TLDR

When navigating the Singapore property market, it’s crucial to consider various superstitious beliefs that can impact your decisions. From avoiding certain numbers in unit addresses to steering clear of properties near cemeteries or columbariums, superstitions play a significant role in property pricing and buyer behavior. Understanding these superstitions can help you make informed decisions and potentially secure a better deal when buying or selling a property.

Growing up in a multicultural society like Singapore, superstitious beliefs were passed down from generation to generation, influencing what I did or didn’t do.

My parents were adamant about their set of dos and don’ts, and any breach of those rules, I was warned, would lead to unrepairable consequences.

Common superstitions that may sound familiar include not pointing at the moon, not opening umbrellas indoors, and of course, in order to guarantee a handsome husband in the future, I had to make sure to finish every last grain of rice on my plate!

Although not everyone may agree with superstitious beliefs, sometimes these can hinder the process of buying a property. To make the right choice, the key considerations should be a desirable location, generous dimensions, a picturesque landscape, potential to increase in value, and of course, affordability.

Do superstitious beliefs have an impact on our decisions when it comes to big-ticket items like purchasing a home? Our homes provide both physical and psychological comfort, so it’s understandable if we take superstitions into account.

Let’s look into the data and find out if superstitions truly affect the property market!

Each year during the seventh lunar month, the Hungry Ghost Festival is celebrated to pay homage to the dearly departed. Many people refrain from buying or selling property during this time, believing that new beginnings may invite spirits into their homes or that such life changes could bring misfortune.

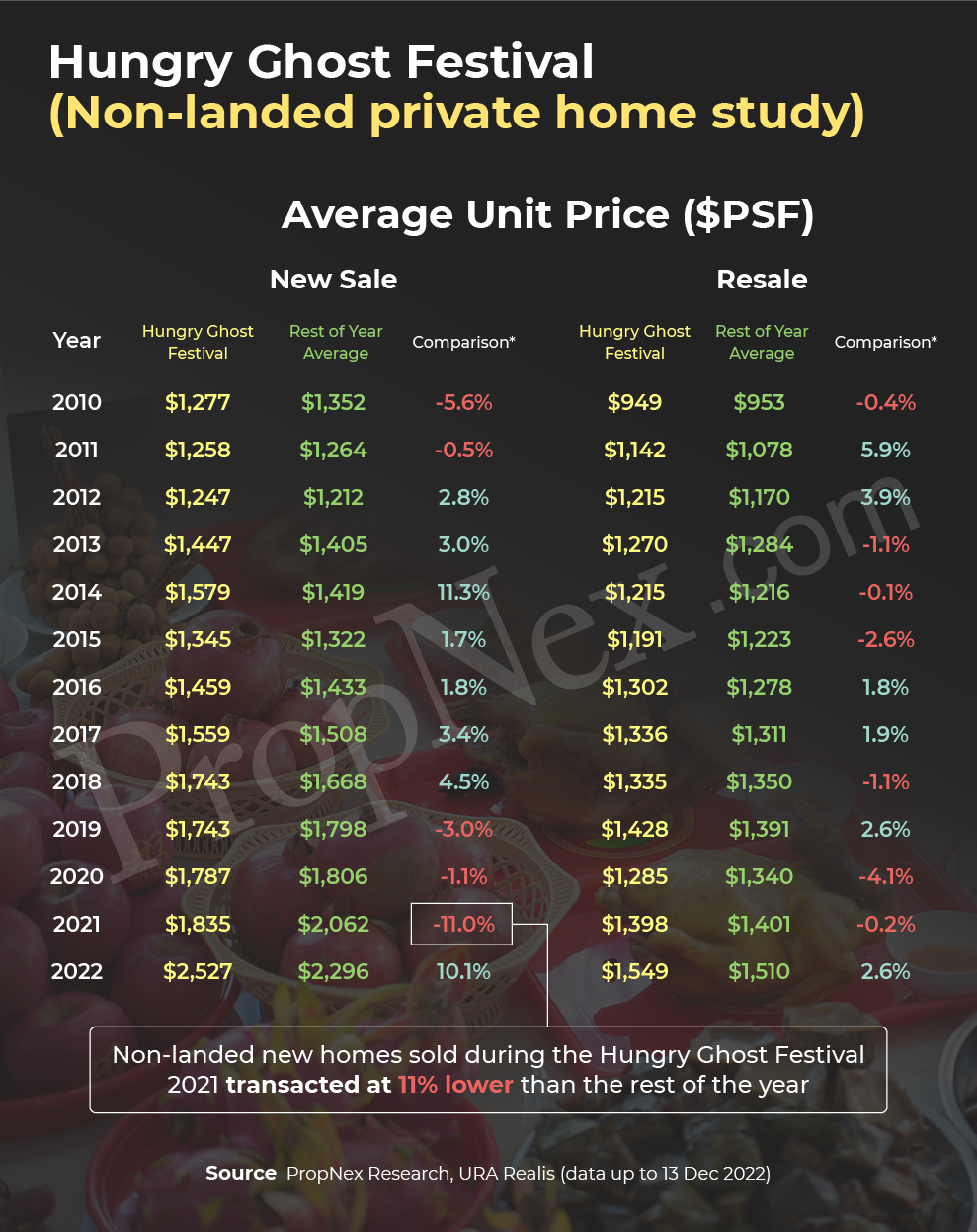

You can clearly observe from the table below that sales during the Hungry Ghost Festival typically experience lower activity than the other 11 months of the year, as developers typically steer clear from launching new products during this period. It is not astonishing to observe the fluctuation of the resale market through the years, since it is more sensitive to the festival.

Glancing at the sale prices for transactions conducted during the Hungry Ghost Festival, we observe that there was an immense difference of 11% between this particular month compared to the average of 11 months in 2021.

This discrepancy was caused by the majority of sales being attributed to the Outside Central Region (OCR), particularly The Watergardens at Canberra which sold at a median price of $1,470 psf. As for the resale market, the prices fluctuate annually, a reflection of the market’s response to the festival.

It is no surprise that the Hungry Ghost Festival has a large effect on the resale market, with developers usually avoiding launches at this time. This makes complete sense from a consumer’s point of view; if it were me, I would certainly shy away from buying or selling a property during this period for a sense of ease. Now let’s move on to investigate some other superstitions that could be impacting the real estate market.

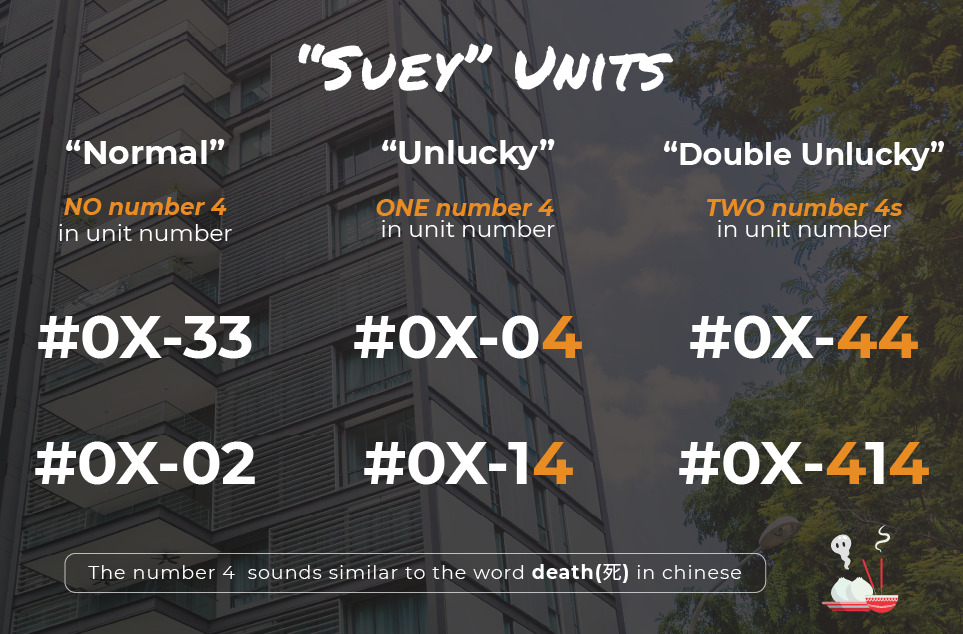

In Chinese (Cantonese) culture, the number “4” is thought to be highly inauspicious as it has a similar sound to the word “death.” Meanwhile, the number “8” is considered very lucky, as it is linked to the Chinese word for “prosperity”. These numbers are even influencing the daily lives of people, from the car plates they choose to the money given in red packets, to selecting the address and unit number for buying property.

Let’s explore how superstitious numbers impact the cost of private properties. Before we start digging into the data, we should set up a few parameters. We’ll focus only on unit numbers, not floors, since our research suggests that Singaporeans don’t seem too concerned about having a “lucky” or “unlucky” number as the floor number.

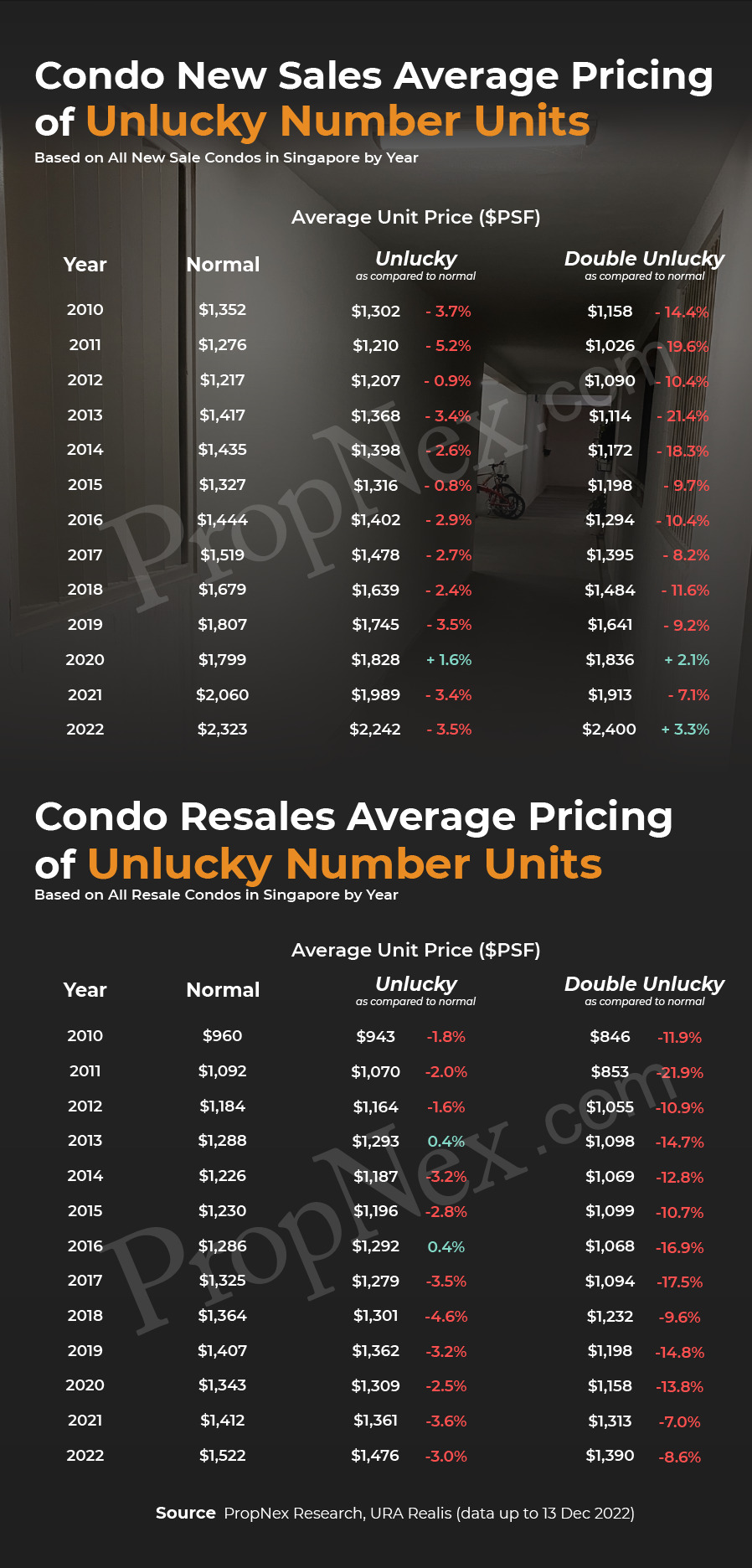

Glancing at the figures for new and resale non-landed private homes with unlucky unit numbers, it is clear that bad luck does indeed affect the pricing of homes – and double unlucky numbers having an even greater impact. Unlucky units almost always go for a lower price, be it a fresh sale or a resale. Double unlucky units can be reduced by as much as 20%, leaving one with the question: Would you be willing to take a gamble on a 20% discount?

Let’s take a leap to the other side of the coin to explore the dynamics of “fortunate” number systems – how do they contrast from “unfortunate” number ones?

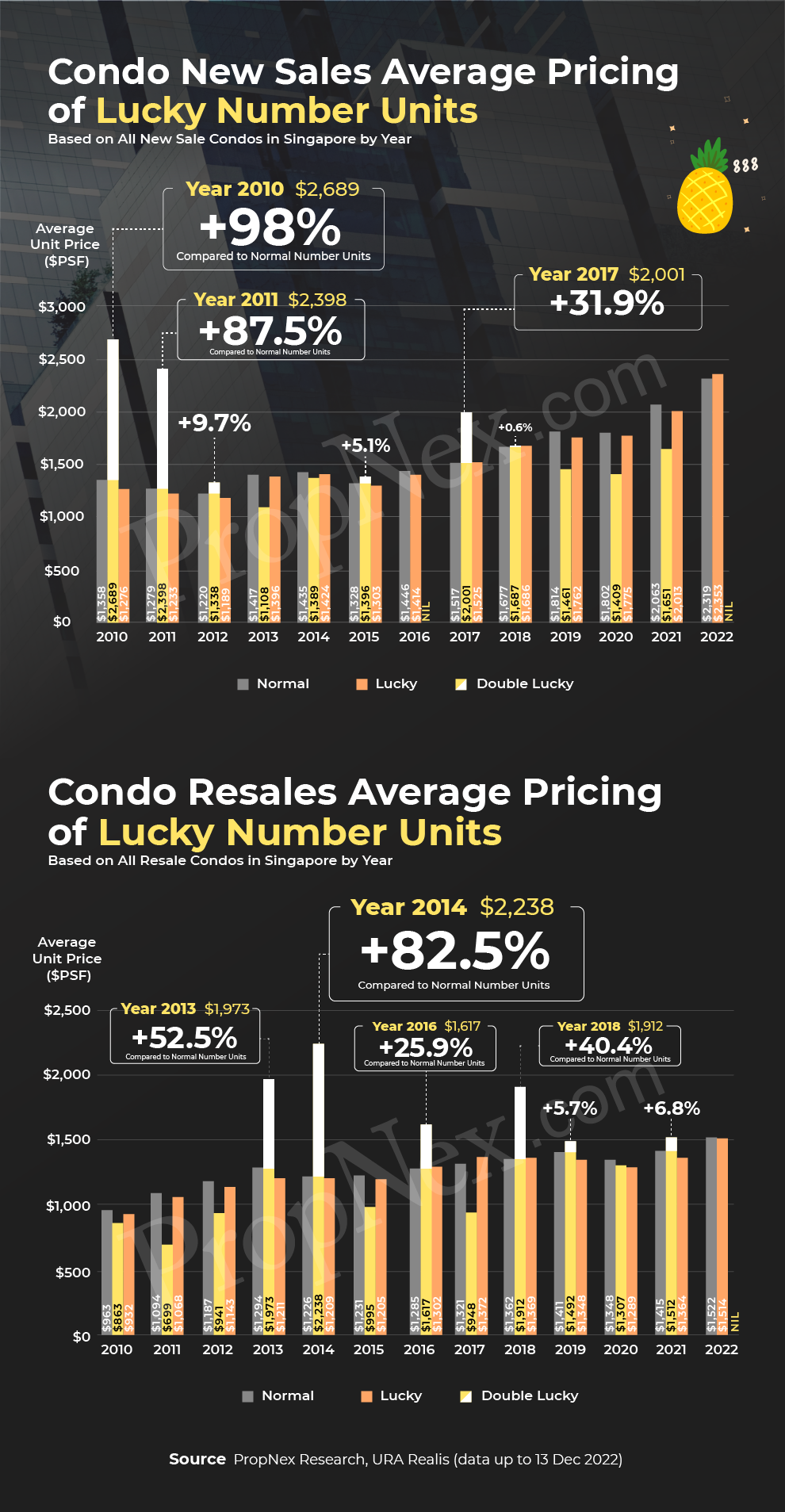

Homebuyers have been willing to pay a premium for their dream ‘lucky’ unit numbers – with some paying nearly double the cost in 2010. Even in 2014, the resale market saw a significant surge of up to 82.5% in cost just for a bit of ‘fortune’!

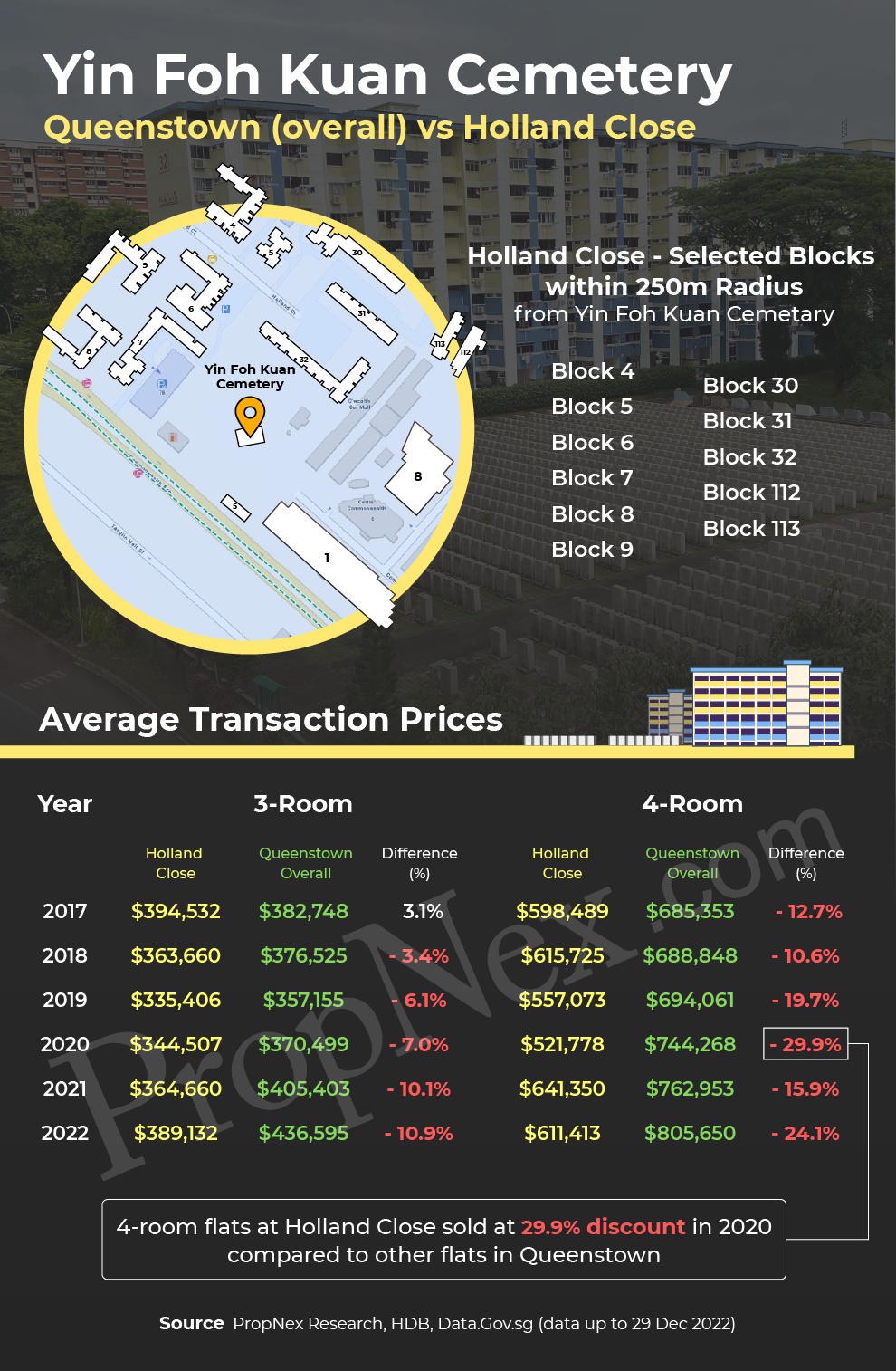

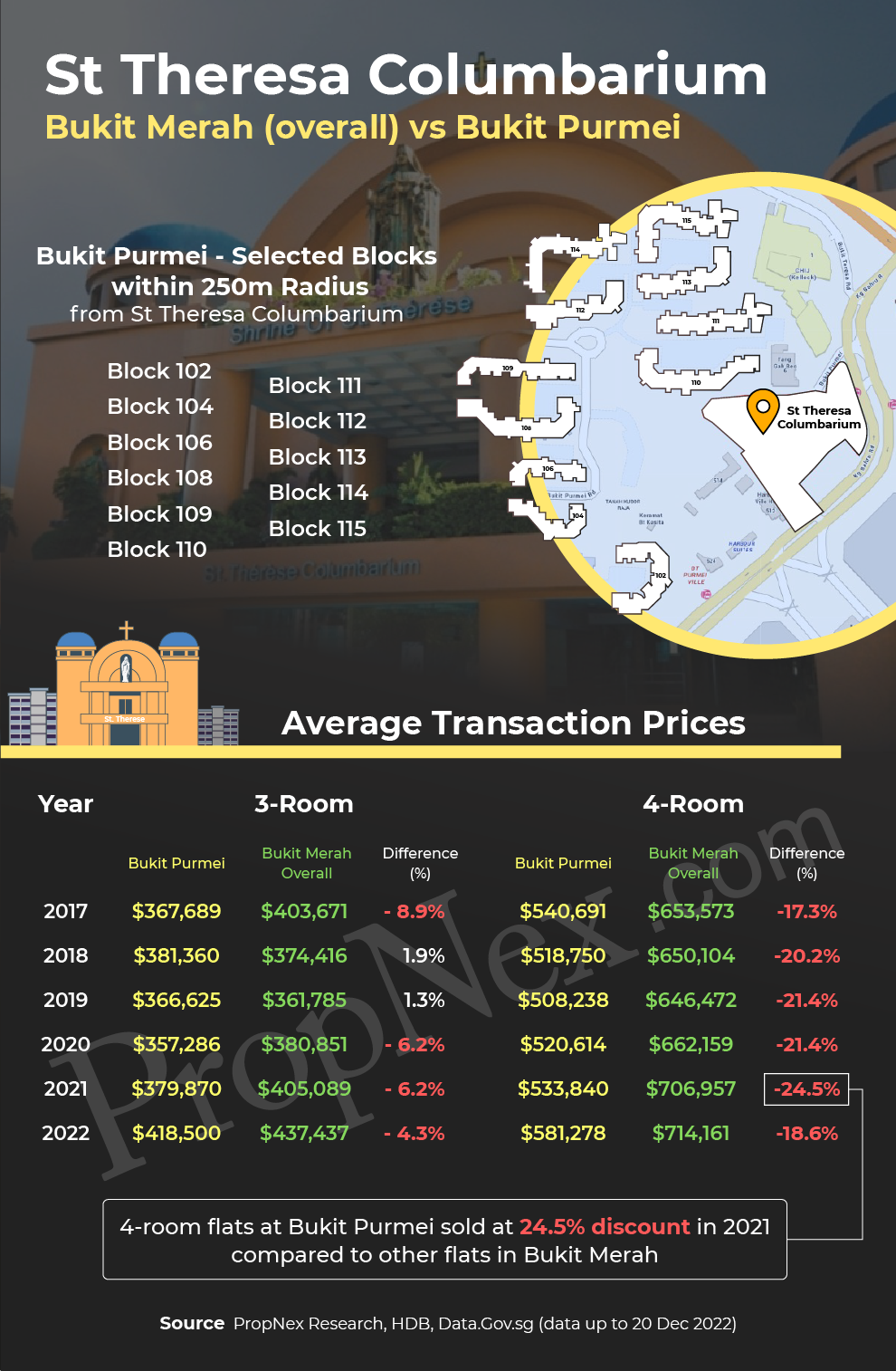

Living close to cemeteries or columbariums is often seen as a bad omen, as many believe that negative energy emanating from these places can have a harmful effect. Yet, some simply feel uncomfortable due to their exposure to horror films while growing up. To analyze the differences between the two, we’ve looked at the HDB blocks located in a 250m radius from the cemetery and columbarium. Amazingly, these two areas contain similar unit types built during the 70s and 80s.

One striking contrast can be seen in the pricing of homes near Yin Foh Kuan Cemetery as compared to the remainder of the neighborhood, with dwellings in the vicinity enjoying up to a 29.9% price reduction.

The price variations of 4-room flats surrounding St Theresa Columbarium can be drastic, ranging up to 24.5%!

Living near cemeteries or columbariums can certainly make property prices dip – making it a great opportunity for bargain hunters who aren’t easily spooked by superstition! So, if you’re on the lookout for a discount and don’t mind a few hauntings here and there, you should look no further than homes near final resting places.

In recent times, a commotion was stirred up in Sengkang West when BTO owners learnt that the Housing Board had assigned a nearby site for the establishment of a Chinese temple along with a columbarium. Many of the future residents were disheartened that the information about the columbarium was withheld from them upon purchasing the property, resulting in apprehensions of the value of their property depreciating in the future if they choose to sell it. This situation reflects the apprehensions of Singaporeans when it comes to owning property close to cemeteries or columbariums.

At the end of the day, it is essential to have property knowledge before making a purchase, even if superstition has a part to play in the property market. To give people the power to grow their property portfolio with confidence, I’ve created an exclusive Masterclass.

With its Property Wealth System – a framework developed by me with decades of experience – no decision should be left to hearsay or superstition. Arm yourself with knowledge, so you can buy with confidence!

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …