TLDR

The HDB market has seen significant changes over the years, with many young owners looking to upgrade to private properties. Government cooling measures have impacted HDB prices, but opportunities still exist for savvy owners. It’s essential to plan financially and consider options carefully to avoid potential losses and make informed decisions for your future. Consulting resources like articles on property investments can provide valuable insights to help navigate the evolving real estate landscape in Singapore.

Today we will take a look at the HDB market to find out what are your options as an HDB owner and if your flat can see you through your retirement. As property prices continue to soar, we’ve witnessed some record-breaking HDB transaction prices in the recent years, the lifestyle and ambitions of the younger Singaporeans have evolved tremendously as compared to their parents. Many more young HDB owners are seeking upgrades to private homes. Are you one of them?

I understand that this might be a daunting process for some as there are many factors to consider and especially if you are not familiar with the finances and lack the insights of the market.

The illustrations probably can sum up the concerns one might have regarding the investment in private homes.

Factors such as the fear of servicing heavy mortgage loans, incurring additional expenses each month, and the constant nag by the older generation telling us that HDB flat as the first purchase is the safest bet and to work hard & save so as to have a better retirement.

It may then seem easier to just avoid this discussion altogether and choose the comforts of being ignorant and continue happily staying in your current home – because ignorance is bliss, isn’t it?

It isn’t a bad choice or wrong choice, but ultimately, is that the best choice for one who yearns for a better lifestyle or earlier retirement?

Continue reading this article if you want to find out what’s best for you. I am pretty sure by the end of this article; you’ll have a good idea on what’s the best move that would benefit both you and the family.

