TLDR

The Singapore residential property market has shown resilience in 2022, with price growth in both private housing and HDB resale flat segments. Despite uncertainties like rising interest rates and geopolitical tensions, the market remained stable. In 2023, private residential property prices are expected to continue rising, especially for new projects. The private housing transaction volume is likely to exceed 2022 figures. The Singapore economy is projected to expand, supporting the property market. Various segments like OCR, CCR, and RCR have shown different price trends. The new cooling measures introduced aim to regulate the market. Overall, the Singapore residential property market remains a sound investment choice with stable fundamentals and strong demand.

Summary

The Singapore residential property market has been remarkably resilient in 2022, keeping its momentum in price growth in both private housing and the HDB resale flat segments. While underlying housing demand generally remained healthy, the limited stock of new launches and resale homes available for sale have crimped transaction volumes. Meanwhile, the residential rental market continued to surprise on the upside with strong rental growth amid persistent demand drivers and tight rental supply.

Despite the strength of the market – with new launches achieving robust take-up rates in 2022 at benchmark prices – sentiment had turned cautious, owing to growing uncertainties, rising interest rates, geopolitical tensions, and global headwinds. Central banks in many advanced economies undertook aggressive rate hikes to tame decades-high inflation, led by the US Federal Reserve which delivered four mega hikes of 75bps in the year. These have raised borrowing cost and mortgage rates.

In Singapore, the 3-Month Singapore Overnight Rate Average (SORA) which is used by banks to price home loan packages raced from 0.1949 % p.a. on 4 January 2022 to 3.0925% p.a. as at 12 December 2022. The rising interest rates prompted the government to introduce new cooling measures in September 2022 to encourage homebuyers to be more prudent with their property purchase. Government land sales tenders also showed signs of wariness among developers with less active participation and more moderate land bids.

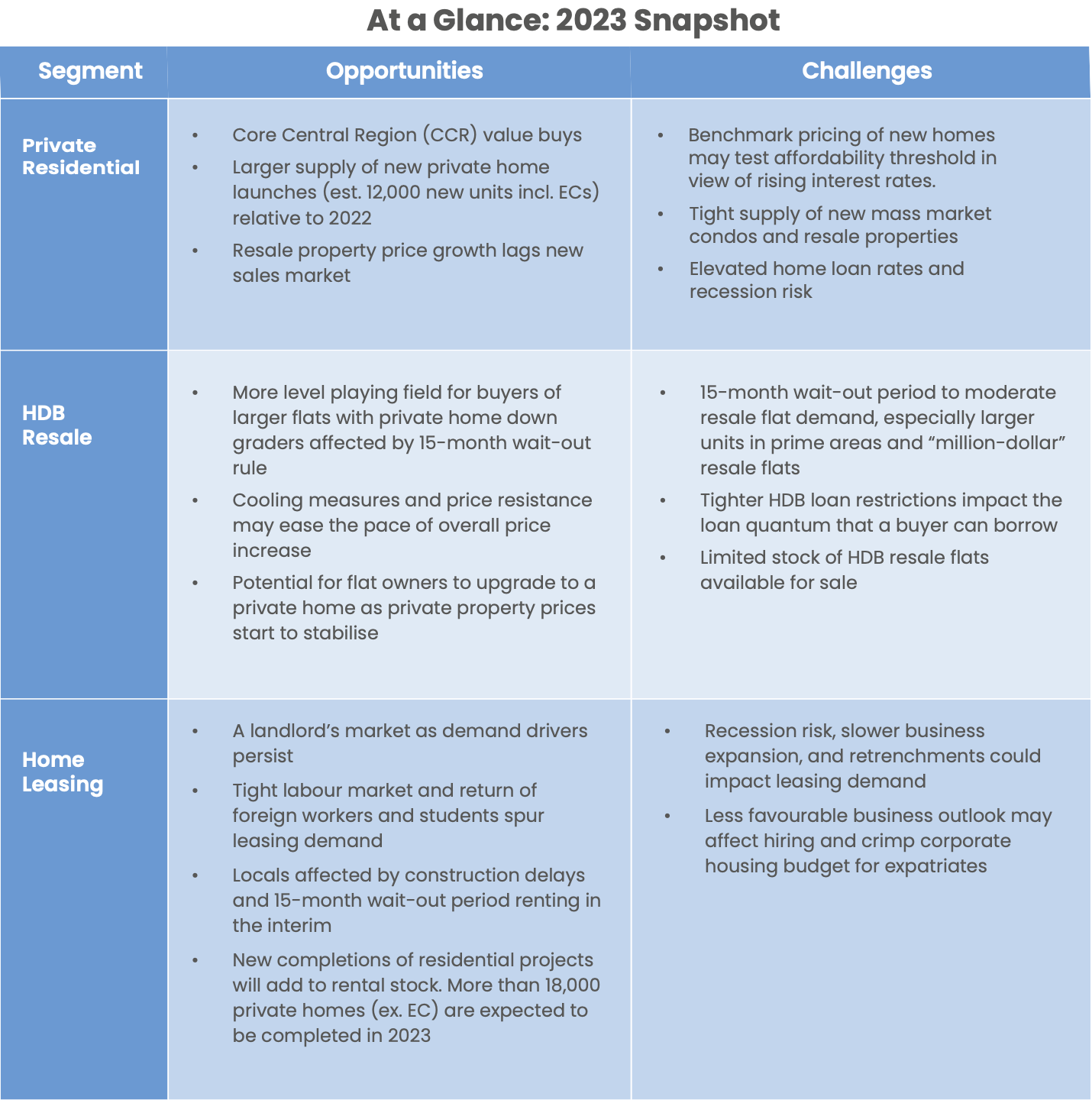

The new cooling measures are mainly targeted at the public housing sector: a new 15-month wait-out period for private home owners who have sold their private property before they can buy an HDB resale flat [an exception for seniors who can buy 4-room or smaller resale flats]; as well as a new 3% interest rate floor and lowered loan-to-value limit to 80% for those taking HDB loans. Meanwhile, the medium-term interest rate used to compute the total debt servicing ratio has been revised from 3.5% to 4%.

In 2023, downside risks persist, including high inflation, the prospect of further monetary policy tightening, geopolitical tensions and rising costs. There are also mounting concerns over slowing economic growth and a global recession. However, the Singapore residential property sector is expected to be relatively stable, supported by the underlying demand for homes and healthy market fundamentals.

Outlook for Private Housing Market 2023

It’s highly unlikely that private residential property prices will suffer any correction in 2023, as developers are factoring in the increased costs of land, construction, financing, and other development costs when pricing their new launches. Plus, with inflation remaining steady, it appears developers will be reluctant to drop their prices – so, private property prices are likely to continue to rise in the year ahead, especially for new residential projects.

With the anticipation of more new projects on the horizon, the private housing transaction volume for 2023 could exceed 2022’s figures. As economic conditions remain uncertain, many buyers are eager to take advantage of the more reasonable prices and smaller units that are becoming increasingly available.

The Singapore economy is projected to expand by around 3.5% in 2022 and 0.5% to 2.5% in 2023, the Trade and Industry Ministry said in November. Barring a worsening of economic conditions, PropNex remains optimistic about the Singapore residential property market in 2023.

Although interest rates are likely to remain elevated, the pace of increase could slow and potentially plateau in the second half of 2023, particularly if central banks are able to bring inflation under control. The stabilisation of interest rates will offer greater certainty to would-be home buyers, who will have more options in 2023 – with more than 12,000 new private homes (including executive condominiums) likely to be launched for sale during the year. Meanwhile, the HDB resale market is projected to remain healthy, as it is supported by a larger demand pool of Singaporean households.

By and large, the financial position of Singapore households remains strong and the macro prudential measures that have been put in place over the years have ensured that home owners are not over leveraged. That being said, the high inflation and rising cost of living could erode consumers’ disposable income, while the more subdued economic outlook may induce more caution among property buyers. Well-located and realistically priced mass market homes should garner healthy buying interest among owner occupiers and HDB upgraders.

Singapore’s status as a global business and wealth management hub as well as its reputation as a safe haven have kept the country on the radar of global investors. Singapore saw a record $448 billion inflow of new money in 2021, according to the Monetary Authority of Singapore. The country will remain attractive to investors and the real estate sector will be a beneficiary of such capital inflows. In particular, residential projects in the city and city fringe would appeal to foreign buyers.

Looking beyond the cyclical headwinds, the Singapore residential property market remains a sound investment proposition for the long-term, owing to the country’s stable political environment, urban rejuvenation plans, industry transformation roadmaps to drive economic growth, efforts at attracting global talent and multinational corporations to the city-state, and rising affluence among a large segment of the population.

Overview

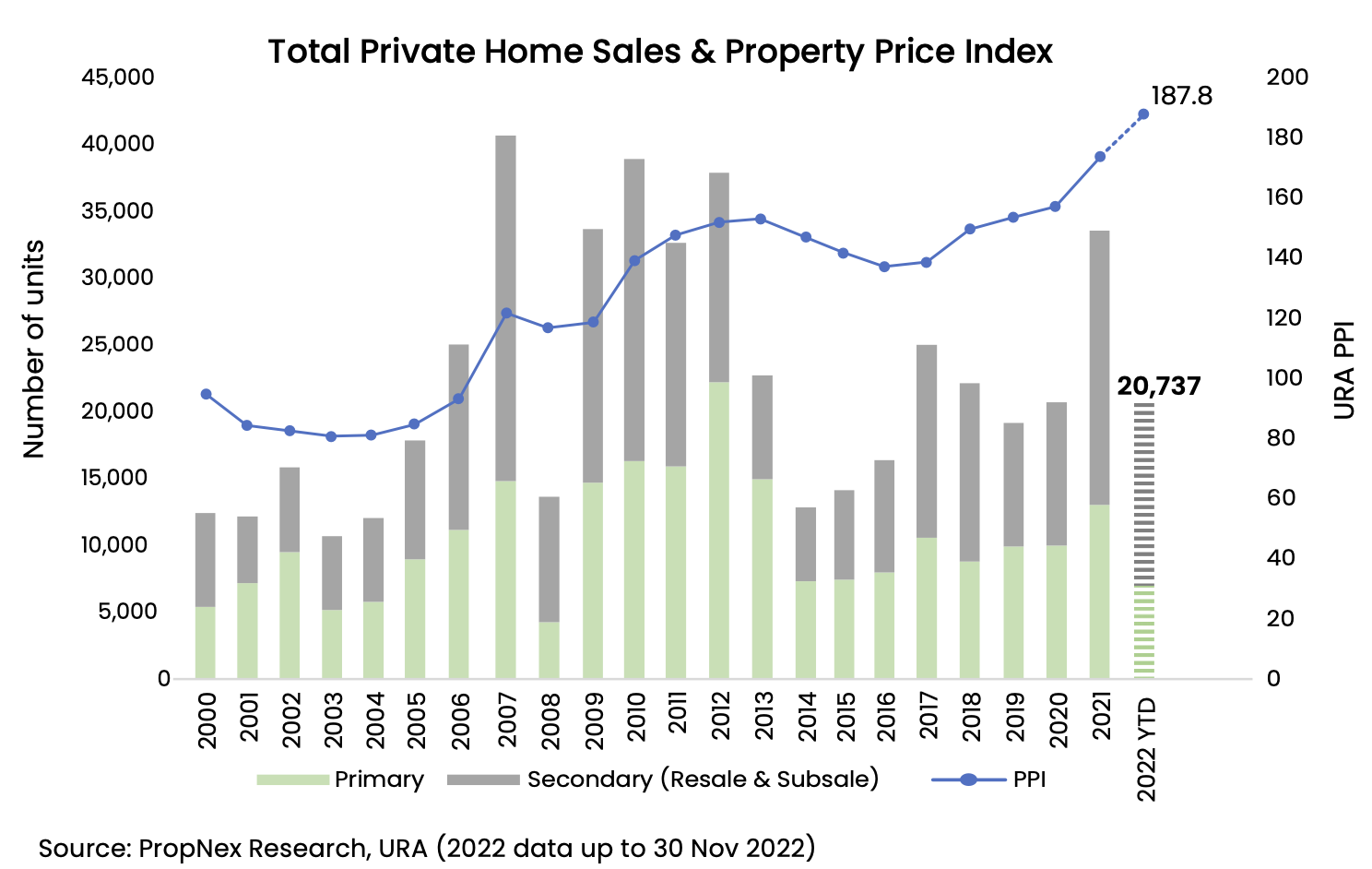

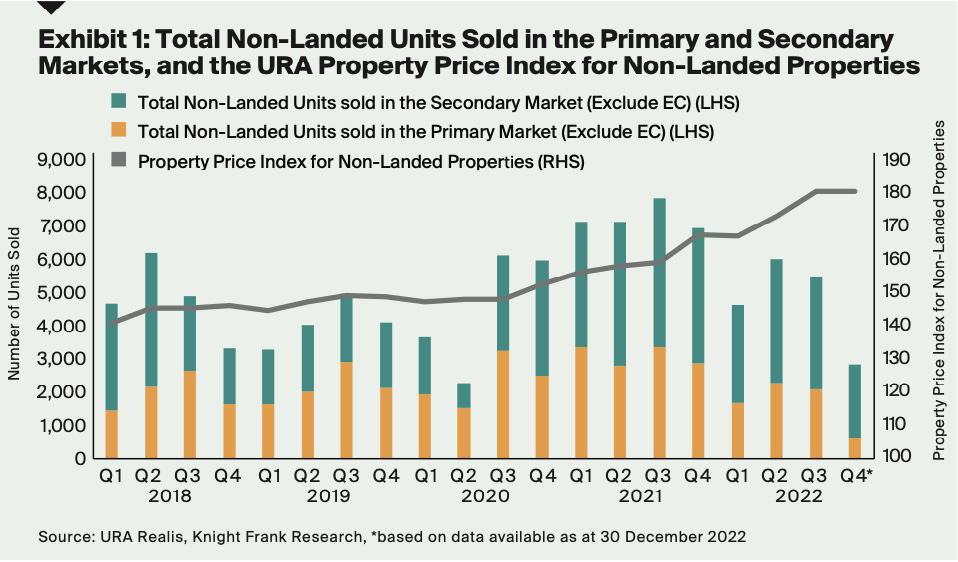

In 2022, private home prices hit a new peak amidst higher benchmark prices at new launches and dwindling inventory of unsold stock. Resilient buyer demand helped to support prices despite rising interest rates and inflation.

Overview

Overview

In 2022, private home prices hit a new peak amidst higher benchmark prices at new launches and dwin- dling inventory of unsold stock. Resilient buyer demand helped to support prices despite rising interest rates and inflation.

Home Prices and Projections

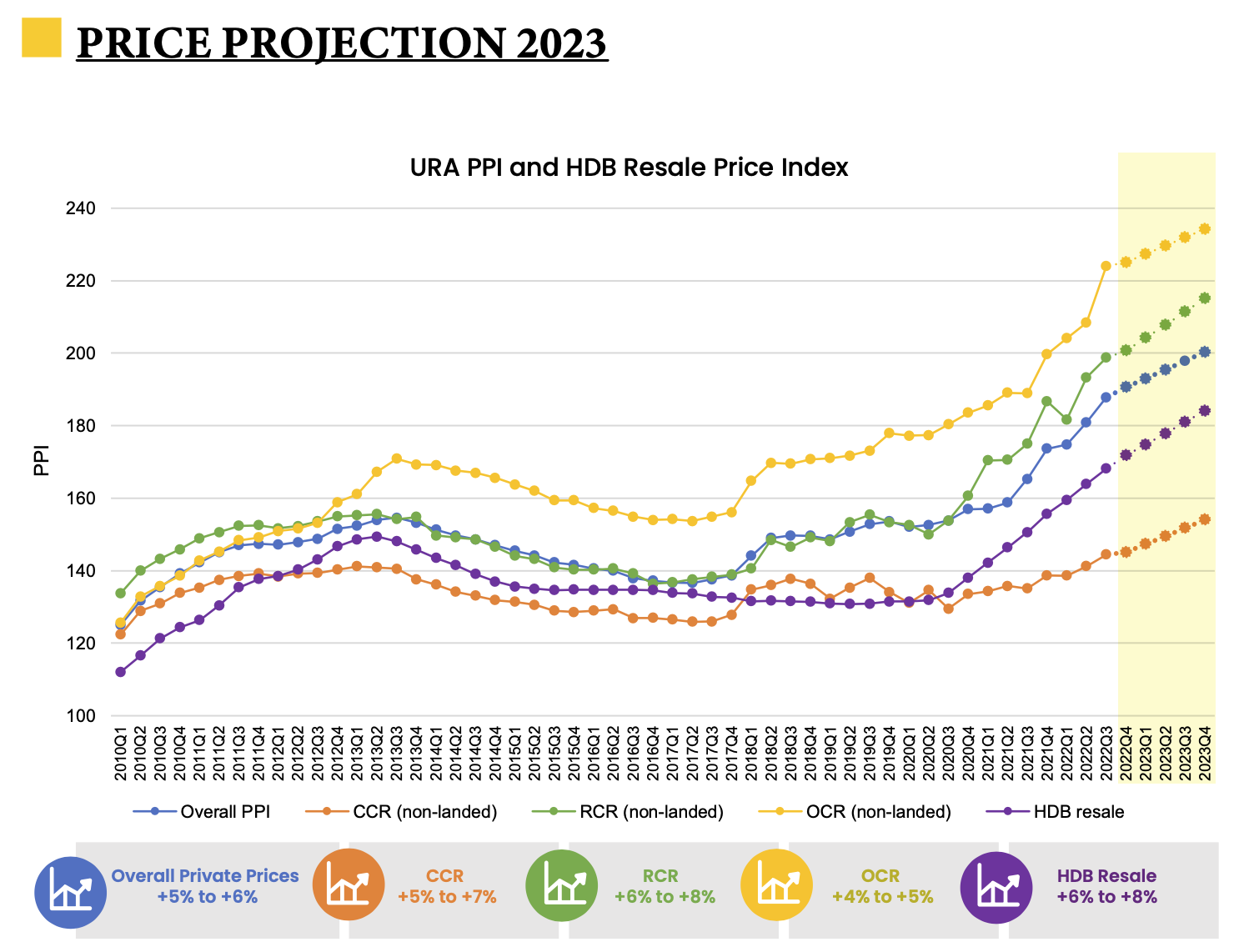

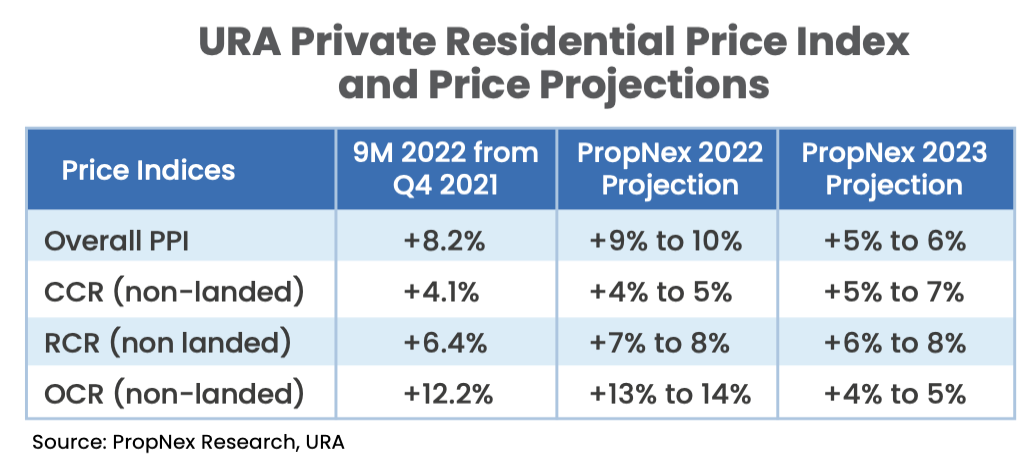

- Private home prices have climbed by 8.2% in the first three quarters of 2022; PropNex expects private home values to rise by 9% to 10% for the full year 2022. By regions, the prices of non-landed homes in the Outside Central Region (OCR) grew the fastest, rising by 12.2% in the first three quarters of 2022 from end-2021. The increase was fuelled by new benchmark prices at major suburban new launches.

- Buyers continued to find value in city centre and city fringe homes as prices of mass market homes rise. Prices of non-landed homes in the Core Central Region (CCR) and Rest of Central Region (RCR) posted modest growth in 9M 2022, despite the higher ABSD for foreign buyers and property investors, following the cooling measures introduced in December 2021. CCR and RCR prices rose by 4.1% and 6.4% respectively in 9M 2022 from end of 2021.

- Owing to global headwinds and high interest rates, the growth in private home prices in 2023 is expected to moderate, rising at a slower pace of 5% to 6%.

- With more project launches in the RCR in 2023, PropNex estimates that home prices in the city fringe could grow by 6% to 8%, partly driven by higher land prices paid by developers. CCR home prices should see some upside with several CBD launches in the pipeline. Meanwhile, OCR home prices may grow at a slower pace, having chalked up substantial gains in 2022.

New Home Sales Market

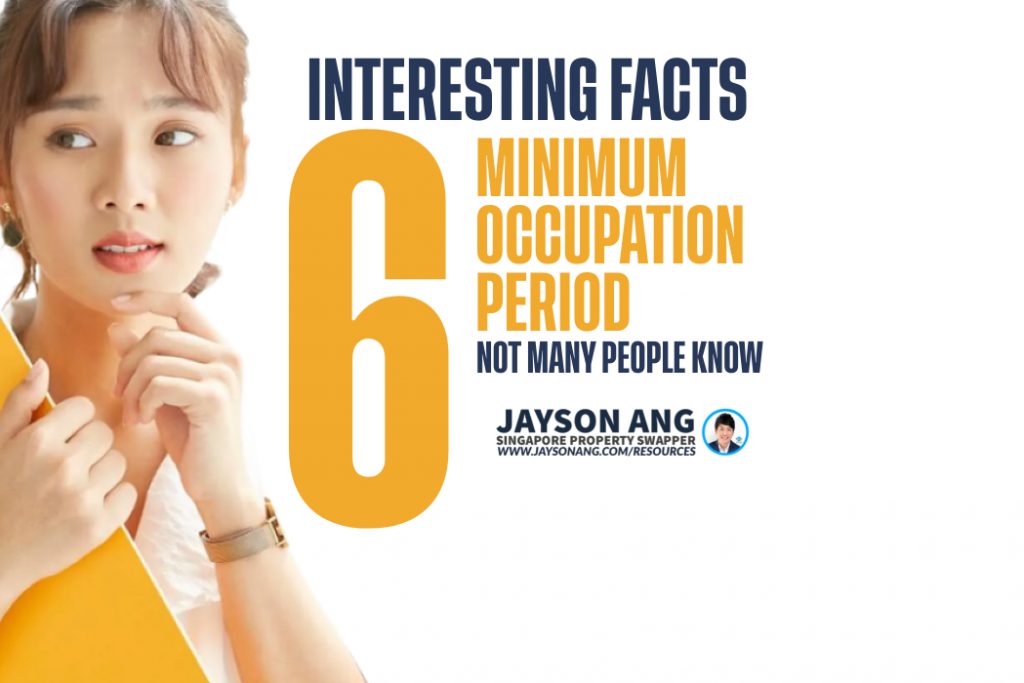

- Developers sold nearly 7,000 new private homes (ex. Executive Condos) in the first 11 months of 2022 – normalising from the 13,000 units sold in 2021 due to fewer new launches during the year and depleting unsold inventory.

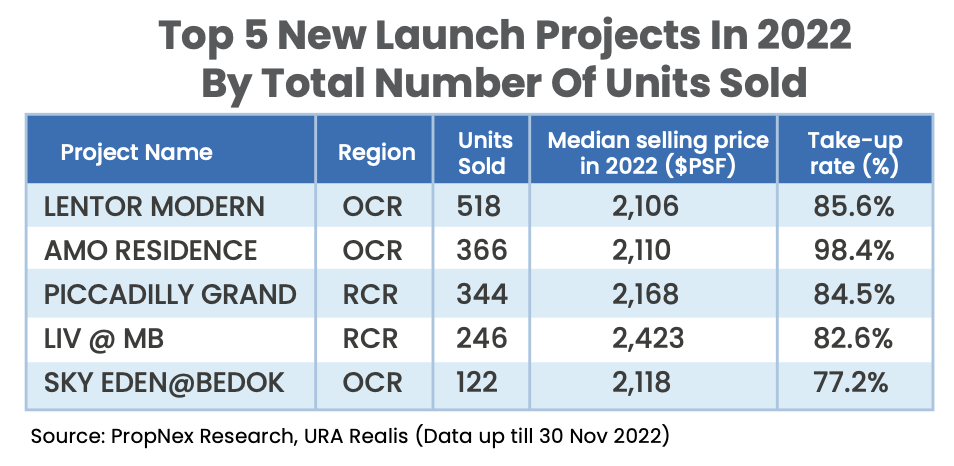

- The sales momentum in the new launch market was driven mainly by several OCR and RCR launches namely, Lentor Modern, AMO Residence, Piccadilly Grand and Liv @ MB.

- Due to the dwindling supply of new mass market homes, most project launches in 2022 fared well, achieving more than 70% take-up – fuelled by demand from upgraders and owner -occupiers.

- RCR projects dominated new home sales in 2022 – accounting for 39% of new homes sold. This was followed by the OCR (35%) and the CCR (26%).

- The top selling project of 2022 was Lentor Modern, selling 518 out of 605 units at a median price of $2,106 psf.

- In terms of buyer profile, Singaporeans and Singapore Permanent Residents (PRs) made up 93% of the non-landed new home sales in 2022. Meanwhile, the proportion of new non-landed homes purchased by foreigners rose to 7% in 2022 from 4% in 2021.

- In 2022, PropNex projects that new private home sales will likely exceed 7,300 units (ex. ECs); while in 2023, new sales volume may increase slightly to 8,000 to 9,000 units (ex. ECs) in view of the ample launch pipeline.

Inventory and Future Launches

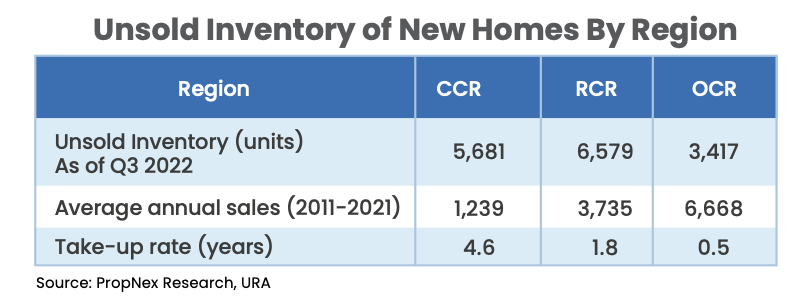

- As at the end of Q3 2022, the inventory of unsold new homes stood at 15,677 units (ex EC)

- The unsold stock in the CCR, RCR, and OCR stood at 5,681, 6,579, and 3,417 units respectively. The unsold stock in the OCR as of Q3 2022 marks a historic low for the sub-market.

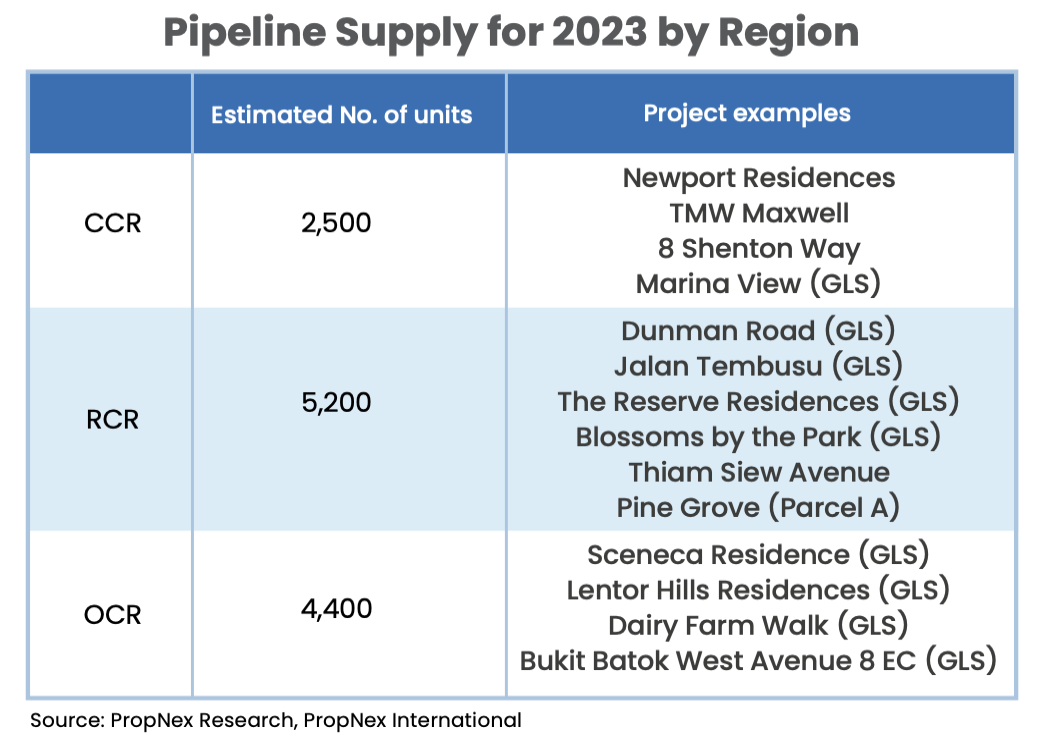

- In 2023, a larger supply estimated at about 12,000 new units (incl. EC) may be launched – with over 5,200 units in the city fringe (RCR), 4,400 units in the suburbs (OCR) and 2,500 units in the city (CCR).

- Project launches in the RCR are expected to lead the market with new average benchmark prices, owing to the higher land cost for sites acquired at recent state tenders, e.g. Dunman Road, Jalan Tembusu, and Pine Grove.

- CCR new launch prices could also climb in view of more city centre projects lined up – most are mixed-use or integrated developments, such as Marina View, 8 Shenton Way and TMW Maxwell.

- Meanwhile, prices of suburban (OCR) new homes will likely remain firm, grow slightly from 2022’s pricing. Upcoming launches in 2023 include Sceneca Residence, Lentor Hills Residences, and Dairy Farm Walk.

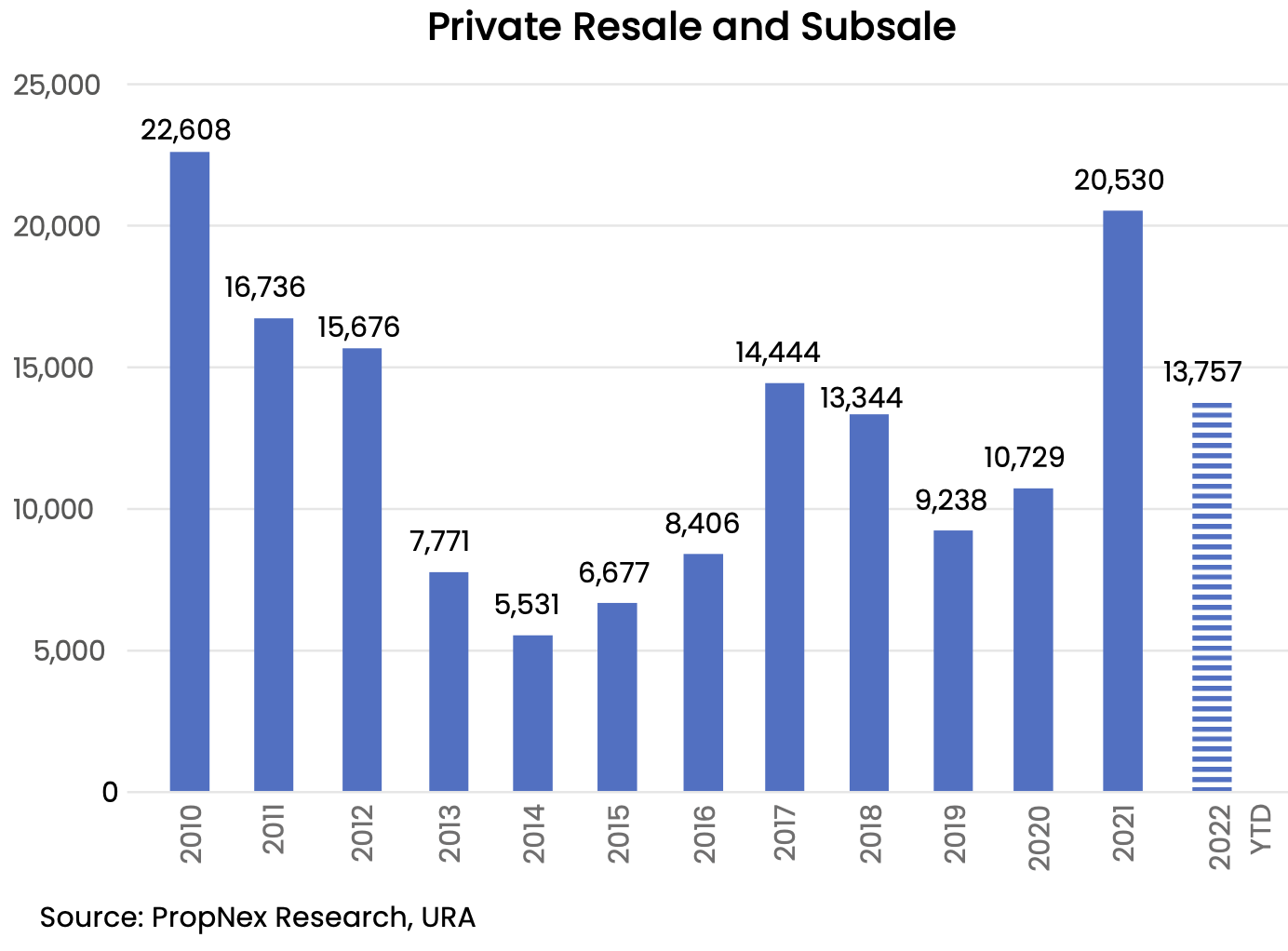

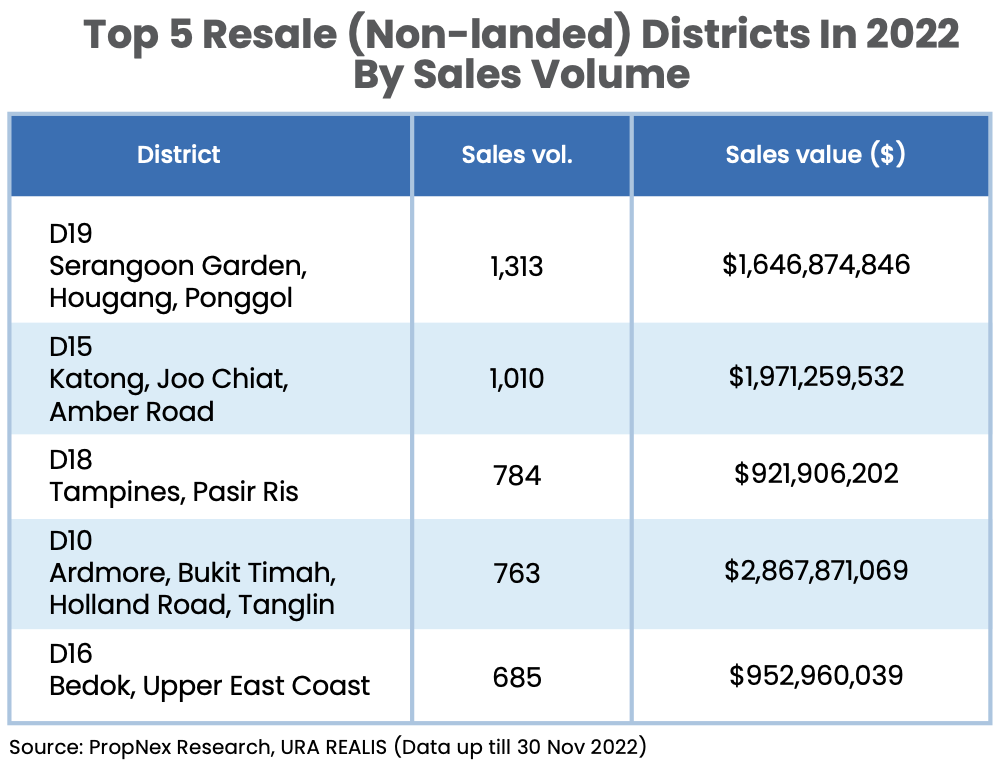

Private Resale Market and Outlook

- The most popular districts in the resale market included District 19 and District 15, which chalked up more than 1,300 and 1,000 deals respectively in the first 11 months of 2022; these are popular areas amongst locals and HDB upgraders.

- In terms of transaction value, resale homes in the prime District 10 recorded $2.87 billion worth of deals.

- In 2023, the resale volume could hit between 14,000 and 15,000 units – with more supply completions entering the market.

- A bumper crop of 18,000 private homes (ex. EC) are expected to be completed in 2023 which should contribute to the resale stock and help to prop up overall resale prices.

Property Prices In Different Market Segments

The fourth quarter of 2022 brought a surprise in the Outside Central Region’s (OCR) non-landed housing sub-market: prices retracted by 2.6%, the only property price index that declined that quarter despite surging by 7.5% in the preceding quarter. This goes against the notion that OCR condo prices were riding a wave of rapid snagging even at prices above $2,000 psf, showing that the market is not as invincible as some had thought.

The absence of new private launches in the OCR market during 4Q 2022 could be behind the drop in prices; a potential additional factor could be that the 7.5% spike in prices in the third quarter might have pushed the rate of growth too high, leading to a correction in the following quarter that brought prices down to a steadier rate of 9.3% yearly growth.

In 4Q 2022, the Rest of Central Region (RCR) experienced the fastest rate of price growth amongst the three market segments, with its price index increasing 2.6% qoq, just behind the 2.8% qoq surge witnessed in the preceding quarter. Non-landed housing in the city-fringe proved to be the star performer.

The RCR market is a desirable option for both owner-occupiers and investors alike, as the homes are within close proximity to the city centre but at a more affordable price than private homes located in the CCR. With home prices in the OCR rising faster than the other two market segments during the first three quarters of 2022, some homebuyers may choose to extend their housing budget to acquire a property in the city’s outskirts.

Wondering What Move To Make In The Real Estate Market?

Whether it’s time to buy or sell, or if it’s best to wait, the decision can be confusing.

Keep in mind that everyone’s situation is different, and it’s important to consider your own unique circumstances before making a decision.

But don’t worry – my data-driven approach and years of on-the-ground experience will help provide clarity to you.

Whether you’re a first-time homebuyer or an experienced investor, we will take a systematic and goal-oriented approach to ensure you make the right decision.

I can help you by :

- Providing Strategic Property Advice – will ensure you have the right plan to guide you in your property journey.

- Finding the ideal buyers for your home – use of high quality photography, excellent response rate, and a deep knowledge of buyers gives us the edge to showcase your property in the best way possible, helping you meet your goals.

You May Also Like …

Essential Steps for Safely Purchasing Your First Home in Singapore

The Top 10 Traits Of A Good Real Estate Agent

Beware of These 7 Deceptive Tricks In Showflat Condo Sales

Singapore Property Bubble Ahead? My Friends Share My Market Predictions

Discover 5 Reasons Executive Condominiums Could Prove To Be A Smart Investment Despite Growing Inflation

Introducing Top 5 Power Property Tips

Are You Considering Paying Off Your Mortgage Loan Ahead of Time? Is It the Right Financial Move?

6 Secrets Foreign Investors Are Rarely Told About Singapore’s Real Estate Market

Should Foreign Buyers Be Deterred By the 30% ABSD?

Integrated Developments: Do They Live Up to the Hype? Check Out These Five Factors

Unlock The Secrets To Successfully Selling Your Home In Just 7 Simple Steps!

Why Can’t Everyone Have Homes In Good Locations?

Ready To Make The Jump From HDB To Condo? This Guide Has All The Answers!

6 Essential Factors HDB Upgraders Should Be Aware Of Before Purchasing a Condo in 2023

Transaction Volumes Remained Subdued Due To The Dearth Of Inventory In Q4 2022

6 Misleading Claims Property Agents Often Make That Savvy Buyers Are Aware Of

5 Disastrous Property Transaction Nightmares (and How to Avoid Them)!

Why En Blocs Often Fail to Succeed

Which Is Better For You: A 99-Year Leasehold Or Freehold Property Tenure?