TLDR

The blog post discusses the looming ABSD deadline for several new launch condos in 2023, highlighting the impact on developers and potential discounts for buyers. Specific projects like Riviere, Royalgreen, One Pearl Bank, and The Landmark are analyzed for their sales progress and remaining units. Additionally, the post touches on strategic real estate advice and property investment insights for readers.

The property market may be booming, but there are still many projects that have yet to sell out before the ABSD deadline. Savvy buyers hoping for a bargain may track these projects closely, as developers may be compelled to reduce prices for the last remaining units.

Nonetheless, developers may also opt to sell the remaining units en masse to a single buyer, rather than selling them piecemeal to multiple individuals.

What is the ABSD Deadline, And Why Would There Be Discounts?

Developers must pay 40% Additional Buyer’s Stamp Duty (ABSD) when buying land for development. Luckily, ABSD remission is available after five years, provided all units are sold; but 5% is non-refundable, so the developer will always have to pay a minimum of 5% ABSD.

This rule is in place to discourage developers from creating artificial scarcity by hoarding land.

For developers, the ABSD cost is steep; holding onto units past the five-year deadline is not something they want to do. This means more discounts for buyers, as the developer rushes to sell the remaining units. The five-year window applies no matter how many units, whether it’s 100 or 1,000 – all must be sold.

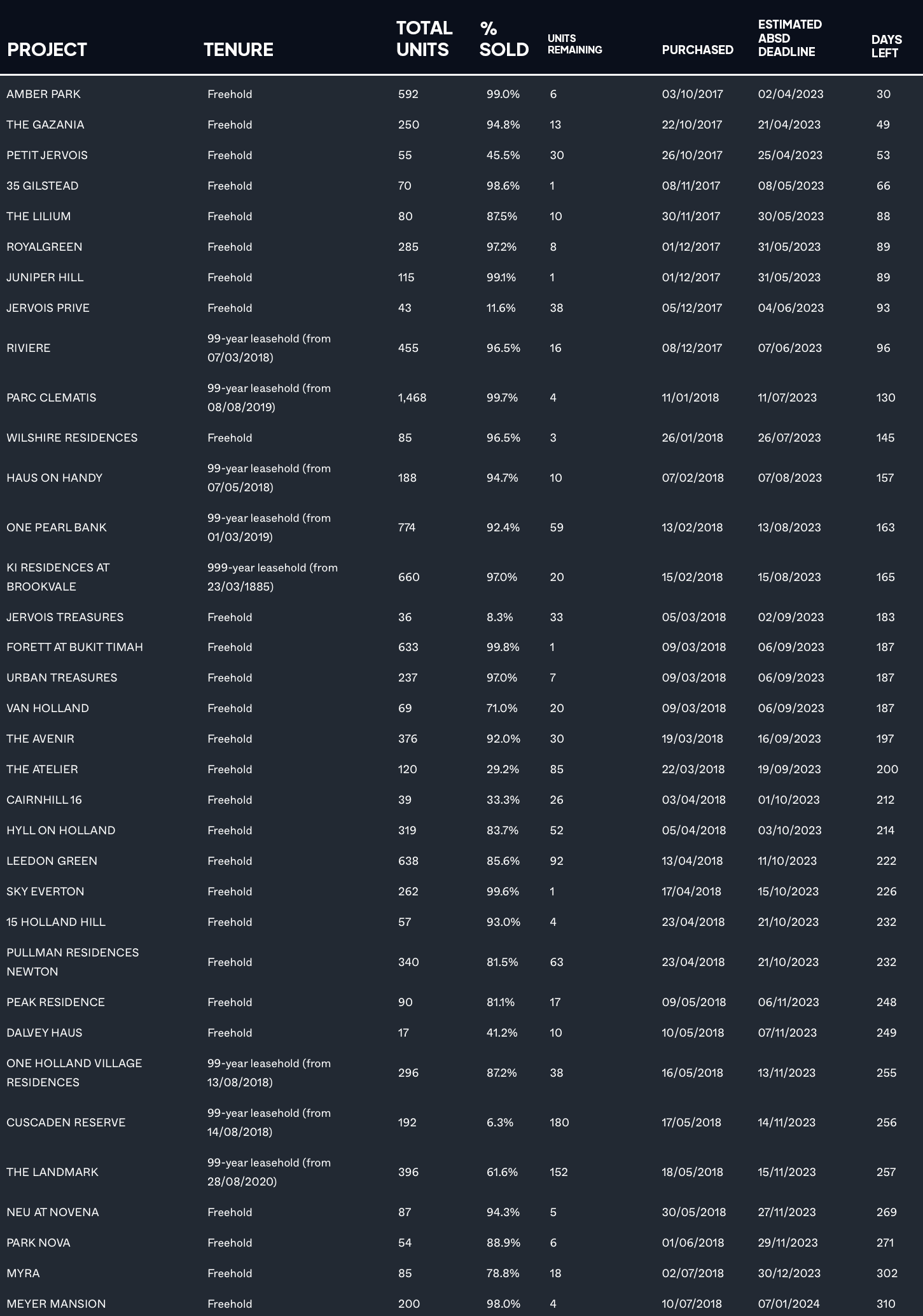

With that in mind, here’s a list of 35 new launch condos set to reach their ABSD deadline in 2023 – perfect for those on the lookout!

As of March 3, 2023, the ABSD deadline is only a guess based on the date of purchase plus an extra 5.5 years – including the six-month extension.

The ABSD period is calculated by adding 5 years (365 x 5) plus an additional 6 months (182 days) from the date of purchase of the land (whether through successful bidding of a GLS site or en bloc sale).

Therefore, the period should be taken as a close approximation and not an exact day.

Here are some notable highlights of this list:

1. Riviere Has Achieved A Stunning Turnaround

As of March 2022, Riviere had sold 46.81% of its 455 units, but after receiving its TOP just recently, only 16 units remain – mainly the upper floors. I’ve heard on the ground that the development has been well-received, with potential buyers claiming that the final product looks even better in person!

Seeing Leedon Residence’s success, it’s likely Riviere will have no problem selling off the remaining units before completion. After all, having the actual product to show the higher-end buyers can make all the difference, and with only a few months to go, prospective buyers will be able to view the development firsthand.

No surprise that there have been numerous comparisons drawn between Irwell Hill Residences and Riviere; though both residential developments are located close by, Riviere holds a particularly illustrious place, resting beside the river. But what’s intriguing is how much of a difference a later launch date, a greater momentum in sales, and a differing unit mix can make.

2. Even Though The Development Of Royalgreen Is Completed, The Units Are Yet To Be Fully Sold

Despite its premium location near Bukit Timah, the freehold TOP development Royal Green has only 8 units left, all 2-bedrooms ranging from 689 to 818 square feet.

This may appear unusual to casual onlookers, however it offers a variety of facilities and amenities, in addition to a rooftop tennis court for just 285 units – making it a truly desirable proposition for those looking for convenience, comfort and culture.

If we delve deeper, we can see that Fourth Avenue Residences may be taking sales away from RoyalGreen as both properties are created by the same developer. One being a freehold and the other a 99-year leasehold, there could have been greater product differentiation.

Additionally, there may be a demand for larger units at RoyalGreen due to the surrounding area of landed homes and the typical wealthier customers. The few 4-bedroom units available were bought up quickly, indicating the need for more spacious units.

Despite being fully sold out, Fourth Avenue Residences still had a few 2-bedroom units left to fill the gap.

3. Struggles Of New Launches On The City Fringe Of Central Business District

It’s easy to spot One Pearl Bank and The Landmark on this list because of their remaining units. Nestled at the two ends of Pearl Hill’s City Park, One Pearl Bank is in a more easily accessible location than The Landmark.

It’s tough to pinpoint the issue, especially now that the pandemic is over and foreigners have come back to our country.

Could it be the location? Highly unlikely, considering the success of Canninghill Piers, which is in close proximity and has already sold its 8,956 square feet super penthouse.

To keep updated on what’s going on, follow my Blog where I’ll also provide reviews of both new and resale properties.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …