TLDR

When selling your property, watch out for negative cash sales that could leave you with no money after CPF refunds. Consider factors like property appreciation, loan repayments, and market trends to avoid financial setbacks. Upgrading to a condo may require significant value appreciation in your HDB flat. Be cautious of bank loan challenges and fluctuating interest rates. To ensure a positive cash sale, strategize your CPF and cash allocations wisely. Keep an eye on market conditions and potential returns before making property decisions.

With resale flat prices reaching all-time highs, it is easy to assume that negative cash sales are a thing of the past. However, this isn’t always the case and negative cash sales still occur in a seller’s market. To avoid such a sale, you need to ensure that your flat has appreciated in value sufficiently.

What’s A Negative Cash Sale?

Having no cash on hand after refunding your CPF when you sell your property can be a major setback. For instance, if you sell your flat for $500,000, but need to give back $515,000 to your CPF account, you will find yourself with absolutely no money.

Even though you can still use your CPF for your next purchase, the banks ask for a minimum of five per cent of the cost to be paid in cash, so unless you are able to get that sum of money together, it can limit your future upgrade options.

Despite the fact that this scenario might not apply to everyone, the majority of people use their CPF to pay their mortgage so that they can save or invest their cash. Therefore, even if they face a negative cash sale situation, it doesn’t have to mean they are in a hopeless situation.

*As long as you sell at the market price, you don’t owe the additional $15,000; all you have to do is refund the full $500,000 into CPF.

Are You At Risk Of Experiencing A Negative Cash Sale If You Sell Right After MOP?

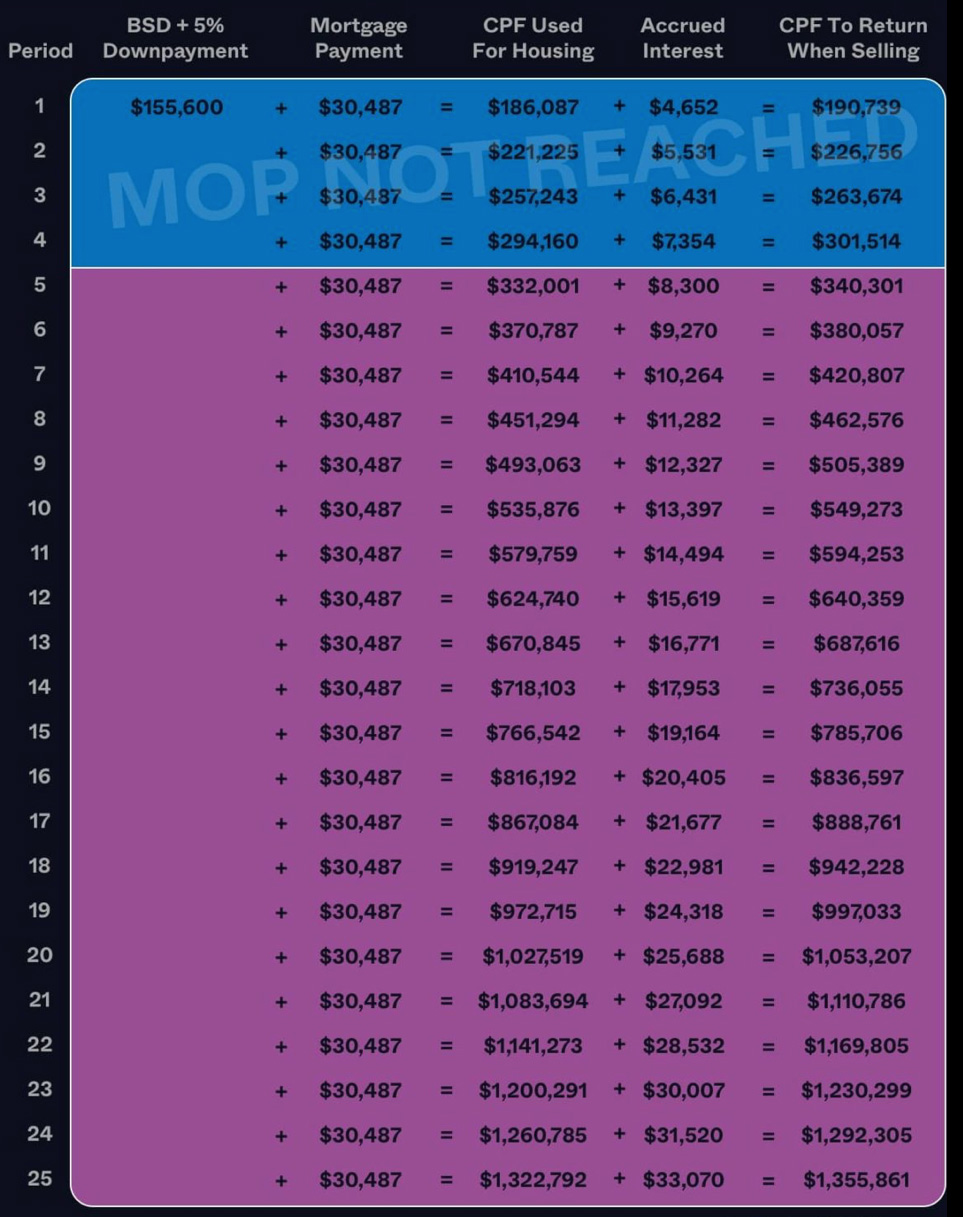

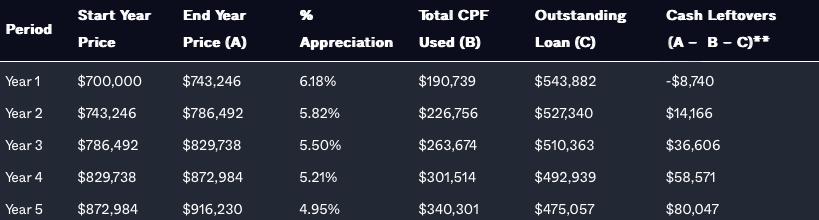

Let’s explore how much you would need to pay back to CPF for a $700,000 HDB resale flat, bought with a 25-year HDB loan and an initial $140,000 down payment plus a Buyer’s Stamp Duty of $15,600 – all of which are taken from CPF.

Assuming the flat is sold after 5 years and the loan is taken at the standard 2.6 per cent per annum with a maximum amount of 80 per cent, or $560,000, here’s what the refund would look like :

At the start of each year, we assume that the BSD and downpayment are made and the mortgage is paid through the same period. The interest accrued is then added to the total CPF amount used, resulting in a new balance which carries over to the following year. Mortgage payments are added to this sum and the accrued interest is added to the new balance, continuing this cycle.

Once you pass the 25th year, the amount of CPF refundable upon sale of your flat increases based solely on the interest that has accrued – given that your flat is already completely paid off.

Please be aware that the aforementioned example includes $2,500 of legal fees and 2% of the selling price as agent fees, both to be paid in cash.

How Much Must Your HDB Property Value Increase To Ensure You Don’t Have A Negative Cash Sale?

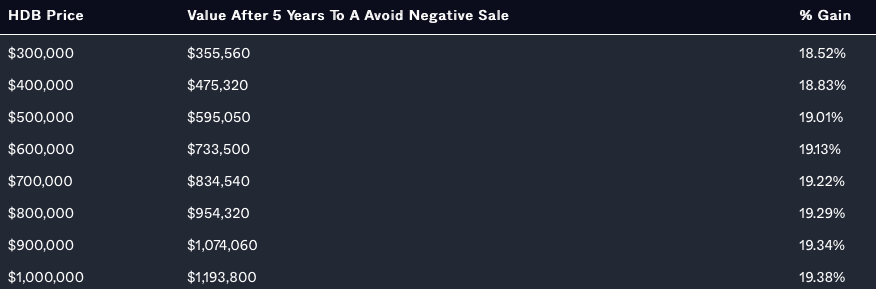

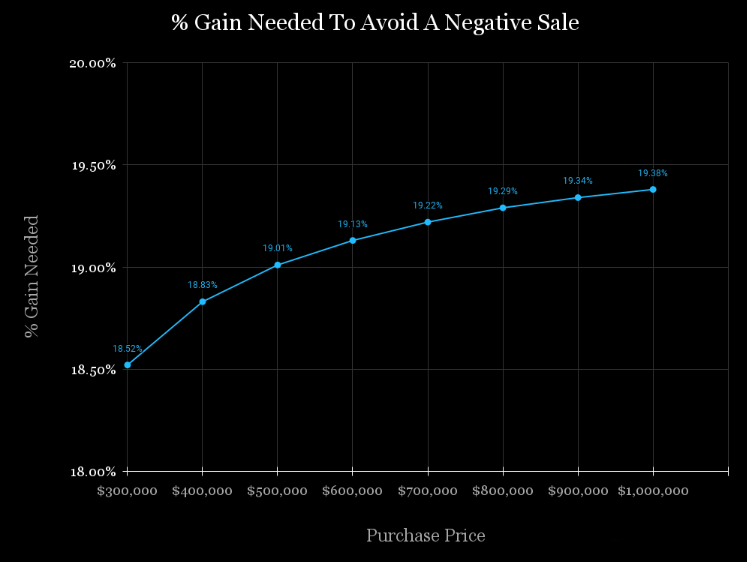

Let’s see how much your HDB needs to appreciate if you want to sell it in the fifth year after its MOP and not take a hit in the cash sale – and all this, without having to take into account any other factors than the ones in the table above.

Let’s run a simulation of HDB prices ranging from $300,000 to $1,000,000 and get the numbers!

The more expensive the HDB flat, the greater the potential appreciation in value – even if only incrementally.

From the chart, it’s clear that your flat needs to increase in value by 19% within a five-year span in order to avoid an adverse cash flow situation.

What If You Want To Use Some Of The Cash To Upgrade To A Condo?

For HDB upgraders, the typical price range they can afford is around $1.6 million. Therefore, you must have at least $80,000 in cash as a 5% down payment. To accomplish this, here’s an idea of how much your flat needs to appreciate for you to make the purchase:

In 5 years, the flat must increase in value from $700,000 to $916,230 – a 31% rise, which is not unheard of, but it also means that private property prices are going to be even higher than they are now.

Most Singaporeans don’t end up receiving the maximum loan amount available; the CPF allows up to $20,000 to be kept, any excess needs to go towards the purchase of property.

After subtracting the 2% selling fee, the remaining cash comprises the original price plus a legal fee of $2,500.

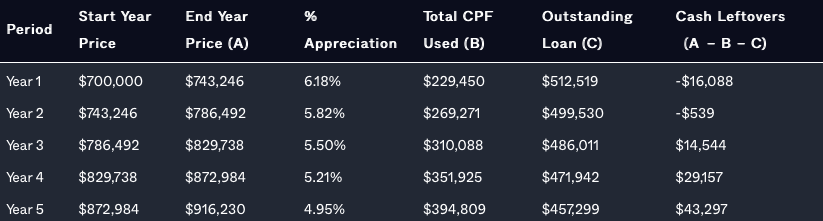

By 2023, Obtaining Bank Loans Has Become A Much More Challenging Endeavor

Not all are eligible for an HDB loan, and if you find yourself in the higher income bracket, HDB may suggest opting for a bank loan instead.

This could be an alarming risk for those looking for a cash sale, as the implications of such a decision are vast.

With bank loan rates continuously changing, the prospect of a sudden interest rate surge is disconcerting, especially considering that current interest rates are far higher than they were a decade ago.

Even opting for a fixed-rate loan could be risky as they are currently set at around four per cent.

Those who purchase a flat with a bank loan will need to see greater appreciation on their property than those with an HDB loan; in this example, the flat would need to appreciate to $904,513 with a 4% fixed rate loan taken out over five years, as well as a 25% downpayment.

With an interest rate 4% higher than 2.6%, the difference in cash after 5 years is almost $40K! Plus, opting for a down payment of $700K would have cost an additional 5%, or $35,000.

Buyers Of Resale Flats, Take Heed: Peak Prices Are Unlikely To Last

Purchasing a resale flat in 2023 could mean you are buying at a peak market rate, however, it is highly unlikely that these price increases can remain the same for the next five years.

This is due to the fact that HDB has increased their BTO flat production in 2022 and 2023, meaning a considerable amount of resale flats could be added to the market soon.

Therefore, if you were to sell your flat at this time, it is possible that you would not make the returns you were expecting and could end up with a negative cash sale.

Rather Than Pinning Your Hopes On A Rise In The Value Of Your Flat, The Most Sensible Approach Is To Conserve Your Cpf Funds

If you’re aiming to stay on top of your upgrading goals in 2023, your best move would be to use a mix of cash and CPF – that way, part of your loan can be paid off with cash, while the other part is covered by CPF.

But, if you’re looking to eliminate any risk, why not just use your CPF for the down payment and BSD and make your loan payments in cash – that way, you can guarantee a positive cash sale!

Looking to Sell Your Property?

-

Are you approaching the Minimum Occupation Period (MOP) of your HDB apartment or has the Seller Stamp Duty (SSD) window of your condo already passed?

-

It is always advantageous to have an understanding of the potential returns if you were to put your property up for sale. Additionally, you need to ascertain if your gains will enable you to upsize to the dream home in the neighbourhood you and your family have been longing for.

-

For an easy and reliable way to get a free Property Valuation, just send me a request!

-

If you’ve got a property-related story that you’d like to share, don’t hesitate to drop me a message and I’ll get back to you!

-

Alternatively, you can send me a DM and I’ll reach out to you

You May Also Like …