TLDR

Foreign buyers interested in private residential properties in Singapore is a common sight due to the country’s positive reputation and stable environment. Despite a decline in foreign buyer participation since the introduction of additional stamp duties, recent easing of travel restrictions may attract more overseas buyers. Several factors make Singapore an attractive investment destination, including its safe environment, stable economy, well-established property market, robust infrastructure, and educational opportunities. Foreign buyers can also consider resale properties as an alternative to new condo purchases to potentially lower the stamp duty payable. Additionally, some individuals from specific countries are exempt from the additional stamp duty. Foreigners can buy condominiums without ownership restrictions but need approvals for landed homes on the Singapore mainland. For more information on potential buying opportunities, direct message the article author.

Foreign buyers keen on private residential properties in Singapore should come as no surprise.

Singapore is usually on the radar of global investors, given its reputation as a prosperous, efficient, and safe country. It has a long track record of political stability and peaceful transition of political leadership. The country’s ability to mobilise its people and resources to tackle the Covid-19 pandemic, making a successful transition to endemic Covid-19 living would only further boost investors’ confidence.

While Singaporean buyers have always made up the majority of private home purchasers in the country, the participation of foreign buyers have seen a sharp decline following the introduction of the additional buyer’s stamp duty (ABSD) in December 2011.

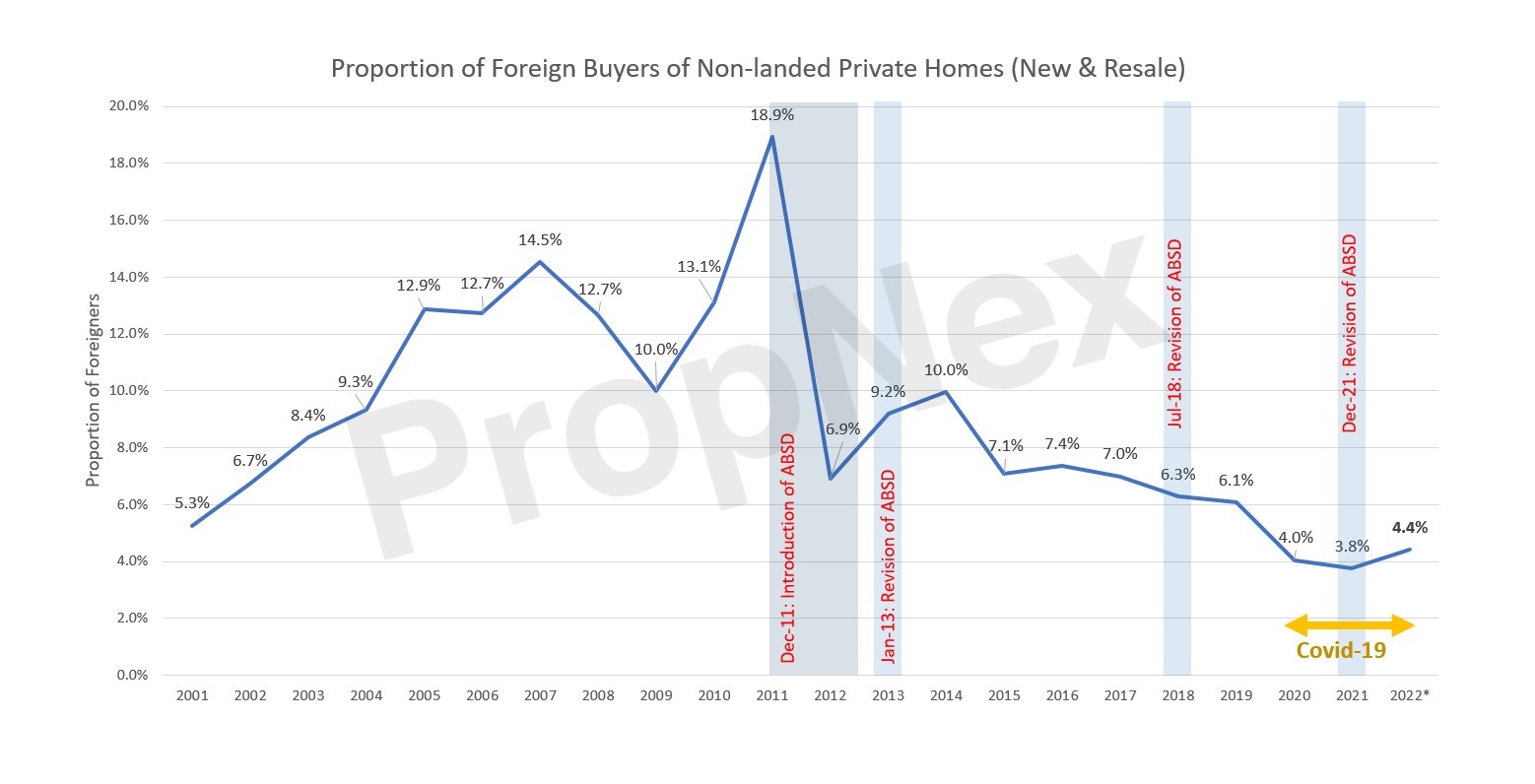

The proportion of non-landed private homes purchased by foreigners plunged from nearly 19% of total sales (new sale and resale) to 6.9% from 2011 to 2012 (see Chart 1), with the new 10% ABSD rate in place for foreign buyers.

Some 11 years on since ABSD was first implemented, the tax rate was further hiked thrice more – in January 2013, July 2018, and December 2021 – as part of a package of measures to cool the residential property market. At the time of writing, the ABSD rate levied on foreign buyers is 30% for the first and subsequent private home purchase in Singapore.

The level of foreigner participation in the private home market fell further in recent years amid the Covid-19 pandemic which led to strict measures, including border closures and travel restrictions that affected prospective buyers from visiting Singapore to transact. In the year-to-end August 2022, foreigners constituted just 4.4% of overall non-landed private residential transactions.

Chart 1: Proportion of Foreigners Who Purchased Non-Landed Private Homes (New Sale and Resale) In Singapore

Source: PropNex Research, URA Realis (data up till 31 August 2022)

Source: PropNex Research, URA Realis (data up till 31 August 2022)

With the easing of travel restrictions, some would-be buyers from abroad may be revisiting the idea of picking up a property in Singapore.

Here’s a brief list of considerations in assessing whether a foreigner should stump up the ABSD to buy a residential property here.

A) Singapore As A Safe Haven For Investment

Singapore is strategically located in a growth region where companies and investors home in on to tap opportunities in Asia and Southeast Asia. It is a vibrant and thriving global business and financial hub, with favourable tax rate and pro-business policies.

A key attraction of Singapore is its strong governance and the stable political environment, where leadership transition is typically uneventful and peaceful. It also has effective rule of law as well as transparent regulatory framework and processes that provide clarity to and protect buyers.

There is also no capital gains tax nor estate duty which makes it conducive for property investment.

B) Stable Currency And Economy

The country’s sound economic fundamentals and strong currency will assure buyers that their properties will hold their value over the long-term. In addition, the Singapore government is also committed to ensuring the nation remains competitive and relevant in an ever-changing global environment – by pushing for innovation, attracting foreign investments, and nurturing talent in growth sectors.

C) Well-Established Residential Property Market

Singapore has a well-established property market with reputable and reliable developers, underpin by healthy local demand. Residential leasing market is also active amid Singapore’s favourable policies towards attracting foreign direct investments and wooing top global talent to the country.

The property market has a good track record of weathering crises and emerging stronger. Over the last 20 years, the overall private home prices have grown by 118% from Q1 2002 to Q2 2022, as tracked by the Urban Redevelopment Authority’s property price index.

D) Infrastructure And Urban Renewal

Singapore has excellent transport infrastructure and is one of the most connected country in the world. According to EDB Singapore, Changi Airport serves more than 100 airlines flying to about 100 countries and territories globally. Domestically, the public transport infrastructure is well-developed, with a reliable and comprehensive rail and bus network. A report by The Straits Times in October 2020 said that Singapore’s public transport system has been ranked top in the world by a US-based travel website, Far & Wide, beating other cities like London and Hong Kong.

Apart from a well-functioning and convenient transport system, the Singapore government also sets out long-term plans to chart the country’s development by reviewing land uses and rejuvenating urban areas. Some of the exciting upcoming developments include the Greater Southern Waterfront, the Jurong Lake District, the redevelopment of the Paya Lebar Air Base site after its relocation, and the expansion of the Changi Airport. Such new developments and urban renewal will not only enliven the various precincts but also play a part in supporting property values.

E) Education, Culture and Language

Singapore is well-known for its high-quality education system, and it is highly rated in the subjects of math and science. There are also numerous international schools where foreigners residing in Singapore can enrol their children for classes. Many foreigners, including Chinese Nationals are also comfortable living in Singapore due to the familiarity with the culture and language here.

F) Alternatives In Resale Market

For foreign buyers who are put off by the 30% ABSD on new condo purchases owing to the higher prices of new condo launches, the resale market may present lower priced alternatives that could suit their needs. The lower quantum of resale properties would mean that they would not have to fork out as much in ABSD payable. For instance, the 30% ABSD on a $2-million new launch unit works out to $600,000, but would be $450,000 for a resale home valued at $1.5 million. Speak to me to find out what are the possible buying opportunities in the resale market if the prices of new launches do not fit your budget.

G) ABSD Remission Under Free Trade Agreements

Under the respective FTAs, Nationals or Permanent Residents of the certain countries will be accorded the same Stamp Duty treatment as Singapore Citizens. They are Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland, as well as Nationals of the United States of America. This means that these individuals would not have to pay ABSD on their first residential property purchase in Singapore, unlike other foreign buyers.

There are no ownership restrictions on foreigners buying a property in a condominium development, but relevant approvals are required to purchase a landed home on Singapore mainland.

DM me for potential buying opportunities to find out how you can grow your wealth via property investment.

You May Also Like …