TLDR

When it comes to purchasing a landed property in Singapore, there are three main types to consider: terrace houses, semi-detached houses, and bungalows. Terrace houses are rows of at least 3 homes with common walls, while semi-detached houses consist of two homes sharing a common wall. Bungalows are detached houses with their own land titles. Good Class Bungalows have specific criteria to meet. Prices for these properties can range from over $3 million for a terrace house to around $14 million for a bungalow, depending on the location.

Foreigners need approval to buy landed property in Singapore, and financing options include using CPF savings and bank loans. Title searches are crucial before buying to understand land boundaries and restrictions. While filing a caveat is optional, it can safeguard buyers’ interests in property transactions.

Singaporeans are no strangers to purchasing HDB flats and condos, yet few have ever had the privilege of buying a landed property here. After all, such properties are occupied by only 5% of Singapore households. But for those lucky ones who are getting a landed property or who are curious about the process, here’s your complete guide to owning a landed property in Singapore!

Types of Landed Property Available in Singapore

In Singapore, there are three major types of landed property: terrace houses, semi-detached houses, and bungalows.

According to URA, terrace houses are a row of at least 3 homes with common walls between them, all of which have their own land titles. Corner terrace houses are the most sought-after since they tend to have more spacious plots of land. On the other hand, semi-detached houses consist of two homes that share a common wall, and each one holds their own land title. Most of the time, these homes are side-by-side, but they can also be attached back-to-back.

A bungalow is a detached landed house with its own land title. The property doesn’t share any common walls with any other property and is surrounded by land space.

Notably, these kinds of landed properties can be strata-titled.

Though technically a bungalow, a Good Class Bungalow stands apart from its counterparts with its individualistic traits, meriting a special category all its own.

- A GCB must be located within the 39 GCB areas listed by URA

- Generally, land size of at least 1,400 sq m (about 15,069 sq feet)

- Cannot be more than two storeys high (excluding attic and basement)

- At least 60% of the land must be allocated to greenery and landscape

How Much Does It Cost To Buy A Landed Property In Singapore?

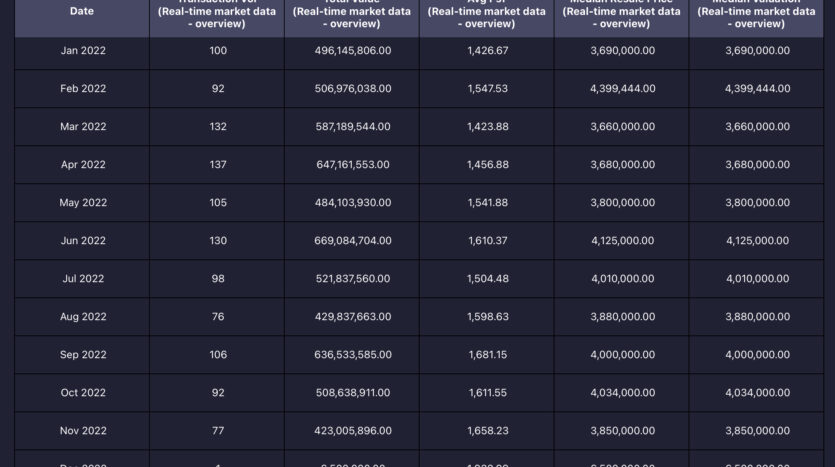

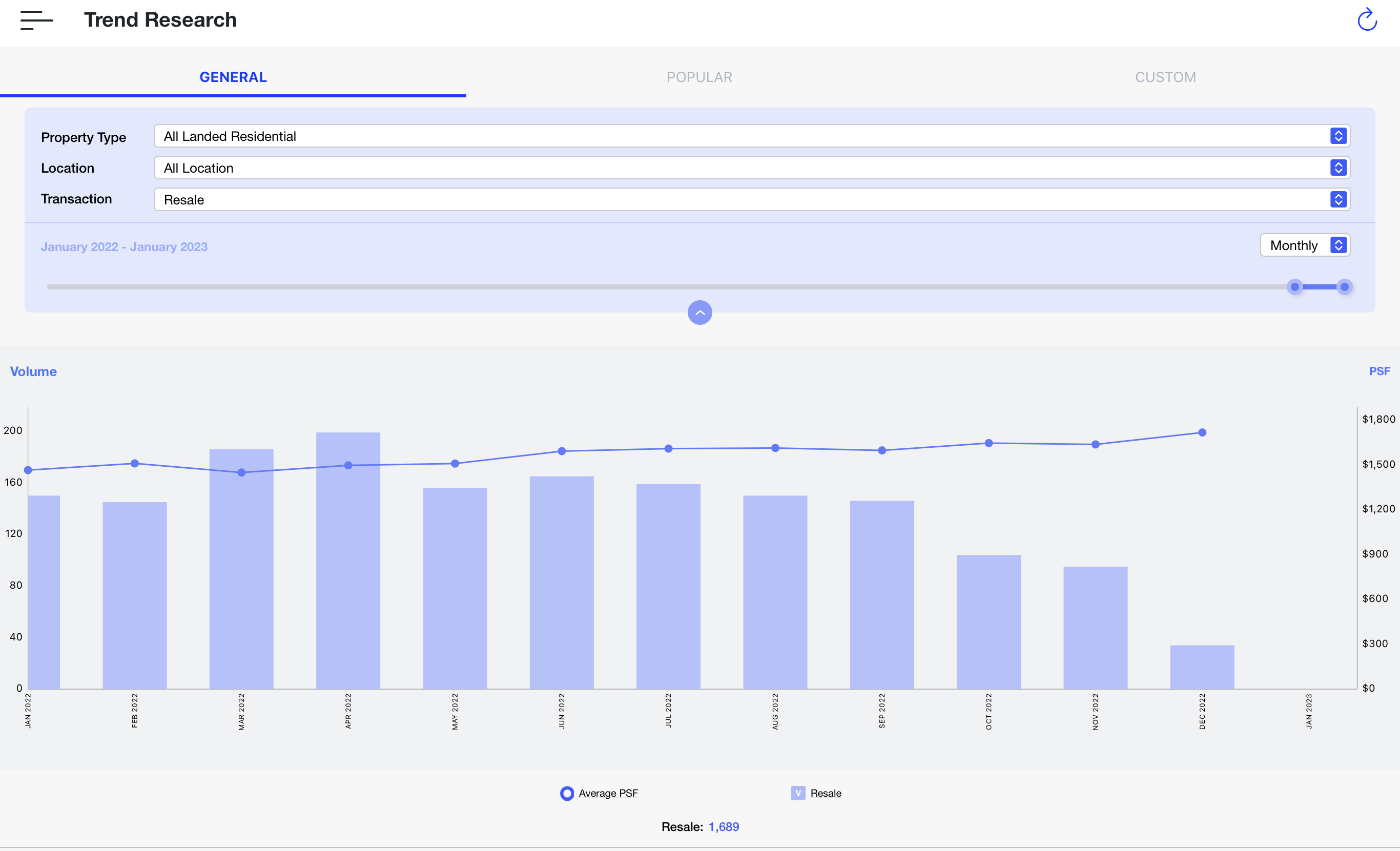

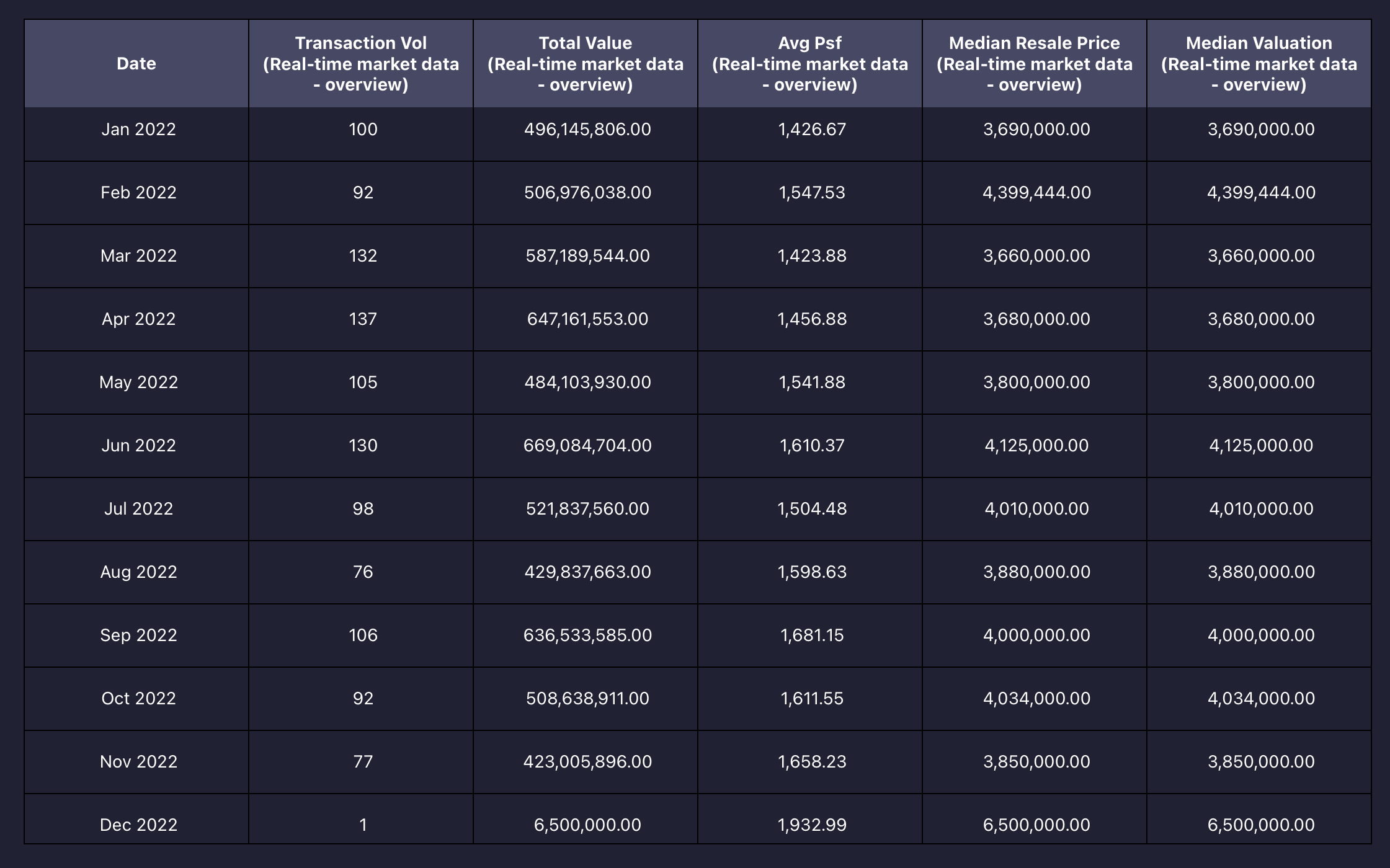

From January 2022 to December 2022, a whopping 1689 resale landed property transactions had their caveats lodged or options issued – according to URA’s Private Residential Property Transactions. Of course, we did not take into account new sales or sub sales, since most landed property transactions are for resale properties; nor did we consider strata-titled landed properties.

Buying a landed property is no small expense for most people; the supply of available landed properties is also limited. Generally speaking, shelling out over $3 million for a terrace house, close to $5 million for a semi-detached, and approximately $14 million for a bungalow is the expected price tag.

Location certainly has an impact on the prices of landed properties; those in the Outside Central Region (OCR) tend to be the most economical, while the Core Central Region (CCR) – the wealthiest part of Singapore – is home to the luxurious Good Class Bungalows (GCBs) and is consequently the most expensive.

Non-Singaporean Citizens or Permanent Residents Cannot Buy Landed Property in Singapore without Approval

If you are a foreigner, such as someone who is not a Singapore Citizen, Singapore company, Singapore limited liability partnership or Singapore society, you will need to obtain approval from the Controller of Residential Property in Singapore Land Authority (SLA) if you want to purchase a landed residential property in Singapore. Under the Residential Property Act, this is a restricted property type and so approval is necessary for all non-locals wishing to invest in such properties.

Aspiring property owners in Sentosa Cove must first seek approval from the Singapore Land Authority (SLA), despite the fact that foreign persons are allowed to buy landed property there. The SLA will assess each application based on criteria such as Permanent Residency in Singapore for a minimum of 5 years and an exceptional economic contribution to the country, including employment income which is taxable in Singapore.

You Can Use CPF And/ Or A Bank Loan

If you’re purchasing a landed property, you can leverage your CPF savings and take out a bank loan to finance the purchase. But keep in mind that to utilize your CPF funds, the remaining lease must be no less than 20 years and the amount is prorated depending on the age and lease of the property. For the maximum CPF contribution, make sure that the property’s remaining lease covers the youngest owner until they reach the age of 95.

If you haven’t already met the Basic Retirement Sum (BRS), the most CPF you can use towards buying a private residential property, such as a landed property, is limited to the purchase or valuation price – whichever is lower. However, if you have already met the BRS, you can use up to an extra 20% of the lower price.

When applying for a bank loan to purchase private property, the same loan-to-value (LTV) and total debt servicing ratio (TDSR) requirements apply. If you don’t have an existing loan, the most you can borrow is 75% with a minimum of 5% cash downpayment. Remember, the combined debt obligations including your mortgage must not exceed 60% of your gross monthly income.

Buyers of landed property must abide by the same buyer’s stamp duty, additional buyer’s stamp duty, and seller’s stamp duty as all other property purchasers.

Title Searches Are Important Before Buying Landed Property

When purchasing a landed property, there are certain factors to take into account that are not applicable to HDB flats or condominiums; namely the land itself and the possible easements and covenants attached to it. An easement, for instance, might allow a right of way to be granted to another property, meaning certain areas of your land could not be built upon without permission.

It’s essential to understand the boundaries of your land title to ensure you don’t trespass onto someone else’s property or public land. Though most land titles don’t come with any easements or covenants, it’s always wise to enlist the help of an experienced lawyer to conduct a thorough due diligence, to make sure you don’t encounter any unexpected issues.

Filing a Caveat for Landed Property is completely optional

URA states that Caveats are legal records lodged with the Singapore Land Authority by purchasers in order to document their legal rights in the property. Generally, Caveats are registered after a purchase option has been executed or a Sales and Purchase contract has been signed.

It is not compulsory to lodge a caveat with the Singapore Land Authority, meaning that certain property transactions may remain unknown to the URA’s Private Residential Property Transactions. Yet, it is highly recommended for buyers to lodge a caveat, as it safeguards their interests. If there are multiple claims to a property, the time of lodgement of the caveat will determine who is the rightful owner. As a rule of thumb, this step is usually taken by the lawyer in the conveyancing process.

You May Also Like …

3 Winning Strategies for Skyrocketing Your Property Market Profits (Including Real-Life Success Stories)

5 Tips for Renting Property in Singapore

Top 5 Mistakes to Avoid When Investing in Singapore Real Estate

Five Pitfalls of Selling a Home for the First Time

Crucial Facts : All First Time Buyers Need to Know

Top 5 Best Unique Nighttime Experiences in Singapore

3 Trends For New Launch Properties In 2023

5 Most Iconic Landmarks In Singapore’s Landscape

Top 5 Reasons : How Investing in a Luxury Condominium in Singapore Can Boost Your Portfolio

Top 5 Best Green Spaces to Picnic in Singapore

What Factors Contribute To Singapore’s Real Estate Market Exhibiting Less Volatility Than Other Major Cities?

Top 5 : Benefits of Investing in Newer vs. Older Singapore Property Market Condos for International Buyers

Discover the Optimal Timing to Invest in Singapore Real Estate: Unveiling Historical Insights

Bayshore: Reinventing the Experience of Living by the Beach

Top 5 Thai Restaurants in Singapore

5 Reasons Why You Should Consider Investing In Singapore Real Estate

The Lease Buyback Scheme Is A Strategy That Could Help You Retire Comfortably In Your HDB Flat

Can Your HDB Flat Safeguard Your Retirement?

What’s Needed For Singapore To Lift Those Cooling Measures?