TLDR

When it comes to property investment for first-time buyers in Singapore, careful planning and early action are key. Consider options beyond public housing for better future prospects. Analyze market trends, potential upside, and risks involved before making a decision. Learn from others’ mistakes to avoid financial setbacks. Join informative sessions and research historical data to make informed choices. Prioritize financial soundness and strategic property selection for a successful real estate journey.

As first-time property buyers, there are many things we may fear.

Most people lack the necessary experience in buying & selling properties so it may be daunting to choose the ideal property that could possibly enjoy growth yet well within affordability.

The number 1 property choice of most first timers is either the next BTO or a resale flat close by their families as most of them are being prudent considering the affordability of public housing. So is this a good idea?

If all you want is a humble and mundane life, it could be the right move. But if what you yearn for is the betterment of your future and lifestyle, you may want to reconsider other options. Why? Let’s take a look.

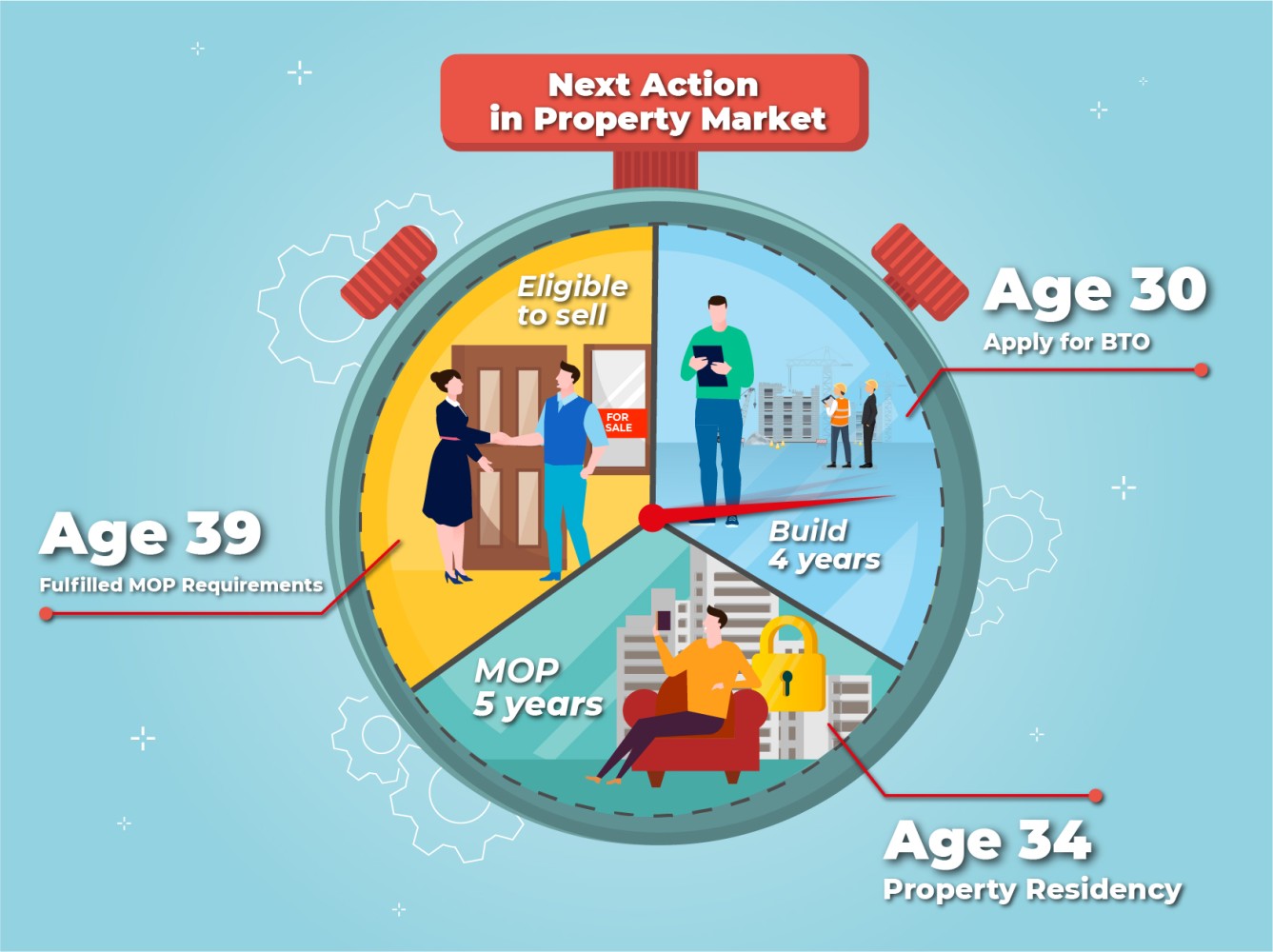

What most young property buyers do not consider is the lengthy timeline for one to realise their first pot of gold

The long 4 years waiting for construction to complete coupled with the Minimum Occupation Period of 5 long years easily lock a young 30 years old couple for a dreadful 9-10 years and means the young couple would have reached almost 40.

We all learnt that time is money and this is an irrefutable fact of life! Many people have the misconception that investment should only start at the later stage in life but due to the mortgage limitations in Singapore, the older one gets, the shorter the loan tenure will be and that sadly means that the monthly loan repayment will be heftier while other family expenses such as child care and education commitments are increasing. Many people have already missed this high-speed train of investment and while you still have this advantage , wouldn’t you do something about it?

So let say if you are able to get a nice home for your own-stay while this very first investment still has a high potential of making decent profit in 5 years (half the time of the public housing route), wouldn’t that be great help to jumpstart your real estate investment journey?

It is important to know that you have to start this journey as early as possible so long as your finances are sound.

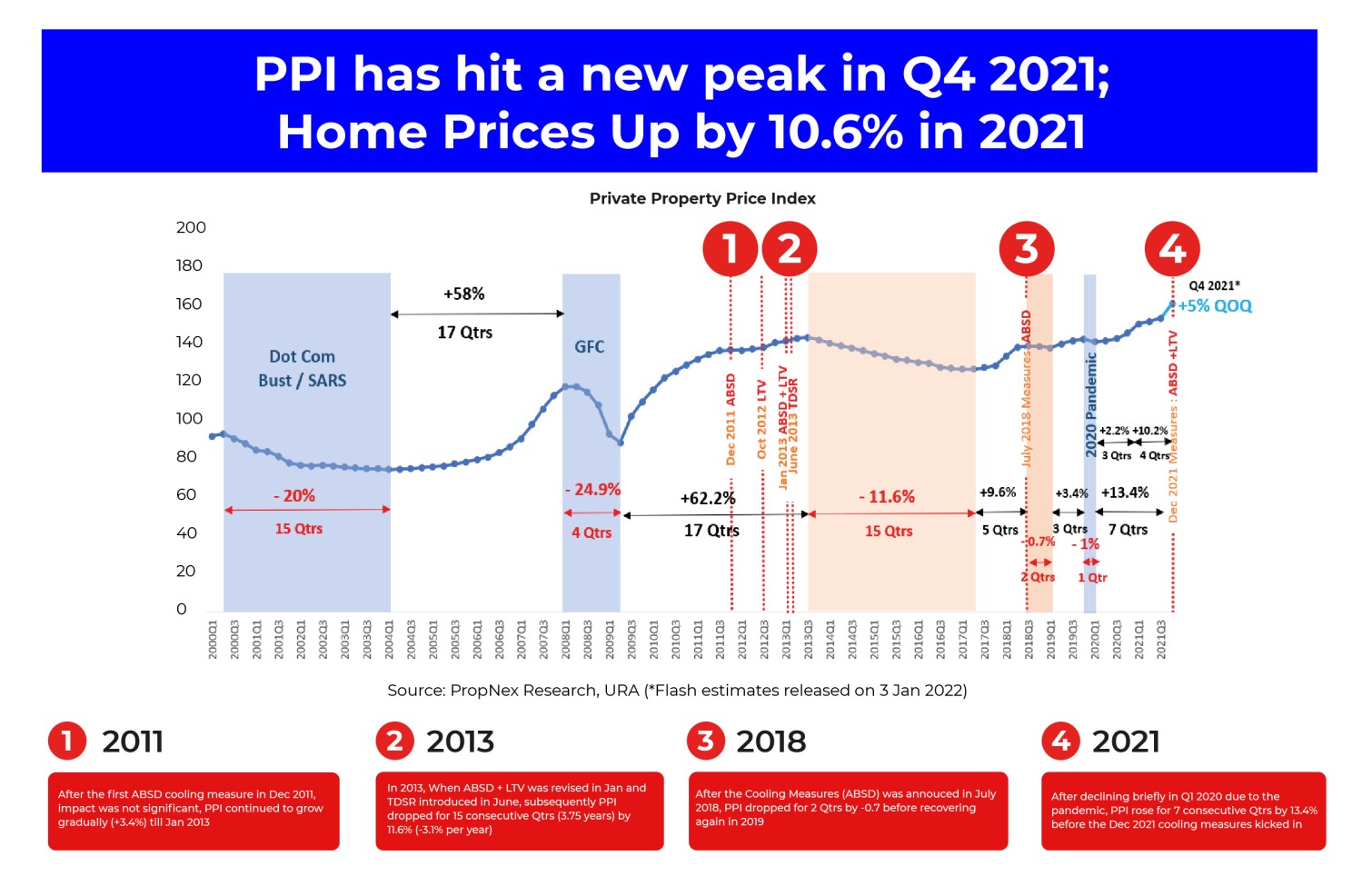

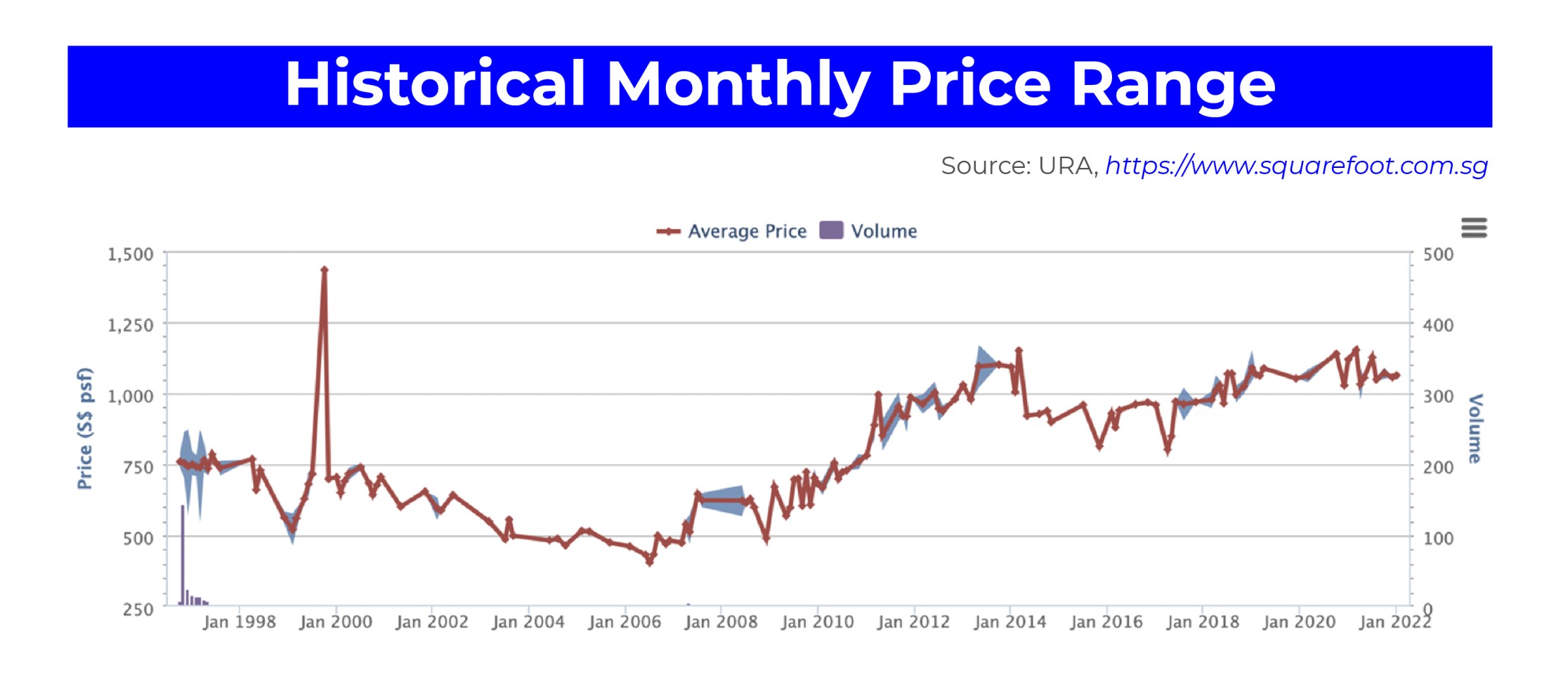

Remember I mentioned that being prudent is important. I cannot stress enough that careful planning is highly critical to the success of your first investment. Now we can see prices of private homes hitting new highs in 2021 in Figure 1.

Every time the market dips, it rebounds even higher, and those who are apprehensive and choose to wait end up paying even more than they have to. These are fundamental mistakes that you can avoid easily.

Even though the overall chart shows that home prices continue to climb but truth be told, there are some inexperienced “investors” who made losses too. This could be due to various factors and some of the most common ones are not setting aside reserve funds, having slow hands or simply not understanding the property market well enough. Sounds daunting, right? It can be easy and much safer so long as you follow our proven strategy closely.

Figure 1: Private property price index (%) from 2000Q1 to 2021Q3

In Figure 2 below on the historical price chart of a private property Changi Green, as a first-timer, should you buy into the property since prices now are at its previous high in 2014? Do you believe that the price will continue to escalate in the next three years?

Figure 2: Changi Green historical monthly price (psf) range.

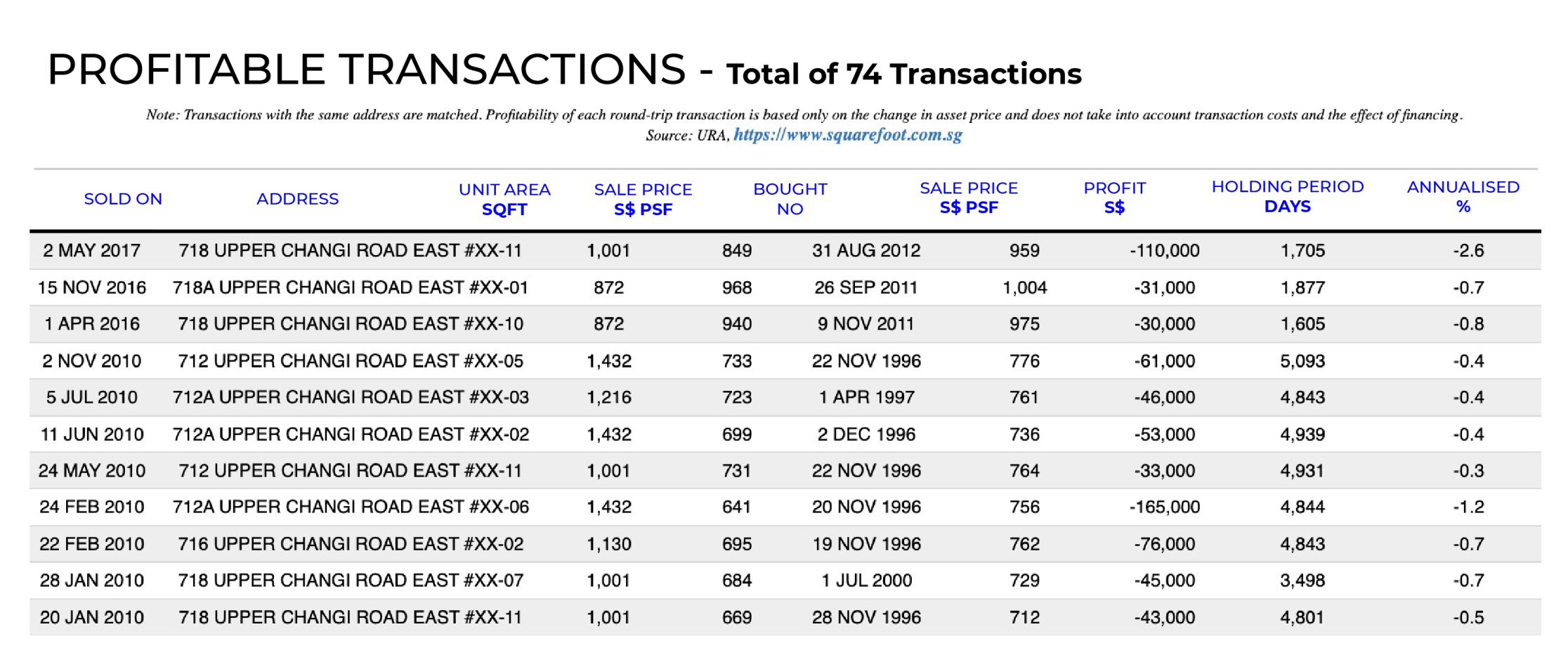

Now, let me draw your attention to Figure 3 below to look at some of the transactions that happened in these recent years at Changi Green. You might have noticed that some buyers brought into a resale property and ended up not making profits like they would like to, on the contrary, some of them even incurred losses.

Do not repeat these costly mistakes made by others!

Figure 3: Changi Green profitable transaction history

The question then boils down to, how does one select the RIGHT PROPERTY?

There are TWO important factors you should use to determine – Potential Upside & Risk Involved.

With these two points as my basis coupled with careful analysis of the facts, figures and market insights to determine if the property is safe to enter. And definitely no one can guarantee that you will make money for sure, that is why considering risk is equally important as the potential upside.

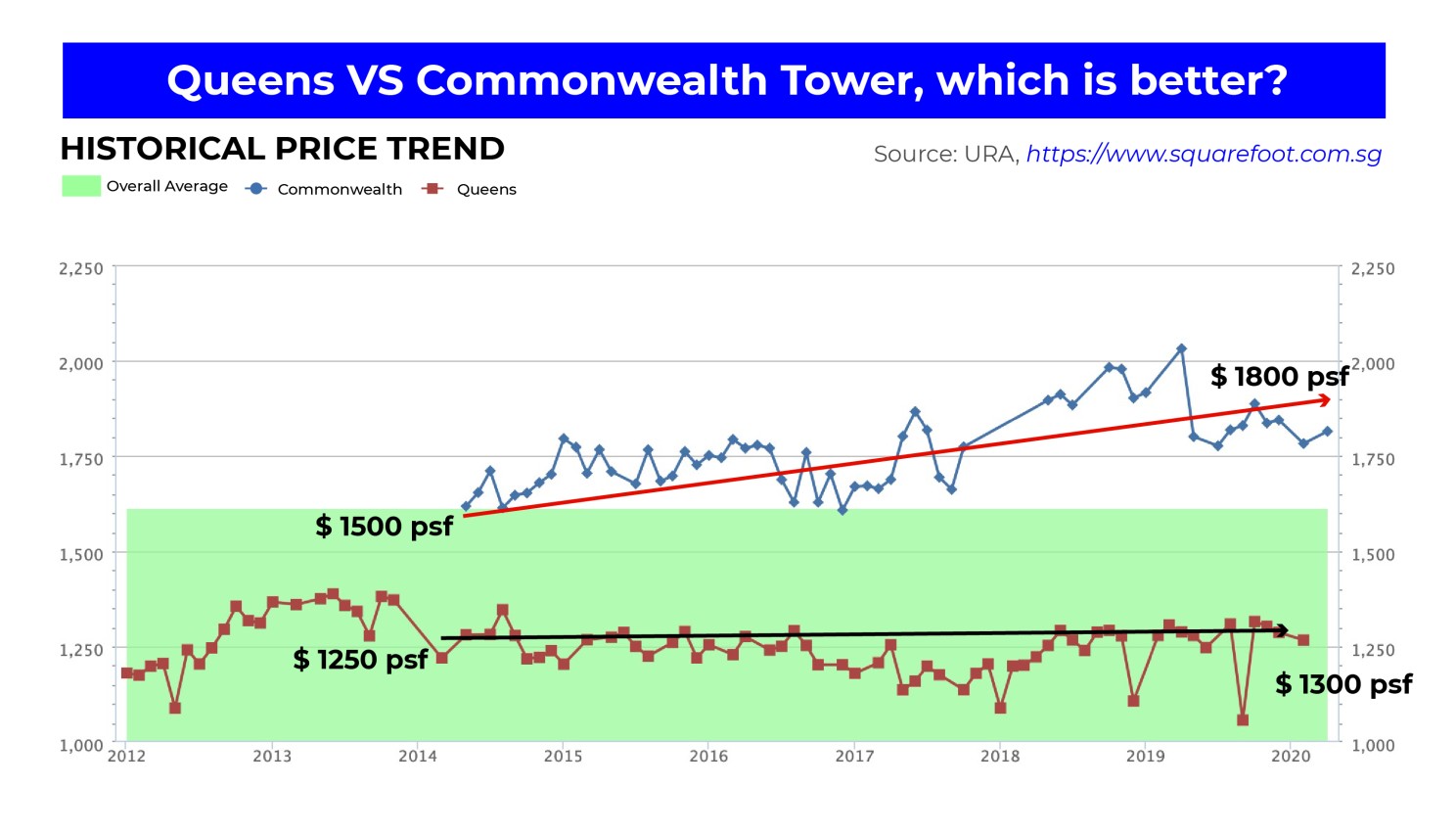

One last example to illustrate my points further. Looking at Figure 4 below, between Queens and Commonwealth Tower, you would have been relatively upset and utterly disappointed if you chose to purchase the former due to its lower entry price. As you can see, even though Commonwealth Tower has a higher entry price, the profits amounted to so much more. Why do you think that is the case?

Figure 4: Historical price (psf) trend for Queens & Commonwealth Tower

With all these questions in mind, you know that it is key to understand how to select the right property. With factors listed above coupled with criteria that are essential in spotting the right property, you will be able to start your real estate journey moving towards the right direction.

It can all be a seamless process when you grasp the fundamentals of choosing properties as it can be applied to find future properties as and when you upgrade.

Avoid repeating others’ mistakes and come join me at my upcoming zoom session, where I will address all these burning questions just for you.

Dear reader, if you are keen to have another of my article that I share with my clients and friends on how I select a property that is $300psf to $400psf below the market price in the current market, do DM me for it.

Thank you for taking time to read my article, do share with your friend if you find this artice useful, greatly appreciated

You May Also Like …