TLDR

The Urban Redevelopment Authority (URA) Flash Estimates for Q4 2022 show a 0.1% increase in non-landed private home prices quarter-on-quarter, with an impressive 8.0% rise year-on-year. The Core Central Region (CCR) saw a 0.5% price increase, while the Rest of Central Region (RCR) experienced a 2.6% boost. The Outside Central Region (OCR) had a notable 9.3% price growth. Despite challenges like revenge travel and reduced sales volume, the market outlook remains positive with upcoming new projects offering more options to buyers. Whether to buy, sell, or wait depends on individual circumstances, with strategic real estate advice and market knowledge essential for decision-making.

URA Flash Estimates

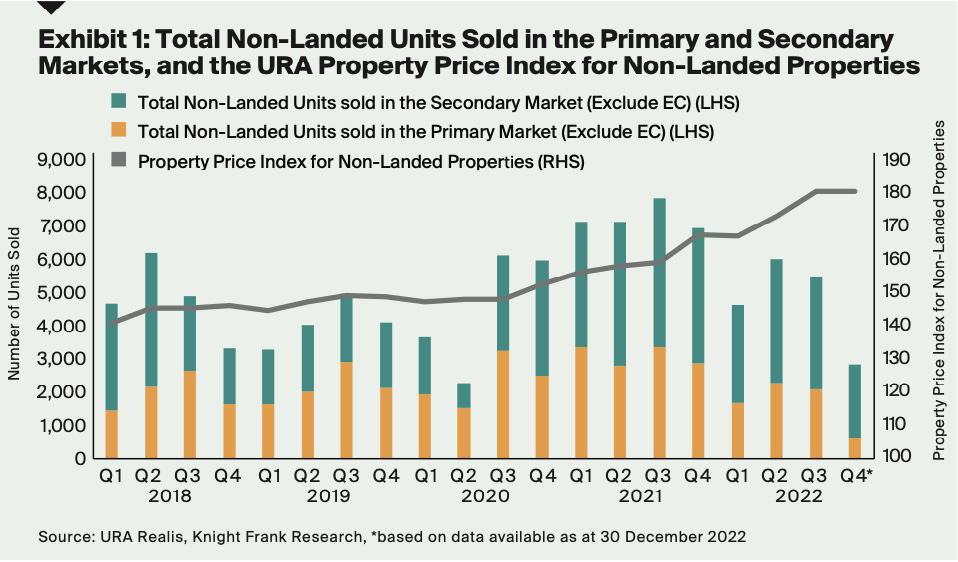

As we come two years post-pandemic, the Urban Redevelopment Authority (URA) estimates reveal a moderate 0.1% quarter-on-quarter price increase in non-landed private homes (excluding Executive Condominiums (ECs)), representing an impressive 8.0% year-on-year rise in 2022. This was largely due to robust sales of newly launched residences, primarily in suburban and fringe areas, that propelled prices to an all-time high of 18.6%.

The fourth quarter of 2022 brought a surge of revenge travel, as many potential homebuyers sought to make up for the international restrictions caused by COVID-19. Consequently, sales transactions of non-landed private homes dipped drastically, plummeting 48.3% quarter-on-quarter to just 2,884 units. With inventory in short supply, it seemed that many homebuyers chose to take a holiday before looking into prospective housing purchases.

In Q4 2022, developers released fewer new units as new sales volume contracted by a staggering 69.4%, with only 652 units sold. Meanwhile, secondary market sales declined 35.1%, registering 2,232 transactions. With an impending global recession and high interest rates, homebuyers opted to adopt a ‘wait-and-see’ attitude due to the lack of listings and the reduced transaction activities of non-landed homes.

Core Central Region (CCR)

In Q4 2022, prices of non-landed homes in the CCR rose 0.5% quarter-on-quarter and 4.6% year-on-year. Despite Singaporeans still representing the majority of non-landed homebuyers in the CCR, the share of foreign buyers increased from 8.9% in Q1 2022 to a noteworthy 15.8% in the last quarter of the year.

In spite of only a moderate rise in prices, sales in CCR experienced a sharp decrease of 33.8% quarter-on-quarter in Q4 2022*, with only 792 non-landed transactions. Newly contracted sales went down 33.0% quarter-on-quarter to 374, while resale volume experienced an even more dramatic fall of 34.5% to 418 during the same period.

Rest of Central Region (RCR)

In Q4 2022*, prices of non-landed homes in the RCR saw a noticeable boost of 2.6% quarter-on-quarter and 9.2% year-on-year, with the successful launch of properties like Piccadilly Grand and Liv @ MB throughout the year. However, overall transaction volume in the RCR decreased due to dwindling new sales, which sank 53.3% quarter-on-quarter to 170 transactions, and secondary market sales also plummeted 37.1% to 663 sales.

Outside Central Region (OCR)

The OCR shined brightest amongst all other market segments this year, boasting both impressive price growth and sales volume. Despite a slight dip in price index by 2.6% in the fourth quarter of 2022, the OCR still managed to close out the year with a notable 9.3% increase.

This remarkable price expansion throughout 2022 was driven by the strong demand for new launches in the first three quarters – until the interest rate surge pushed buyers onto the sidelines in the last quarter.

Q4 2022 was an incredibly challenging period for the OCR with new sales shrinking an incredible 91.1% quarter-on-quarter to just 108. With no new launches in the last three months of the year, overall sales were also hit hard, tumbling 57.5% to 1,259 transactions. Even secondary sales suffered a 34.2% drop, ending the quarter on 1,151 units.

Market Outlook

Despite an estimated 17,000+ new private homes slated for completion in 2023, the leasing market is unlikely to slow down due to the persistent demand in the private residential market. Moreover, those affected by the cooling measures who are forced to downscale their private home may put further pressure on the leasing market.

Homeowners have been reluctant to put their properties on the market with no new home to move into, even with price premiums being offered. Nonetheless, come 2023, 12,000 units in 34 new projects island-wide could offer some relief to the undersupplied housing situation, providing prospective buyers with an array of options in diverse locations.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …