TLDR: Understanding the HDB Market Outlook 2023

The HDB resale market showed resilience in 2022, with significant growth in sales and prices driven by factors like economic recovery and delays in new BTO flat completions. Despite cooling measures, prices are expected to remain relatively stable in 2023, with a forecasted growth rate of 6 to 8%. Demand will be supported by housing grants for first-time buyers. Additionally, million-dollar HDB resale transactions are on the rise, particularly in prime locations. The market is expected to see continued activity with fewer MOP flats entering the market compared to 2022.

Overview

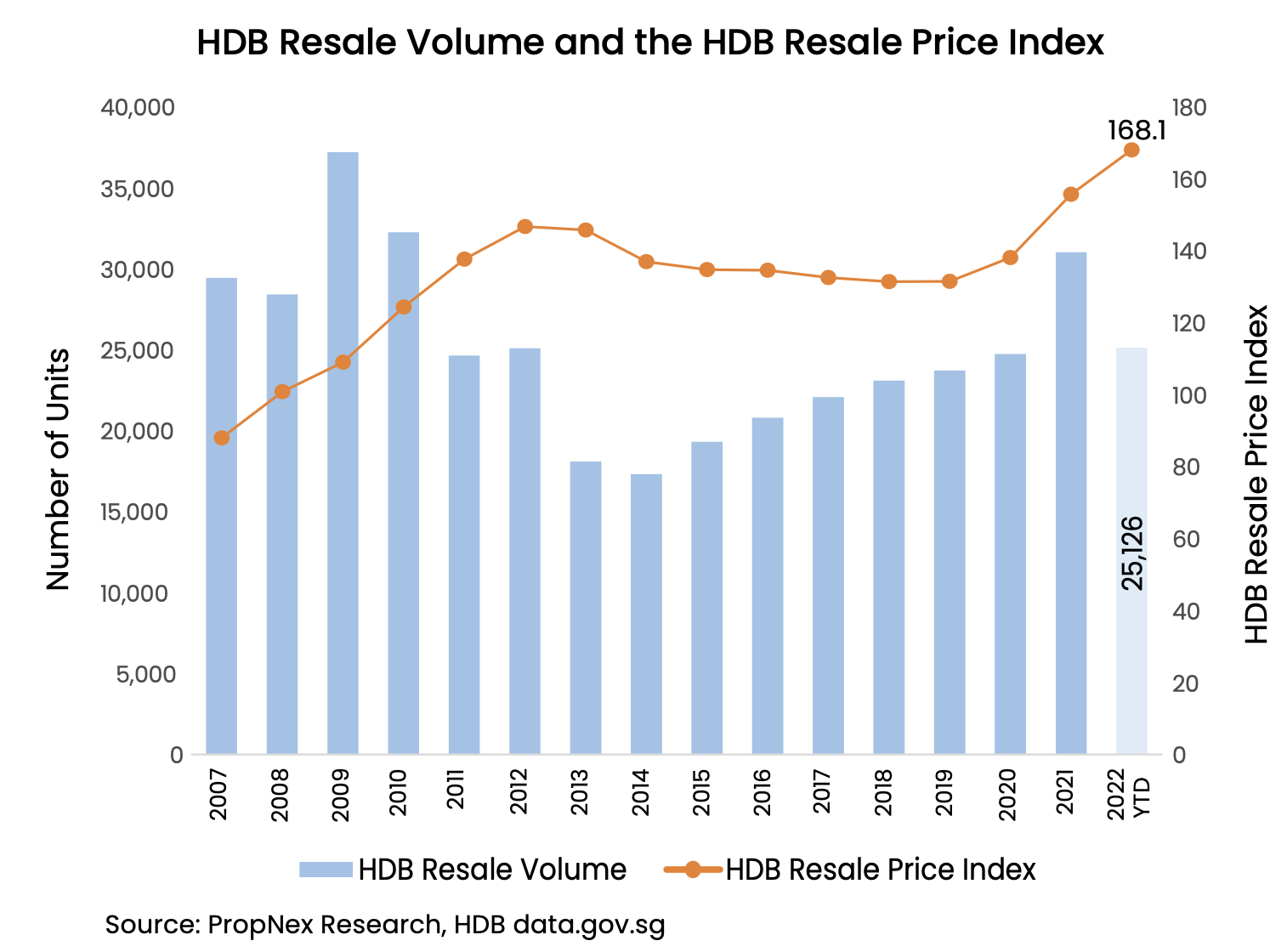

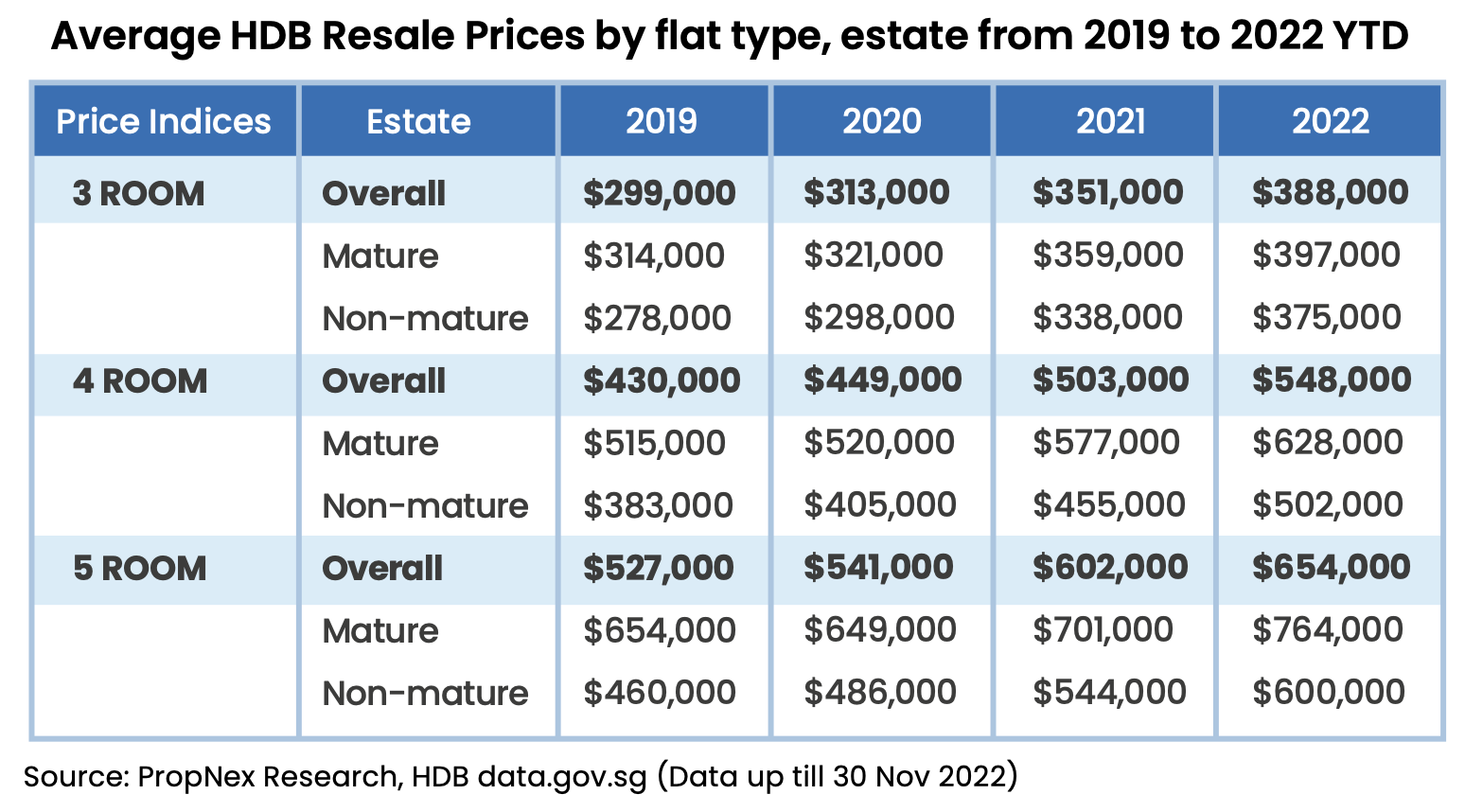

The HDB resale market remained resilient in 2022, with more than 24,000 units resold in the first 11 months of 2022. Meanwhile, HDB resale prices are expected to post another year of double-digit growth.

The economic recovery, delays in the completion of new BTO flats, and a large supply of flats exiting the minimum occupation period (MOP) were all factors that have contributed to driving sales and price growth in 2022.

HDB Resale Market Outlook

- Despite the recent cooling measures – aimed at encouraging home buyers to be more prudent with property purchase amid high interest rates – HDB resale prices are not likely to see a significant downward correction, as the tight resale stock and stable demand will help to keep prices relatively steady. PropNex projects HDB resale prices could rise by 9% to 10% for the whole of 2022, slowing from the 12.7% growth in 2021.

- The temporary 15-month wait-out period intro- duced as part of the latest cooling measures will moderate demand for larger flats, especially flats in prime locations. For first-timer buyers, this helps to level the playing field by easing demand from private home downgraders, who tend to have a greater financial ability to pay a higher price for resale flats.

- In 2023, HDB resale prices may grow at a slower pace following two years of robust performance. Together with the cooling measures and some price resistance setting in, this may slow the pace of the overall price increase. PropNex forecasts that HDB resale prices may grow by 6 to 8% in 2023.

- With fewer MOP flats entering the market in 2023 compared to 2022, the available stock for resale could remain tight. PropNex expects the HDB resale volume to come in at around 27,000 to 28,000 flats in 2023. Demand will continue to be driven by those with more pressing housing need as well as families who do not wish to wait 3-5 years to get a BTO flat. Notably, eligible first-time buyers can also receive up to $160,000 in housing grants from the government, making HDB resale units attractive to Singaporean households.

Transactions and Prices

- An estimated 31,325 flats have completed their 5-year MOP in 2022, possibly injecting fresh supply of units to the resale/rental market. In 2023, about 15,700 HDB flats are likely to attain MOP – substantially lower than the MOP stock in 2022.

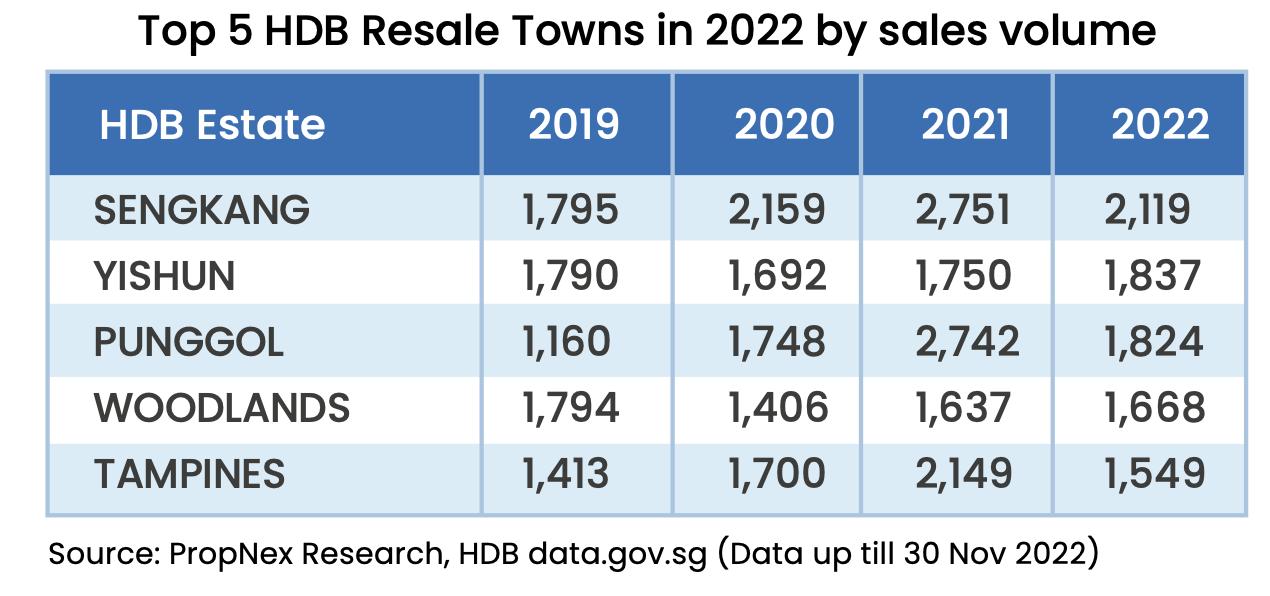

- The HDB estates that clocked the most resale trans- actions in 2022 were in non-mature towns such as Sengkang, Yishun, and Punggol – more than 2,100 flats in Sengkang were resold in the first 11 months of the year – being popular among home buyers due to their more affordable pricing and a wider selection of units.

Million Dollar HDB Resale Transactions

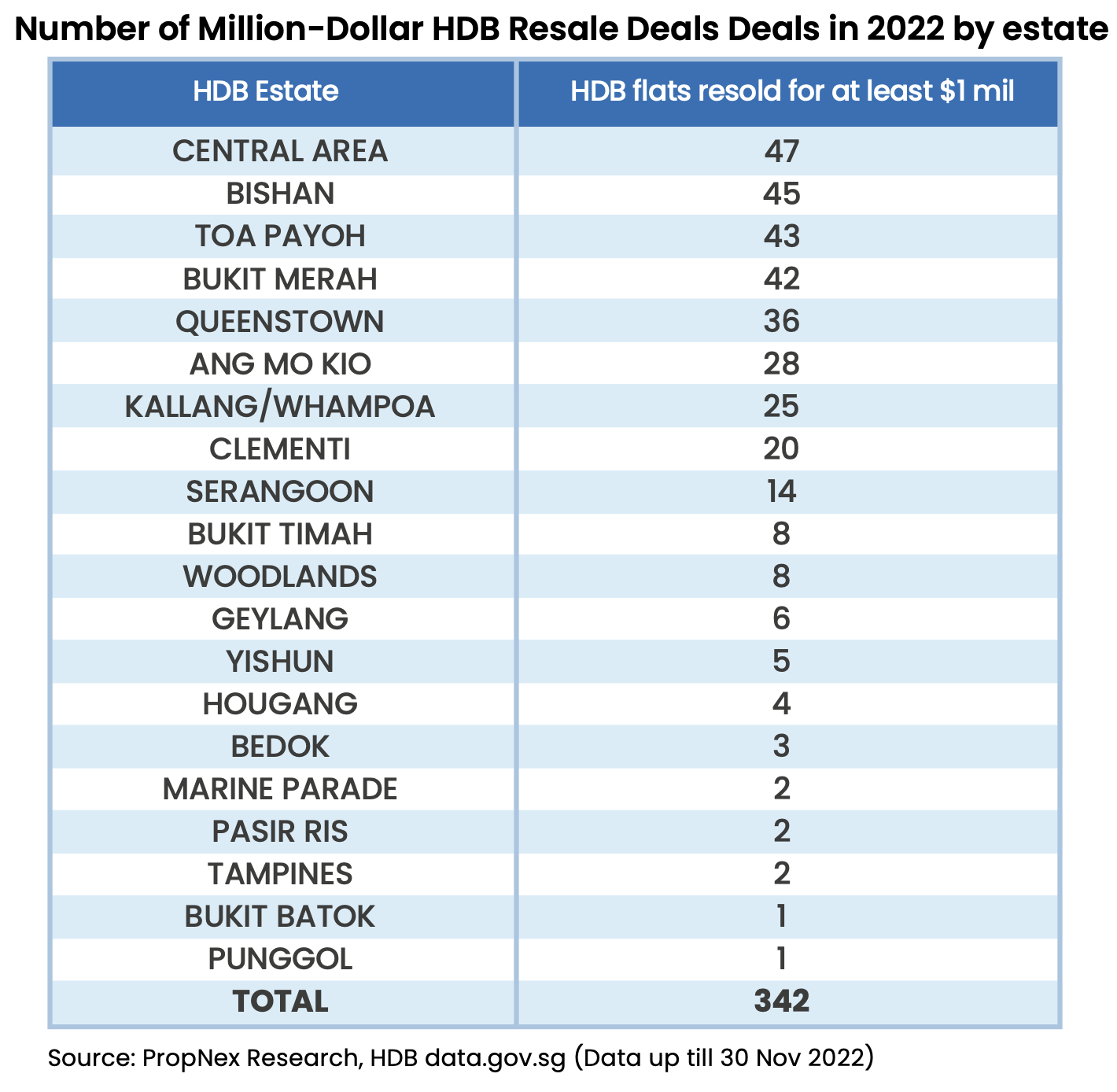

- In the first 11 months of 2022, more than 340 HDB flats were resold for at least $1 million – already surpass- ing the record 259 deals done in the whole of 2021.

- Most of these million-dollar flats are either located in prime mature estates or have fairly large floor areas which contributed to their hefty price tags. The HDB towns of Central Area, Bishan, Toa Payoh and Bukit Merah had the highest number of million-dollar resale flat deals in 2022. The most expensive resale flat sold in 2022 was a 5-room flat at SkyTerrace @ Dawson that went for $1.418 million in July.

Wondering What Move To Make In The Real Estate Market?

Whether it’s time to buy or sell, or if it’s best to wait, the decision can be confusing.

Keep in mind that everyone’s situation is different, and it’s important to consider your own unique circumstances before making a decision.

But don’t worry – my data-driven approach and years of on-the-ground experience will help provide clarity to you.

Whether you’re a first-time homebuyer or an experienced investor, we will take a systematic and goal-oriented approach to ensure you make the right decision.

I can help you by :

- Providing Strategic Property Advice – will ensure you have the right plan to guide you in your property journey.

- Finding the ideal buyers for your home – use of high quality photography, excellent response rate, and a deep knowledge of buyers gives us the edge to showcase your property in the best way possible, helping you meet your goals.

You May Also Like …