TLDR

In Singapore, owning both an HDB flat and a private property has become complicated due to factors like Additional Buyer’s Stamp Duty (ABSD) and high down payments. Keeping a flat while buying a private property is subject to citizenship and property acquisition order. ABSD rates, rental income, property appreciation, and maintenance costs are essential considerations. The flat’s age affects appreciation and loan value. Financing a second property requires significant cash and CPF savings, and meeting Total Debt Servicing Ratio (TDSR) requirements is challenging. Retaining an HDB flat as a backup plan can be beneficial for financial security and family dynamics. Making informed decisions based on personal financial situations and professional advice is crucial.

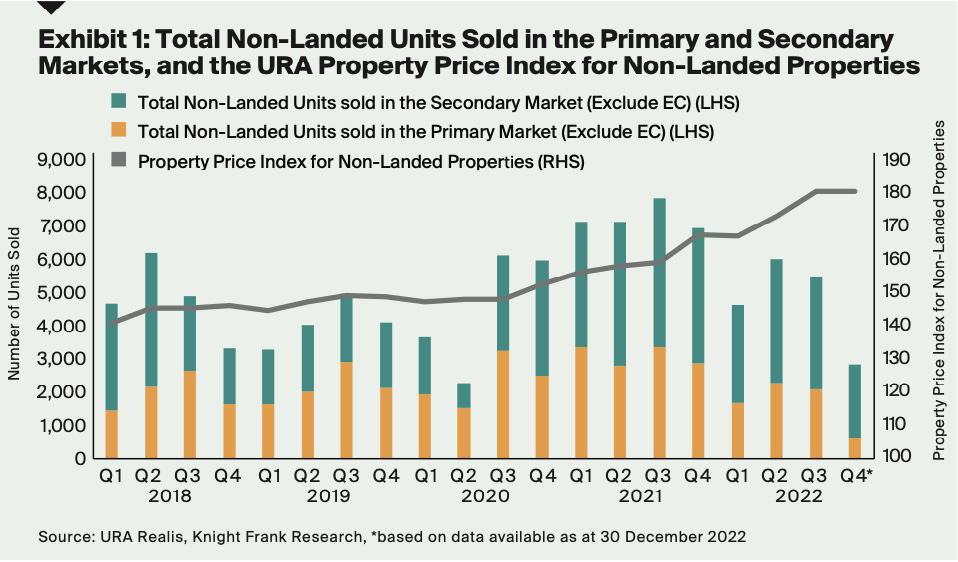

Twenty years ago, the decision seemed crystal clear – renting out your flat and using the profits to offset your condo mortgage was the standard practice. But as we approach the year 2022, the once simple question has morphed into a convoluted dilemma.

With additional buyer’s stamp duty (ABSD) and steeper down payments, juggling both a HDB flat and a private property may no longer be the optimal choice for everyone. In fact, it’s become a hot topic in our popular weekly advice series, even though a mere 3 percent of HDB residents have taken the plunge into private property ownership.

To sum up, here are the new considerations:

Can You Keep Your Flat While Owning a Private Property?

The answer to this complex property puzzle is not set in stone, as it relies on a combination of citizenship and the order in which you obtained your properties.

For those who secure a HDB flat first, with at least one Singaporean owner, a simple wait of five years (or 10 years for Prime Location Housing) is all that stands between them and the ability to purchase a private property while still holding onto their beloved flat.

However, those who opt for a private property as their initial investment must first part ways with it before being eligible to own a flat*. And the plot thickens for those with only PR status, as they must quickly dispose of their flat within six months of acquiring a private property.

*But wait, there’s more! The game of waiting continues, with a 30-month cooling period after selling a private property before being allowed to ballot for a BTO flat. And for those eager to snag a resale flat, a 15-month wait is still required, depending on their age and the size of the flat. So plan carefully, dear property seekers, for the timing of your acquisitions holds great weight.

Should You Keep Your Flat or Sell It?

1. The ABSD Rate

Owning a second property in Singapore can be a lucrative investment, but it also comes with its fair share of expenses. As a prospective buyer, you may be faced with the daunting possibility of paying the Additional Buyers Stamp Duty (ABSD) if you choose to hold on to your current flat. The current rate for this duty is a staggering 17 per cent of the second property’s price or value, with a higher rate of 25 per cent for Permanent Residents (PRs).

Naturally, this raises the question of whether the rental income and potential returns from your HDB flat can offset the hefty ABSD. For instance, if you purchase a $1.6 million condominium and pay $272,000 in ABSD, it would take approximately 7.5 years of rental income at $3,000 per month to break even; not exactly a tempting prospect for most buyers, despite the high rental rates in the current market.

On the other hand, you could also consider the appreciation rate of your HDB flat. Let’s say your current flat is valued at $500,000. In order to cover the ABSD through its appreciation by the time you decide to sell, you would need an impressive 45.4 per cent increase in its price. This may seem like a daunting figure, but thorough research and analyzing transaction histories in your area can give you a better understanding of its feasibility.

Of course, this decision must be weighed against the potential returns of upgrading to a single larger home, or even owning two private properties. It ultimately depends on your own expectations and the nature of the properties involved, and I am here to assist you in making the most informed decision.

However, with ABSD rates being at an all-time high in 2022, it may not be wise for most buyers to hold on to their flat. This is especially true for PRs, who face an even higher rate of 25 per cent.

If you still wish to retain your flat, it is advisable to have only one spouse registered as the owner. This allows the other to purchase a second property without incurring the ABSD. As such, it is crucial to plan early and seek professional guidance, which we have elaborated on in further detail here.

2. Where Do You Call Home?

Imagine a scenario where you have the best of both worlds – living in your cozy flat while raking in rental income from your private property. This dreamy situation is not just a figment of the imagination, but a reality for many older Singaporeans who have fully paid off their HDB flats and are now seeking to invest in a smaller one or two-bedder unit for additional income.

However, as with any financial decision, careful considerations must be made. Just like the first point, it is crucial to ensure that the rental rates and eventual resale value of the private property are able to cover the Additional Buyer’s Stamp Duty (ABSD). This may be a simpler feat compared to the HDB flat, as the private property is likely to appreciate at a faster rate.

Not only does this strategy offer a sense of security – being able to fall back on your HDB flat if the need arises to sell the private property – but it also proves to be a practical choice in light of the recent cooling measures in September 2022. With a waiting period of up to 15 months for those selling their private homes to purchase a resale flat, the option of retaining the HDB flat while renting out the private property becomes even more appealing.

However, it is essential to keep in mind that the maintenance fees for the private property must still be paid, regardless of whether you choose to reside in your flat or rent out the condo. So, while you may have an additional stream of income, the responsibility of maintenance costs remains with you, not your tenant.

3. How Old is Your Flat?

As the midpoint of a lease approaches, flats are prone to slower appreciation or even depreciation – a grim reality that may deter future buyers and force banks to lower the maximum loan quantum. This could spell trouble for your investment as it erodes potential returns, making it challenging to cover the Additional Buyer’s Stamp Duty (ABSD) (see point 1).

However, the ultimate disappointment would be holding onto your flat, only to sell it a decade later at a meager gain or possibly even a loss due to the declining lease – a double whammy of ABSD expenses. On the bright side, rental income remains relatively unaffected by this issue. After all, tenants are more concerned with the prime location and impeccable upkeep of your flat rather than its remaining lease. So if you’re content with collecting rent until the lease runs out, it may still be a wise decision to hold onto an older flat.

4. Secure Your Cash Down Payment Without Selling Your Flat

Perhaps you’ve heard the enticing promise that you only need to set aside five per cent of a private property’s price to secure your dream home. It certainly makes the idea of holding onto your current flat much more feasible. After all, why give up your beloved abode if you can simply save up for the down payment, right? Unfortunately, the reality of this situation is not as simple as it seems.

In reality, the initial cash outlay for purchasing a private property can far surpass just five per cent*. This is due to the standard Loan To Value (LTV) ratio for bank loans, which is set at 75 per cent of the property price or value (whichever is lower). While only the first five per cent (or $80,000) is required in cash, the remaining 20 per cent must be paid in a combination of cash and CPF. This means that for a $1.6 million property, you will need a whopping $400,000 in cash upfront, and also ensure that your CPF has enough funds to cover the rest.

But that’s not all. Don’t forget about the Additional Buyer’s Stamp Duty (ABSD), which will cost you around $272,000 for your second home. Can you rely on your CPF to cover 20 per cent of your condo’s price as well as the stamp duties?

It’s also important to consider the Total Debt Servicing Ratio (TDSR), which is currently capped at 55 per cent of the borrower’s income. Since the cooling measures implemented in September 2022, TDSR is calculated with a minimum interest rate of four per cent. This means that for a loan of $1,200,000 for a $1.6 million property, with a loan tenure of 25 years at four per cent interest, the monthly repayment will be a staggering $6,334. This translates to a minimum required monthly income of around $11,516 to qualify for the maximum loan amount. If your income falls below this amount, you will need to increase your down payment even further until it falls within the TDSR framework.

After crunching these numbers, you may find that the idea of keeping your current flat while purchasing a private property is much more challenging than simply “saving up five per cent”. *In our example, we have assumed that you have fully paid off your flat before attempting to buy a second private property. If you still have an outstanding loan on your flat, it is highly unlikely that you will be able to afford both your flat and a private property. This is because the LTV for your private property will only be 45 per cent and the minimum cash component will increase to 10 per cent.

In addition, meeting the TDSR requirements for having two home loans is a feat that few Singaporeans can achieve. So before you start dreaming about owning multiple properties, make sure you have a realistic understanding of the financial commitments involved.

5. Tackling Challenges Beyond the Investment

Are you and your children planning to pool your cash to purchase a private property and move in together? It’s important to consider retaining your HDB flat as a backup plan. You never know, things may not work out as smoothly as you hope. Let’s take a look at two possible scenarios:

Scenario 1:

An elderly couple sells their HDB flat and hands over all the proceeds to their children, before moving into a luxurious condo with them. However, as time goes by, they realize that living together is not as idyllic as they thought. Unfortunately, they are now stuck in a difficult situation. Without the means to purchase another home, they have to rely on their children to sell the condo and divide the profits fairly. But let’s be real, family disputes over money are never pretty.

Scenario 2:

On the other hand, we have an elderly couple who have the foresight to keep their HDB flat while contributing what they can to their children’s purchase of a larger condo. They move in with their children, but instead of leaving their flat vacant, they rent it out. Not only do they enjoy a passive income, but they also have the option to move back into their HDB flat if living with their children becomes too overwhelming.

(Disclaimer: In both scenarios, we assume that the condo is solely owned by the children, without the parents’ names on the title to avoid additional buyer’s stamp duty.)

There could be other reasons for holding on to your HDB flat as well. Perhaps you’re looking for a reliable source of rental income in your golden years and have no intention of selling your flat. In this case, the ABSD and potential resale gains may not be a major concern for you. Everyone’s situation is unique, so if you need personalized advice, don’t hesitate to reach out to us.

The bottom line is, don’t make the mistake of giving up your HDB flat without careful consideration (it’s not easy to get it back!) or paying unnecessary ABSD rates. Protect your future by making informed decisions.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …