TLDR

When buying a new launch condo in Singapore, start by planning your finances to determine loan and property limits. Shortlist condos based on factors like location, unit size, facilities, and market trends. Pay a 5% deposit, sign the Option to Purchase, engage a solicitor, and pay Buyer’s Stamp Duty. Make payments progressively up to completion. Finally, collect your keys post-TOP. Remember to follow timelines and seek professional guidance throughout the process for a successful investment journey.

The trend of buying new launch properties is growing rapidly as people see it as a way to enhance their income or for their personal use. This year, over 30 projects are expected to be launched. If you’re a beginner in this field and have the financial capability to invest in a new launch property, you might be curious about the entire process and costs involved. We have compiled a step-by-step guide to help you make your goal of owning a private property a reality in a professional and easy-to-understand manner

Table of Contents:

- Start your financial planning

- Shortlist new launch condos and make appointments to visit show flats

- Pay the booking fee for your new launch condo unit

- Sign the Sales & Purchase Agreement

- Make payment up to completion

- Collect the keys to your new home

How to Buy a New Launch Condo

Step 1: Start your financial planning

Determine the highest amount of home loan and property purchase price that aligns with your financial capacity, taking into account your income, age, and existing loan obligations.

- The Total Debt Servicing Ratio (TDSR) is a measure introduced to cool down the property market and prevent borrowers from taking on excessive loans. Its purpose is to ensure that borrowers do not use more than 60% of their gross monthly income to repay all their loans, including home loans, car loans, and credit card bills. In other words, the TDSR is designed to help borrowers avoid getting into excessive debt.

- The Loan-to-Value (LTV) ratio allows you to borrow up to 75% of the property’s value for your initial housing loan through a bank loan. However, the LTV for the second housing loan is significantly lower.

Please take note that if you still have any outstanding home loans to pay off and are considering buying a second property, the maximum loan-to-value (LTV) limit is 45%. However, if you plan to purchase a third property, the LTV limit is 35%.

For property owners who intend to use CPF savings for their existing property, they must first set aside half of the prevailing CPF Minimum Sum before utilizing the excess savings in their Ordinary Account for subsequent properties. Savings in the Special Account and Ordinary Account can be used to meet half of the prevailing Minimum Sum.

Do note that the CPF Minimum Sum is adjusted every July, so you should check online for the latest amount you need to set aside. It is advisable to obtain an approval-in-principle (AIP) from a bank at this point.

Step 2: Shortlist new launch condos and make appointments to visit show flats

Prior to being influenced by the developer’s impressive marketing tactics, it is imperative that you take note of the following factors to ascertain if your decision is appropriate.

- Location (accessibility and amenities)

- Unit size

- Facilities

- Interior of the condo

- Capital appreciation (based on upcoming developments)

- Current market situation

- Rentability

- Environment (i.e. noise level)

- Developer track record

After narrowing down your top choices, you should seek out reputable agents who can aid you in your acquisition.

What’s the best part of setting an appointment with me?

I offer a comprehensive tour with professional guidance to ensure your needs are met. My insights are exclusive and unbiased, giving you a clear understanding of available developments. I simplify the buying process by conducting thorough research and comparisons for your convenience.

Step 3: Pay the booking fee for your new launch condo unit

When purchasing a new launch condo unit in Singapore, you must pay a 5% cash deposit upon booking and signing the Option to Purchase (OTP) to confirm your reservation. If you decide not to proceed with the purchase, you will lose a portion of your booking fee (usually 25%).

Once you have a copy of the OTP, you can proceed to finalize your loan for the new launch condo. The bank that you are borrowing from will provide you with a Letter of Offer – a document that outlines the terms of the loan.

Additionally, you will need to engage a solicitor to represent you in the purchase and handle the conveyancing matters.

Step 4: Sign the Sales & Purchase Agreement

- The developer will provide you with the Sales & Purchase Agreement (S&P) within two weeks after you receive the OTP.

- Once you have the S&P, you’ll need to sign it and exercise the OTP within three weeks.

- After signing the OTP, you’ll have eight weeks to pay the remaining 15% down payment (also known as the exercise fee) in cash or CPF.

- Additionally, you’ll be required to pay the Buyer’s Stamp Duty (BSD) within two weeks of signing the S&P.

Please note that these timelines are important and should be followed accordingly.

BSD refers to a tax that home buyers are obligated to pay upon purchasing a property. The amount of BSD levied is based on the price of the property, with higher-priced properties incurring a higher tax burden.

For residential properties, you will be charged with the following:

- 1% for the first $180,000

- 2% for the next $180,000

- 3% for the next $640,000

- 4% for the remaining amount

The Additional Buyer’s Stamp Duty (ABSD) is an additional tax levied on top of the Buyer’s Stamp Duty (BSD). This tax is calculated based on the higher value between the purchase price or the current market value of the property.

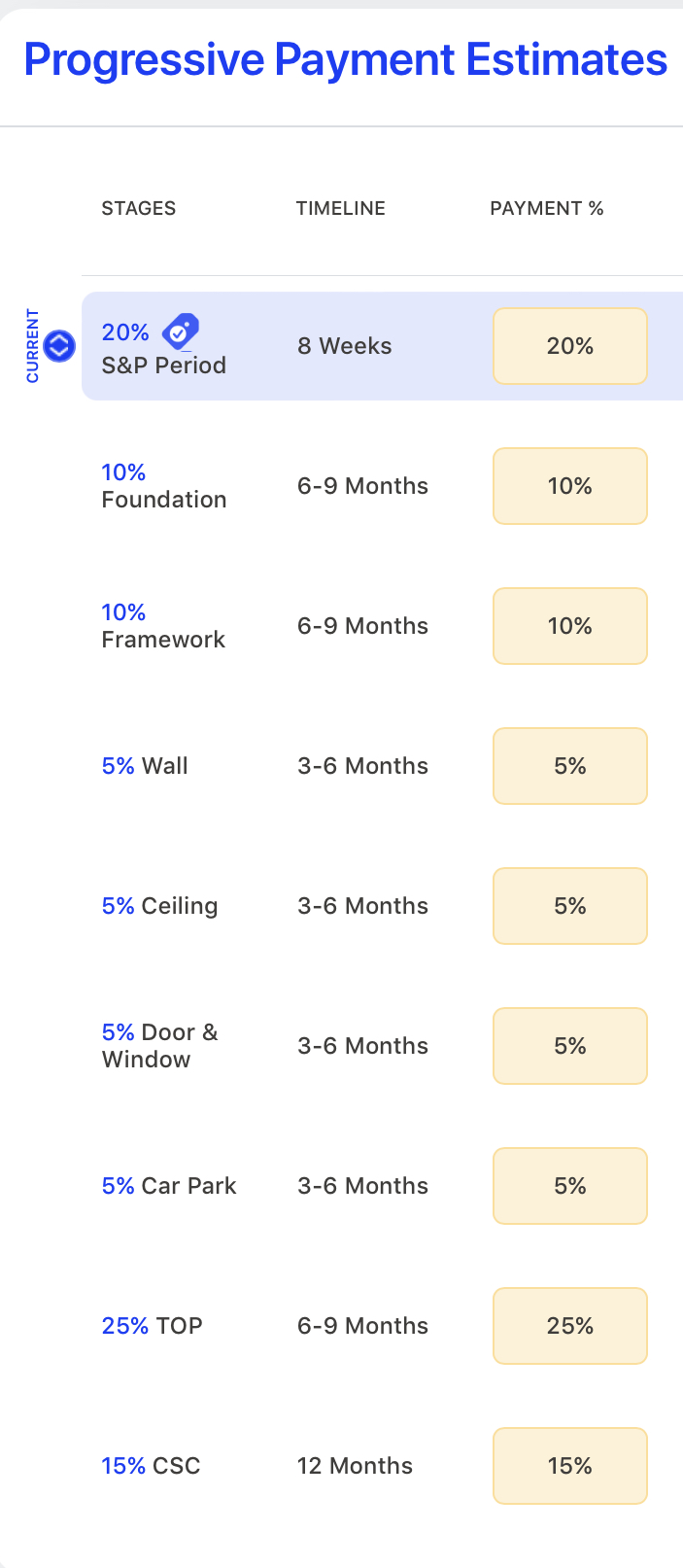

Step 5: Make payment up to completion

Going forward, it is required of you to make payments progressively. The payment plan for purchasing an uncompleted property or BUC is as follows:

*You may utilize the funds from your CPF Ordinary Account to cover expenses related to stamp duty and legal fees. However, it is important to note that due to the restricted timeline for payment of BSD/ABSD, you will be required to make the initial payment in cash and then obtain reimbursement through CPF thereafter. Please be advised that CPF board cannot disburse the funds within the specified time frame.

Step 6: Collect the keys to your new home

After TOP, the developer will inform you and set a date for you to collect the keys to your newly purchased property. This marks the successful conclusion of the process of buying a new launch condo after selling your HDB flat.

By keeping in mind these guidelines and steps, you now have all the required information to become an informed and knowledgeable property investor.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …