TLDR

The property market in Singapore has witnessed significant shifts in the past two years, with a surge in prices in the Outside Central Region (OCR) and Rest of Central Region (RCR) compared to the Core Central Region (CCR). Singaporeans lead the luxury real estate market, followed closely by Chinese buyers. The pandemic led to a decrease in foreign buyers from China, but as global economies reopen, a resurgence is expected. Despite challenges, the CCR market shows potential with growing interest from high-net-worth individuals. New launches have made CCR properties more accessible, narrowing the price gap with RCR. Local buyers can seize opportunities in the current market before potential price increases by foreign buyers. The impending rise in Additional Buyer’s Stamp Duty (ABSD) could impact investment demand, favoring local homebuyers. For personalized real estate advice and assistance in buying or selling, a strategic and data-driven approach can provide clarity and direction for your property journey.

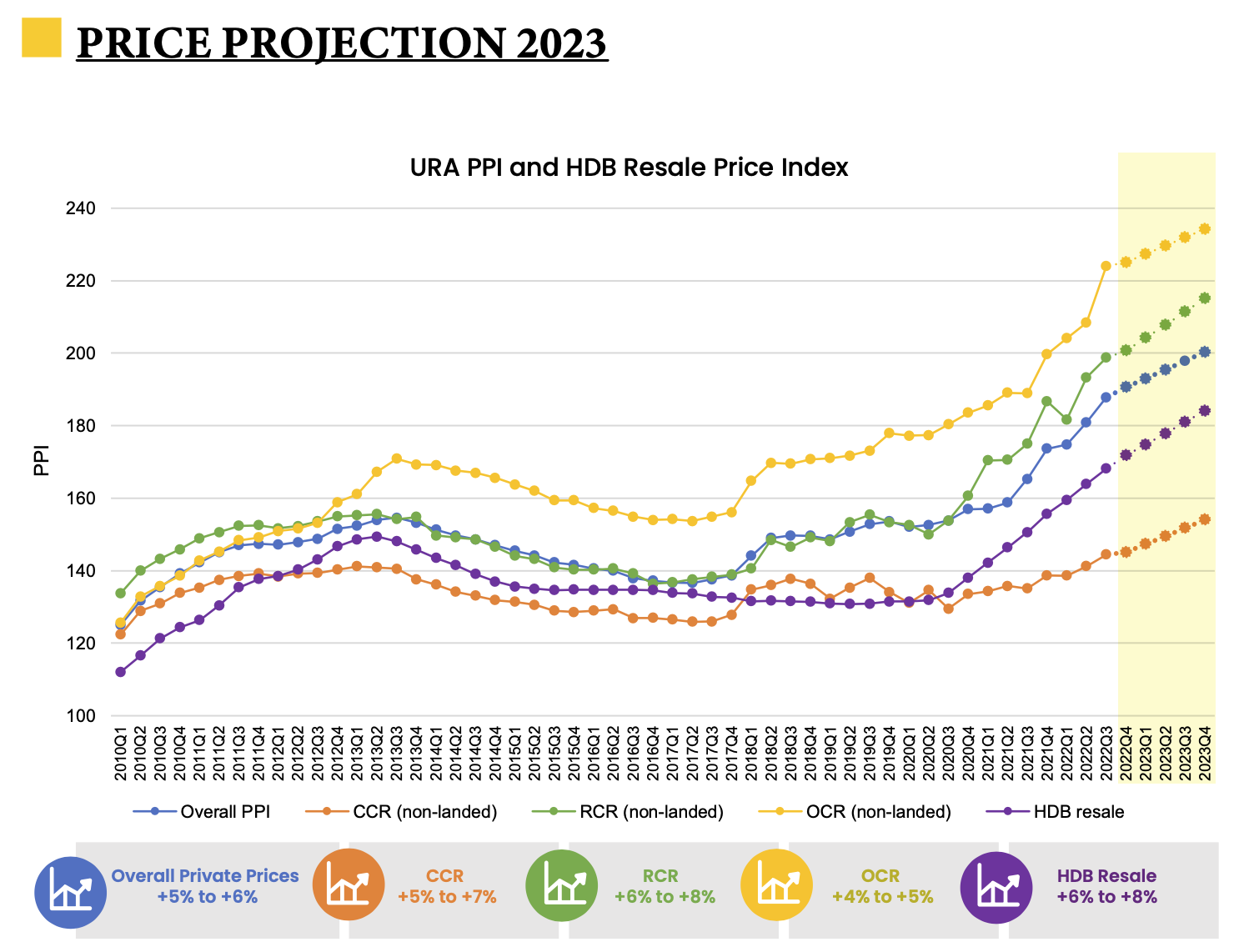

Discover the Property Price Trends Across 3 Different Market Segments

The past two years have seen an incredible surge in the prices of private residential properties due to the various socio-economic repercussions of the Covid-19 pandemic, such as delayed construction and limited supply. This has resulted in a flurry of activity for new residential property launches, with some even shattering records with their prices.

The biggest transformation in the 3 real estate segments came from outside the heart of Singapore’s Core Central Region (CCR). Prices of non-landed private properties in the Outside Central Region (OCR) and Rest of Central Region (RCR) skyrocketed by 19% to 27% over the last two years, whereas non-landed property prices in the CCR rose steadily at a rate of 9%.

The sluggish rate of property appreciation in the CCR region can be linked to the decreased demand from overseas purchasers during the pandemic, combined with the December 2021 cooling measures, which raised the Additional Buyer’s Stamp Duty for foreign house hunters by no less than 10 percentage points.

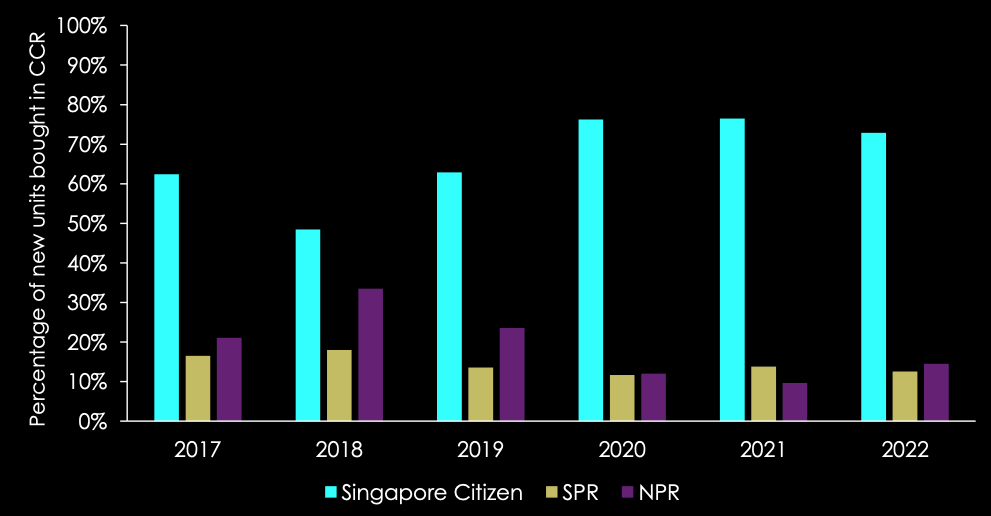

Nationalities Of Prime Property Buyers

Singaporeans lead the pack as the top purchasers of luxurious real estate in Singapore, with Chinese buyers coming in a close second.

From 2017 to 2019, Chinese citizens comprised the largest proportion of foreign buyers for prime residential properties in Singapore, with 12.7% of the total new housing units purchased. However, during the pandemic from 2020 to 2022, this figure plummeted to a mere 5.8%.

As global economies begin to reopen in 2023, an influx of foreign property buyers from countries such as China could significantly drive up the demand for high-end properties in the CCR and potentially return it to pre-pandemic levels.

The proportion of CCR homes bought by foreign nationals had dropped during the pandemic, leaving much room for growth in this sector.

Proportion of CCR Primary Sales Buyers' Nationality

Unlock The Untapped Potential Of The CCR Market

From 2017 to 2019, prior to the outbreak of the pandemic, roughly 20-33% of primary CCR homes were purchased by non-permanent resident foreigners. In the three pandemic-ridden years, however, the number of primary market property sales dwindled to a mere 10-14.5%.

The growing economic instability around the world has attracted a large number of high-net-worth foreigners to Singapore, who are setting up family offices here and bringing their funds with them. Despite the higher Additional Buyer’s Stamp Duty imposed on foreign property buyers, Singapore still appeals to them as a safe haven and as a real estate asset for wealth storage.

As China’s borders open up, more Chinese expatriates are flocking to Singapore in search of work, life and investment opportunities – driving a surge in wealthy investors house-hunting in the CCR. As a result, the CCR property market is seeing a renewed interest.

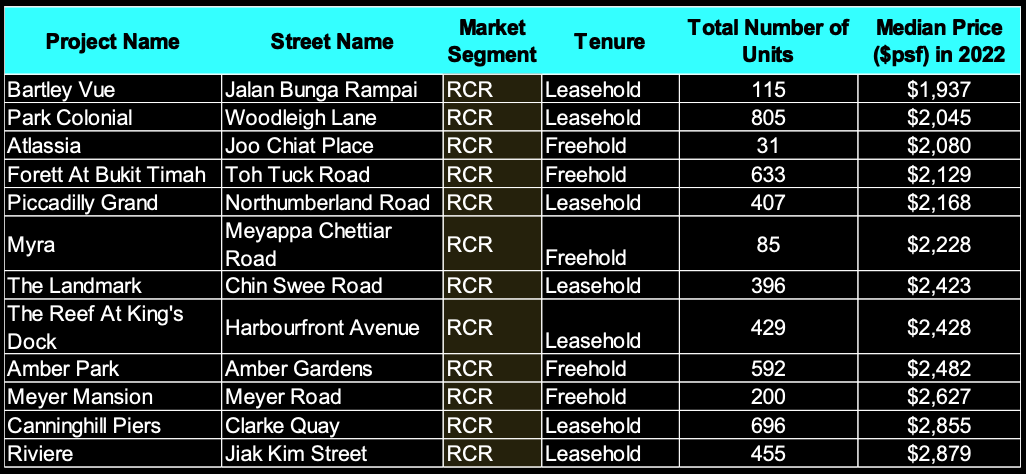

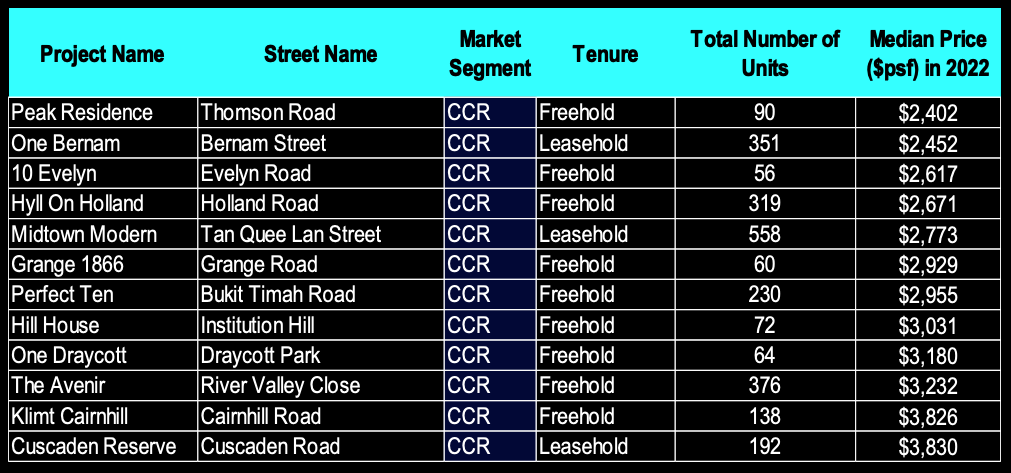

Undiscovered Gems In The CCR

Singaporeans often overlook private properties in the prime market segment due to the notion that new launches in the CCR market are too costly. Yet, the last two years have seen an exponential rise in condominium prices in the OCR and RCR, which has been narrowing the price gap between private properties in the RCR and CCR.

The new launches in 2022 have made CCR properties increasingly accessible to local homebuyers, with median prices of housing units starting as low as $2,402 per square foot. What’s more, the majority of these CCR projects are freehold properties – a great incentive for those looking to invest in the area!

With the booming growth of property prices in the RCR, the median prices of new launches there are now comparable to those in the CCR. Therefore, savvy local buyers can snap up luxurious freehold developments in prime districts at an affordable cost – but they must be quick before foreigners arrive and push prices up!

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …