TLDR

Luxury freehold properties in Singapore may not always be the lucrative investment opportunities they appear to be. High-end properties are often bought for personal use rather than investment purposes, leading to potential losses when sold. Factors such as limited buyer pool, location constraints, market fluctuations, and evolving buyer preferences contribute to these properties selling below their expected value. Despite challenges, properties with unique features and strong appeal can still attract buyers in the luxury market. Buyers and sellers should consider individual circumstances and market conditions before making real estate decisions.

Guess what? If you’re a newcomer to Singapore’s property market, you may find this surprising. Those top-tier, freehold luxury properties might not be the golden investment opportunity you thought they were. Sure, they’re seen as the best of the best, but if you chat with some seasoned real estate pros, you’ll often hear that they’re not quite as optimistic about these homes. Now, don’t get me wrong, there are a few that do deliver big returns. Yet, there are also those usual suspects that keep popping up again and again. Let’s dive into why this seems to be the case.

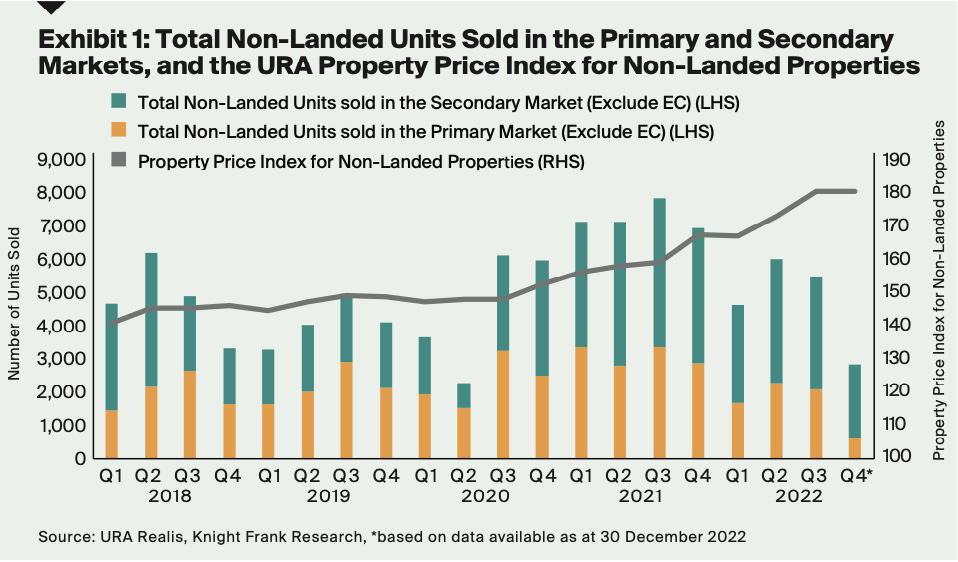

Freehold Properties over the past 10 years

Believe it or not, even the best condos in fancy areas like Orchard and Marine Parade aren’t immune to losses. Take a peek at the past decade’s stats, and you’ll see some big names on the loss list. Famous spots like Ardmore Park reported a whopping $1.5 million loss, while the renowned St. Regis Residences suffered a $600,000 loss.

The buyers of these posh units are usually pretty loaded, right? So, why would they sell at a loss when they’ve got the bucks to hold onto them without batting an eyelid? It begs the question, why do these luxury properties often register considerable losses?

Judging from the whispers on the street and the trends we’ve noticed in their price shifts, let’s hazard a guess:

So, what makes these swanky freehold luxury condos sell for less than their worth?

- Maybe they weren’t bought as investment pieces to begin with

- Not many folks out there who can afford such places

- Being first off the block doesn’t always work in posh areas

- “Forever yours” doesn’t pack the same punch when everyone else is saying it

- Any hiccups in the market hit them first

- Wealthy buyers usually have eyes for newer, trendier luxury properties

1. Maybe They Weren’t Bought As Investment Pieces To Begin With

Most real estate agents we chatted with shared the same insight: a lot of high-end properties are bought to live in, not just as investments. Imagine it this way, one agent compared swanky freehold condos and HDB resale flats and found something they have in common:

“Would you shell out more than a million bucks for a flat that’s 40 years old? If you’re looking to turn a profit, I doubt any agent would suggest that. But if you’re looking to settle down and make that place your forever home, you couldn’t care less about how much it might sell for later. All that matters is that you love it.

So, while swanky properties and HDB flats might seem worlds apart, they share this similarity. Buyers of both these types of properties often only care about living there themselves. They’re not buying property, they’re buying a home.”

This means that these homes might be tougher to sell (we’ll get into that below), and since the owners aren’t expecting to make a profit, it might result in a sale that doesn’t cover costs.

Another agent pointed out that if you’re after returns on your investment, luxury freehold condos might not be your first choice:

“The ongoing costs are steep, and the income from rent may actually be lower than for a leasehold condo. If buyers are all about the bottom line, they’d probably go for luxury landed properties instead.”

But she did add that there can be exceptions, like when new properties are sold at a discount. Even though we didn’t include this in our table above, the agent was confident that transactions involving new properties generally fare better than second-hand ones.

*This is because renters won’t pay extra for a freehold place, even though it costs more than a leasehold one.

2. Not Many Folks Out There Who Can Afford Such Places

We touched on the Latitude deal earlier, which ended in a shocking $3.5 million loss for a property agent. She pointed out that the final price tag was still a whopping $9 million. This, she believes, explains why high-end properties might not be the best for profit-making:

“Even after slashing the price by $3.5 million, a sale tag of $9 million is still beyond most people’s reach. Despite such a huge ‘price cut’, it usually takes time for serious offers to come in.”

Another property agent agreed, adding, “For expensive properties, you could be advertising for more than a year and only get one or two inquiries.” This can happen even when properties are priced below their value, simply because there aren’t many buyers who can afford them.

Now think about this: wealthy property owners are often willing to take big losses (like we discussed earlier). Because of this, asking prices tend to drop. More often than not, the pressure is on the agent not to haggle for a higher price, but to close the deal within a particular timeframe.

3. Being First Off The Block Doesn’t Always Work In Posh Areas

First-mover advantage is like being the first to spot a gem in a bargain bin. You find an affordable place in a neighborhood that’s yet to be discovered, and you watch its value go up as the area improves over time. Places like Tiong Bahru and Joo Chiat are classic examples of this, as is Jurong.

But when it comes to luxury homes, it’s a different story. These properties usually pop up in already posh parts of town where prices are sky-high. So, there’s not much room for prices to go any higher.

One real estate agent suggested we might want to consider all property types in Districts 10 and 15, not just the luxury ones with freehold. Here’s why:

“I have this gut feeling that whether a property is freehold or leasehold won’t make a big difference in the results. I think the real game-changer is the location. If you compare districts like 10 and 15 with RCR or OCR districts, you’re likely to see bigger dents in your wallet and smaller gains. That’s because buyers in prime areas are already shelling out more money right from the start.”

So, taking his point into account, it seems like freehold condos might be getting the short end of the stick since they’re pricier than their leasehold counterparts to begin with.

4. “Forever Yours” Doesn’t Pack The Same Punch When Everyone Else Is Saying It

One property agent shared that in places like Orchard or Marine Parade, the “freehold” tag doesn’t hold much sway. She explained:

“When it comes to condos, if it’s freehold in a sea of leaseholds, it’s a big deal. But in prime areas, almost every residence is freehold. So in Orchard, Tanglin, Cairnhill, and similar places, being freehold isn’t anything to shout about.”

Basically, this means that in these prime locations, the ‘freehold’ label isn’t as rare or valuable.

This same agent pointed out another interesting fact. For wealthy buyers, owning freehold land is more prestigious than owning a freehold condo. She said:

“Any foreigner can buy a freehold condo anywhere if they’re ready to pay the ABSD. But getting a freehold land? That requires special permission from SLA, and not everyone qualifies. So, people aren’t as eager or interested in a condo just because it’s freehold or has a 999-year lease. This could be why luxury freehold condos aren’t as sought-after compared to landed properties.”

5. Any Hiccups In The Market Hit Them First

The ABSD rate has been bumped up quite a few times, but there’s always one constant: foreigners and companies consistently get the short end of the stick with the highest rates – 60% and 65% respectively, last I checked.

This tends to hit the luxury market the hardest since many buyers, especially from China, are interested in fancy freehold properties. On the flip side, areas on the outskirts and more affordable, leasehold properties don’t feel the pinch as much. For instance, someone living in an HDB flat who’s looking to buy a condo in Sengkang would not have to worry about ABSD at all, or they’d at least be eligible for total remission.

It’s interesting to note that over the years, the ABSD rate has only ever gone up, never down. And let’s face it, any hope we once had that these measures were just a temporary thing has long since evaporated. The market has pretty much resigned itself to the fact that they’re here to stay.

This has resulted in a continuous squeeze on the freehold luxury sector, which always seems to bear the brunt of every new cooling measure. It’s no accident that the downward trend started around 2013 – the last peak of the property market and the time when the most stringent cooling measures began to take effect.

6. Wealthy Buyers Usually Have Eyes For Newer, Trendier Luxury Pads

The world of fancy real estate is always changing. What was a symbol of luxury in the 90s might not cut it today. Sure, some old condos like Ardmore Park are still considered top-notch, but others that were once high-end, like Helios Residences, now seem a bit dated compared to new kids on the block, Boulevard 88 and Park Nova.

So, if you’ve got a chunk of change to spend, you might be tempted to go for the newest and fanciest options, even if they come with a hefty price tag. But remember, while some luxury properties can lose value fast, others could make you a tidy profit.

Still, don’t write off older condos like Yong An Park or The Claymore. They’ve kept their value, mainly because they offer plenty of space – something that’s becoming a rare find in the market these days.

But Is There Hope For The Luxury Property Market Going Forward?

We’re not spotting any quick fixes on the horizon, you know? If anything, the rise in ABSD and bank loan rates might just make things even tougher.

But hey, that’s looking at the big picture. When we zoom in on specific properties, those with killer views, amazing layouts, and so on, they’ll still attract buyers. They might even go against the grain. Some well-off folks are always around, ready to shell out a bit more for unique, top-notch homes.

Despite all this, we believe the market for freehold luxury properties won’t be bothered by any potential losses. Even now, buyers are clued in about the risks, but still, they press on. At the end of the day, it’s all about real people looking for their dream homes, not just folks trying to make a quick buck.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …