Buying a home always seems daunting especially such it is a big-ticket item and the prices for private homes can easily start at a million dollars.

But when you have the ability to break down the figures and have a clear overview of your financial capabilities in terms of servicing your monthly mortgages, you’ll realise that owning private homes is actually very within reach.

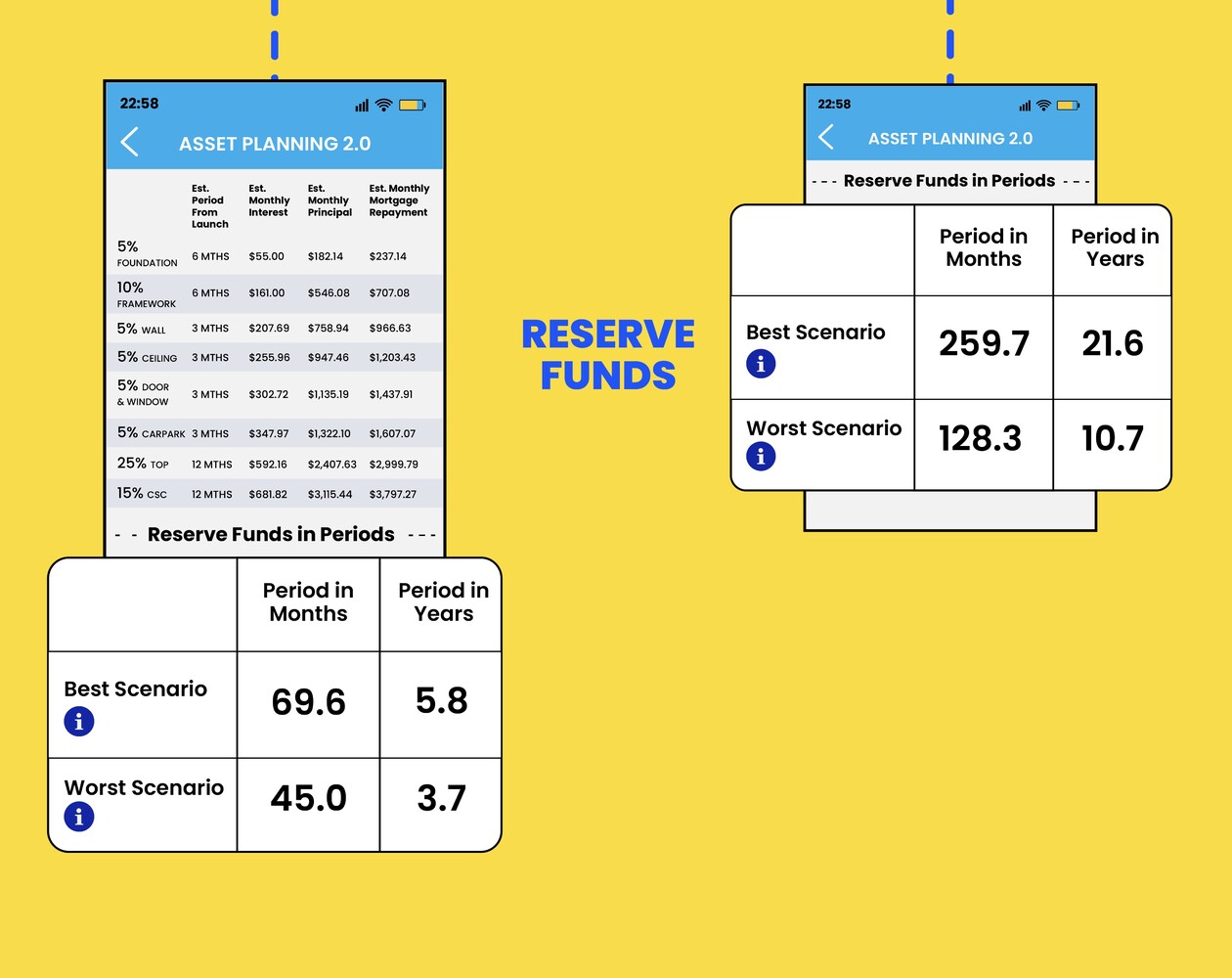

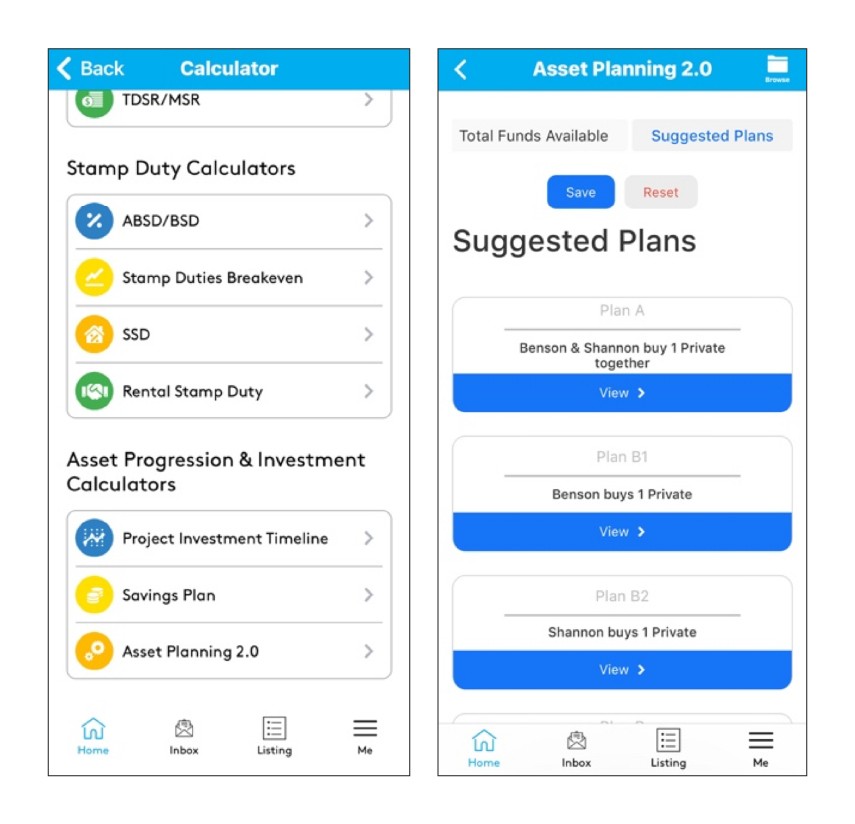

One huge perk of engaging my consultation services is having proprietary financial tools that can assist you in planning well. The tools help you map out your finances easily and provide a vote of confidence to any upgraders looking to take their next step. You are definitely not jumping in blindly!

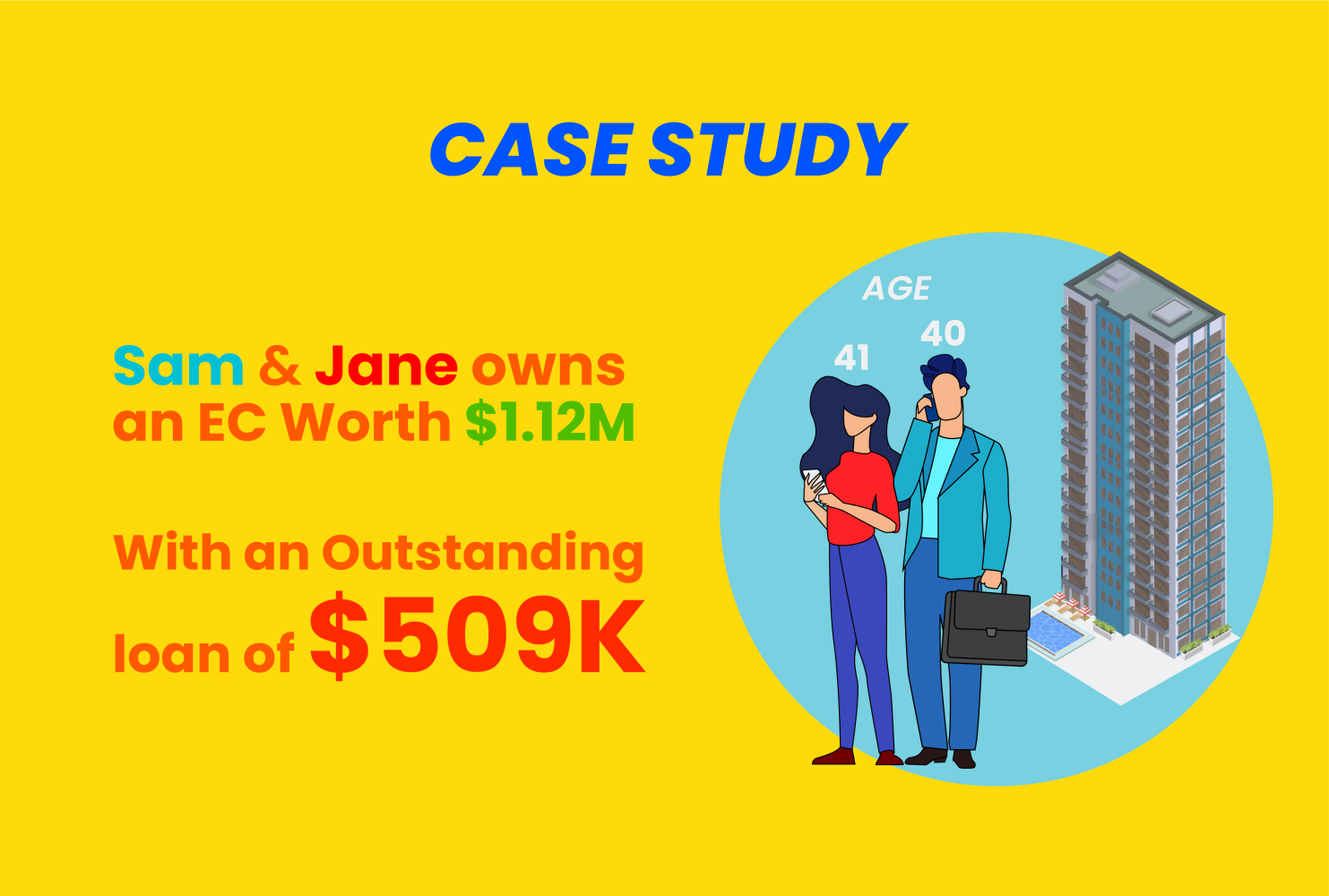

Let’s take a look at the case study below. Sam & Jane owns an Executive Condominium (EC) and is looking to sell it and buy two properties. How can my proprietary app help them?

Let’s take a look at the case study below. Sam & Jane owns an Executive Condominium (EC) and is looking to sell it and buy two properties. How can my proprietary app help them?

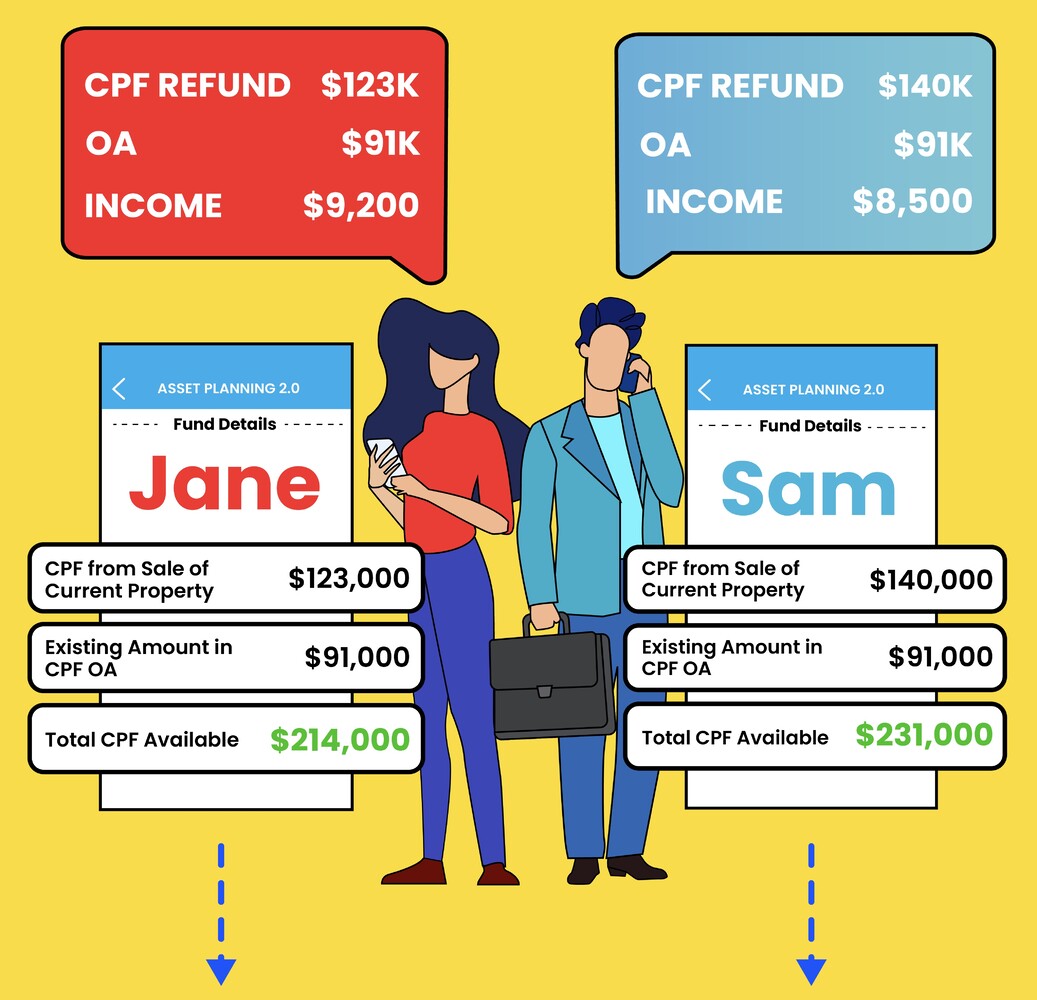

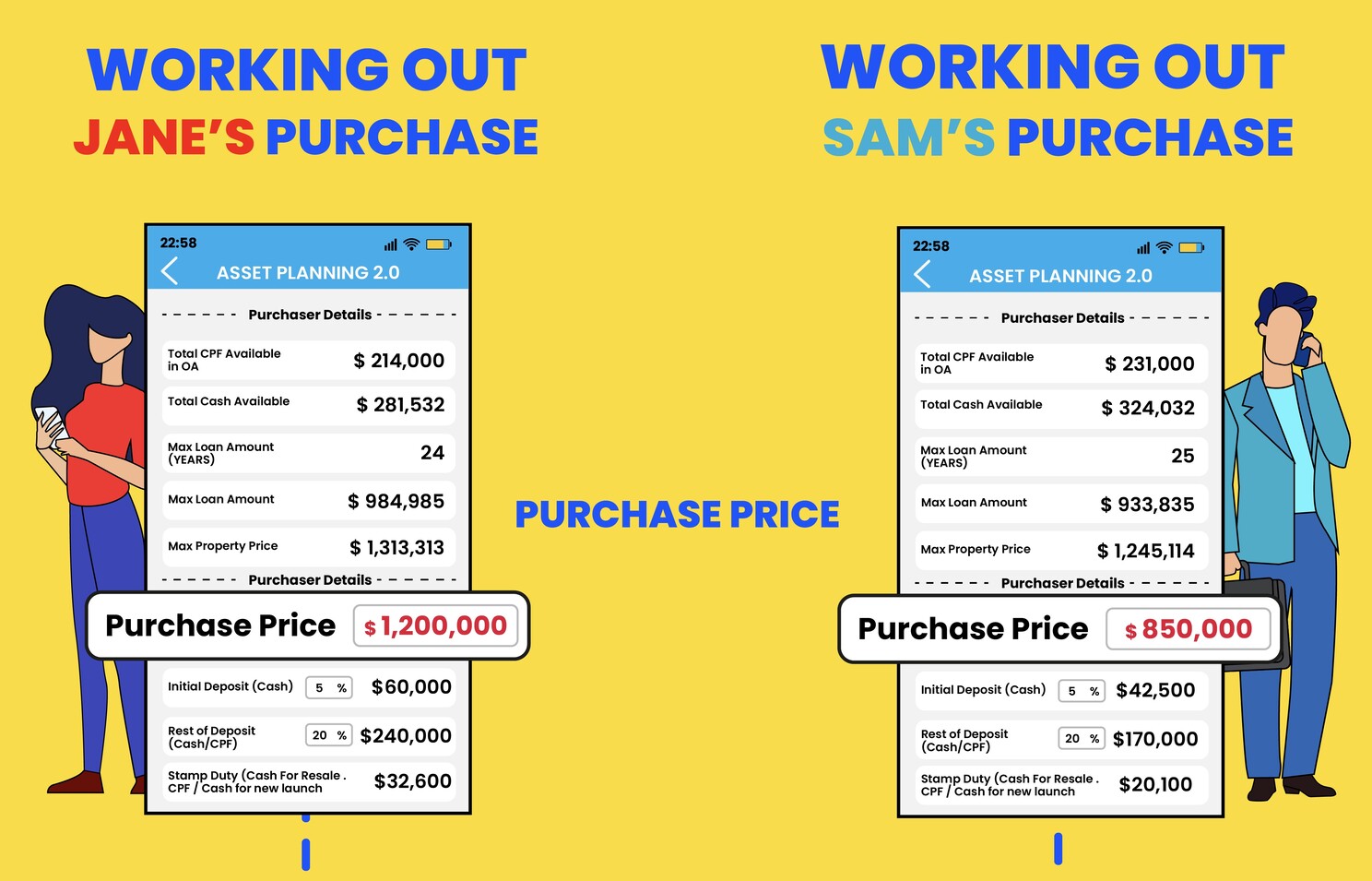

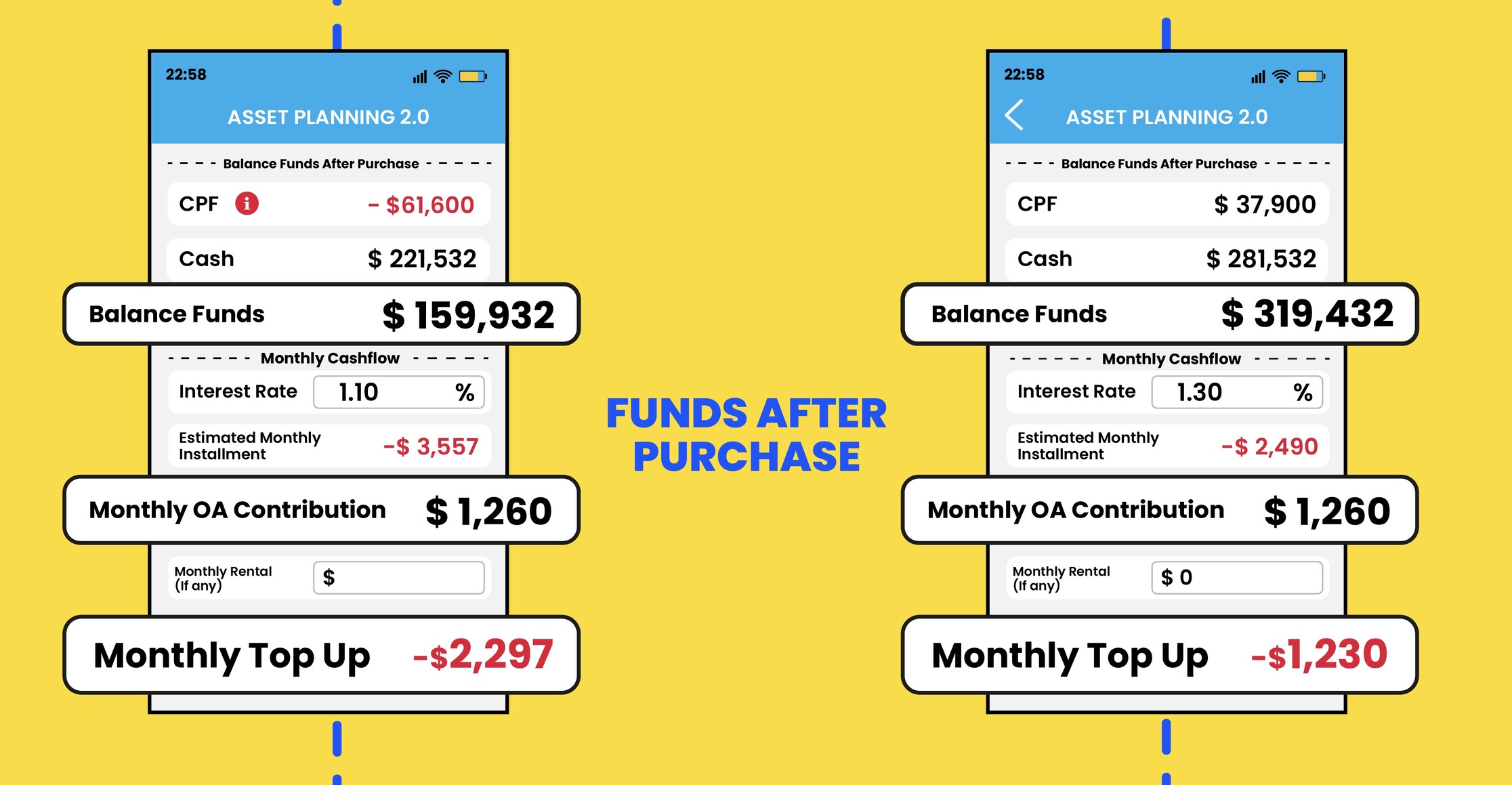

With my proprietary calculator app, you can easily work out your finances and determine whether you can afford your target home purchase or should you be looking elsewhere. It takes into consideration based on your cash on hand and the amount in your CPF, and works out your monthly repayment depending on the purchase price of the property you are looking at.

Understanding clearly what your limits are and how comfortable are you with the monthly payments will empower you to make more informed moves.

As you can see from Jane’s breakdown of figures, at the bottom, it clearly details the monthly mortgage repayment needed in the different phases of construction if it is a new launch.

One more point I would like to make, as a matter of fact, an important point that I have been advocating for years;

it is that no matter how hard we work and save up, we can never beat those who make their hard-earned money work for them through property.

This is why I endeavour to equip home-owners with the ability to make informed decisions that will impact their future, both for them and the family!

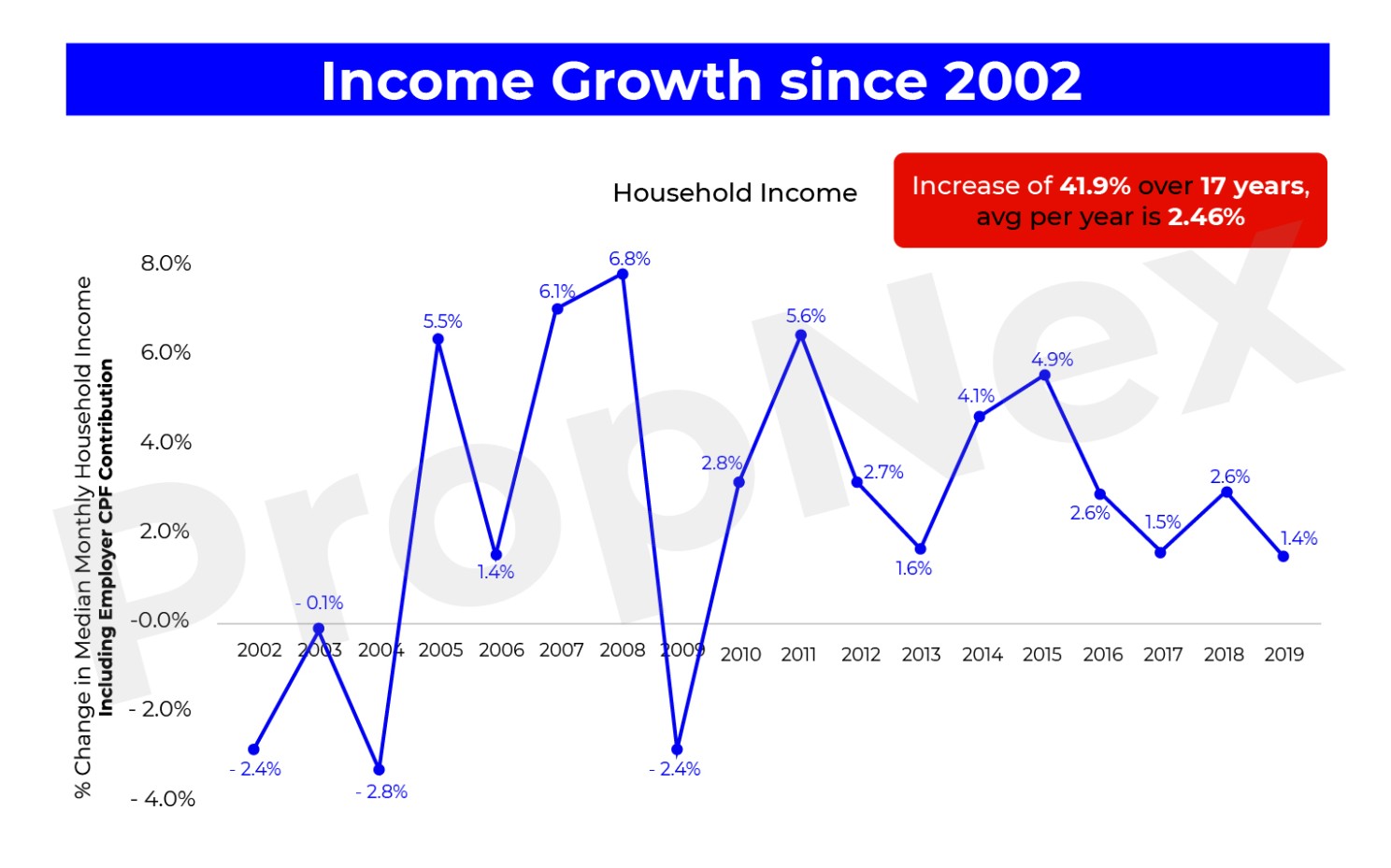

The average income growth is at an abysmal rate of 2.4% annually (Figure 1), comparing that to those who are able to make phenomenal profits of $300,000 in basically within the span of 3-4 years.

We can safely assume that you and most people would want to make that profit too, right?

Figure 1: Average household income growth (%) from 2002 to 2019

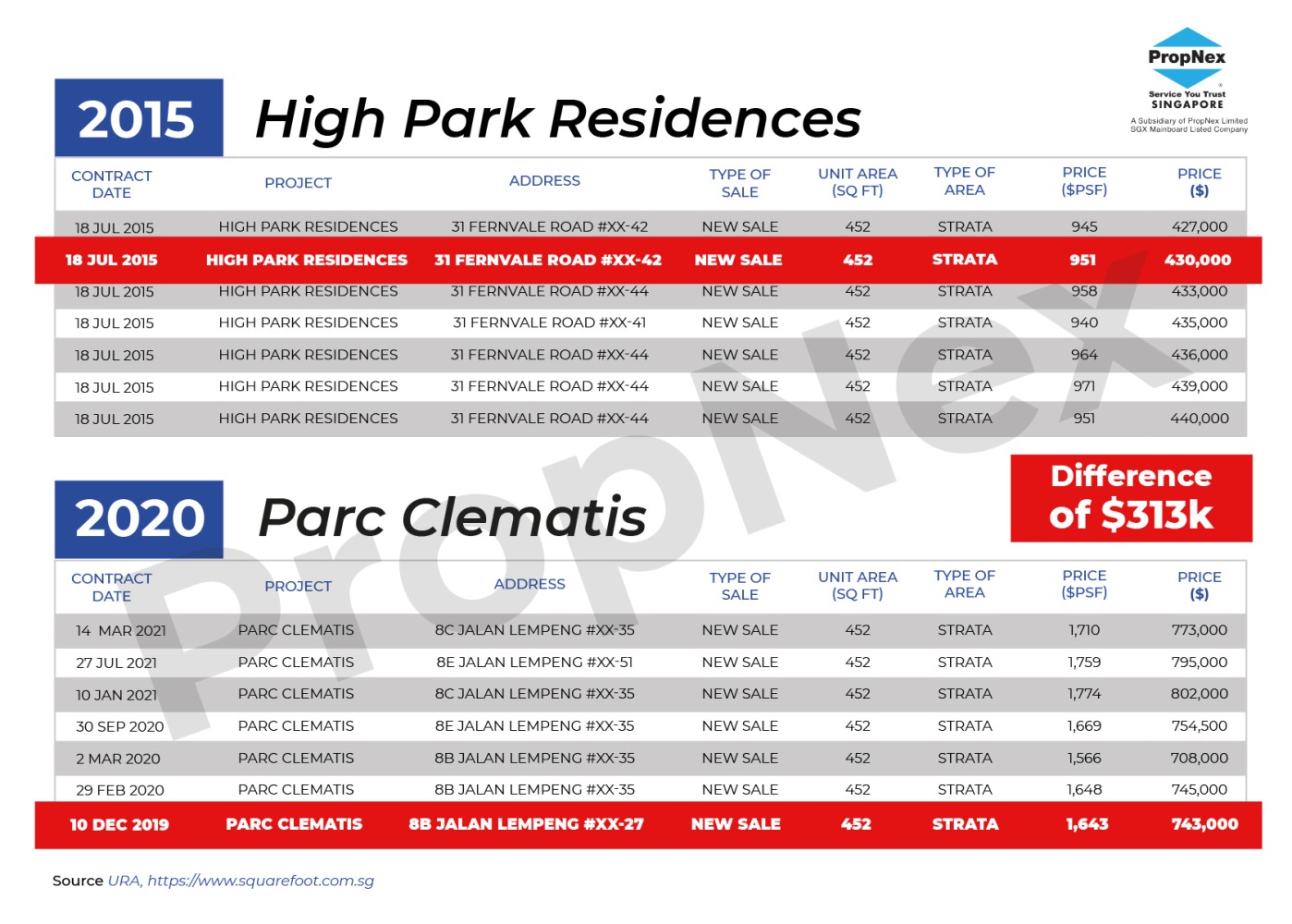

In Figure 2 below, we see the comparison of two similar unit types of condominium projects, albeit different locations, but are equivalent in terms of targeted market audience. We can see that in just a span of less than 5 years, property prices differ so very much. Therefore, your inaction can actually cost you dearly without you even realising it.

And based on the reality of income growth, bonuses and savings, are you able to even generate any amounts close to such returns? The answer is cruel but real.

Now is the optimal time for you to make a life-changing decision, to enjoy a huge leap in this rat race and seize this opportunity to provide your family with the best while you still harness the capacity to work hard, make a decent income and youth to enjoy maximum loan tenure. You don’t have to look at others in envy thinking that they got lucky or are blessed enough to enter the property market and are making a splash, you can be that person too!

Figure 2: High Park Residences (2015) & Parc Clematis (2020) transactions

With so many questions involved, there are many crucial choices to make as a property upgrader. At the end of the day, everyone wants financial freedom, and not to be burdened by monetary issues especially at every stage of one’s life. Attaining financial freedom is definitely possible, with meticulous planning and commitment.

There is so much to benefit from when you make the right choices, and the first right choice to make now is to reach out to me via WhatsApp to explore your options and see how you can make your hard-earned money work for you.

Want to get more infomative articles such as

“Leasehold vs Freehold” or “The correct entry price”?

You May Also Like …