TLDR

When making property decisions in Singapore, it’s crucial to consider various factors like affordability, loan-to-value ratios, and CPF requirements. Options include upgrading to a freehold condo in specific districts, saving for an additional investment property with ABSD implications, or upgrading to a larger HDB flat. Exploring leasehold options widens choices. Due to eligibility constraints, a second BTO may not be feasible. Consider younger leasehold developments for potential growth and future retirement planning. Each option has its pros and cons, so thorough research and strategic planning are essential for a successful property investment journey.

Case Study : With An Income Of $180K per Annum, Should We Save Up To Purchase An Investment Property, Move Up To A Private Condo, Or Go For A More Spacious HDB?

Hi Jayson!

We are excited to have read your advice columns and are amazed by the dedication and detail in the responses. My wife and I find ourselves in a crossroads.

We own a three-bedroom HDB flat in Clementi Ridges, which we purchased for nearly $400k. Our Minimum Occupancy Period ends in April, and we are both in our mid-thirties, earning a combined gross income of $15k a month with no other debts other than our HDB loan.

We do not intend to have any children. We desire to create a nest egg for retirement, and we are unsure of the best way to go about it.

Should our next move be…?

- Upgrade to a freehold condo – we’re only interested in one located in Districts 9, 10, 11, 20, or 21;

- Save up to buy an additional investment property; or

- Upgrade to a larger HDB through resale/2nd BTO.

We eagerly await your insights to guide our decision-making process. Many thanks!

- Outstanding loan – $238k

- CPF used plus accrued interest – $128k from me + $36k from my wife

Greetings!

I’m delighted that you’re considering taking the first steps towards your retirement planning.

Getting started early is a great way to maximize your potential to build your nest egg!

With so many options out there, it can be overwhelming to choose what’s best for you.

Rest assured, I’m here to guide you in the right direction and make your decision-making process smoother.

Let’s begin by focusing on your budget!

Affordability

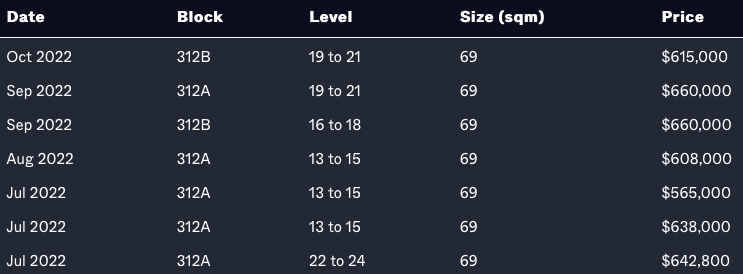

These are some of the recent 3-room transactions for Clementi Ridges:

We will use the average selling price of $626,971 for calculation purposes.

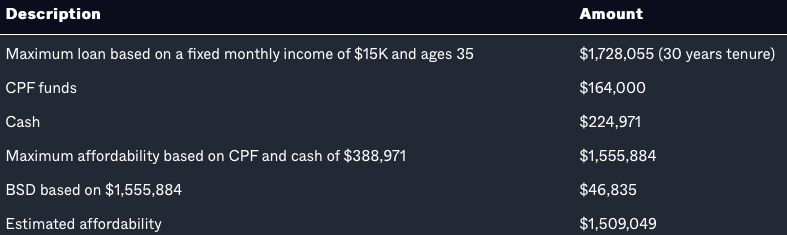

Affordability (For a Private Property)

Given the CPF and cash that comprise the 25% downpayment, it is not possible to obtain the maximum loan.

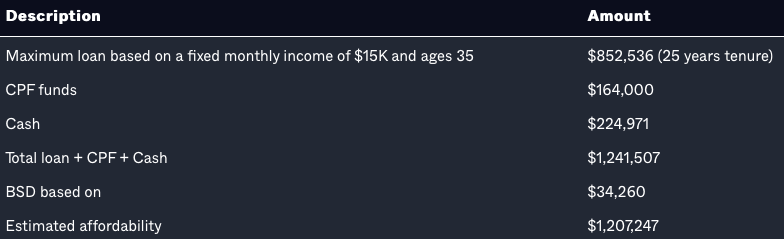

Affordability (For an HDB)

Option 1: Upgrade To A Freehold Condo in D9, 10, 11, 20 or 21

With $1.5 million, you’ll most likely be browsing for a 1 + Study or two-bedroom flat in these locations.

Since you don’t plan on having kids, that should suffice, though you may need to adjust to a smaller space compared to a 3-room HDB flat.

If you look around online, you’ll notice the options are sparse, and the majority of properties within your budget range are boutique projects.

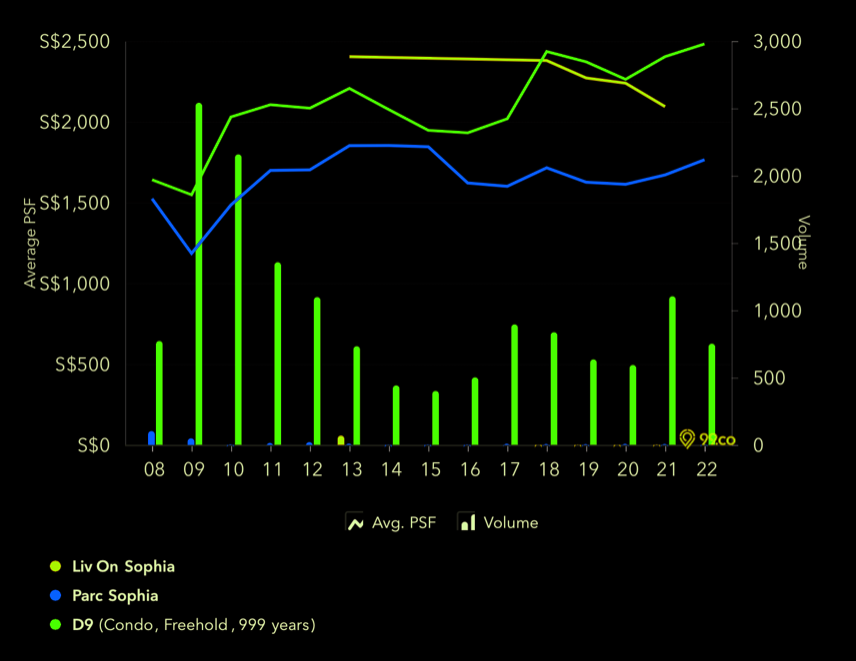

District 9

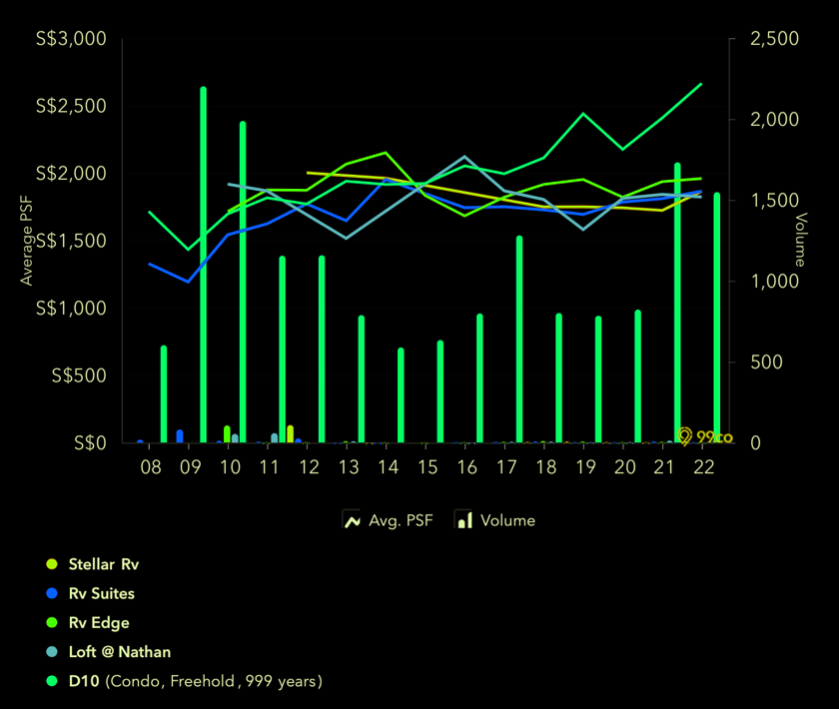

District 10

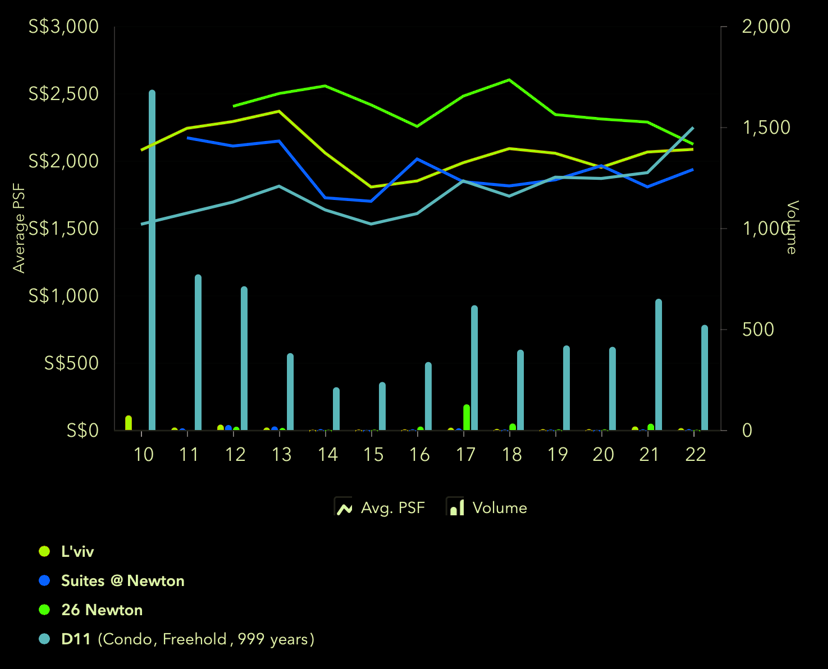

District 11

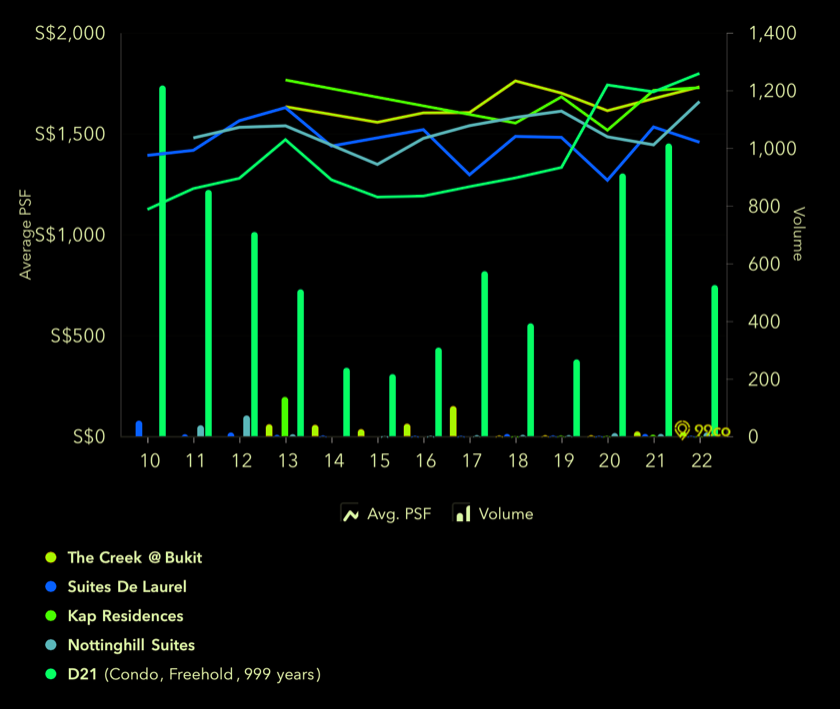

District 21

The developments detailed above are those that are both in your budget and available.

After the launch, you can see the low transaction volumes reflected in the occasionally volatile trend lines. This is to be expected with boutique developments since if turnover is low, it is hard to create price appreciation, as banks rely on recent transactions for valuation.

The graphs demonstrate that the prices for most of these projects remain mostly flat compared to other freehold condos in the area.

Furthermore, many of the latest developments are comprised of mostly single and double-bedders which attract investors due to their accessibility. Nonetheless, this can be an issue as investors generally follow the money; thus, if they spot a better option, they won’t hesitate to dispose of their units – even at a loss.

Homeowners, on the other hand, often have a strong emotional connection to their properties. To ensure that prices remain protected, it’s recommended to go for a development that caters to both homeowners and investors alike – a good mix of units is key.

In comparison to HDB flats, these projects often offer a stronger store of value for the future, since there is no risk of lease decay.

On the other hand, those searching for rapid capital growth in the short to medium term might find better options elsewhere.

Nevertheless, we remain convinced that there are still good opportunities to be found in the CCR area if you pick the right properties.

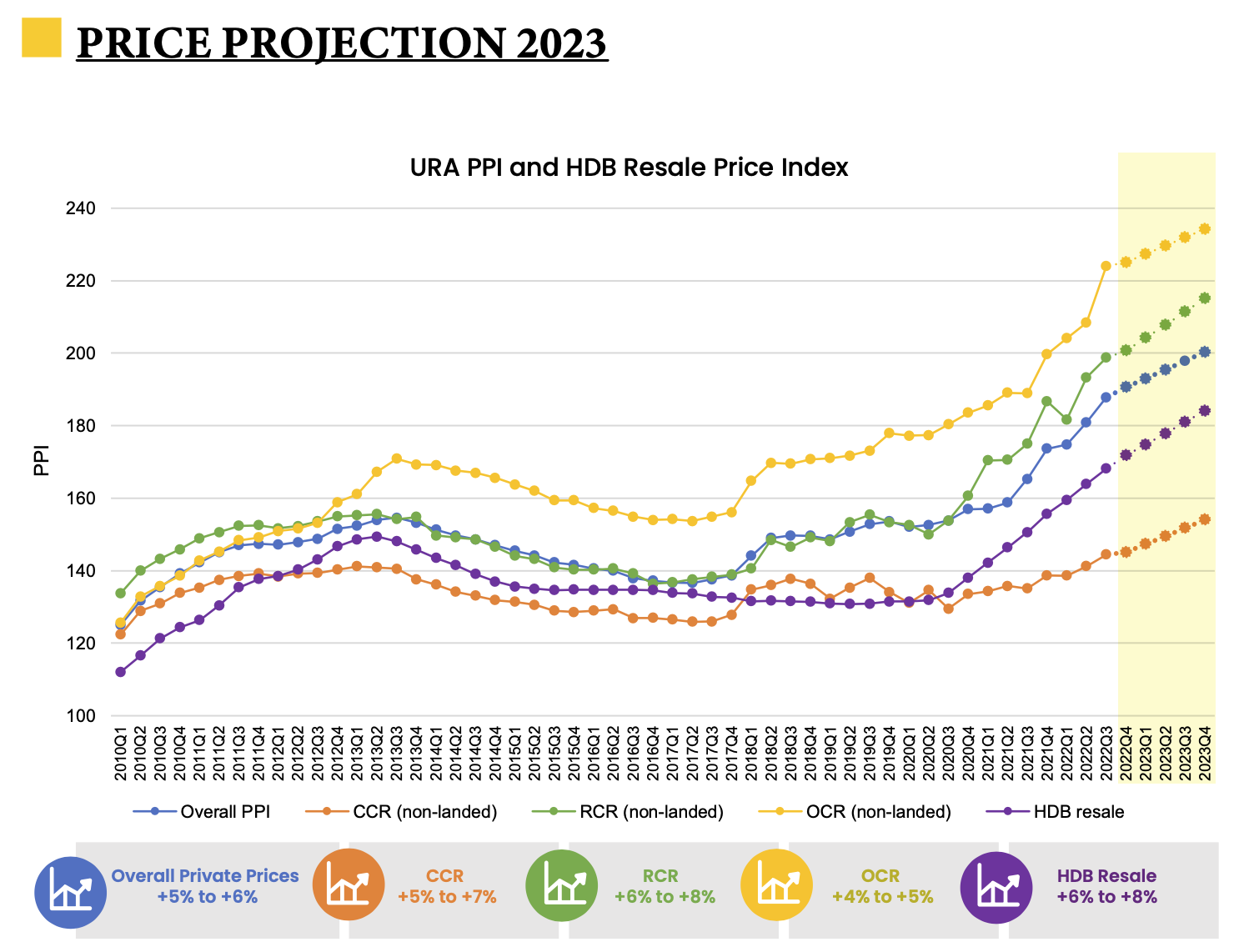

Analyzing the Property Price Index across all regions, we can observe that prices in the RCR and OCR have risen sharply compared to those in the CCR in recent years.

We anticipate that the CCR will eventually experience a similar surge, bringing its growth rate up to par.

Recently, we also published an article highlighting the diminishing gap between the prices of RCR and CCR projects – you can check it out here. If the CCR prices begin to climb, will it spur an upswing in the prices of these boutique developments as well?

Option 2: Save Up To Buy An Additional Investment Property

Considering you both own a flat and have an outstanding housing loan, it’s important to take several things into account when you’re looking at buying a second property.

Loan-To-Value Ratio (LTV)

When it comes to purchasing your first property, if your income allows, you may be able to get a loan of up to 75% of the property value. However, when buying a second property while still paying off the mortgage of the first one, the loan-to-value ratio reduces to 45% of the property value.

Higher Downpayment

The Loan-To-Value (LTV) ratio for a second property decreases with an increased downpayment. This downpayment can be split into two parts; at least 25% must be paid in cash, with the other 30% coming from your CPF account if you have sufficient funds.

Additional Buyer Stamp Duty (ABSD)

With the additional 17% ABSD rate on top of regular BSD, purchasing a private property in Singapore can be costly. Remember, the stamp duty must be paid in cash within 14 days of exercising the Option to Purchase – not enough time to apply for CPF withdrawal. However, if you do have enough funds in your CPF, the cash will be reimbursed later.

CPF Requirements

Before you can use your CPF funds for the purchase of a second property, make sure you have set aside the necessary funds.

- The Basic Retirement Sum (BRS) provides a financial cushion for you to enjoy life’s pleasures until you reach the ripe old age of 95 – if you have at least one property purchased with your CPF savings, or if the property you are buying can cover you until then.

- If you don’t own any assets that can support you until you reach 95 years old, the current Full Retirement Sum is your safety net.

*If you manage to sell the property and have enough money to sustain you until you’re 95, you will need to save a portion of it in a retirement fund.

The amount of CPF you can put towards your second property will be determined by the length of the lease: will it last until the youngest owner reaches the ripe age of 95?

Suppose you were to buy a second property worth $1 million – for the sake of easy calculations:

The figures demonstrate that the cost of buying a second property is quite significant, so it may take a while to accumulate the necessary funds.

Even though we’ve created an in-depth article to explain why ABSD on investment properties is often not the most desirable option, to sum up, it’s usually not a good idea.

Option 3: Upgrade To A Larger Flat (Resale/BTO)

Owning a BTO in Singapore is an extraordinary privilege, and since people get two opportunities at it, most households try again if they qualify.

Unluckily, it’s more challenging the second time since only two to five percent of BTOs are reserved for those attempting a second go.

Additionally, the maximum household income required to be eligible is $14,000, and unfortunately, yours has exceeded that, so you no longer qualify.

If you’re aiming to build your retirement nest, buying a flat may not be the most advantageous investment. However, purchasing a BTO flat or a resale property and taking advantage of the CPF Housing Grants can be a good stepping stone for those wishing to upgrade.

As the supply of newer HDB flats entering the resale market dwindles in the near future, prices may still remain stable for the time being. Nonetheless, being a form of public housing, prices are regulated by the government in an effort to make them accessible for everyone.

Alternative Option

If you’re looking for a property but aren’t sure if freehold or leasehold is best, consider the fact that there are many other factors that affect the performance of a property other than its tenure.

So instead of limiting yourself to freehold properties in the districts you’ve identified, why not take a look at leasehold options instead?

This way, you’ll have a much wider variety of choices – and if you expand your search to other locations, you’ll have even more options!

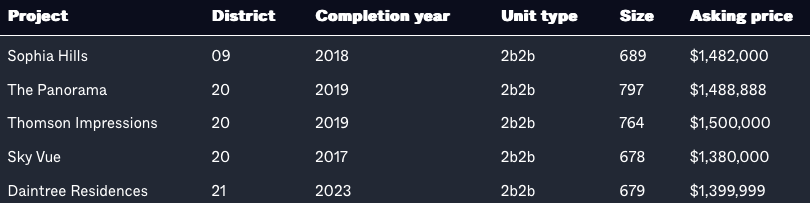

To get you started, here are some 99-year leasehold units currently on the market that fit your budget:

These projects have been chosen with your desired districts and age in mind, but that doesn’t necessarily mean they are the best fit for you. We strongly recommend consulting me for further analysis.

If you wish to stay in this property in the short- to mid-term, you can potentially enjoy excellent appreciation and upgrade to a larger unit or freehold property, which you can inhabit for the long-term.

And in the end, you could cash out for retirement and downsize to a smaller unit.

Conclusion

Let’s quickly review our choices: if you’re looking to buy a freehold condominium in Districts 9, 10, 11, 20 or 21, the options are quite limited and the developments are typically boutique projects (which do bring up some red flags).

It’s important to be selective, as freehold doesn’t necessarily guarantee a sound investment.

For the second option – saving up for a second property for investment – you’d need a sizeable amount of money, and it could take a while to save up for it.

Unfortunately, your household has become ineligible to apply for a second BTO, so upgrading to a bigger HDB is no longer an option. However, investing in HDB may not be the wisest move as it is a highly controlled market.

Since you’re in your mid-30s, you can take full advantage of the loan tenure. Why not consider taking a look at some younger leasehold developments with potential for growth?

This way, you’ll have more choices available to you. You could stay in the property while waiting for it to appreciate, and once it does, you could move on to a larger freehold development where you could stay for the long term.

Although moving can be a hassle, it’s an inevitable step if you’re looking to cash out on your property for your retirement nest.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …