TLDR

When deciding to sell your house in Singapore’s competitive real estate market, timing is crucial. Selling during a seller’s market can lead to higher profits due to high demand and low supply. However, factors like needing to buy a replacement home or recent refinancing should be considered. Ultimately, the best time to sell depends on your specific motivations, whether financial reasons, changes in family lifestyle, or stagnant property prices. Understanding your goals and the market conditions will help you make the most of your property sale.

Deciding when to put your house on the market can be a tricky decision, particularly in today’s highly competitive real estate landscape where home prices are reaching record levels, but with interest rates rising and warning signs of a looming economic slowdown.

Can You Really Time The Market When It Comes To Selling Your House?

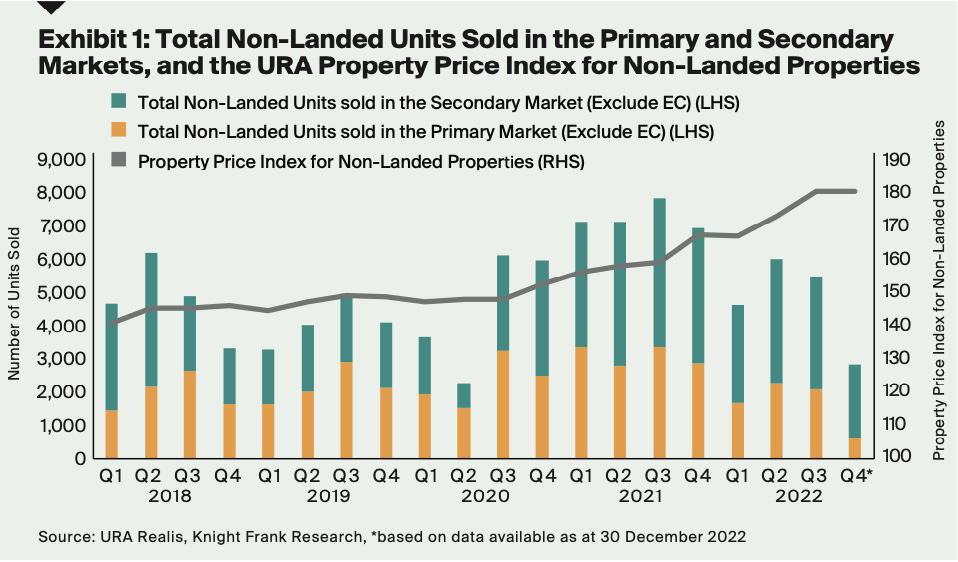

No one could have anticipated that after the COVID-19 pandemic hit, housing prices would reach a peak like never before. It is notoriously difficult to predict the direction of price movement when it comes to buying or selling a house, even with transaction data. What is documented is merely a snapshot of the past, a moment in time which has already passed. Thus, the real challenge is gauging when prices will hit an all-time low or soar to unprecedented heights.

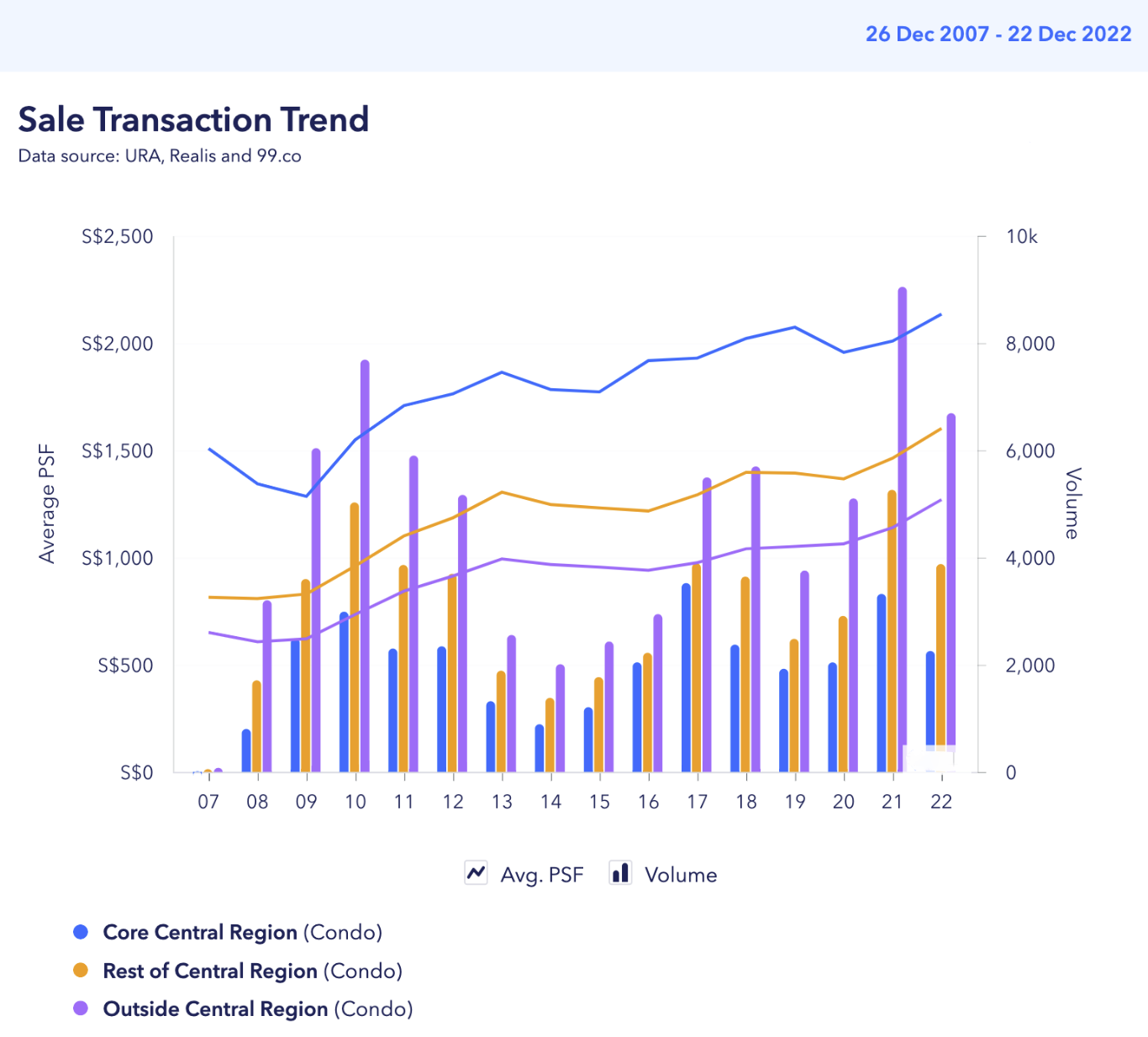

With condo resale prices reaching record levels and having climbed for 28 straight months, now may be the time to consider cashing out of your condo unit.

By 22 December 2022, the average psf price of a resale condo in the Core Central Region (CCR) stands at S$2,135, the Rest of Central Region (RCR) at S$1,601, and the Outside Central Region (OCR) at S$1,269.

Considering the current seller’s market, it could be a savvy move to sell your house now, as you have the chance to reap the benefits of higher prices and greater profit. On the other hand, if your house is an investment, holding off may bring even bigger returns in the long run. Ultimately, it all depends on what you want to gain from the sale of your home.

Why It’s Good To Sell Your House During A Seller’s Market

When supply is low and demand is high, a seller’s market emerges, and people are willing to fork out higher prices for what’s available.

1. You Could Possibly Fetch More Than Your Listed Price

Given the high demand and low supply of houses, you can maximise your sale price and profits by making your property stand out. With an abundance of buyers in the market, you can potentially sell higher than your asking price if your home is highly desirable and competitive. With the right marketing and showcasing, you can create a bidding war and attract multiple offers, allowing you to leverage the best deal possible.

2. You Can Unlock The Gains Faster

If you list your property during a seller’s market, you have a great chance of quickly selling it – even if it has a few undesirable features, such as being close to a rubbish chute or on a lower floor. This could allow you to capitalise on your gains even sooner!

When It’s Not Good To Sell Your House During A Seller’s Market

In a seller’s market, selling your house may be very tempting; however, you should always remain mindful of the next phase of your homeownership adventure.

1. You Need To Buy A Replacement Home

If you’re planning to sell your only home but don’t want to move in with your family or rent, you may need to purchase a replacement. Unfortunately, in a seller’s market, you might have to pay a hefty price for it. Before committing to buying the next home, make sure you can afford it, even if you have the sale proceeds and a home loan. Otherwise, it might be wise to put off the home-selling plan.

2. You Recently Refinanced Your Home Loan

If you refinance your home loan, you’re usually locked in for two to three years; selling your property during this time will incur an early redemption penalty, thus diminishing any potential profit.

Nevertheless, The Best Time To Sell Depends On The Motivation You’re Selling

Don’t be tempted to sell your house just because it’s a seller’s market and all your neighbours are unloading theirs; the best time to sell your house depends entirely on your reasons for doing so.

1. You’re Selling It For Financial Reasons

If you find yourself needing to sell your house due to financial difficulties, you may be struggling to make ends meet, or perhaps interest rates have risen, leaving you wanting to lighten your debt burden and downsize to a more affordable residence. Or, maybe it’s time for a change and you’re in the market for something newer that doesn’t require all the upkeep your current house needs. Whatever the reason, it’s best to sell the house quickly so you don’t miss out on the best possible price.

2. There Are Changes In Your Family Lifestyle That Require You To Change House

Maybe you’ve added another addition to your family, or your two children no longer want to share a room, but your current home is too small for this. Or, maybe your house has stairs and you’re already fed up with climbing them up and down. Selling your current house for the funds needed to buy a new one seems like a sensible solution, yet you’d rather put up with the issues than wait for prices to rise before taking the plunge.

3. Your Property Price Have Been Stagnating For The Longest Time

The location of this house might be ideal, but unfortunately, the price has been stagnant for quite some time and there’s no indication of any imminent developments in the vicinity that could lead to any substantial increase in the value. Perhaps it’s time to put this property on the market and invest the funds in a more profitable asset, such as a property near an upcoming transformations.

You May Also Like …