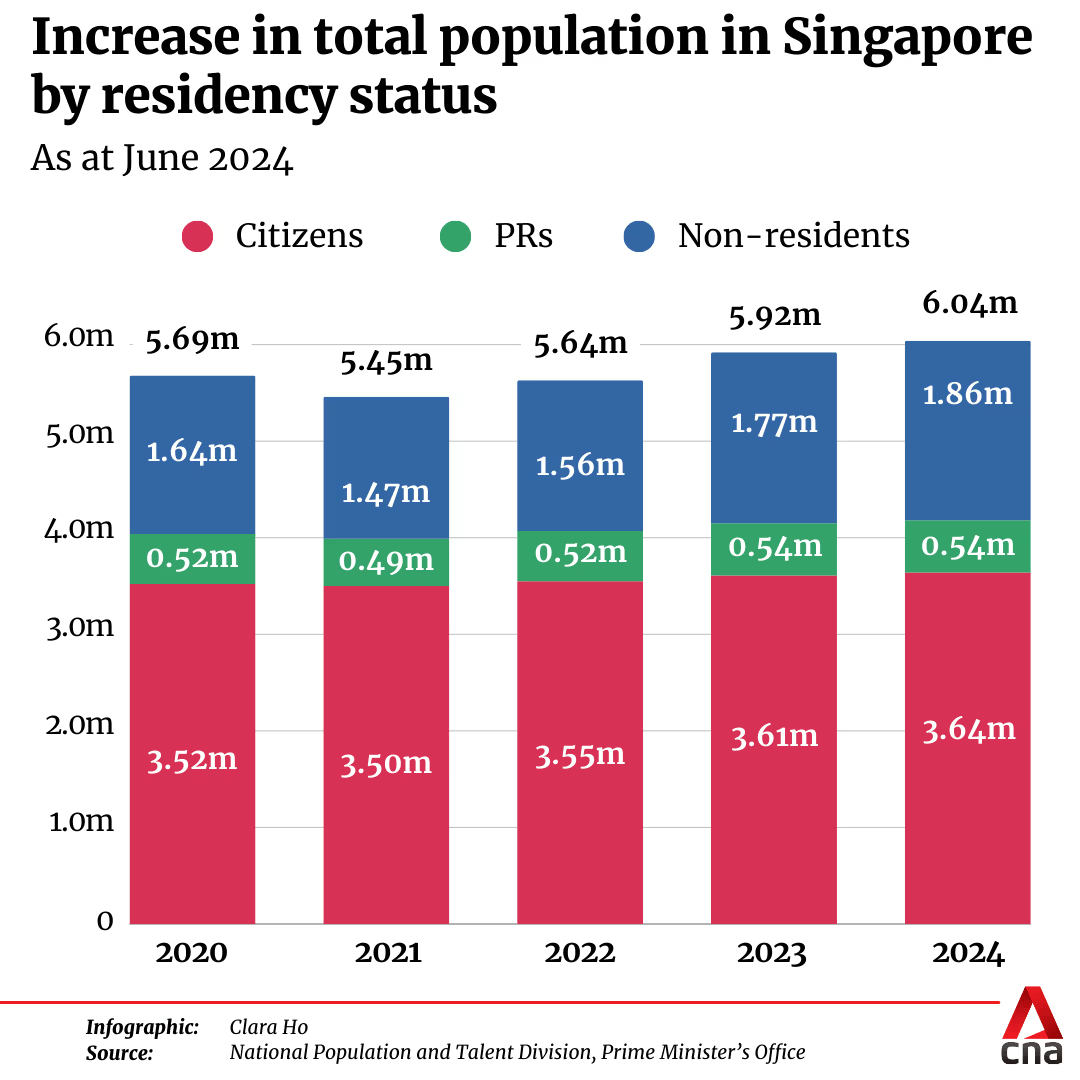

There has been significant outcry regarding Singapore’s population hitting a record high of 6.04 million, largely due to an increase in non-residents (which rose by approximately five per cent from the prior year). This issue is particularly sensitive for many Singaporeans, who already perceive our small island as overcrowded and believe there is excessive competition for resources, especially housing. Additionally, there is a belief that property owners and landlords might benefit from this situation, but the reality is not so straightforward:

To begin with the obvious: Singapore certainly seems much more congested.

You might have come across the commentary suggesting that we can reduce density through specific architectural features. I disagree, and I believe the typical Singaporean will definitely feel the pressure.

The referenced commentary discusses Pinnacle @ Duxton, which accommodates around 8,000 residents on 2.5 hectares. That is indeed an impressive feat, and I concur that projects like Pinnacle manage to avoid a sense of overcrowding. However, how many of us can actually reside in a development like Pinnacle? If you can afford the approximately $900,000 to $1 million price tag and have access to some of the finest sky gardens or terraces, you might not feel cramped – but that’s not the case for everyone. In any event, I would argue that it isn’t primarily the sky gardens or terraces that alleviate demand. The location and the limited supply in the vicinity are the key drivers behind its appeal, even without those enhancements.

Similarly, the commentary mentions the development of the Bayshore area, which is somewhat ironic. As someone residing there, I would assert that it serves as the opposite example of crowd mitigation: the allure of living at Bayshore was precisely its solitude and tranquillity. While I don’t oppose the construction of a new HDB estate there (as I recognise its necessity), it illustrates how the need for additional housing is making each neighbourhood progressively denser. One reason low-density neighbourhoods are so costly is indeed their scarcity.

Then there’s the concept of integrated developments or mixed-use projects. Although this may be an excellent idea for urban planning, such developments contribute to congestion and noise. I’ve also encountered numerous homeowners who consider living above a mall – especially one linked to a busy MRT or bus station – to be their worst nightmare.

Moreover, integrated developments are typically pricier. Woodleigh Residences, Lentor Modern, The Reserve Residences, etc., are not among the more affordable options in their respective locations; thus, this approach makes certain financial assumptions.

Furthermore, perhaps some discontent stems from the way land types are utilised in Singapore. There is no denying that GCB (Good Class Bungalow) zones occupy extensive areas, often in prime locations where land is already scarce. While these GCB areas are prestigious and highly desired, they arguably represent one of the least efficient uses of land. Given Singapore’s limited land resources, dedicating such large spaces to a relatively small number of affluent homeowners raises questions about equitable space distribution, especially in light of ongoing housing shortages for middle and lower-income groups.

So let’s be honest with ourselves. Urban planners and architects are not miracle workers, and the average Singaporean (i.e., those who cannot afford luxurious sky gardens or landed properties) will certainly feel the strain. Coffee shops will run out of seating, trains and buses will require close proximity to others, and a constant low-level hum of crowds will be pervasive in certain areas.

I’m not suggesting that we might not have a choice or that we don’t need this population increase; that’s beyond my expertise. However, I do believe we should be candid and recognise that we will pay for this in terms of roominess and comfort. Those who cannot afford low-density areas or more spacious (read: costly) developments will suffer the most.

It may not be fair, but that is the reality we face.

Those who miss out the most are those who cannot afford to purchase their own apartments.

Pure Permanent Resident (PR) families are ineligible to purchase BTO flats and must wait three years before they can buy a resale flat. During this waiting period, they find themselves competing with foreigners in the rental market, unless they have sufficient wealth to consider a condominium.

Lifelong singles, especially those who cannot remain at home due to various circumstances (including some from troubled backgrounds), will face high rental prices for both HDB and private properties; this will be the case until they reach the age of 35. It’s a long wait, and a significant portion of their income will go towards rent.

Lastly, we should not overlook the foreigners in this situation. While some may unfairly hold them responsible for the issues at hand, it’s important to recognise that a 60 per cent Additional Buyer’s Stamp Duty (ABSD) means only the wealthiest can afford to purchase property. In the meantime, they too will experience pressure from rising rents. Except for corporate employees with generous housing allowances, they are unlikely to fare any better than Singaporeans who cannot buy HDB flats. Eventually, the government may need to step in to support essential sectors that rely on foreign workers, such as nursing in hospitals.

So, landlords and investors come out on top, correct? Not necessarily

This is a straightforward assumption, but it won’t hold true universally. Although landlords and investors might notice quick gains from a surge in population, there are certain challenges that could take them by surprise.

The surge in population is driving decentralisation, which may affect the value of expensive CCR/RCR properties

Recent incidents involving the transport infrastructure highlight that it is not feasible for everyone to be commuting to and from the same location in the city—essentially the whole country—simultaneously each day. This is not a new revelation, as the Urban Redevelopment Authority (URA) has been working on decentralisation for many years, resulting in the establishment of various hubs such as Jurong East, Paya Lebar, and the Woodlands North Corridor.

With the growing population, the urgency for decentralisation increases significantly. We are likely to witness the emergence of additional “hub” areas that draw workers away from the conventional Central Business District (CBD).

Although a rising population may bolster rental demand, there is no assurance that this demand will adhere to current trends. This is worth considering before making any commitments to Central Core Region (CCR) or Rest of Central Region (RCR) assets.

Land reclamation and rezoning can influence property values

Let’s revisit Bayshore, as I recently used it as an example. When purchasers of Bayshore Park, The Bayshore, and Costa Del Sol bought their properties, it seemed unimaginable that their views would be significantly blocked, given their proximity to the beach. This was before the Long Island project emerged, which could potentially introduce some flats in the distance decades from now.

To clarify, Long Island primarily focuses on erosion prevention rather than simply increasing housing; however, it seems improbable that the desire for more living space isn’t a contributing factor. Historically, property owners lost their sea views due to the land reclamation for Marine Parade for similar reasons.

Additionally, there is the concern of rezoning. While your condominium may currently be situated in a low-density area, you cannot assume that will remain unchanged with a growing population. The emergence of a mega-project nearby could lead to a permanent decrease in rental rates and limit resale profits; thus, not all investors might welcome the anticipated population growth in the future.

Ultimately, those looking to upgrade could find themselves priced out more quickly than they anticipate.

A growing population may lead to higher rental and property prices; however, it is risky to assume that you will benefit from this trend. The disparity in prices between HDB flats and condos could increase, even as overall prices rise. Furthermore, with the growth of urban density, the value of landed properties is likely to surge even more, making it challenging for condo owners to transition to landed homes.

Therefore, the expanding population may not be equally advantageous for all investors and landlords. While some may experience immediate gains, they should be cautious not to become overly optimistic in their forecasts.

In the end, a rising population seems unavoidable and could provide some support for the anticipated increase in vacant HDB flats as the elderly pass away (as discussed here). Although regulations might mitigate this issue, a growing population can help alleviate its impact.

For ongoing updates on this evolving situation and news about the Singapore property market, follow me here. If you wish to arrange a more detailed consultation, you can reach out here.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …