TLDR

The recent hike in ABSD rates, especially the increase from 30% to 60% for foreign buyers, has dramatically affected Singapore’s property market. Introduced on April 26, 2023, these measures aim to cool the market amidst soaring prices and high demand. This is the fourth adjustment since 2011. Foreign buyer transactions have plummeted, with local buyers taking a dominant role. Americans now lead among foreign buyers due to favorable trade agreements. Private home sales in prime regions like the Core Central Region have dropped significantly, and price growth has stabilized. Developers are adopting cautious strategies, focusing on keeping prices attractive to local buyers. High interest rates and stringent ABSD rules are pushing some Singaporeans to consider overseas property investments.

Just like previous rounds of efforts to cool the property market, the most recent surge in additional buyer’s stamp duty (ABSD) rates caught everyone off guard, announced with a dramatic flourish just before midnight on 26 April 2023. But what really made heads turn was the sharp increase in the ABSD rate for foreign purchasers of residential properties in Singapore, skyrocketing from 30% to a staggering 60%.

And it didn’t stop there – even Singaporeans and permanent residents looking to buy their second or subsequent home faced higher ABSD rates. This is the fourth alteration to the ABSD measure since its inception back in December 2011.

A quick refresher: what spurred these measures in the first place?

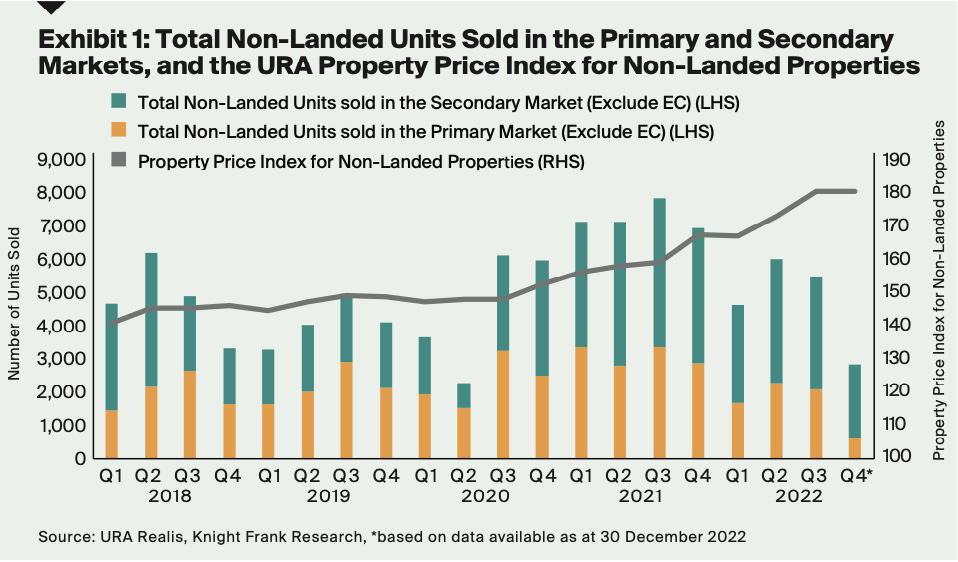

The tightening of the ABSD measure (see Table 1) came amidst a buoyant property market and unwavering demand for housing. In the first quarter of 2023, private residential home prices had surged by a whopping 11.4% compared to the previous year, following a sizeable 8.6% increase in 2022.

Fueled by soaring prices and a less-than-favorable interest rate environment, the ABSD hike was a necessary step taken by the government to promote sensible financial decisions among buyers and maintain a sustainable housing market. One year on, let’s examine the impact of these elevated ABSD rates on the residential property scene.

Table 1: Summary of April 2023 ABSD rate revisions

| Additional Buyer’s Stamp Duty Rates (ABSD) | Before 27 Apr 2023 | On or After 27 Apr 2023 | |

| Singapore Citizens | 1st property | 0% | 0% |

| 2nd property | 17% | 20% | |

| 3rd & subsequent property | 25% | 30% | |

| Permanent Residents | 1st property | 5% | 5% |

| 2nd property | 25% | 30% | |

| 3rd & subsequent property | 30% | 35% | |

| Foreigners | Any Residential property | 30% | 60% |

| Entities/Trustees | 35% | 65% | |

| Housing Developers | 35%* + 5%** | 35%* + 5%** | |

*Housing developers may apply for remission of this ABSD subject to conditions

**This 5% is non-remittable, and is to be paid upfront upon purchase

The housing market landscape has shifted in recent times, with a notable decrease in foreign buyers and a rise in local purchasers dominating home sales. This can be attributed to the hefty Additional Buyer’s Stamp Duty (ABSD) rate of 60% for foreign buyers, dissuading them from investing in private homes.

In the months leading up to the April 2023 ABSD hike, the proportion of foreign buyers in the overall non-landed private new home sales showed a steady incline, reaching a peak of 22% in December 2022, according to URA Realis caveat data (Chart 1).

However, the implementation of cooling measures saw a sharp decline in foreign buying demand, with their presence remaining below 5%, except for sporadic spikes in September and October 2023. In January 2024, only a mere 1% of overall non-landed new home sales (excluding ECs) were attributed to foreigners – a record low.

The impact of the cooling measures was most evident in the Core Central Region (CCR) and Rest of Central Region (RCR) sub-markets, known to attract a larger proportion of foreign buyers. Despite slight fluctuations, the proportion of non-landed private home transactions by foreigners dwindled drastically, dropping to 3.7% and 0.9% in the CCR and RCR respectively in January 2024 (see chart 1).

Chart 1: Proportion of foreign buyers (non-PR) over total buyers (%) of non-landed new sales by region vs overall

Source: PropNex Research, URA Realis

Change in buyer profiles – more American buyers

In the year 2023, the dominance of American buyers in the foreign market has soared, surpassing their Chinese counterparts in both proportion and absolute numbers. With a staggering 208 transactions, representing 34% of the total landed and non-landed private residential new sales and resales, US buyers have claimed the top spot on the podium. In comparison, Chinese buyers lagged behind with 185 transactions, making up about 30% of the year’s transactions (refer to Chart 2A, 3A).

This was a complete reversal of fortunes from the previous year, where it was China that reigned supreme (refer to Chart 2B, 3B). In 2022, the Middle Kingdom secured 262 foreign buyers, capturing 29% of the landed and non-landed new sale and resale private home deals, while their American counterparts fell short with only 248 buyers, representing 27% of the market share.

Source: PropNex Research, URA Realis

The United States has taken the lead over China in the number of foreign home buyers, which comes as no surprise due to the fair trade agreements that grant Americans the same stamp duty benefits as Singaporeans. Along with four other countries – Switzerland, Norway, Iceland, and Lichtenstein – these FTAs ensure that foreign buyers from these nations will remain unaffected by the recent increase in ABSD if they are buying their initial residential property in Singapore.

Source: PropNex Research, URA Realis

Moderating demand for new private homes in the city centre

The implementation of the ABSD hike sent ripples through the housing market, impacting sales volume across all segments. Among them, the prestigious CCR took the biggest hit, known for its allure to foreign buyers. The URA monthly sales data revealed a significant drop, with only 128 new private homes sold per month in 2023, compared to 215 and 175 units per month in 2021 and 2022, respectively.

By the first quarter of 2024, the once bustling CCR market had plummeted even further, with a measly average of 35 new homes sold per month (see Chart 4). This downward trend was also mirrored in the neighboring RCR, where new private home sales also experienced a decline.

Chart 4: CCR new home sales (excl. ECs) and monthly average by year (Jan 2021 – Mar 2024)

Source: PropNex Research, URA

Home prices stabilising

As we examine real estate transactions spanning different regions, we can see that the average unit price of new non-landed private homes in the RCR and OCR rose at a more modest pace of 4.8% and 7.6% respectively, from April 2023 to April 2024. This is in contrast to the previous year, where prices in these areas experienced a more robust growth of 8% and 12.1% respectively (refer to Chart 5).

However, the story in the CCR is quite different. In April 2024, new home prices in this prestigious region defied expectations and surged at a remarkable rate of 12.2% year-on-year, compared to a more modest increase of 5.5% the previous year. This surge can be attributed to heightened sales activity in popular CCR projects such as Cuscaden Reserve and Watten House.

The latest quarterly data released by URA also supports this trend, with the CCR non-landed property price index expanding by 4.4% year-on-year in Q1 2024, a slight dip from the impressive 5.8% growth recorded in the same quarter of 2023.

Chart 5: Average unit prices ($PSF) of non-landed new homes (excl. ECs) by region by month

Source: PropNex Research, URA Realis (April 2024 data up to 28 April 2024)

As the cooling measures tightened their grip and interest rates remained stubbornly high, the resale market felt the impact even more strongly. In April 2024, the average price of non-landed private homes in the coveted CCR area ticked up by a mere 0.1%, a stark contrast to the 6.6% year-on-year surge seen in April 2023. This slowdown in price growth was echoed in the RCR, where the rate of increase held steady at 8.5% year-on-year. However, the OCR saw a different story, with a consistent rise in prices by 8.5% year-on-year in April 2024, fueled by the buzz of new launch transactions (refer to Chart 6).

Chart 6: Average unit prices ($PSF) of non-landed resale homes (excl. ECs) by region by month

Source: PropNex Research, URA Realis (April 2024 data up to 28 April 2024)

The residential property market has been shaken by the latest round of property cooling measures, rolled out in April 2023. The impact has been significant, as evidenced by a decline in foreign transactions.

As a result, local buyers will play a larger role in driving private home sales, and their price sensitivity may prove to be a determining factor. The current market sentiment, coupled with high interest rates, will undoubtedly continue to influence home prices in the upcoming months.

To entice potential buyers, developers will likely adopt a strategic approach in pricing their new projects. Keeping the overall price quantum within a reasonable range will be key in attracting buyers during the initial launch phase.

In addition, developers seem to be adopting a more cautious land acquisition strategy, submitting conservative bids in recent public tenders. This could be attributed to the current tentative interest in home buying, increasing costs, and the new rules on gross floor area harmonisation.

As the Additional Buyer’s Stamp Duty (ABSD) remains in place, some Singaporean investors are exploring the idea of diversifying their assets and generating passive income by purchasing properties overseas. The allure of investing abroad may prove to be a tempting option for those seeking to expand their portfolio.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …