TLDR

The article delves into the intricacies of property asset progression in Singapore’s real estate market. It highlights the risks involved, such as negative cash sales, widening price gaps, risks of individual mortgages, property downturns, and picking the wrong property for progression. It emphasizes the importance of strategic decision-making, understanding market trends, and being cautious in property investments to mitigate these risks and achieve financial goals.

Imagine yourself sitting with a real estate agent, talking about your future financial objectives.

You express your aspiration to increase your wealth through property investment, and you can see the enthusiasm in the agent’s eyes.

Suddenly, they start to tell you a story of the potential of buying and selling properties, which could result in tremendous profits and financial independence.

The pitch is undeniably seductive, and plenty of people are allured by it.

Yet having witnessed the good and the bad of the Singapore property market, I can confirm that the truth is far more intricate.

Property Asset Progression is certainly a profitable way to build your wealth, but it’s important to remember that it’s not without its risks.

No matter the simplicity of the concept of property progression, the devil is always in the details, and executing this plan comes with more risks than you may think.

These are the primary stumbling blocks:

- Negative cash sales

- Widening price gaps

- Risk of individual mortgages (for “sell one, buy two”)

- Property downturns at the wrong time

- Picking the wrong property for progression

1. Negative Cash Sales

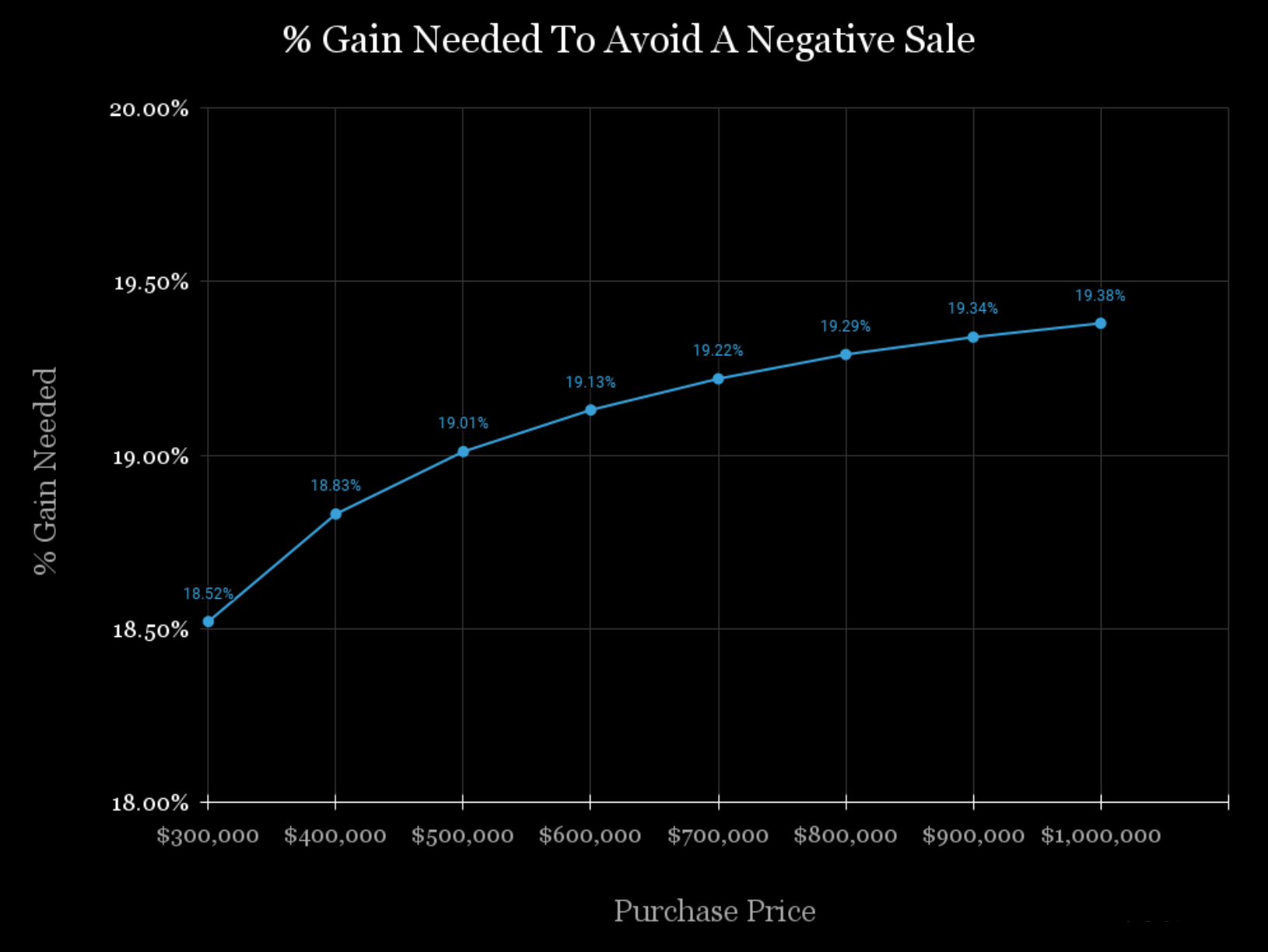

Once you sell your home, you must return all CPF monies used, plus the accrued 2.5 percent interest. It’s possible that, after paying off the loan and reimbursing your CPF, you may have zero cash left in your pocket.

To illustrate, if you sell your flat for $500,000, but you’re obligated to repay $515,000 to your CPF account, you may find yourself without any cash after the sale.

Negative cash sales can seriously disrupt your plans for home progression, as you must have a minimum of 5% of the price in cash – this could put your upgrade on hold for anything between months and a few years, depending on how quickly you can save up.

However, not all are affected in this way; many people can use their CPF to make payments, which preserves their cash for saving or investing. Even if you do find yourself in this situation, it doesn’t necessarily mean your finances are in trouble.

*Provided you sell for the market value, you won’t need to repay the additional $15,000.

All it requires is for you to return the complete $500,000 to CPF.

This article provides an in-depth explanation of negative cash sales, and here’s what you need to achieve in order to prevent it from happening: a minimum estimated gain!

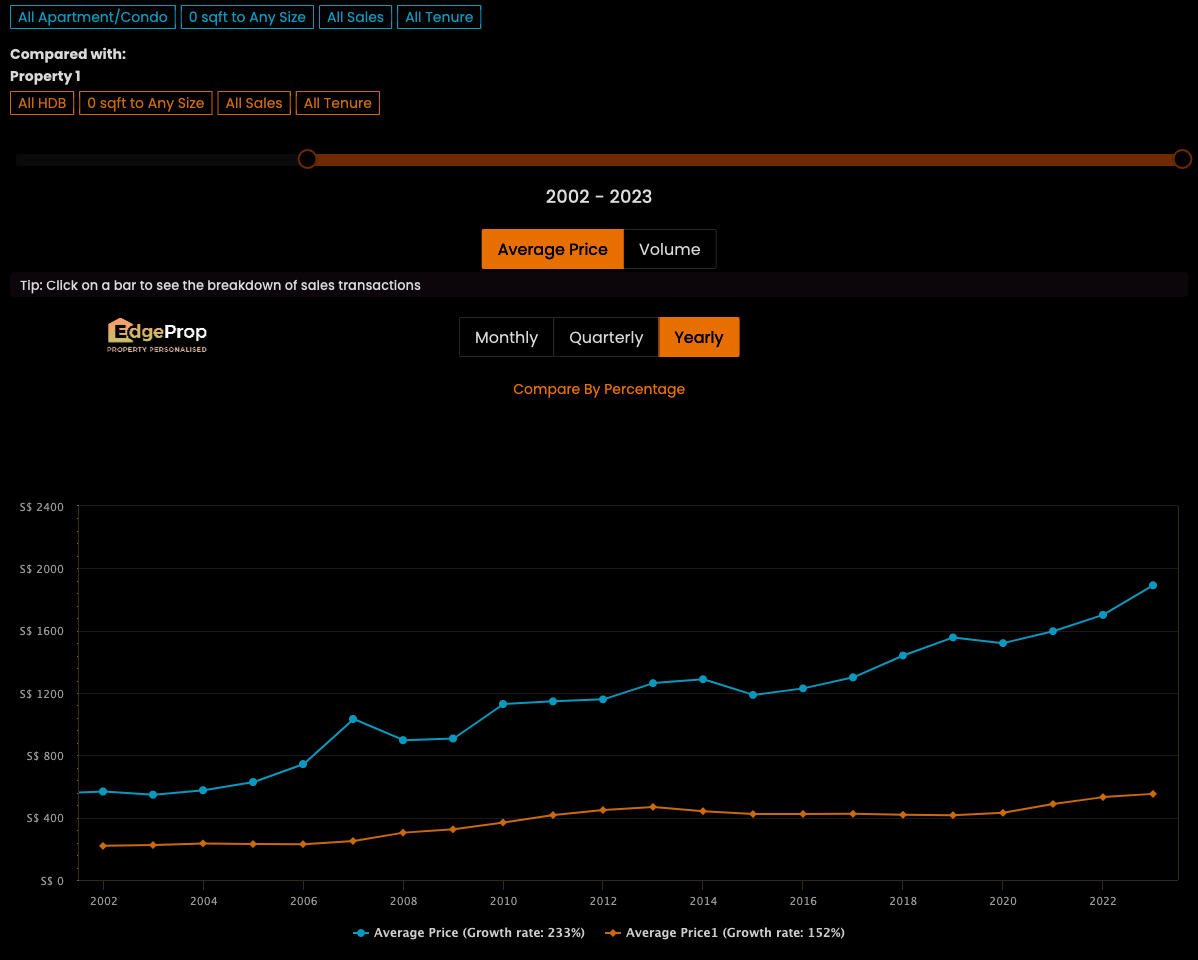

2. Widening Price Gaps

The significant divergence in prices between HDB flats and condos, ECs and private condos, and even between private condos and landed housing, can determine the extent of upgrade you decide to make.

The potential for a price gap between your resale flat and BTO flat could be a risk – prices may rise to the point where your resale flat won’t give you enough funds to upgrade.

This is why resale flats are preferred to BTOs – you have the option to sell earlier and limit the risk.

However, bear in mind this can be a scare tactic employed by some agents – don’t rely solely on this point when making your decision, as the price gap could narrow again in the future.

3. Risk of Individual Mortgages (For “Sell One, Buy Two”)

What if one of you could no longer work or experienced reduced income or retrenchment?

In this case, it may be necessary to liquidate one of the two mortgages – often the larger one – which would mean the end of rental income, or possibly even having to sell both properties and move back into a flat.

Given the high-interest rate climate and current economic climate, it is especially advisable to employ the “sell one, buy two” approach only if both spouses can buy within their means and have steady incomes.

However, although rental prices are currently high, we have witnessed signs indicating that they may soon reach a peak.

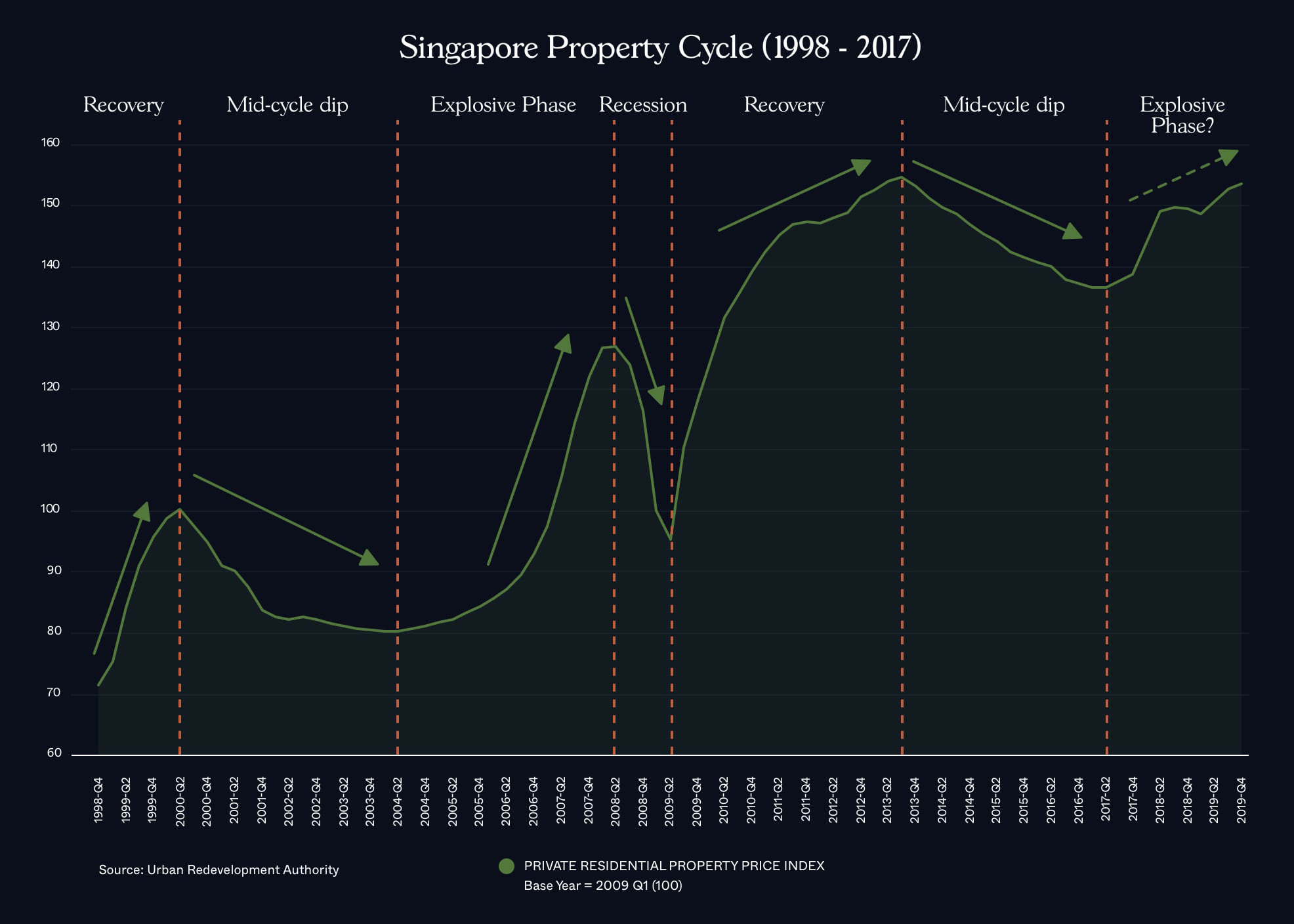

4. Property Downturns At The Wrong Time

No matter how carefully we plan, the property market doesn’t always cooperate: resale flat prices could plummet right when you’re attempting to buy a condo, or, as you try to sell and retire, you may face a sharp decline in the market.

It is beyond your capabilities to accurately anticipate the outcome of this situation, and there is no way to change that. Therefore, the only course of action is to remain patient and maintain your grip on your property – even if it means waiting longer than anticipated. That way, you can ride out the market and sell at a more opportune time.

Timing the market can be quite a challenge, as evidenced by some individuals who prematurely divested of their real estate investments at the onset of the pandemic, presuming that prices would drop.

In fact, even experts often get it wrong – take a look at these inaccurate property predictions from the past couple of years!

5. Finally, There’s The Issue Of Picking The Wrong Property For Asset Progression

Be mindful when investing in “out of sequence” properties. For instance, starting with a one-bedder unit may prevent you from quickly upgrading to an HDB flat as you must first sell your private property.

Additionally, some properties may be tougher to resell than others; a two-bedder EC unit may not be as desirable to families as a four-bedder. This can hinder your upgrade to private property or potentially extend the timeline.

When it comes to buying and selling property, it’s not as straightforward as trading in a phone at a mobile shop. There are many complexities and timing considerations to be mindful of, which is why I can be of great help.

I can assist you in making the right decisions, while some savvy buyers may have a knack for picking properties that outperform their expectations (e.g. moving directly to a private condo instead of an EC).

Remember, this is where your personal judgment and acumen come in.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …