TLDR

The market outlook for 2024 suggests continued uncertainties affecting housing demand and risk appetite due to geopolitical tensions, macroeconomic headwinds, and high interest rates. Property cooling measures have slowed price growth, with developers relying more on the local market. HDB resale prices are projected to climb at a more measured pace in 2024. Opportunities in the private residential sector include potential opportunistic buys, while challenges include keeping prices affordable and policy risks. In the HDB resale market, challenges include a mismatch in price expectations and competition from Build-to-Order projects. It’s advisable to seek strategic real estate advice and leverage market knowledge for successful transactions.

Market Outlook

Much of the uncertainties that raised caution in the market in 2023 are expected to persist into 2024, at least in the first half of the new year. Geopolitical tensions, macroeconomic headwinds, rising costs and high interest rates will continue to influence housing demand and risk appetite. Where interest rates are concerned, there is a likelihood that they may stabilise further, with some observers predicting the US Federal Reserve could start to trim rates from June 2024.

In addition, the Monetary Authority of Singapore has in October 2023 said that the Singapore economy is projected to improve gradually in the second half of 2024, and that Q3 2023 “likely marked the turning point in the slowdown”. Meanwhile, the labour market remains tight and unemployment rate is low which will help to support the housing market.

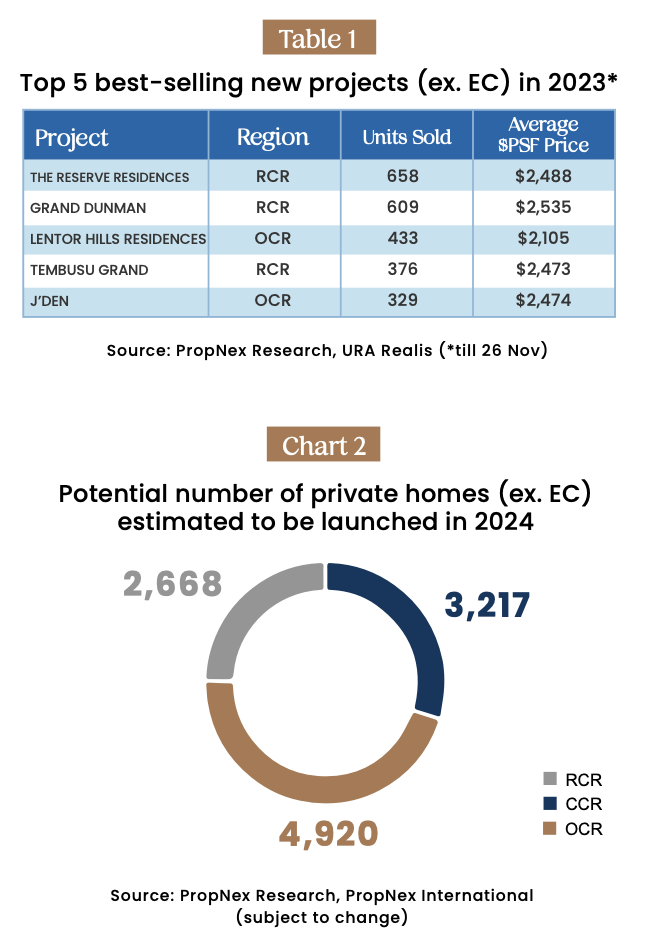

Going by recent primary market sales activity and bids for government land tenders, it appears that the residential property market remains relatively resilient, and that home buyers and developers are generally still confident about prospects in the housing market. In particular, the robust demand for well-located projects such as The Reserve Residences, Watten House, and J’den – suggests that the market still has ample liquidity to be deployed when highly attractive developments become available.

Collectively, three rounds of property cooling measures from December 2021 have helped to slow the momentum of price growth in both the private and public housing segments. In particular, the doubling of the additional buyer’s stamp duty (ABSD) rates on foreigners for home purchase to 60% from end-April 2023 has blunt foreign investment interest. To this end, developers will have to increasingly rely on the local market (Singaporean and Singapore permanent resident buyers) to drive project sales, especially in the Core Central Region which tends to see more foreign demand.

Over in the public housing segment, the effects of the cooling measures in September 2022 and the ramping up of new flat supply via the HDB’s Build-to-Order (BTO) exercises have moderated price growth in the HDB resale market. The HDB has committed to launch up to 100,000 BTO flats between 2021 and 2025, to meet current demand. In 2023, the housing board has launched 22,780 BTO flats.

One of the key things to look out for in the new year is the introduction of the Standard, Plus, and Prime HDB flat classification framework from the second half of 2024. The new framework will better reflect the locational attributes of BTO projects, with Plus and Prime flats – which will be in more attractive locations – being subjected to subsidy recovery, longer minimum occupation period of 10 years, and tighter conditions for resale and rental.

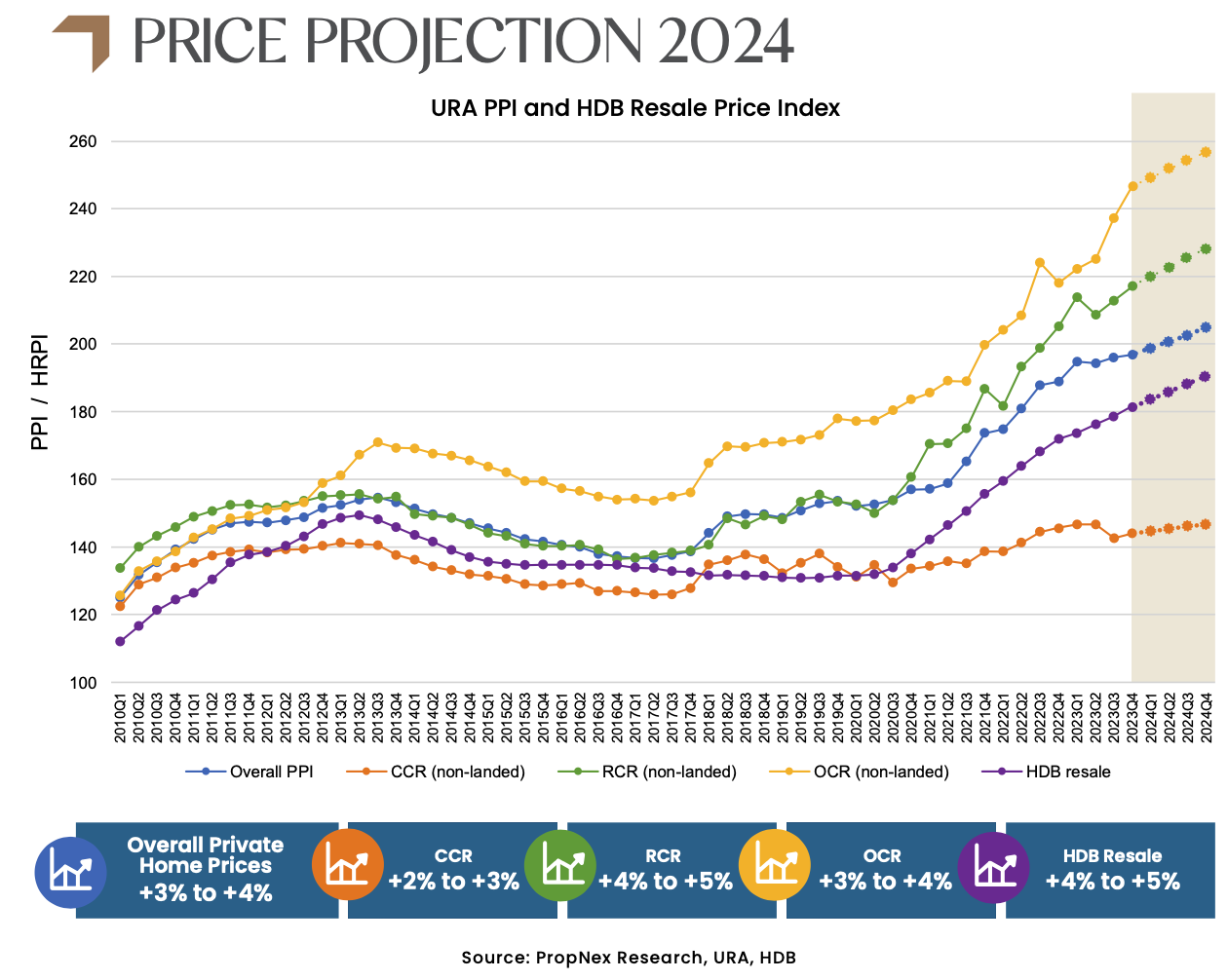

Overview

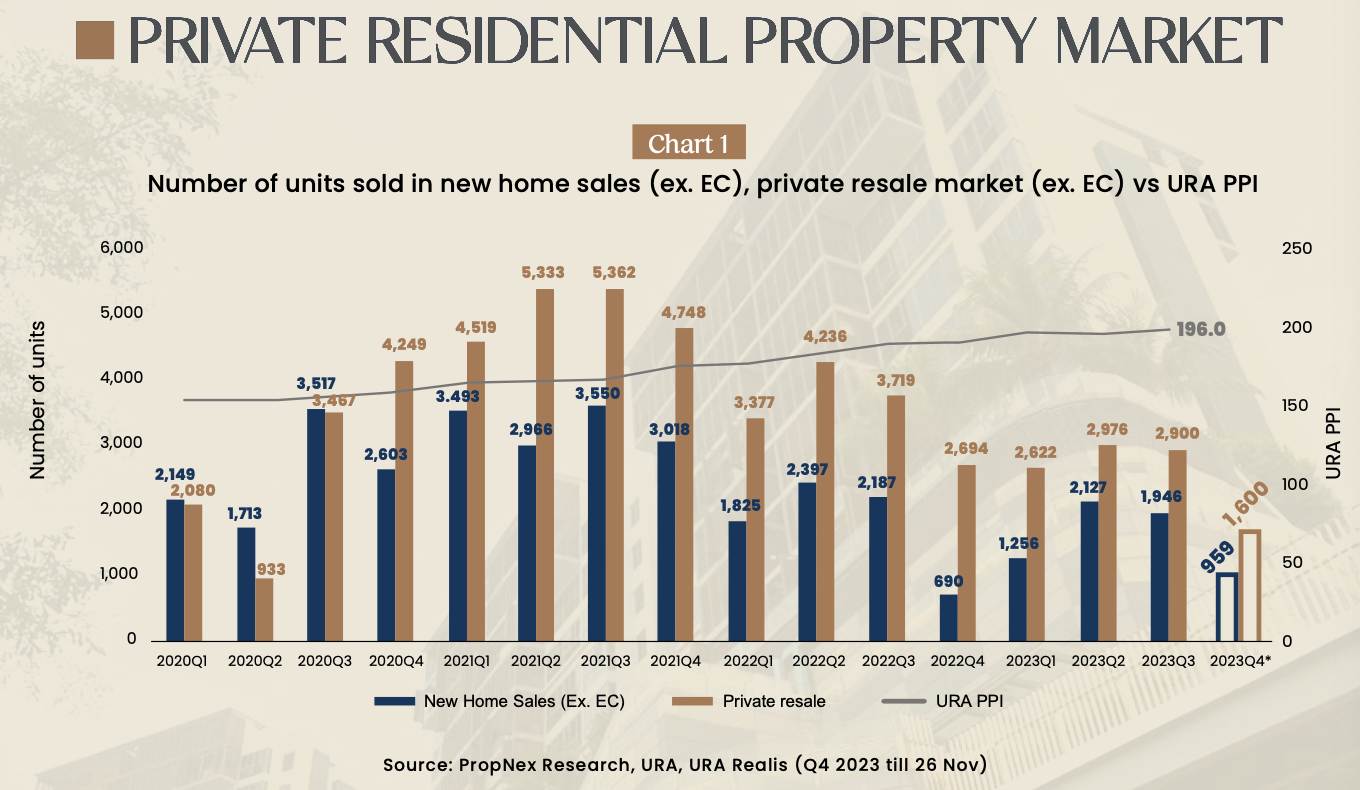

- PropNex projects that overall private home prices could grow by 3% to 4% for the full-year 2024 – slowing from what could be a 4% to 5% price increase in 2023. Firm land prices, rising construc- tion costs, elevated interest rates, and new rules on gross floor area definitions will put upside pressure on prices. As at end of Q3 2023, the URA property price index has risen by a cumulative 3.9% in the first nine months of the year. As prices start to peak and cooling measures bite, the transaction volumes have also moderated in 2023 (see Chart 1).

- Several projects launched in 2023 have set a new benchmark price in their respective planning area/segment. They included J’den (one of the best-sellers in 2023; see Table 1) which fetched an average price of $2,474 psf, TMW Maxwell which transacted new units at an average price of $3,348 psf, and Altura EC, where the average price touched a new high for ECs at $1,474 psf.

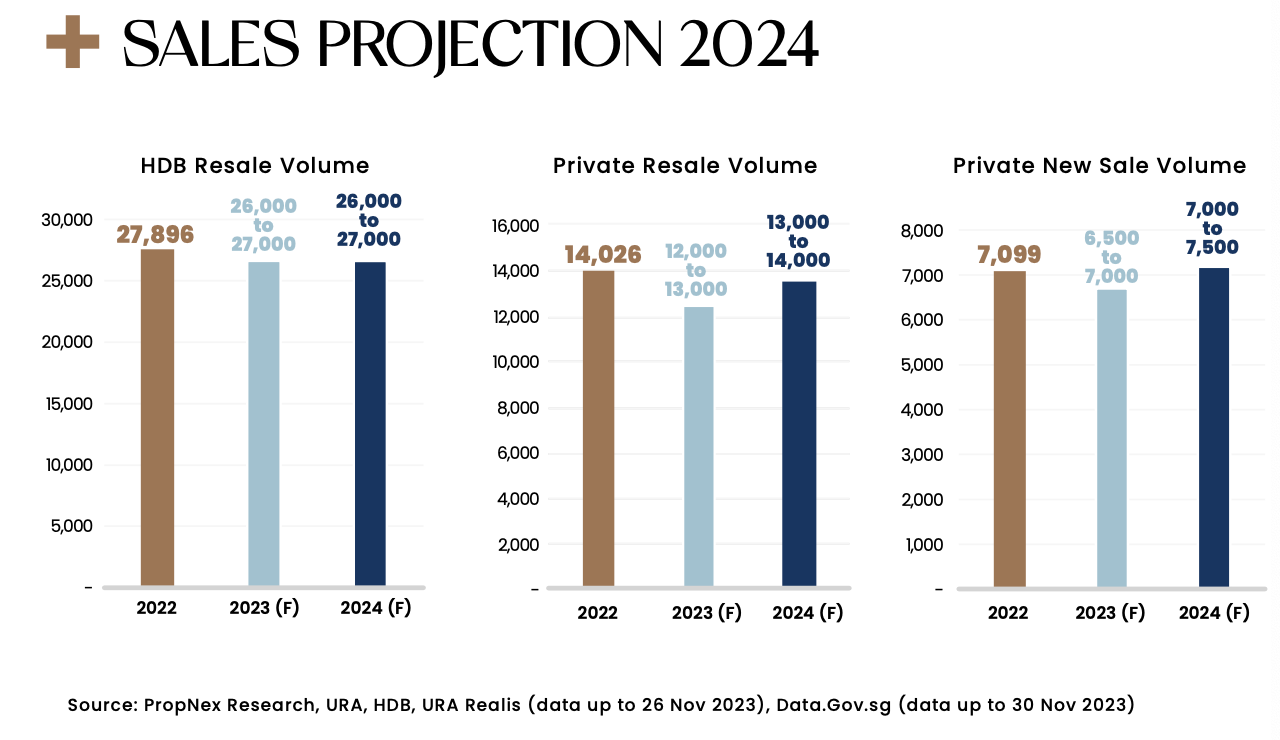

- New private home sales (ex. EC) look set to under- perform the 7,099 units sold in 2022. As at 26 November 2023, developers have sold about 6,290 new units (ex. EC). PropNex expects 6,500 to 7,000 new homes to be transacted in 2023.

- Based on PropNex’s estimates, more than 30 projects (ex. EC) with over 10,000 residential units could potentially hit the market in 2024 (see Chart 2), with the Outside Central Region (OCR) accounting for nearly 46% of the supply.

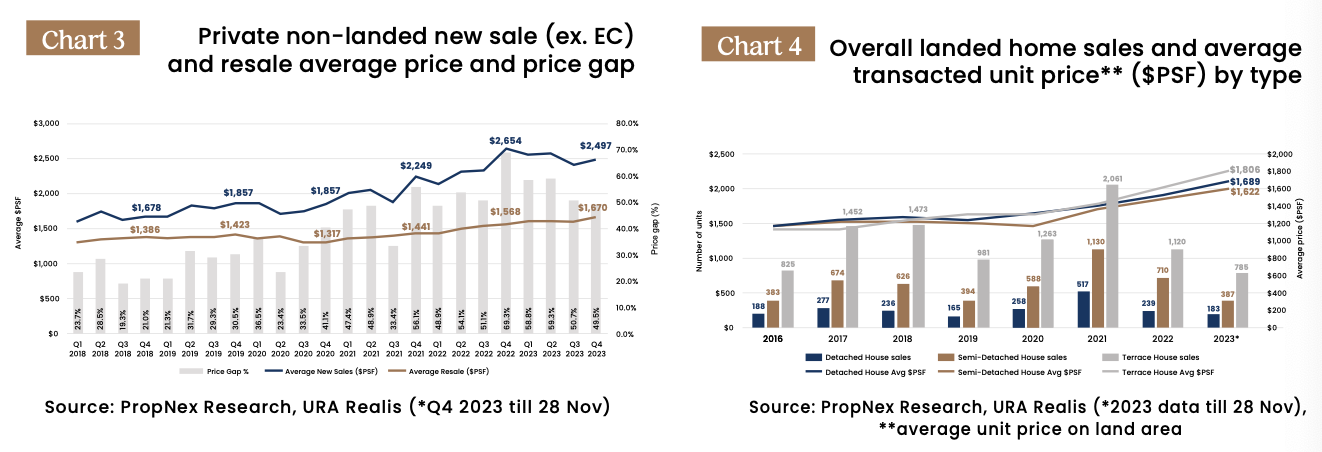

- In 2024, PropNex anticipates home sales to remain relatively stable with developers’ sales coming in at around 7,000 to 7,500 units (ex. EC), while the number of private homes resold may range from 13,000 to 14,000. The demand for resale properties is expected to remain stable amid their more affordable prices compared with new launches, with the average price gap at nearly 50% in Q4 2023 (see Chart 3).

- On landed homes specifically, PropNex expects this segment to continue to experience slower sales due to the modest economic outlook and uncertainties in the market. However, landed home prices are still projected to be resilient in the near-term, as owners of such properties have substantial financial holding power and are not in a hurry to sell. Transactions of landed homes have been tepid in 2023, but the average unit prices on land area have generally held up in view of the scarce supply of such properties in Singapore (see Chart 4). The ABSD rate hikes for foreigners and investors are not likely to impact the landed homes market severely as these houses are predominantly purchased by Singaporeans and usually for own-stay.

HDB Resale Market

The HDB resale market continued to power on in 2023, albeit losing some momentum from the prior two years. The HDB resale price index climbed by 1.3% QOQ (178.5 pts) in Q3 2023 and has reached a new peak (Chart 5). Overall HDB resale prices grew by a cumulative 3.8% in the first nine months of 2023, with PropNex projecting the full-year price growth to come in at around 5% in 2023. The price increase came amid a slight moderation transaction volume, as the ramping up of BTO supply could have funnelled some demand from the resale market.

In 2024, PropNex expects HDB resale prices toclimb at a more measured pace of 4% to 5% – inwhat could be the slowest year of price increasesince 2020 where resale prices rose by 5%, and 2021and 2022 where resale values surged by 12.7% and10.4% respectively.

Meanwhile, HDB resale volume could hover at around 26,000 to 27,000 units in 2024 – relatively on par with the sales in recent years. With the significant increase in BTO flat supply, elevated resale prices, and effects of the September 2021 cooling measures, it could be sometime before the market repeat the feat of the robust sales seen in 2021, where more than 31,000 flats were resold.

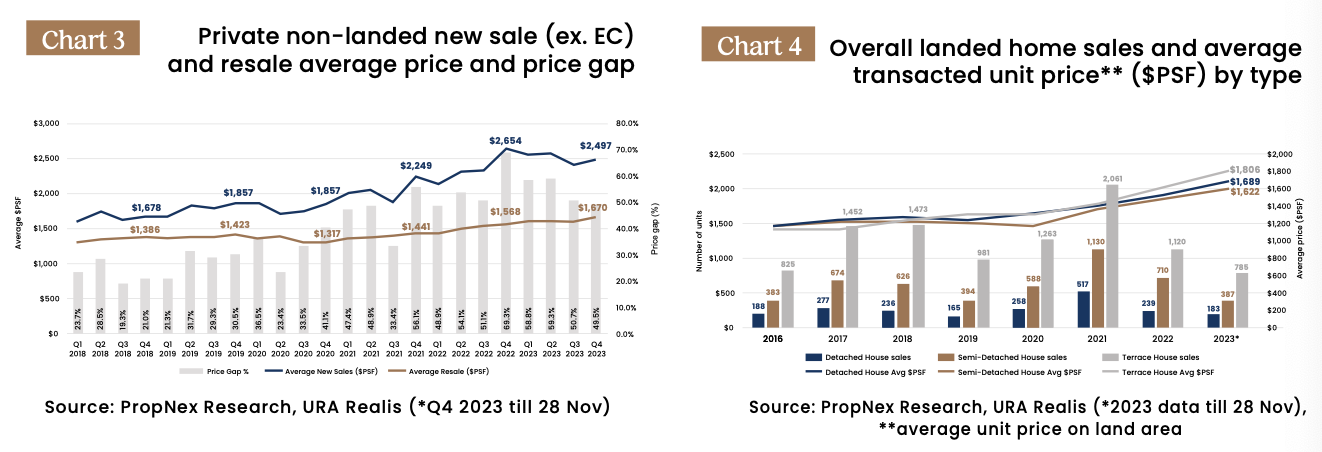

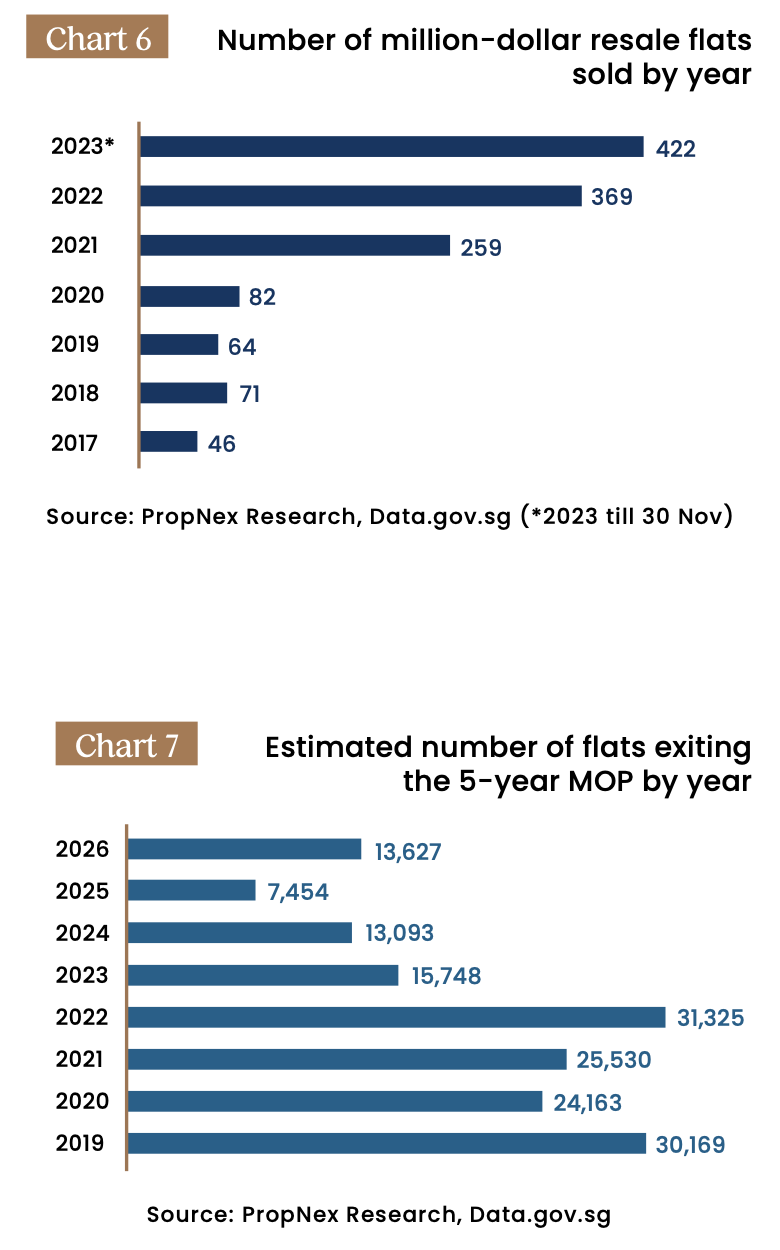

The number of resale flats resold for at least $1 million came in at 422 units as at 30 November 2023 (see Chart 6) – already 14% higher than the record 369 units transacted in the whole of 2022.

PropNex expects the number of million-dollar HDB flat transactions should remain elevated in 2024, as many buyers perceive these units which are frequently bestowed with desirable and unique attributes to offer bang for the buck, in view of the pricey private homes in the same location.

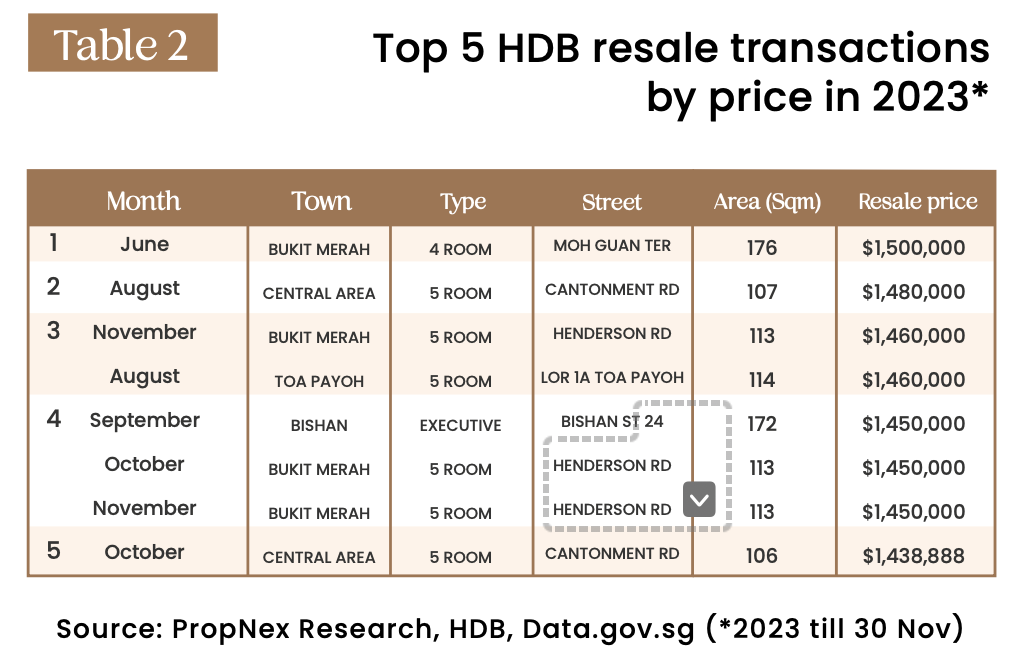

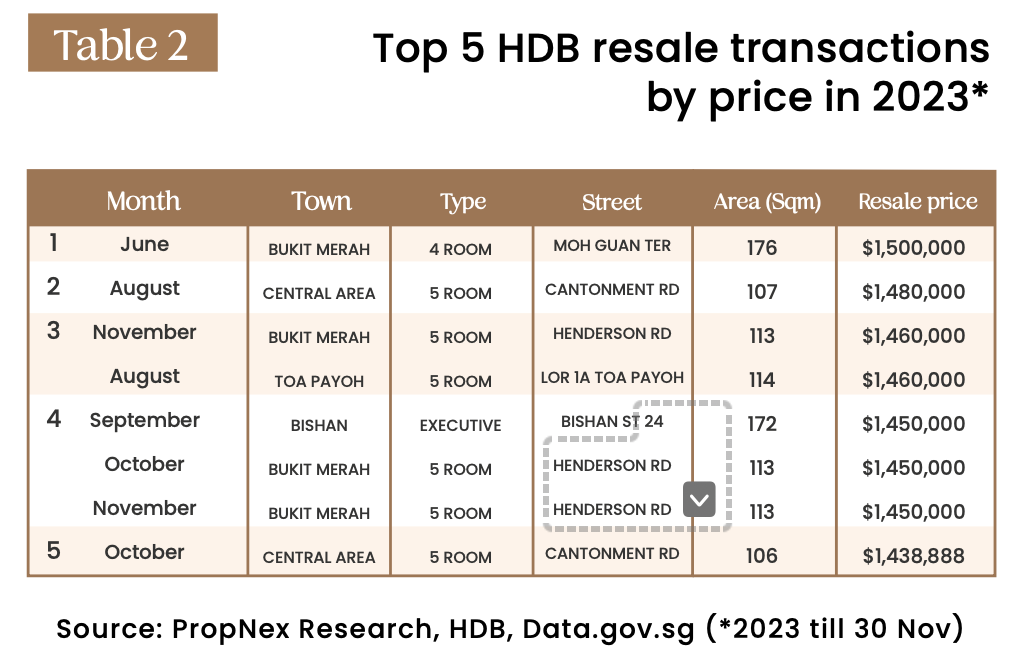

Apart from rewriting the transaction volume of million-dollar resale flats, the prices of such flats also continued to move up. In June 2023, a large 176-sq m adjoined flat in Moh Guan Terrace in Bukit Merah became the most expensive resale flat ever transacted when it was sold for $1.5 million (see Table 2).

By flat type, 4-room resale flats led average price growth in Q3 2023 – rising by 1.8% over the previous quarter. This was followed by executive flats and 2-room flats (see Table 3). Meanwhile, the average resale price of 3-room flats crossed the $400,000-mark in Q1 2023 and has stayed above that level since.

Based on completion status of HDB projects, PropNex estimates that 13,093 HDB flats (see Chart 7) could potentially exit their respective 5-year minimum occupation period (MOP) in 2024, with Sembawang, Sengkang, Tampines, and Toa Payoh accounting for about 61% of the total. With fewer flats slated to exit the 5-year MOP in 2024, this could impact the resale stock available on the market. However, this could be supplemented by HDB upgraders who are seeking to sell their flats upon receiving keys to their newly completed homes.

From the second half of 2024, new flats will be classified under a new “Standard, Plus, and Prime” framework, with the latter two categories subject- ed to a longer MOP and stricter resale/rental con- ditions. While the new framework will not affect existing flats, it is possible that some prospective buyers could be put off by the tighter restrictions for the Plus and Prime flats in choice locations (such as near town centres and the MRT station), and may decide to purchase resale flats nearby – this could then push up resale prices, depending on the lease balance and condition of the resale units.

At a Glance : 2024 Opportunities & Challenges

Private Residential

Opportunities

- Potential opportunistic buys in the CCR as ABSD weighs on foreign demand

- An estimated more than 30 new projects with over 10,000 units (ex. EC) may be launched for sale, presenting more options for buyers and investors

- Developers likely to price sensitively to get a good head start to project sales

- Resale market for value buys and more affordable homes

Challenges

- Keeping prices within affordability threshold of buyers, with new launches hitting benchmark prices in past years

- Interest rates expected to remain high, at least in first half of 2024

- Macroeconomic uncertainties and the impact on market sentiment

- Policy risks should the government decide to intervene with new measures

HDB Resale

Opportunities

- Potential increase in demand for larger flats from former private home owners who have served the 15-month wait out period after selling their private home

- HDB upgraders looking to sell their HDB flats expeditiously after collecting keys to their new private home

- Home buyers may opt to buy resale flats in choice locations rather than be subjected to stricter conditions for the new Plus and Prime flats (from 2H 2024)

Challenges

- Mismatch in price expectations between buyers and sellers slowing sales

- Attractive Build-to-Order (BTO) projects may channel some demand away from HDB resale market

- Fewer HDB flats estimated to exit their 5-year MOP in 2024 compared with prior years – may limit resale options for those looking at buying newer flats

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …