TLDR

When it comes to property transactions, understanding the factors influencing rising prices is crucial. The pandemic has driven up construction costs significantly, while the Government Land Sale (GLS) programme and Land Betterment Charge (LBC) contribute to higher property prices. Despite these challenges, the G.R.O.W Method offers a strategy for wealth creation through property investment. Stay informed about market trends and opportunities to make informed decisions in the real estate market.

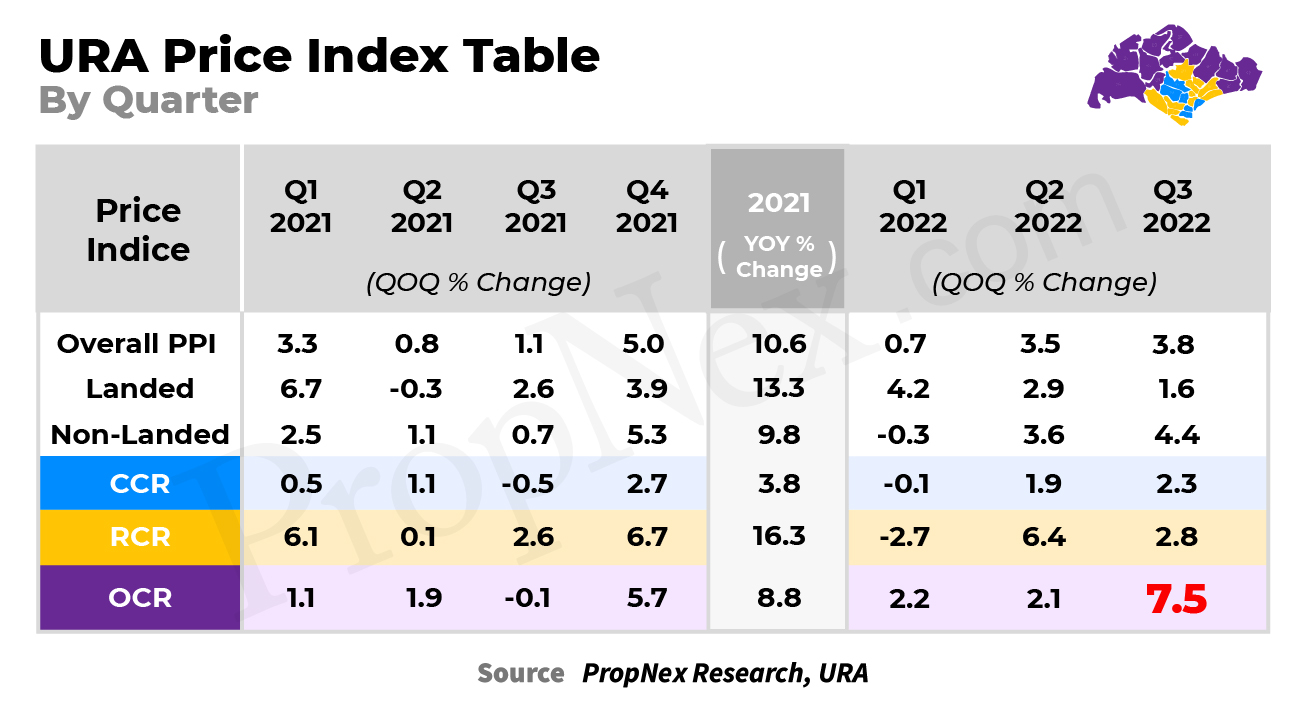

It’s a common belief that the good things in life are worth waiting for. Unfortunately, this isn’t the case with housing. If you’ve kept up with the news, you already know that home prices have been steadily increasing. The URA’s latest report reveals that from Q2 to Q3 of 2022, private home prices rose by 3.8%, and from the start of 2022 to the end of it, the increase was 8.2%.

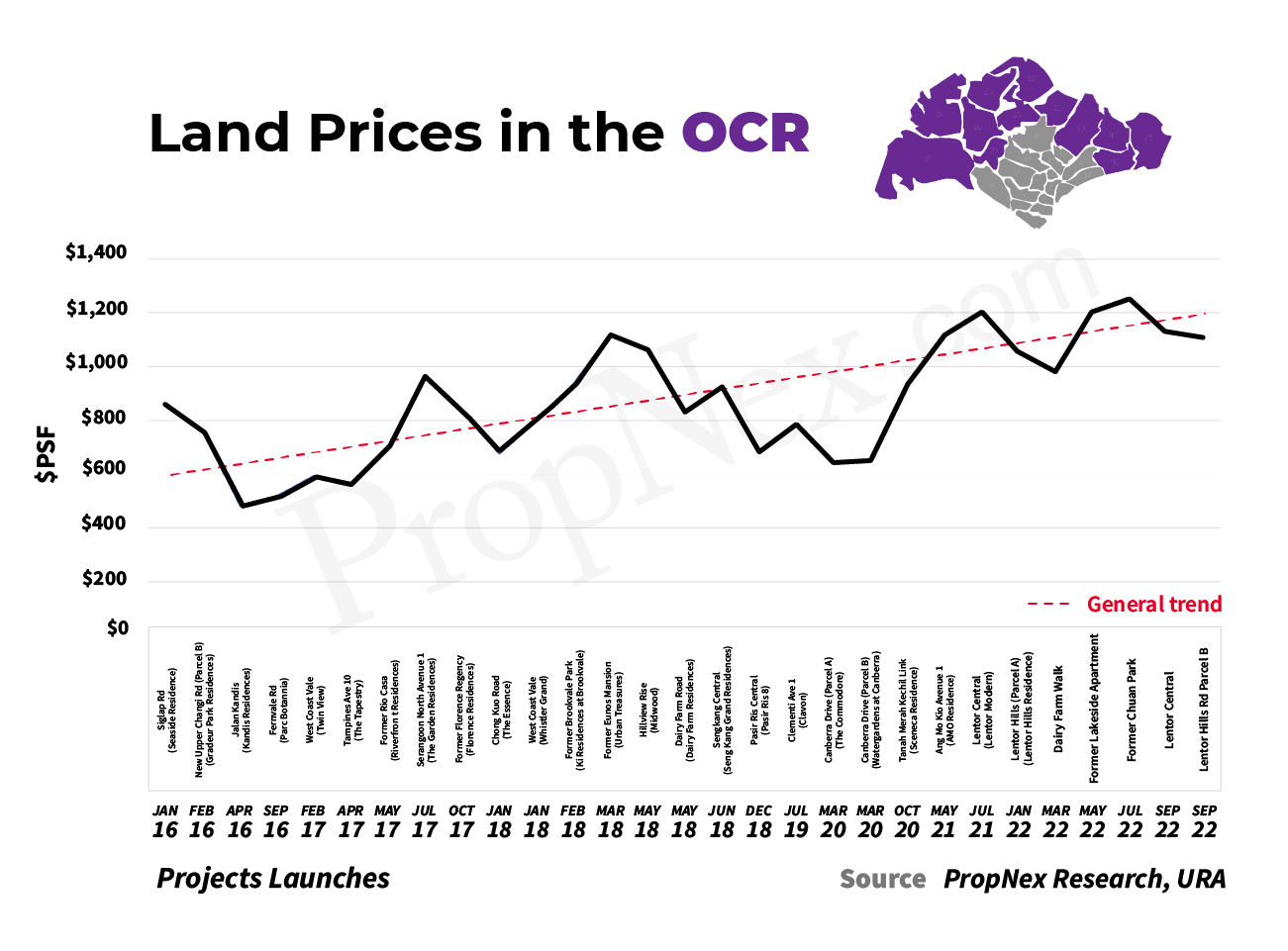

OUTSIDE CENTRAL REGION (OCR) : New Benchmark Prices

Evidently, private homes in the Outside Core Region (OCR) have excelled in the last quarter with a remarkable 7.5% surge in growth. This tremendous increase was first catalyzed by the launch of AMO Residences in July; an astounding 98% (362 units) of the units were sold on launch day alone, at an impressive median price of $2,113 psf.

The amazing results from the quarter were further bolstered by two successful launches in September – Sky Eden@Bedok and Lentor Modern. Both achieved a high rate of uptake, with 76.6% (or 121 units) of Sky Eden@Bedok being sold at a median price of $2,118 psf and a stunning 84.6% (or 512 units) of Lentor Modern selling at a median price of $2,108 psf.

The three successful launches resulted in an average OCR price-per-square-foot of above $2,000, indicating a widespread acceptance of the concept that paying over $2,000 psf for an OCR project is the new normal. Now, let us explore what factors are contributing to the rise in property prices.

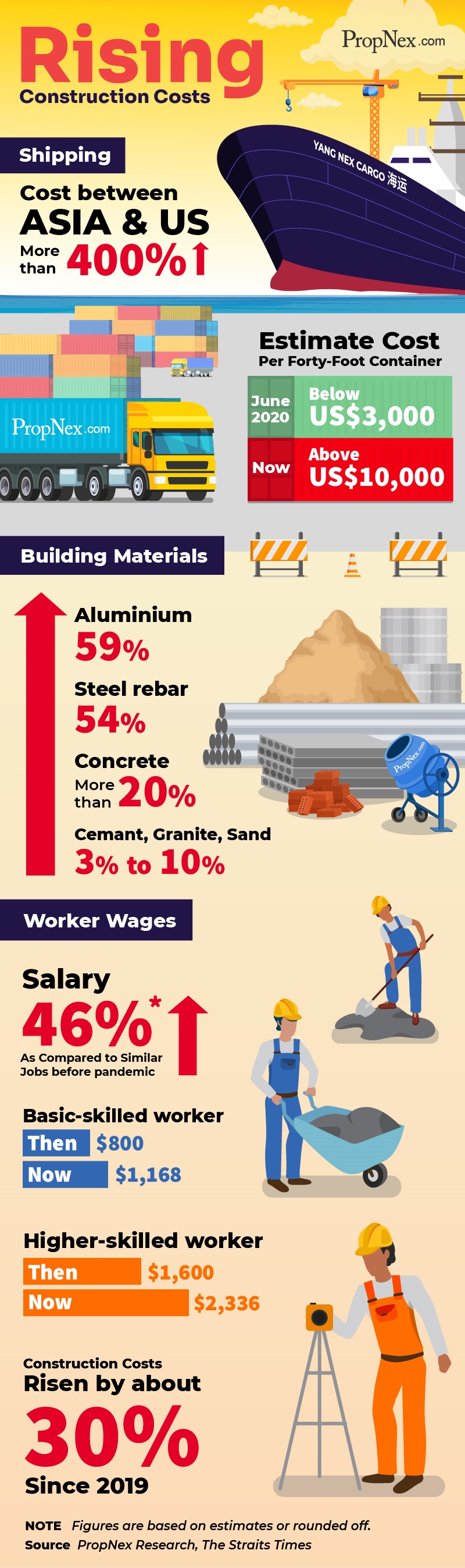

PANDEMIC COSTING EFFECT

The pandemic has caused construction costs to skyrocket, reaching record-high levels in 2022. The construction industry is grappling with higher material costs, a manpower shortage, and inflation, leading to a staggering 30% increase in costs since 2019. There is no doubt that these are the biggest challenges they have ever faced.

The pandemic brought disruption to supply chains, taking its toll on the sector, as these chains raced to fulfill the backlogged demand. To make matters worse, the Russia-Ukraine conflict drove prices of raw materials and crude oil through the roof – the latter being an essential part of the construction industry due to its reliance on crude for shipping and the production of construction materials. Costs have escalated dramatically in the last few years with the pandemic, and now, war.

GOVERNMENT LAND SALE COST

Twice a year, in March and September, the Government Land Sale (GLS) programme offers up a list of land parcels that are ripe for development. Prospective developers are invited to submit their bids for the land parcels via an open tender.

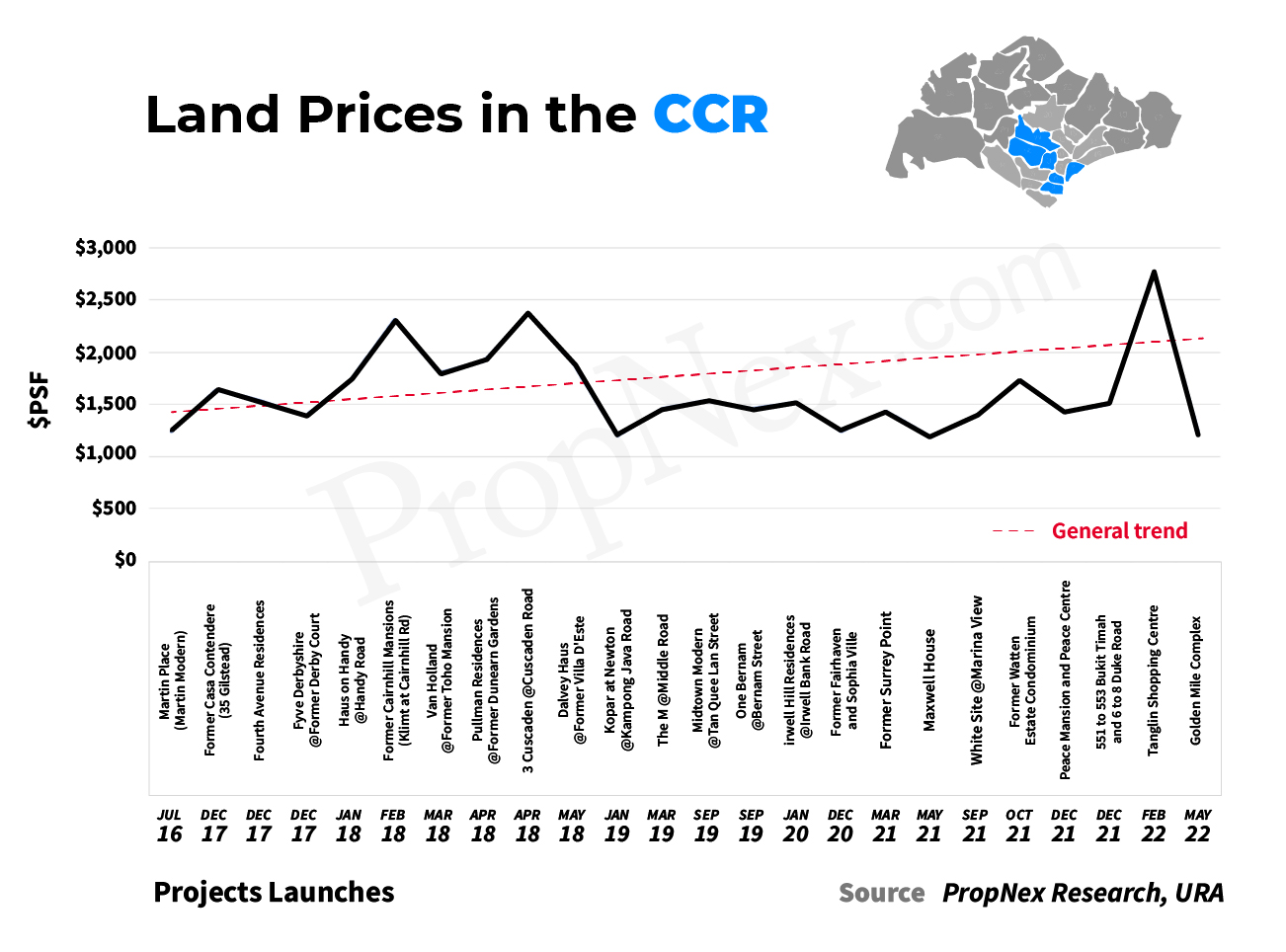

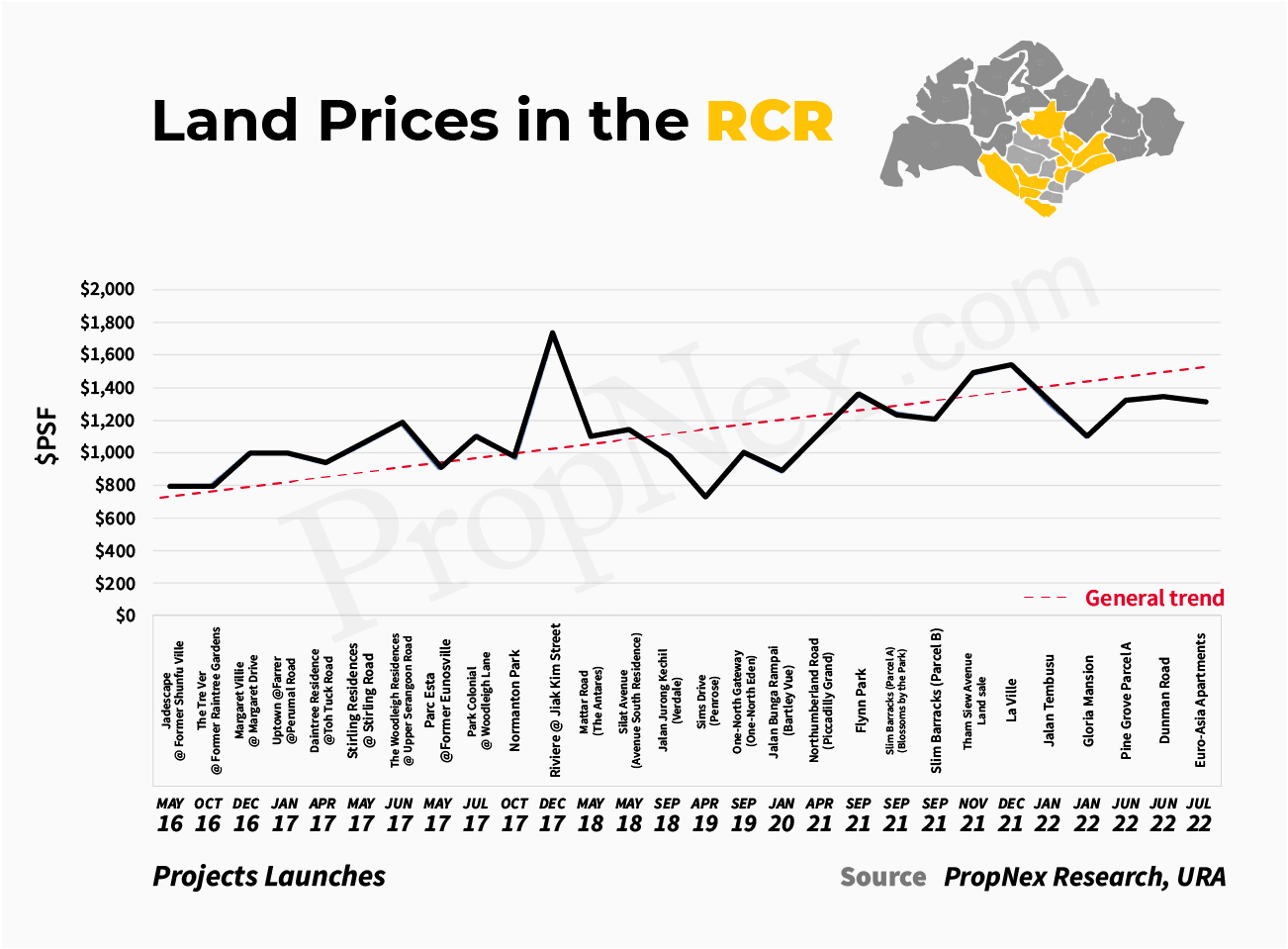

Developers engage in a fierce bidding war for land parcels, determined to secure the perfect space for their projects. This can lead to higher prices for the project, as more bids mean a higher cost of land. It is evident from the graphs that land prices are growing steadily, and this is a cost passed on to homebuyers.

DEVELOPMENT CHARGE < LAND BETTERMENT CHARGE LBC

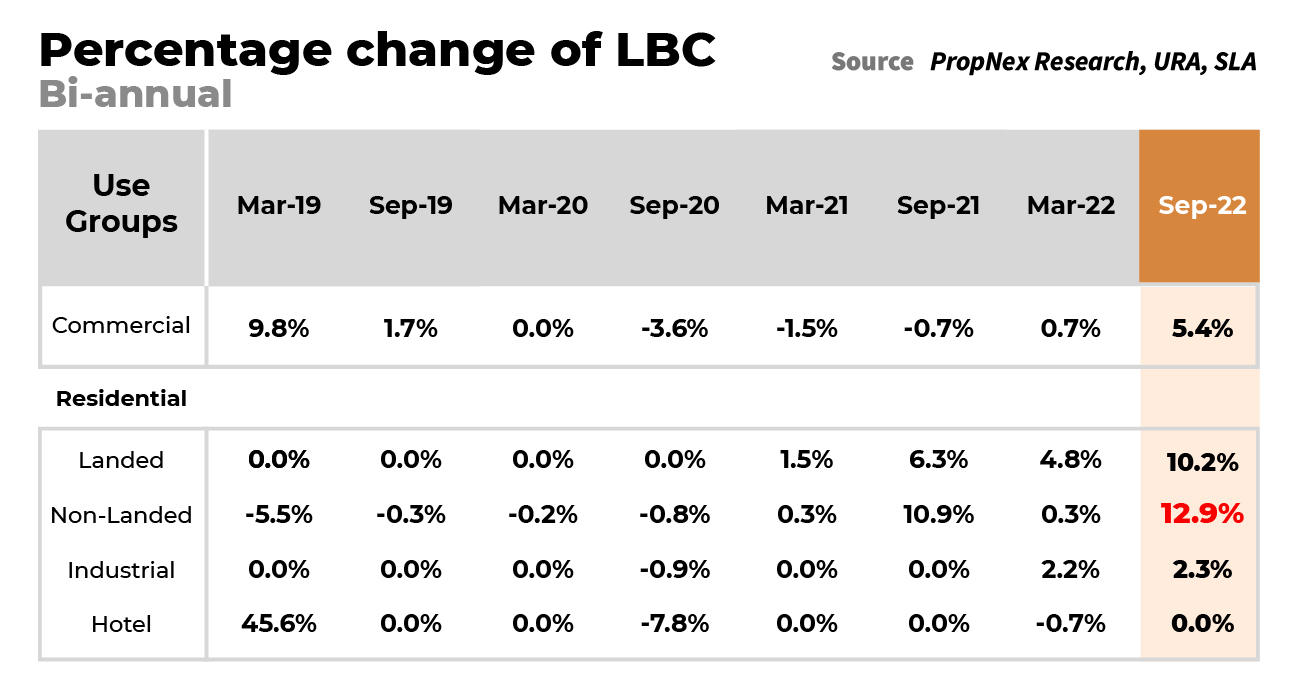

Developers must pay the Singapore Land Authority (SLA) a newly-minted Land Betterment Charge (previously known as a Development Charge) in order to gain permission for projects that increase the value of land. In the case of residential developments, a condominium is a great example of where this levy applies, as it alters the plot ratio to allow more homes to be built.

LBC rates vary according to the type of development and its location – divided into 118 geographical sectors. Similarly to GLS sites, the changes to LBC charges are usually announced in March and September. As you can see from the table, the September changes saw some major increases – the largest increase for non-landed residential projects.

As we adjust to life in a post-pandemic world, certain industries such as shipping and construction are striving to regain their former efficiency. Though they’re making progress towards normalcy, it’s certain that the costs of operations will increase and be a lingering concern. To make matters worse, the ongoing Ukraine-Russian conflict has had a profound effect on global commodities such as crude oil, a necessity for countless facets of our lives. Even more disconcerting is the possibility of inflation emerging in the face of all this.

No doubt, property prices will continue to go up in the near future – making it impossible to pick the right time to buy a house. But there are ways to make the most of the situation! The G.R.O.W Method (GROW) is a tried-and-true method to create wealth and has helped countless people. It outlines an easy-to-follow plan for how to use property to secure your financial future.

Find Out More when my next GROW Method Workshop is happening

Explore >> https://jaysonang.com/explore/

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information printed or presented here, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The ideas, suggestions, general principles, examples and other information presented here are for reference and educational purposes only.

This information contained herein is not in any way intended to provide investment, regulatory or legal advice or recommendations to buy, sell or lease properties or any form of property investment. PropNex shall have no liability for any loss or expense whatsoever, relating to any decisions made by the audience.