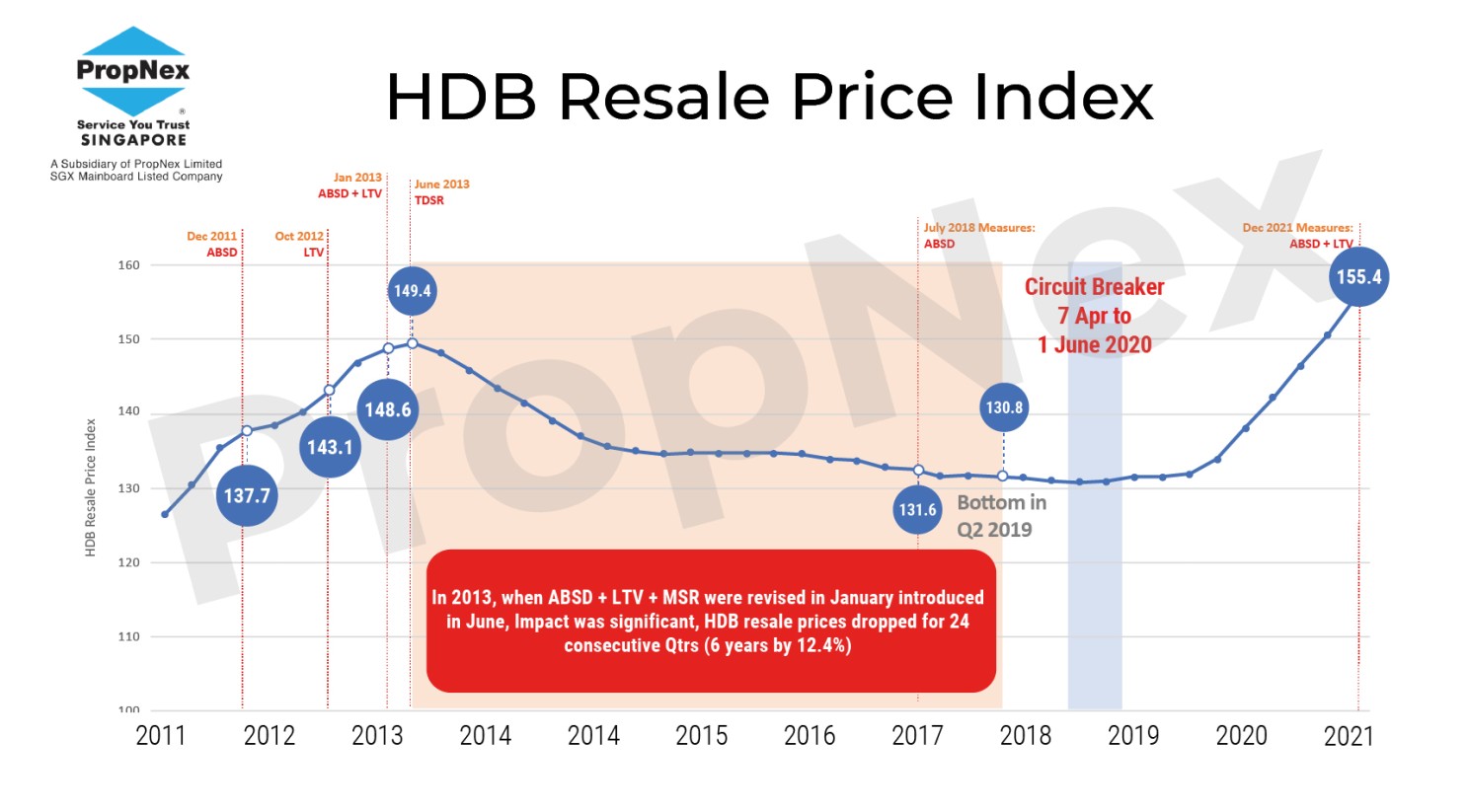

Let’s take a look at the HDB price movement chart (Figure 1) below, which documents the quarterly resale price index over a 10-year period from 2011 to 2021.

In 2013, the government introduced a cooling measure that dictates all HDB buyers’ loans be based on their Mortgage Servicing Ratio (MSR). This move has affected HDB prices causing the market to dip for several years and only rebounding in 2019.

Many question why did the government do that? It is to impede the escalating HDB resale prices that would cause the resale HDB market to be out of reach for many young couples. Afterall, isn’t it important for our elected representatives in parliament to help keep public housing affordable for generations to come?

Even though it took about 8 years for the HDB resale market to hit its previous peak, there were many opportunities that a HDB owner could have taken during that period. Especially those who choose to keep their flats since the previous peak in 2012/2013, many have gone on to upgrade their property to an Executive Condominium or even a private property and have made capital gains.

Don’t fret if you feel like you’ve missed the train, there are still plenty of opportunities awaiting you!

But how long will this window period last is a golden question no one can answer.

However, do take this chance to learn more and avoid similar mistakes. Later in the article, we will be taking a look at some examples of those who took action and how they benefited from it.

HDB Resale prices since 2013 June

Figure 1: HDB resale price (%) index

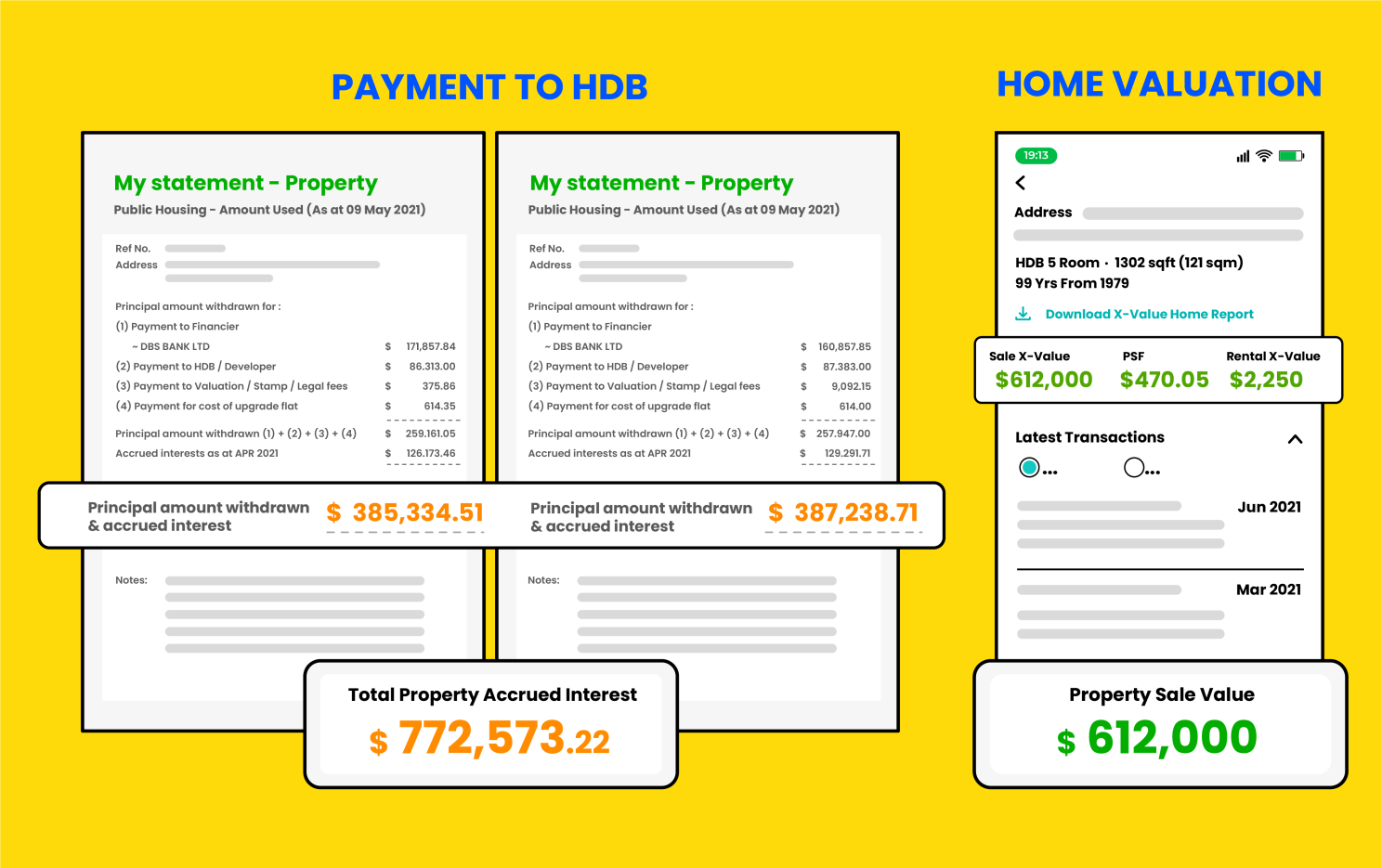

But before that, let’s take a look at a particularly sad case of a hardworking couple who kept their HDB flat for 30 years expecting it to appreciate. But lo and behold they actually made a colossal loss of more than $160,000.

As you can see below, the combined amount paid for the flat is over $700,000, and unfortunately, the valuation of the flat is only about $612,000. This loss you witnessed here is lost due to the accrued interest by CPF . Can your flat price rise enough to defray the interest incurred by your mortgage loans and CPF interest?

When your parents tell you to buy an HDB and stay there until you’re old, does that strategy still work? After understanding the example below, do you want to end up with a loss when you’re 65 and are about to retire?

In late 2021, our government introduced another round of cooling measures to slow down the red-hot property market. The latest slew of additional measures has seemingly little impact on the HDB market even with their plans to increase the supply in the market and the introduction of the new Prime Location Public Housing for HDBs.

Will these eventually cause a slowdown in the HDB market? No one will know for sure, but how much further can the prices of HDB continue moving upwards? Figure 1 clearly shows HDB prices hitting a new peak. With that in mind, what should HDB owners do?

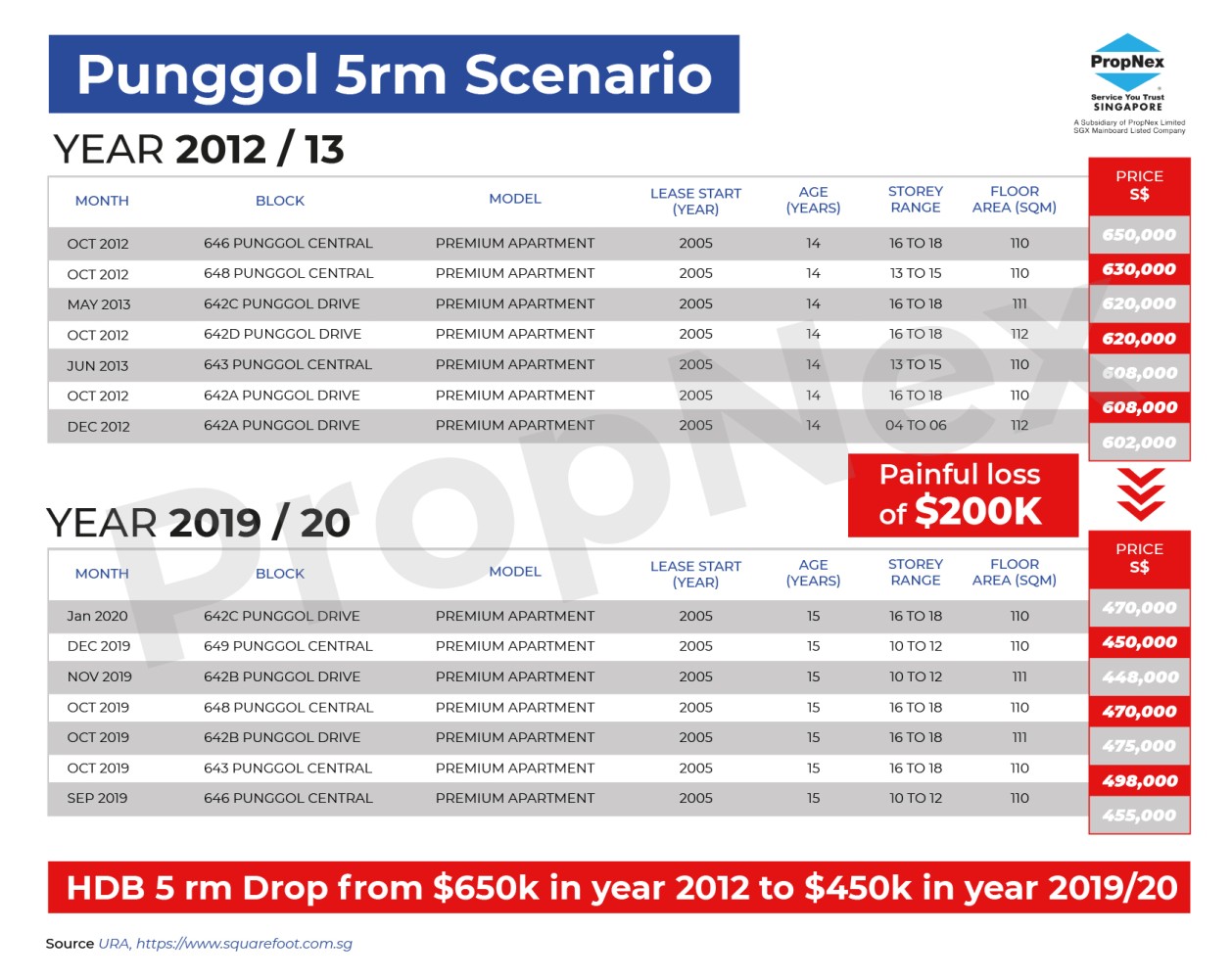

Looking at Figure 2, comparing the prices of a 5-bedroom flat for Punggol in 2012 & 2019/20 respectively we can see a stark difference of $200,000. What a painful loss for those who held onto their flats! In hindsight, with the right advice and immaculate timing, such things can be avoided.

Figure 2: Punggol 5-room HDB flat transaction history for 2012 & 2019/20

Imagine you are one of those well-informed discerning owners who exited at the right time and went on to buy a private property at Riversound condominium in 2012. You would have easily made a whopping profit of $300,000 on an average as seen in Figure 3 below.

Figure 3: Riversound condominium profitable transaction history

By now, many of you are probably thinking this is easy to say looking at all these charts and figures in retrospect.

One of the biggest concerns you’d probably have is if you could pay off the monthly mortgage loans without over-leveraging?

Well, fact is, it might not seem easy when you do not know what options are available for you! The important thing when making such decisions is to work out a financial plan. With a full-proof plan, many HDB owners managed to upgrade hassle-free and live without the stresses of mortgage loans.

Hit me up if you hope to avoid being in the same predicament as the unfortunate case of the old couple above or want to know how to avoid losing unnecessary money. I have another article for you on how to steer clear of all these mistakes and how you can actually take advantage of your HDB flat given the appropriate timing.

You May Also Like …