TLDR

Jayson Ang discusses the essential factors to consider when seeking a property for investment. By analyzing the safe entry price and price gap, clients can make informed decisions. The case study of Cairnhill 16 highlights its attractive entry point compared to other regions, positioning it as a smart investment choice. With the narrowing price gap between different regions and the potential for high returns, investing in freehold properties like Cairnhill 16 in the Core Central Region could be a wise move. Jayson also offers personalized advice, data-driven insights, and strategic real estate solutions tailored to individual needs, guiding investors through their property journey effectively.

What two factors should clients consider when seeking a property to purchase, in order to decide if it is a worthwhile investment?

Safe Entry Price & Price Gap

Let’s make use of Cairnhill 16 as a case study to determine these two key factors.

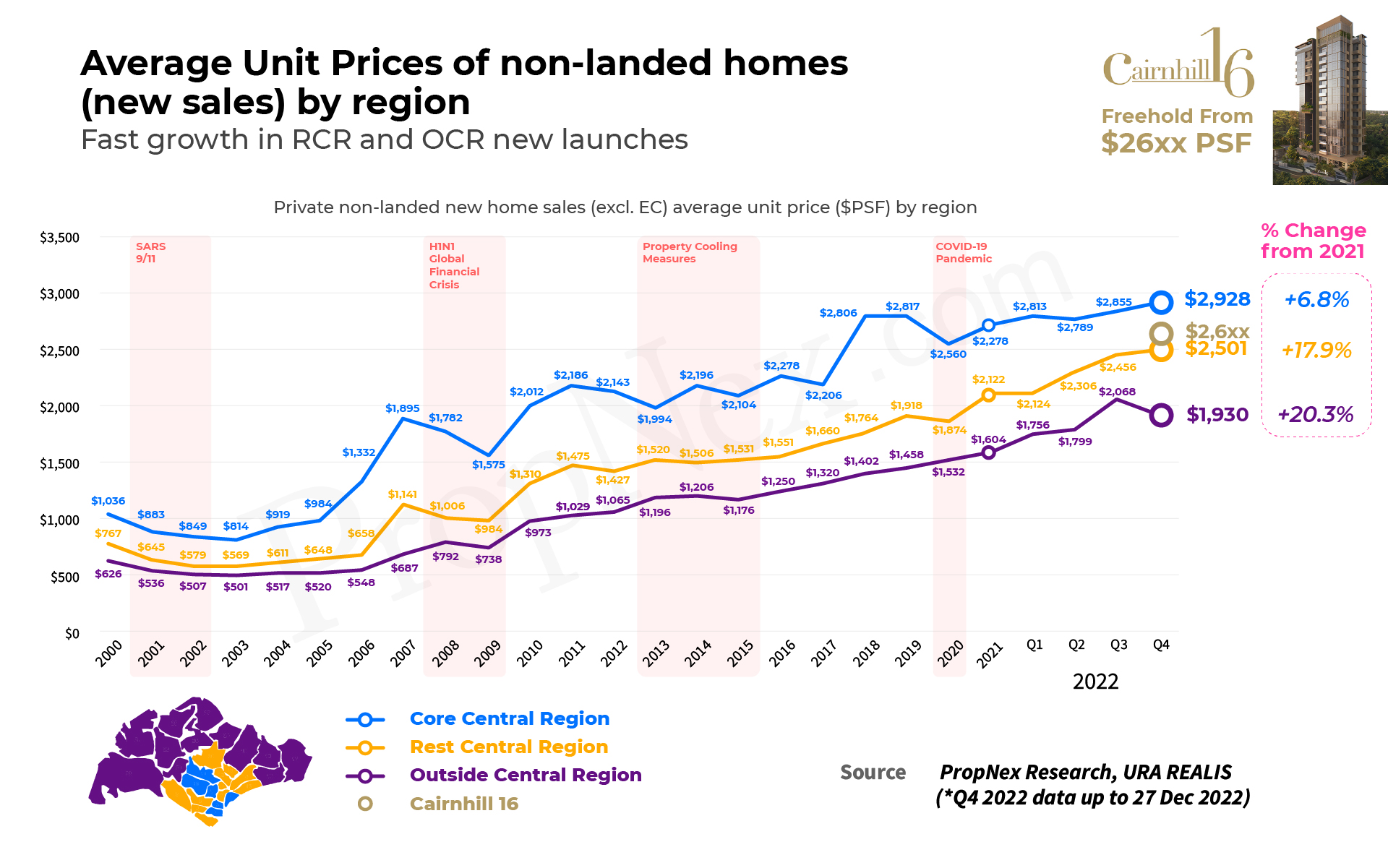

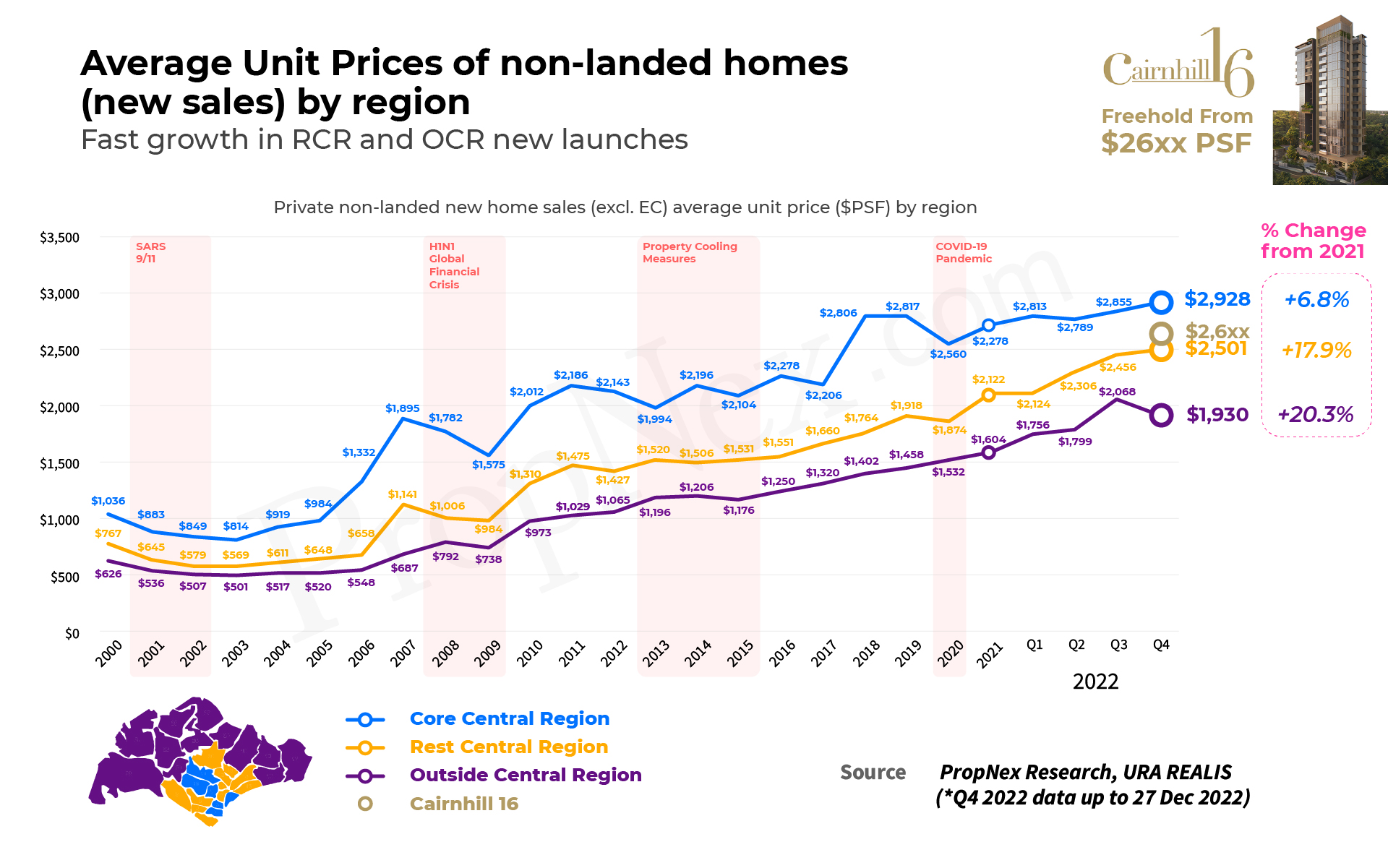

It’s already quite clear that Cairnhill 16, as a freehold property, offers a relatively secure entry point at $2,6XX psf – an attractive proposition compared to 99-year leaseholds in the Outside Central Region (OCR) and Rest of Central Region (RCR), starting from $2,1XX and $2,4XX psf respectively, and with Core Central Region (CCR) properties averaging $2,8XX.

Determining A Safe Entry Price

It’s clear from Figure 1 that the entry price for Cairnhill 16 is below the average for new sales in the CCR – the price gap between RCR and CCR properties has narrowed significantly. This makes Cairnhill 16 a smart choice for entry, as the rising prices of homes in the OCR and RCR have shrunk the difference between them.

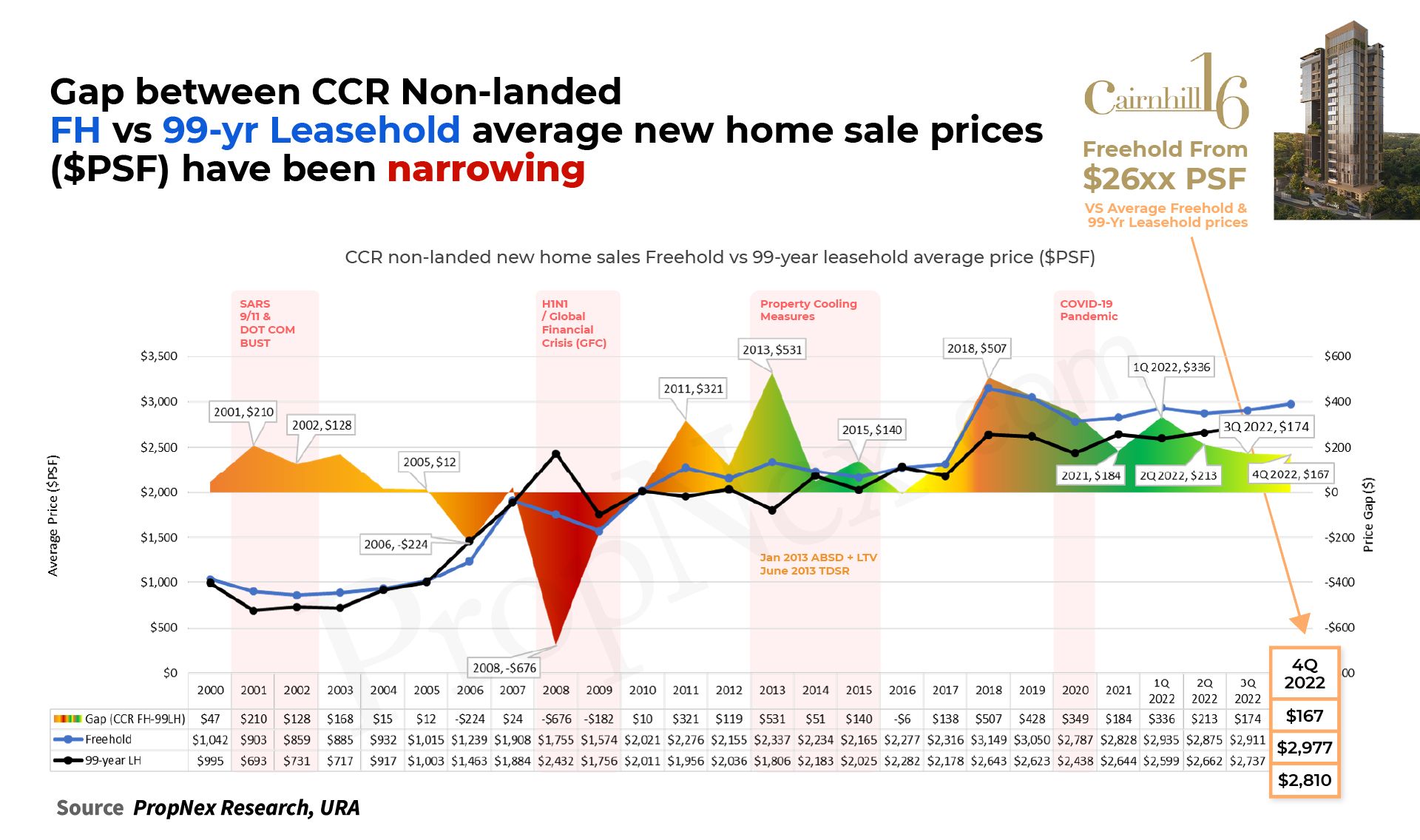

Price Gap Between RCR & CCR Narrowing

Imagine being able to buy a luxurious freehold CCR project for the same price as the average RCR home!

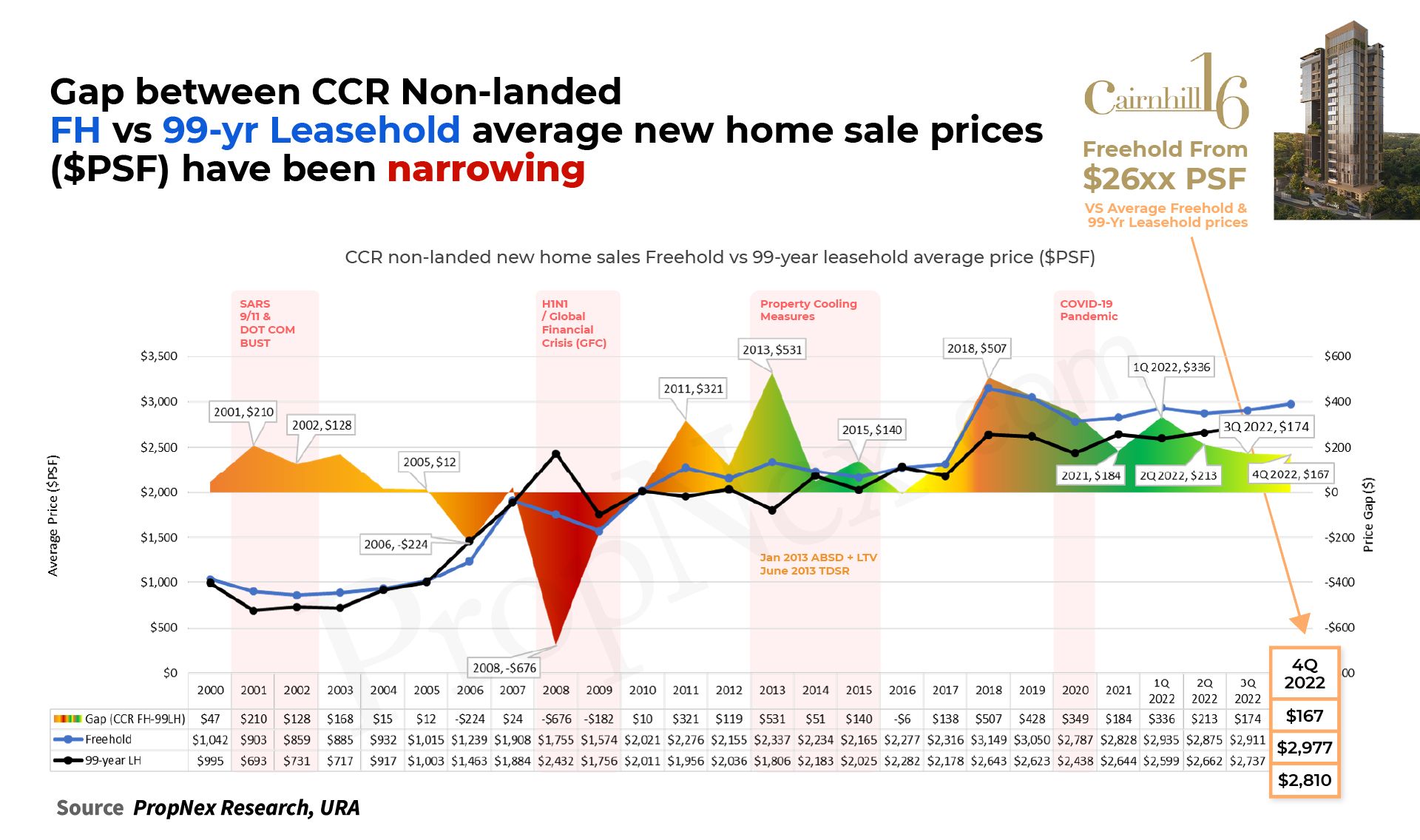

From Figure 2, we can see that the average price of a new home sale in the RCR and CCR has been narrowing throughout the years. In particular, 4Q 2022 saw the average price of a new home sale in RCR reach $2,659 – approximately the entry price of Cairnhill 16 at $2,6XX psf. What an incredible opportunity!

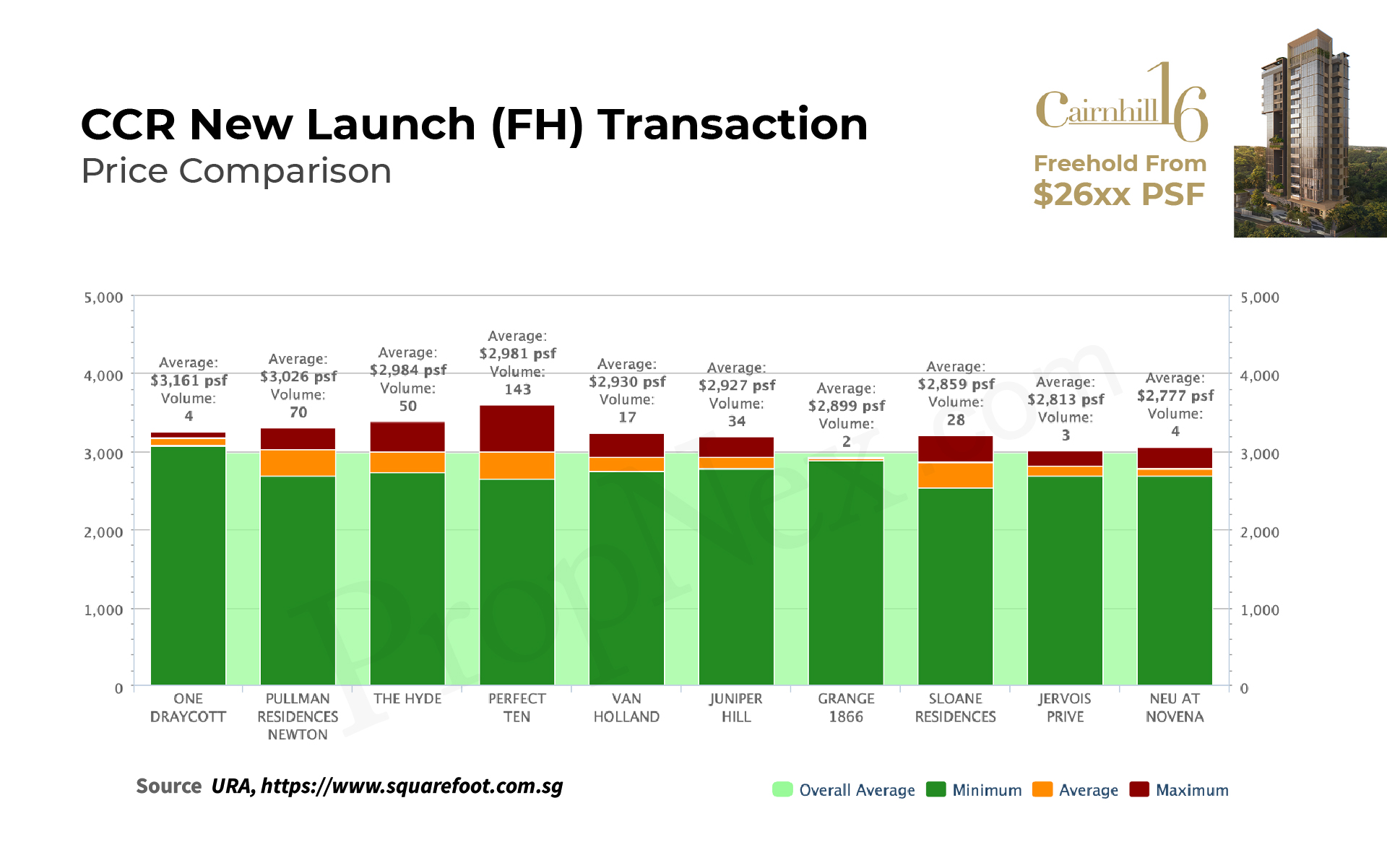

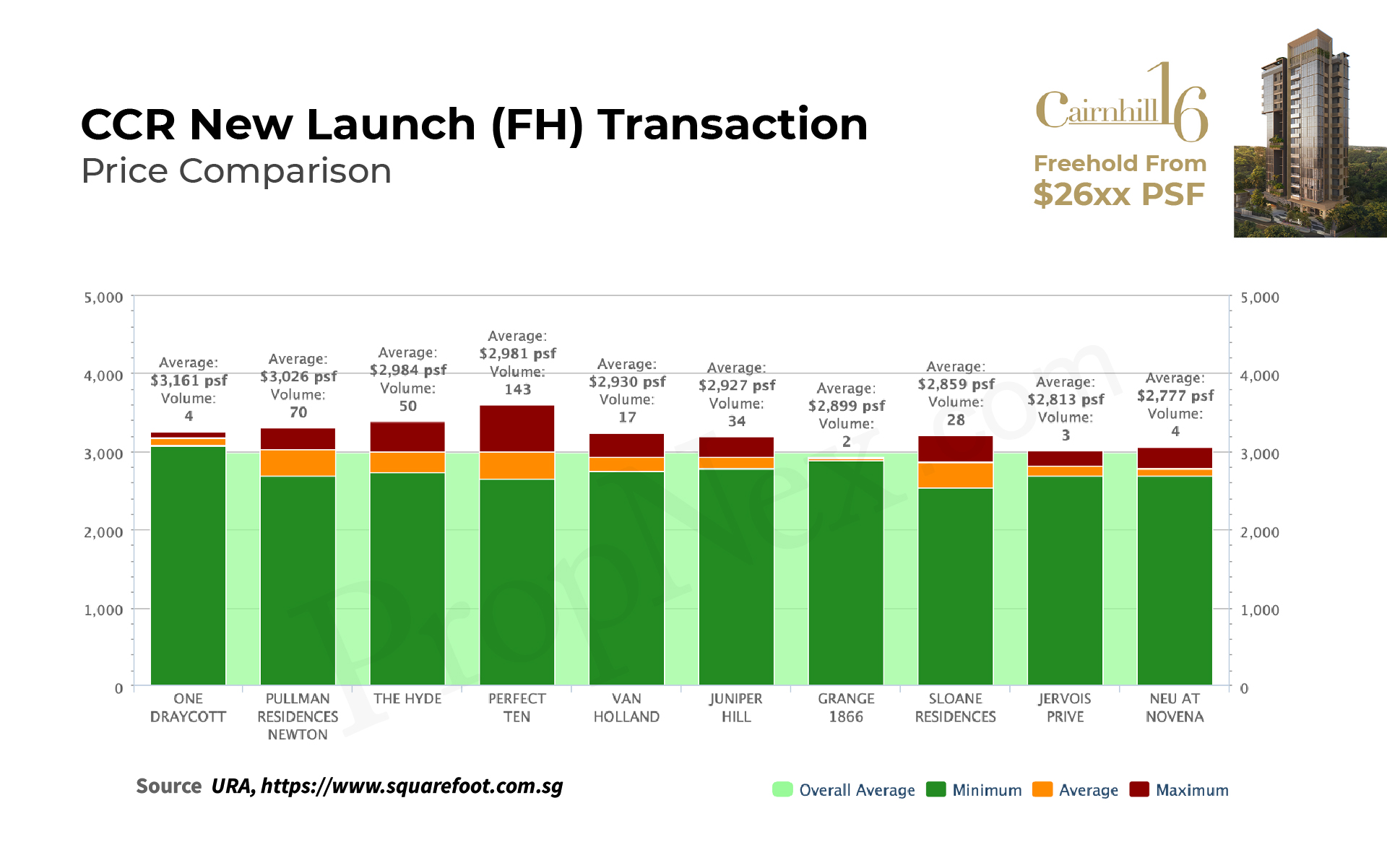

Finally, let us analyze Figure 3, demonstrating the cost of freehold new launches in the CCR; the price range runs from $2,777 to $3,161, doesn’t it make Cairnhill 16 a wise choice for investment?

This year is set to be a exciting time for Core Central Region, with its price offering an attractive alternative investment opportunity to Rest of Central Region.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …

Jayson Ang – October 31, 2024 – Share

TLDR In Singapore, hiring a friend or family member as your property agent can be risky. Disclosing sensitive financial details...

Read More

Jayson Ang – October 23, 2023 – Share

TLDR Understanding property valuations is crucial for both buyers and sellers in the real estate market. Property valuations involve two...

Read More

Jayson Ang – February 19, 2025 – Share

Investing in property, particularly in a thriving market like Singapore, can be an enticing prospect. However, it's not without its...

Read More

Jayson Ang – December 17, 2024 – Share

Singapore, a vibrant and multicultural city-state, is not only known for its iconic landmarks and delicious cuisine but also for...

Read More

Jayson Ang – March 10, 2025 – Share

TLDR Recent challenges in China's real estate sector reveal valuable lessons for Singaporeans, emphasizing the importance of understanding governmental interventions...

Read More

Jayson Ang – October 9, 2024 – Share

Singapore, a small island nation in Southeast Asia, has become a magnet for the world's ultra-rich families seeking to park...

Read More

Jayson Ang – August 30, 2025 – Share

TLDR Selling your HDB resale flat involves a structured 14-step process. Start by registering your Intent to Sell on the...

Read More

Jayson Ang – October 5, 2025 – Share

TLDR Old HDB landed homes, like those in Whampoa, are rare and now fetch over $1.5 million, but their value...

Read More

Jayson Ang – December 10, 2025 – Share

TLDR Historical data of Singapore’s property market shows seasonal trends: Q1 (January to March) often has price dips, making it...

Read More

Jayson Ang – June 14, 2023 – Share

Singapore's Property Insights : Where to Find 5 Hidden Gems? With its booming economy, vibrant culture and attractive regulations, Singapore...

Read More

Jayson Ang – June 24, 2024 – Share

TLDR Summary: The "Sell One, Buy Two" real estate tactic, popularized in 2016-2017, involves selling a property and buying two...

Read More

Jayson Ang – April 26, 2024 – Share

The Singapore property market has always been a hot topic for both locals and foreign investors. With its stable economy,...

Read More

Jayson Ang – October 23, 2024 – Share

Investing is an essential aspect of wealth creation and financial planning. With a plethora of investment options available, it can...

Read More

Jayson Ang – March 20, 2023 – Share

TLDR When considering buying or selling a property in Singapore, it's crucial to understand the market dynamics and key metrics....

Read More

Jayson Ang – January 17, 2025 – Share

TLDR A recent survey by the National University of Singapore (NUS) highlights increasing optimism among real estate industry leaders. The...

Read More

Jayson Ang – March 4, 2024 – Share

Luxury properties in Districts 9 and 10 of Singapore are highly coveted, and for good reason. From stunning views and...

Read More

Jayson Ang – January 17, 2023 – Share

TLDR When navigating the complexities of purchasing a property in Singapore, ensure you meet eligibility criteria, consider affordability factors, and...

Read More

Jayson Ang – February 20, 2024 – Share

TLDR When considering buying your first property in Singapore, start by assessing your budget and qualifying for a permissible loan....

Read More

Jayson Ang – January 18, 2025 – Share

Singapore, a vibrant city-state known for its diverse culture and rich history, offers an array of unique experiences for first-time...

Read More

Jayson Ang – February 14, 2025 – Share

TLDR In today's global workforce, many Singaporeans find themselves working abroad, raising questions about the management of their local properties....

Read More

![Selling your HDB Resale Flat in 2025 [Comprehensive Guide]](https://jaysonang.com/storage/2024/12/Selling-your-HDB-Resale-Flat-in-2025-Comprehensive-Guide-1024x768.jpeg)