Jayson Ang – May 13, 2024 -

18

Craving Dream Homes in the Urban Jungle: The Singaporean Dilemma Unveiled

Jayson Ang – May 10, 2024 -

19

Bayshore: Reinventing the Experience of Living by the Beach

Jayson Ang – May 4, 2024 -

21

Why It’s Not Financially Sensible to Pay Off Your HDB Flat Home Loan in Advance

Jayson Ang – April 29, 2024 -

22

Buying a Mega Development Condo? Here are 5 Overlooked Issues You Should Know

Jayson Ang – April 20, 2024 -

23

Is Lentor Mansion: The 5th New Lentor Condo in 2 Years Still Worth Your Attention?

Jayson Ang – April 17, 2024 -

24

Here’s How Property Data Can Be Misleading: Navigating Through Common Misunderstandings

Jayson Ang – April 14, 2024 -

25

Lessons from the Rollercoaster Ride: Homebuyers Share Their Singapore Housing Market Experiences

Jayson Ang – April 11, 2024 -

27

Your Key to a Happy Retirement in Your HDB? Let’s Unveil The Mystery Behind the Lease Buyback Scheme!

Jayson Ang – March 30, 2024 -

28

Looking To Buy An Older HDB Flat? Here’s What You Need To Know Before You Sign On The Dotted Line!

Jayson Ang – March 27, 2024 -

29

Why The URA Master Plan Matters For Your Property’s Potential

Jayson Ang – March 24, 2024 -

30

It Seems Like Less Folks Living In HDB Flats Are Chasing After The Dream Of Owning A Condo

Jayson Ang – March 21, 2024

-

-

Explore

Reports

Jayson AngOpinion

Jayson AngBuying Tips

Jayson AngSelling Tips

Jayson AngBlog Posts

Jayson AngThe GROW Method

Jayson AngFree Singapore Property Seminars

Jayson AngBlog

Jayson AngTrack Record

Jayson AngExplore

Jayson AngSupport

Jayson AngeBooks

Jayson AngArticles

Jayson AngTestimonials

Jayson AngCase Studies

Jayson AngDaily Posts

Jayson AngResources

Jayson AngConsultation

Jayson AngFor Buyers Sellers

Jayson AngContact Jayson Ang

Jayson Ang10 Reasons To Engage Jayson Ang

Jayson AngAbout Jayson Ang

Jayson AngOpinions

Property Market: Buyer’s Paradise or Seller’s Dreamland?

Jayson AngTLDR The property market in Singapore post-Covid has seen a surge in HDB and private property prices, with a noticeable plateau in resale flat prices. The implementation of Plus and...Market Mistakes in Property Investment: Key Lessons and Strategies for Success

Jayson AngTLDR In property investment, common mistakes include lack of research, overleveraging, and neglecting due diligence. To succeed, conduct thorough market analysis, balance leveraging, and prioritize due diligence to mitigate risks....Will New Launch Condos See a Drop in Prices Soon?

Jayson AngTLDR The real estate market in Singapore is experiencing a trend of lackluster bids for prime properties in various locations. Recent bids for land parcels near Springleaf MRT station and...Why Some New Condo Releases Outperform Others

Jayson AngTLDR When it comes to the real estate market, familiarity plays a crucial role in the success of larger condo projects like Lentor Mansion, compared to smaller boutique condos. Developers...What If Sellers Back Out of a Deal?

Jayson AngTLDR When a seller unexpectedly withdraws from a property transaction before a contract is signed, they are legally allowed to do so. However, once an Option to Purchase (OTP) is...

Advanced Search

Advanced Search

Your search results

Category Archives: Reports

Finding Your Dream Home In The Near Future. Exciting U...

TLDR The real estate sector in 2023 saw significant policy shifts affecting both private and public housing, with various changes like hikes in ABSD rates and tweaks to public housing regulations. In 2024, exciting prospects await with new property launches near MRT stations, mixed-use projects, and developments close to schools and amenities. Whether you seek nature, transport convenience, or educational proximity, there’s something for …

2024 Residential Property Market Outlook

TLDR The market outlook for 2024 suggests continued uncertainties affecting housing demand and risk appetite due to geopolitical tensions, macroeconomic headwinds, and high interest rates. Property cooling measures have slowed price growth, with developers relying more on the local market. HDB resale prices are projected to climb at a more measured pace in 2024. Opportunities in the private residential sector include potential opportunistic buys, …

Is the Dream of Homeownership Becoming a Steeper Climb...

TLDR The article discusses the evolving trends in the Singaporean real estate market, focusing on the affordability and accessibility of different housing options. It highlights the rising prices of private properties compared to public housing, shedding light on the challenges faced by average-income families in purchasing their dream homes. The narrative also delves into the impact of income levels on property ownership, particularly analyzing …

Increase in ABSD April 2023

TLDR The impending rise in ABSD (Additional Buyer’s Stamp Duty) is expected to suppress investment demand, allowing local homebuyers to take center stage. Despite this, the influx of new housing units and upcoming completions will provide relief to the housing and rental markets. First-time residential buyers will find comfort in the unchanged ABSD rates, which accounted for a significant portion of private residential property …

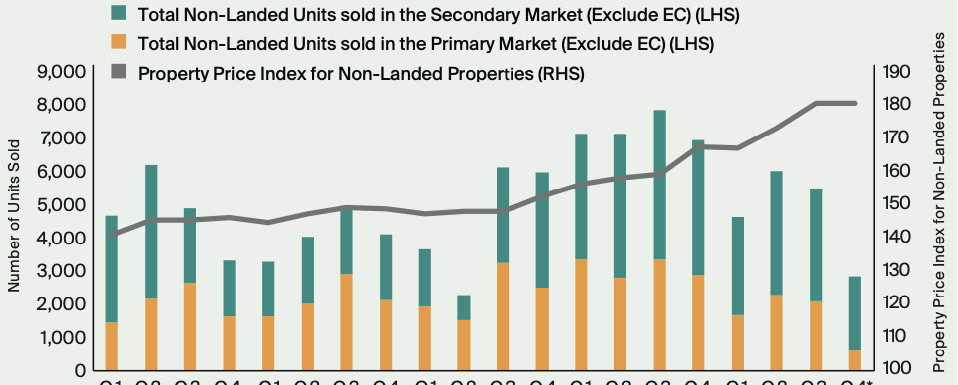

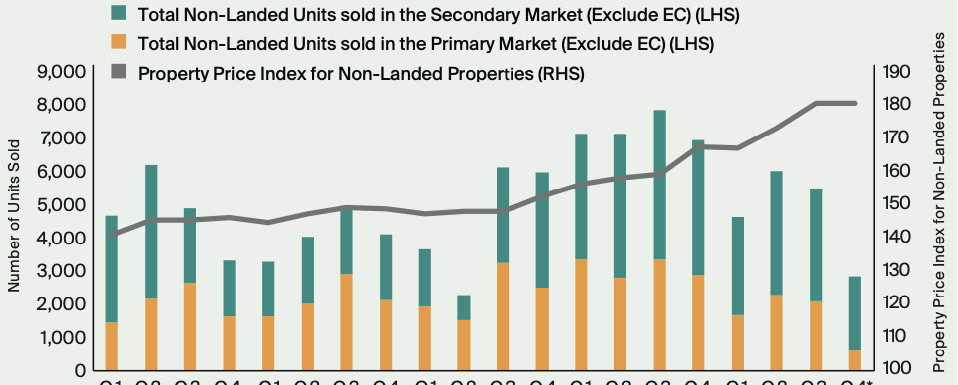

Transaction Volumes Remained Subdued Due To The Dearth...

TLDR The Urban Redevelopment Authority (URA) Flash Estimates for Q4 2022 show a 0.1% increase in non-landed private home prices quarter-on-quarter, with an impressive 8.0% rise year-on-year. The Core Central Region (CCR) saw a 0.5% price increase, while the Rest of Central Region (RCR) experienced a 2.6% boost. The Outside Central Region (OCR) had a notable 9.3% price growth. Despite challenges like revenge travel …