Singapore’s property market has always been a topic of interest for both local and international investors. The city-state’s real estate landscape is known for its stability, growth potential, and attractive returns. However, understanding the factors that influence property prices in Singapore is crucial for making informed investment decisions.

We will discuss the top five key factors that affect Singapore’s property prices.

1. Economic Growth

The state of Singapore’s economy plays a significant role in determining property prices. A strong economy with robust GDP growth, low unemployment, and increasing disposable income leads to higher demand for properties, pushing prices up. Conversely, an economic downturn or recession can result in reduced demand and lower property prices.

2. Population Growth

Population growth is another critical factor affecting property prices in Singapore. As the population increases, the demand for housing also rises, leading to higher property prices. Additionally, the influx of foreign professionals and expatriates contributes to the demand for rental properties, further driving up prices.

3. Interest Rates and Mortgage Availability

Interest rates and mortgage availability have a direct impact on property prices in Singapore. Lower interest rates make borrowing more affordable, encouraging potential buyers to enter the market and driving up property prices. On the other hand, higher interest rates can deter buyers, leading to a decrease in demand and lower property prices. The availability of mortgages also plays a role, as easier access to financing can boost demand and property prices.

4. Government Policies and Regulations

Government policies and regulations can significantly influence Singapore’s property market. Measures such as cooling measures, stamp duties, and loan-to-value limits can affect property prices by either curbing demand or encouraging investment. For example, the introduction of Additional Buyer’s Stamp Duty (ABSD) and tighter loan-to-value limits in 2023 aimed to cool the property market and prevent excessive price growth.

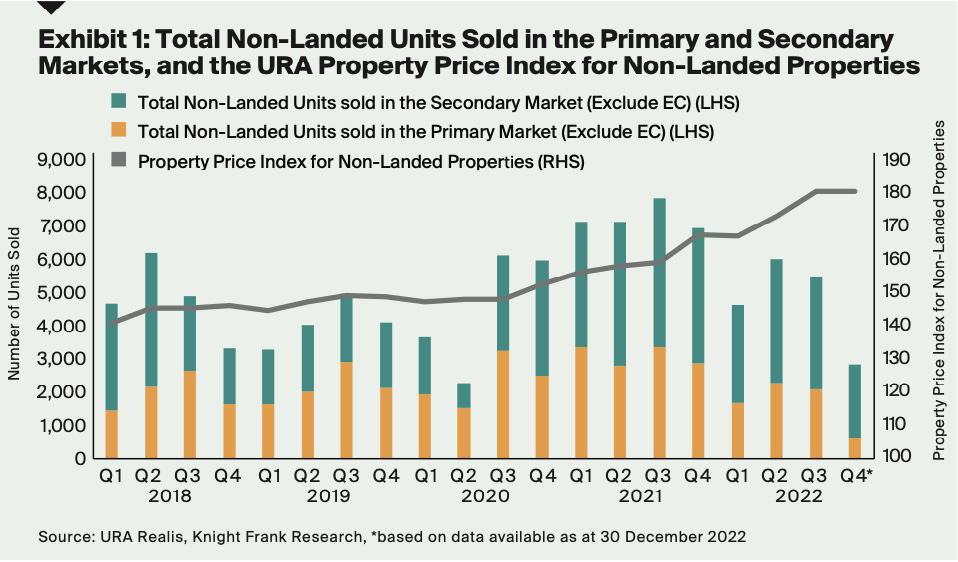

5. Supply and Demand Dynamics

The balance between supply and demand is a fundamental factor affecting property prices in Singapore. When demand exceeds supply, property prices tend to increase due to competition among buyers. Conversely, an oversupply of properties can lead to lower prices as sellers compete to attract buyers. Factors such as new property launches, land sales, and redevelopment projects can influence the supply of properties in the market.

In conclusion, understanding the key factors that affect Singapore’s property prices is essential for making informed investment decisions. Economic growth, population growth, interest rates, government policies, and supply-demand dynamics all play a crucial role in shaping the property market landscape. By keeping a close eye on these factors and staying updated on market trends, investors can better navigate the ever-changing Singapore property market and make sound investment choices.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …