TLDR

The process of purchasing a resale HDB flat involves steps such as checking eligibility, calculating affordability, registering intent to buy, searching for a home, deciding on financing options, making an offer, discussing temporary extensions of stay with the seller, requesting flat valuation, exercising the option, completing the resale application, accepting terms and conditions, making payments for resale fees and stamp duty, receiving approval notifications, and attending the resale completion appointment. It’s essential to follow each step meticulously to ensure a smooth and successful home buying experience.

First-time homeowners seem to be shying away from the recent BTO sales exercise, likely due to the recent increase in the CPF Housing Grant.

This grant gives eligible first-time families buying a 4-room or smaller resale HDB up to $80,000 in subsidies – perfect for those looking to purchase a resale HDB flat.

1. Register Intent to Buy

2. Start planning your mode of finance

3. Get Option to Purchase (OTP) from seller

4. Submit ‘Request for Value’

5. Exercise OTP

6. Submit Resale Application

7. Endorse resale documents

8. Pay resale fees

9. Receive approval of Resale Application

10. Attend Resale Completion Appointment

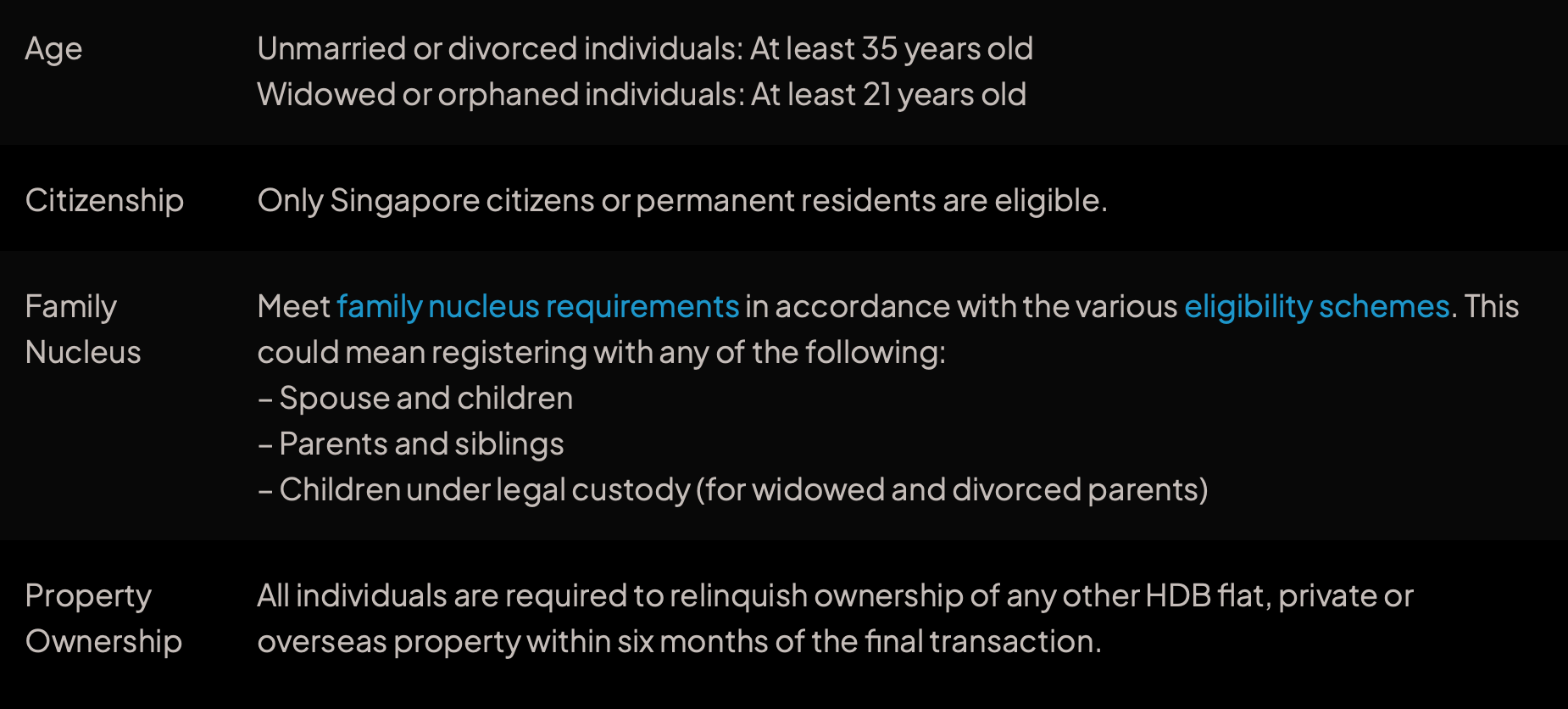

1. Check Your Eligibility

To qualify for the purchase of a resale HDB flat, hopeful buyers must fulfil every single criterion.

When selecting a flat for purchase, you must also take into consideration the Ethnic Integration Policy and Singapore Permanent Resident quota.

While there is no income ceiling for HDB resale flat purchase, keep in mind that your annual income can make you eligible or ineligible for HDB Housing Loan and CPF Housing Grants.

Generally speaking, if you earn more than $14,000 per annum, you won’t be able to take advantage of most subsidies.

2. Calculate Your Affordability

Wondering if you can afford the home you’re considering? I have a Financial Tool that can help you discover the maximum loan amount and loan term for your flat purchase. Do reach out to me for quick and easy access to this invaluable tool. Get the financial insights you need to make the right decisions for your home purchase!

3. Register Intent to Buy

Before purchasing a flat, you need to register your intent to buy with HDB through their Resale Portal with your SingPass.

Click ‘Start Buying’ and you’ll be taken through a sequence of steps. Remember, the Intent to Buy is valid for 12 months, and you must wait out the 7-day cooling period before exercising it.

Once you’ve completed the registration, you’ll receive the following:

- An instant assessment of your eligibility to purchase a flat

- Eligibility for CPF housing grants

- Eligibility for HDB housing loan

Some important things to note:

- You’ll only need to submit one Intent to Buy, even if there is more than one buyer. It must include the personal details of all parties.

- You’re not allowed to make any further amendments once the Intent to Buy has been submitted. You’ll need to re-apply to make any changes.

- To finance your flat purchase, you’ll need a valid HDB Loan Eligibility (HLE) letter or Letter of Offer (LO) from a bank before you can exercise the Option to Purchase (OTP).

4. Start Your Home Search

The search for your perfect home is now on! Log into Online Property Portals; entering an address, MRT station, nearby school, budget or the number of rooms you desire. Let the fun begin!

But before you make an offer and settle on a resale price, make sure to check the recent transactions in your area and be aware of the current market prices!

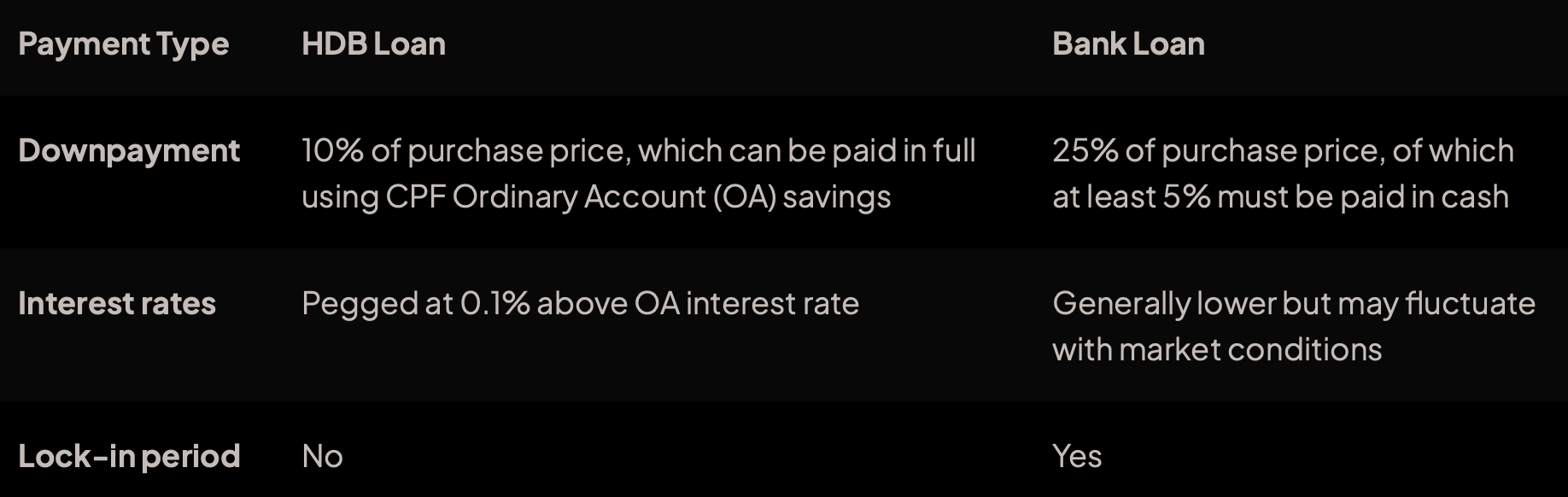

5. Decide On A Financing Option

Purchasing a HDB resale flat is a hefty financial commitment – ranging from a minimum of $350,000 for a 3-room unit to up to $700,000 for the more luxurious 5-room option. Although the amount can be paid off in installments with a mortgage, you will still be required to pay a minimum 10% downpayment.

Choosing the right loan and considering other factors are crucial to deciding how much of your CPF savings you can utilize to purchase your home.

Some things to note if you’re considering taking an HDB or bank loan:

For HDB loan: You must get a valid HLE letter before making an offer.

For bank loan: You must have a bank’s LO before exercising the OTP. Do note that there may be limits on your use of CPF funds and HDB loans.

Also, note that you must use cash for the following payments:

- Deposit to seller (a maximum of $5,000, paid in 2 stages: Option Fee and Exercise Fee)

- Amount not covered by CPF savings and housing loan

- Cash proceeds from disposing of the last flat (if you’re taking a second HDB loan)

You can use the savings in your CPF Ordinary Account (OA) for the following:

- Initial payment in whole or in part, depending on whether you got an HDB or bank loan

- Partial or full payment for the flat purchase

- Monthly mortgage installments (up to valuation limit / Additional Housing Withdrawal Limit)

Additional costs:

- Resale application administrative fee ($40-$80)

- Valuation fee ($120)

- Insurance

- Legal fees

6. Make an Offer

Once you have found your dream home, it’s time to make an offer.

An agreed upon Option fee, ranging from $1 to $1,000, must be paid to the seller who, upon accepting your offer, will give you the HDB-mandated OTP.

By giving you the OTP, the seller is essentially guaranteeing the home to only you.

You then have 21 days to use the OTP, ending at 4pm on the 21st day of receiving the OTP.

Before exercising the OTP however, you must have a valid HLE letter or LO if you need financing to purchase the flat.

7. Discuss Temporary Extension Of Stay With The Seller

If the sellers are unable to vacate their flat by the completion date, they may wish to negotiate a Temporary Extension of Stay of up to three months, for which fees may be discussed. Other applicable fees include:

- Property tax, charged to you at non-concessionary rates (higher than the concessionary rate)

- Admin fee of $20

You and the sellers must submit the Temporary Extension of Stay, set to expire automatically after three months, when applying for a resale flat at an HDB branch. Once the Temporary Extension of Stay has ended, the Minimum Occupation Period for the new owner of the flat will begin.

8. Request For Flat Valuation

If you are using your CPF funds and/or a housing loan to finance your flat purchase, you must submit a ‘Request for Value’ to HDB to determine the amount of loan and CPF you are allowed to use – and you must do this no later than the following business day after obtaining the OTP from the seller.

Information required for ‘Request for Value’:

- Page 1 of the OTP softcopy

- Property address

- OTP serial number, Option grant date, purchase price and Option fee

- Seller’s name, NRIC no. and contact details

- All buyers’ names and NRIC no.

- Contact details of 1 buyer

- Requestor’s contact details

Keep in the loop of your Request’s progress by logging onto the HDB Resale Portal. You’ll find out the flat’s value within 5-7 working days and we’ll send you a notification email once it’s available.

9. Exercise the Option

You must do the following on or before the Option expiry:

- Sign the ‘Acceptance’ in the Option

- Deliver the signed document (original copy) to the seller

- Pay the seller an exercise fee (capped to $5,000, minus the Option fee)

To cancel the purchase, you must inform the seller and allow the OTP to lapse and expire. Remember that the Option fee is non-refundable should you not proceed with the purchase.

10. Complete the Resale Application

After signing up on the HDB Resale Portal, you and the seller have a week to submit the completed application and any necessary accompanying documents.

Do note that there’s an administrative fee of $40 for 1- and 2-room flats, or $80 for 3-room and bigger flats.

The fees are non-refundable and are inclusive of GST; payable by credit card (Visa or Mastercard).

You will be required to provide the following information when filling up the application form:

- Resale flat address

- OTP details (such as OTP serial no., Option fee, purchase price, Option grant/Exercise date)

- Soft copy of personal documents of all buyers and/or occupiers

- Soft copy of proof of income (if applying for CPF housing grant)

Also, take note that you will need to do the following:

- Complete the ‘Intent to Buy’ on the HDB Resale Portal

- Have a valid Intent and HLE letter or LO before the OTP can be granted or exercised

11. Accept the Terms and Conditions

Within 10 working days, you’ll get an SMS from HDB with the info on when you can accept the terms and conditions for the documents ready for you through the HDB resale portal.

Don’t wait more than 6 days to endorse them – once you have endorsed, you’ll get an in-principle approval for the resale!

12. Make Payment For Resale Fees And Calculate Stamp Duty

In addition to covering the cost of associated expenses such as title search fees, you may also incur additional expenses like stamp duty and legal fees.

- Calculate your stamp duty

You can calculate your stamp duty fees on the Ohmyhome app. To do so, tap ‘Services’ and ‘Loan Calculator’, and select ‘Buyer Stamp Duty’.

13. Receive Approval Notification

You’ll receive an SMS or email to notify you when HDB’s approval letter has been posted on the resale portal.

- Final inspection of the flat

Before the Resale Completion Appointment, you should schedule a final inspection with the seller to make sure the flat is empty.

14. Resale Completion Appointment

The appointment for your HDB application will be around 8-10 weeks from the day HDB receives your resale application, as long as all the required documents are submitted correctly and on time.

The appointment is for HDB to witness:

- Signing of the transfer document for the resale flat

- Signing of the mortgage document/ agreement (applicable for HDB loans only)

- Handover of keys (if you opted for a bank loan, the bank’s lawyer can be authorised to collect the keys on your behalf)

You must remember to pay the seller for the Property Tax for the time period you owned the property; additionally, the Seller must have the Service & Conservancy Charges settled up to the day of completion.

And you’re all set!

Congratulations On Your New Home!

Congratulations on finding your dream home at the end of the road! May it be a place of security, coziness, and relaxation for you and your family.

Having a place to call your own is an incredible blessing, so we wish you lots of joy and many precious moments with your family in your new home!

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …