TLDR

Foreign investors find Singapore attractive due to its stable governance and transparent business practices. Foreigners, including Permanent Residents (PRs), have specific rules for buying property. PRs can purchase resale HDB flats, resale executive condominiums (ECs), and private condos, while non-PR foreigners are limited to private properties and landed properties in Sentosa Cove with special permissions. The regulations for foreigners remain unchanged despite recent local property rule updates. Foreigners must pay Additional Buyer’s Stamp Duty (ABSD) of 60%, but exemptions exist for U.S. nationals and certain countries. The process includes using affordability calculators, checking tax obligations, navigating listing portals, hiring property agents, securing bank loans, and completing the purchase. Mixed nationality couples have additional options and exemptions.

For foreign investors seeking a long-term home in the bustling city-state of Singapore, purchasing property has never been more alluring. The nation’s impeccable governance, unwavering political stability, and transparent and efficient business practices have earned it a top spot for foreign investments, despite the hefty price tags that come with acquiring property.

But what type of property can one actually own as a foreigner? Can landed properties be within reach? And are there any recent changes to the rules? Fear not, for we have all the answers in this article. From eligibility criteria to the necessary steps, we have you covered on everything you need to know about buying property in Singapore as a foreigner.

Foreigners Purchasing Real Estate in Singapore: Who Qualifies as a Foreign Buyer?

Those who do not hold citizenship, work for a local company, operate under a limited liability partnership or belong to a Singaporean association are classified as foreigners. Even those with Singapore Permanent Resident status fall under this category.

What Property Can PRs and non-PR Foreigners Buy?

| What PRs can buy | What non-PRs can buy |

| Resale HDB flats (with another PR or Singaporean) | Private condos |

| Resale executive condominiums (ECs) that have reached their Minimum Occupation Period (MOP) | Private ECs |

| Privatised ECs | Landed properties in Sentosa Cove |

| Private condos | Landed properties (with special permission from SLA) |

| Strata-landed homes | |

| Landed properties in Sentosa Cove | |

| Landed properties (with special permission from Singapore Land Authority (SLA)) |

As of late, no new regulations have emerged for foreigners seeking to purchase property in Singapore. The criteria for foreign property ownership remains largely unchanged.

The Residential Property Act outlines specific conditions that must be met for foreigners to acquire both private and public housing. These include various types of properties such as:

– Luxurious apartments or stylish condominiums – Exquisite strata-landed houses within approved condominium developments – Leasehold estates in landed residential properties for up to seven years, with the possibility of renewal – Stunning landed homes on the prestigious Sentosa Cove

For many expats, the allure of a spacious landed property is irresistible. Yet, the burning question remains: are foreigners allowed to own such opulent homes in Singapore?

Foreigner Restrictions for Buying Private Property in Singapore

Yes, a foreigner may indeed purchase landed property in Singapore, though it comes with limitations and conditions. To acquire the following properties, one must reach out to the Land Dealings Approval Unit and utilize the online application on SLA’s website:

– Vacant residential land – Terrace house – Semi-detached house – Bungalow/detached house – Strata landed house not within an approved condominium development under the Planning Act (such as townhouses or cluster houses) – Shophouse (for non-commercial use)

Approval is granted on a case-by-case basis, with a higher chance of success for those who can prove an “exceptional economic contribution to Singapore,” as described by SLA. So, if you dream of owning a piece of Singaporean paradise, showcase your unique value and make it a reality.

Eligibility for Foreigners Buying Property in Singapore

Despite the recent changes in property purchasing regulations for citizens in Singapore, which were announced during the 2024 Budget speech and focused on BTO classifications, the requirements for PR and non-PR foreigners have remained largely unaltered.

As per these regulations, both PRs and non-Singapore PRs are prohibited from acquiring new HDB flats, including Build-to-Order and Sale of Balance Flats units, as individuals. Only those who are legally married to a Singapore Citizen are eligible for such purchases. However, even in this scenario, a non-citizen or non-PR spouse can only be listed as an essential occupier, rather than a co-owner.

1. If You’re a Non-PR Buying Alone

The only available options for purchasing property are limited to either private condo or a fully-privatised executive condominium (EC) that is over a decade.”

2. If You’re an PR Buying Alone

Aside from newly built HDB flats, PRs are prohibited from purchasing a pre-owned HDB flat on their own. The only option available to them is to acquire a resale EC that has surpassed its five-year Minimum Occupation Period. However, for single PRs with a desire for personal property ownership, the possibility of acquiring private property still remains open.

3. If You’re an PR Jointly Buying With Another PR

- A resale HDB flat (three years after obtaining your PR)

- A resale EC that is more than five years old

- A privatised EC that is more than 10 years old

- Private property

4. If You’re an PR Buying With a Non-PR

- A resale EC that is more than five years old

- A privatised EC that is more than 10 years old

- Private property

5. If You’re Jointly Buying as a Non-PR Couple

- A privatised EC that is more than 10 years old

- Private property

6. If You’re Buying as a Singaporean-Foreigner Couple

- 2-room Flexi BTO flat in non-mature estates

- Resale flat (except 3Gen and Prime flats)

- Private property

As a foreigner or a permanent resident (PR) married to a Singaporean with no prior residential property ownership, you have the privilege of being exempt from paying Additional Buyer’s Stamp Duty (ABSD) when purchasing private property.

But the excitement doesn’t stop there! Mixed nationality couples also have the opportunity to purchase an HDB flat together. Keep in mind, however, that this only applies to 2-room Flexi BTO flats in non-mature estates with a 99-year lease. And, of course, you must be at least 35 years old and meet the income ceiling of $7,000.

But fear not, for those who are younger and itching to own a home, you can still purchase a resale flat (with the exception of 3Gen and Prime Location Public Housing flats) at the young age of 21. The only catch is that your non-resident spouse must have a valid Long Term Visit Pass or Work Pass for at least 6 months if they are 21 years and above, and any validity period if they are 35 years and above.

Before making any moves, it’s important to secure the HDB Flat Eligibility (HFE) letter. This letter will not only determine your eligibility for an HDB flat, but also your CPF Housing Grant eligibility and HDB loan eligibility. Talk about a one-stop-shop for all your home ownership needs!

Procedures for Buying Property in Singapore

1. Use Affordability Calculator

Having a rough idea of your desired purchase, the crucial next move is to determine its financial feasibility. Let my Affordability Calculator ease your worries, as it calculates the maximum property affordability according to prevailing government regulations and cooling measures.

2. Check If You Need to Pay Taxes

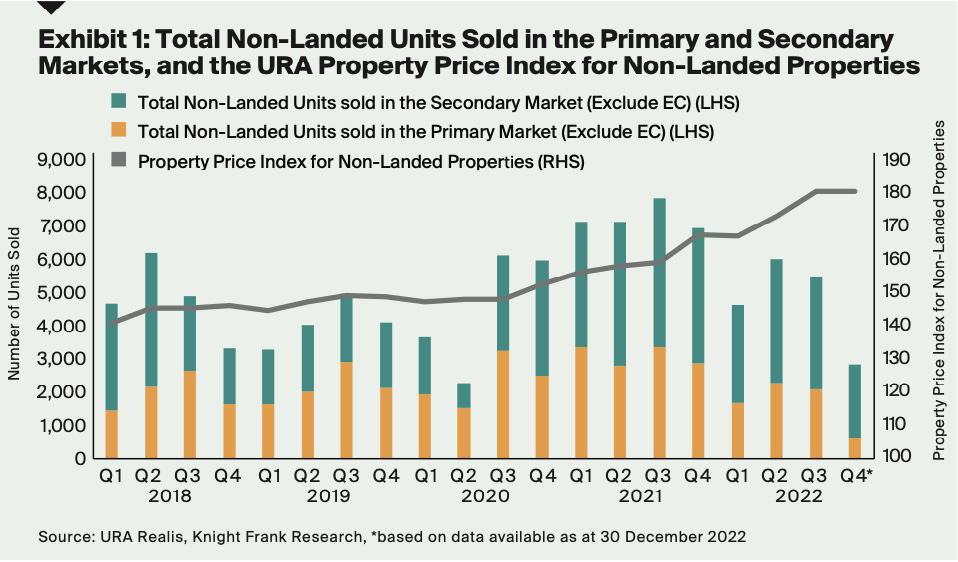

“At present, no fresh regulations have been set for purchasing real estate in Singapore. However, non-citizens are obligated to settle the Additional Buyer’s Stamp Duty (ABSD) on top of the Buyer’s Stamp Duty (BSD) when acquiring private property in the country. These ABSD rates have undergone changes over the years.

For permanent residents (PRs), the rates vary between 5% to 35%, depending on the number of residential properties being purchased. As for foreigners, due to the property cooling measures implemented in April 2023, an exorbitant ABSD rate of 60% is imposed for any residential property purchase in Singapore.

But fear not, there are exceptions to the ABSD rule for nationals of the United States and certain countries such as Switzerland, Liechtenstein, Norway, and Iceland. The full terms for exemption can be found on the IRAS website. And don’t forget, in addition to these costs, there are also legal and administrative fees to consider.

Feeling overwhelmed with calculating your BSD and ABSD? Don’t fret, simply utilize our handy stamp duty calculator to determine the duties owed on your new home.”

3. Go Through Listing Portals in Singapore

Immerse yourself in extensive collection of resale HDB flats, ECs, private condos, and newly launched properties, tailored to fit your budget and preferred location. Don’t forget to take into account the convenience of nearby amenities, like bustling MRT stations, scenic parks, and effortless commuting options, when making your decision.

4. Hire a Property Agent

With an agent by your side, you’ll have a savvy guide to seek out the most advantageous bargains, handle all your monetary computations, streamline your paperwork, and tackle all the tiny yet crucial intricacies. And should there be any fresh regulations for purchasing real estate in Singapore, rest assured, they’ll have the inside scoop and expertly steer you through them.

5. Apply for a Bank Loan

Are you a foreigner looking to secure a bank loan in the bustling city of Singapore? Look no further, for you can receive up to 75% financing on the purchase price of your desired property. However, do keep in mind that bank loan mortgage interest rates are highly influenced by the ever-changing market. This means you have the option to choose between a floating or fixed rate home loan, depending on your financial strategy.

But don’t forget, banks in Singapore are not lenient when it comes to missed payments and have no qualms about repossessing your home. Therefore, it’s wise to have at least 12 months’ worth of savings set aside, just in case. And if you find yourself lost in the labyrinth of home loan applications, fear not, for I am here to guide you through the process. Reach out to me and let’s make your dream of owning a home in Singapore a reality.

6. Make an Offer and Seal the Deal

You have done your homework and are well-informed about the latest property acquisition guidelines in Singapore. Financing has been secured from a reputable bank after carefully browsing through various options. Now, your dream property in the thriving HDB or private market has finally surfaced, beckoning you to make it your own.

For those who have chosen to purchase an HDB resale flat, simply log into the HDB Flat Portal and let the process unfold. Here’s a handy timeline to guide you through the journey:

Condominium enthusiasts, it’s time to take the plunge and seal the deal by putting down a 1% option fee. Within the month, secure financing and settle the remaining 4% option fee. And then, with determination and grit, pay the downpayment, which may vary depending on your Loan-To-Value limit and the loan amount received, starting from 25% of the property’s purchase price.

For non-citizens, the downpayment must be made in cash. As for permanent residents, a combination of CPF OA savings and cash can be utilized. And with that, voila! You are all set to embark on your exciting journey of property ownership in the vibrant city of Singapore. All the very best!

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …