TLDR

Jayson Ang discusses the essential factors to consider when seeking a property for investment. By analyzing the safe entry price and price gap, clients can make informed decisions. The case study of Cairnhill 16 highlights its attractive entry point compared to other regions, positioning it as a smart investment choice. With the narrowing price gap between different regions and the potential for high returns, investing in freehold properties like Cairnhill 16 in the Core Central Region could be a wise move. Jayson also offers personalized advice, data-driven insights, and strategic real estate solutions tailored to individual needs, guiding investors through their property journey effectively.

What two factors should clients consider when seeking a property to purchase, in order to decide if it is a worthwhile investment?

Safe Entry Price & Price Gap

Let’s make use of Cairnhill 16 as a case study to determine these two key factors.

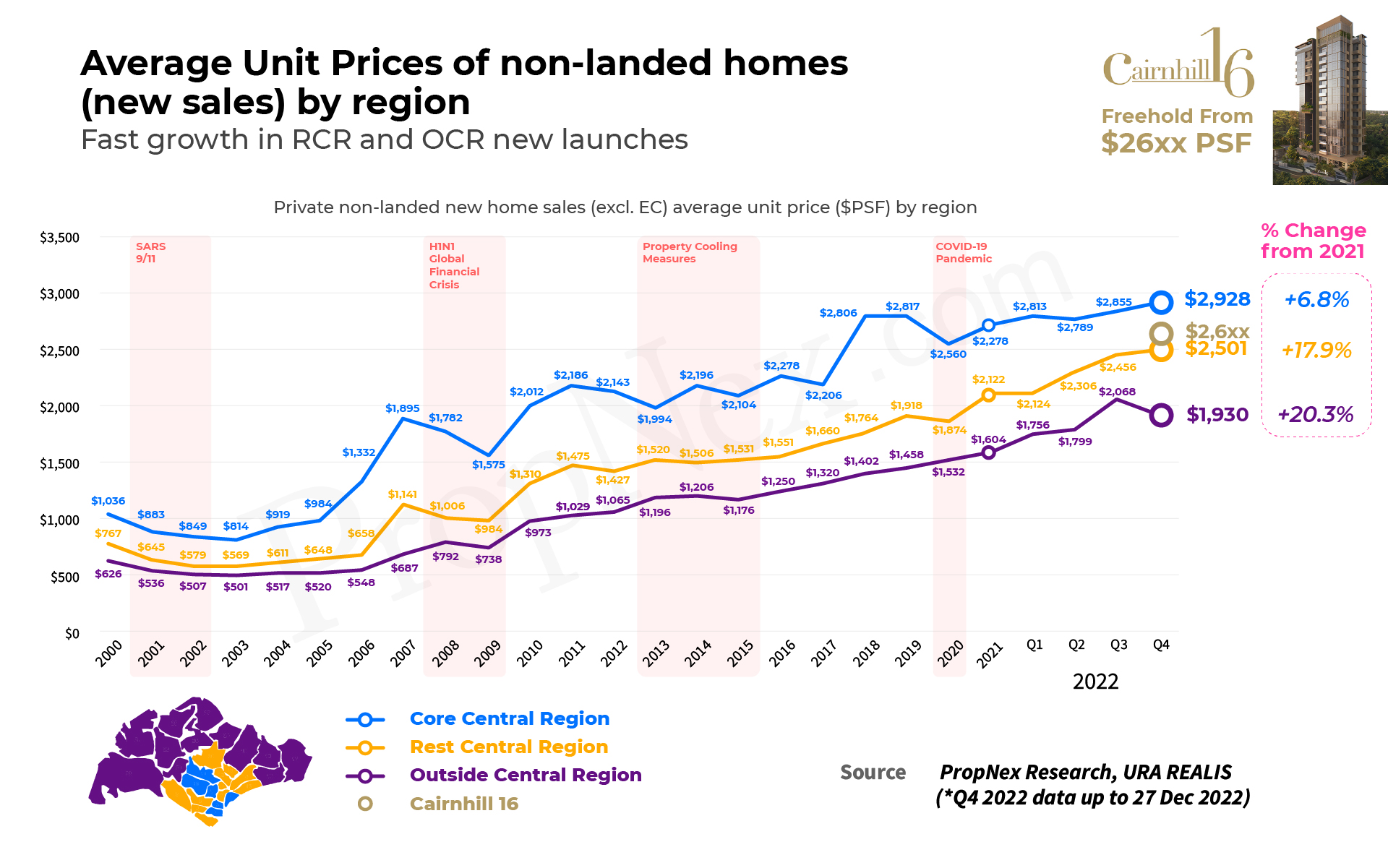

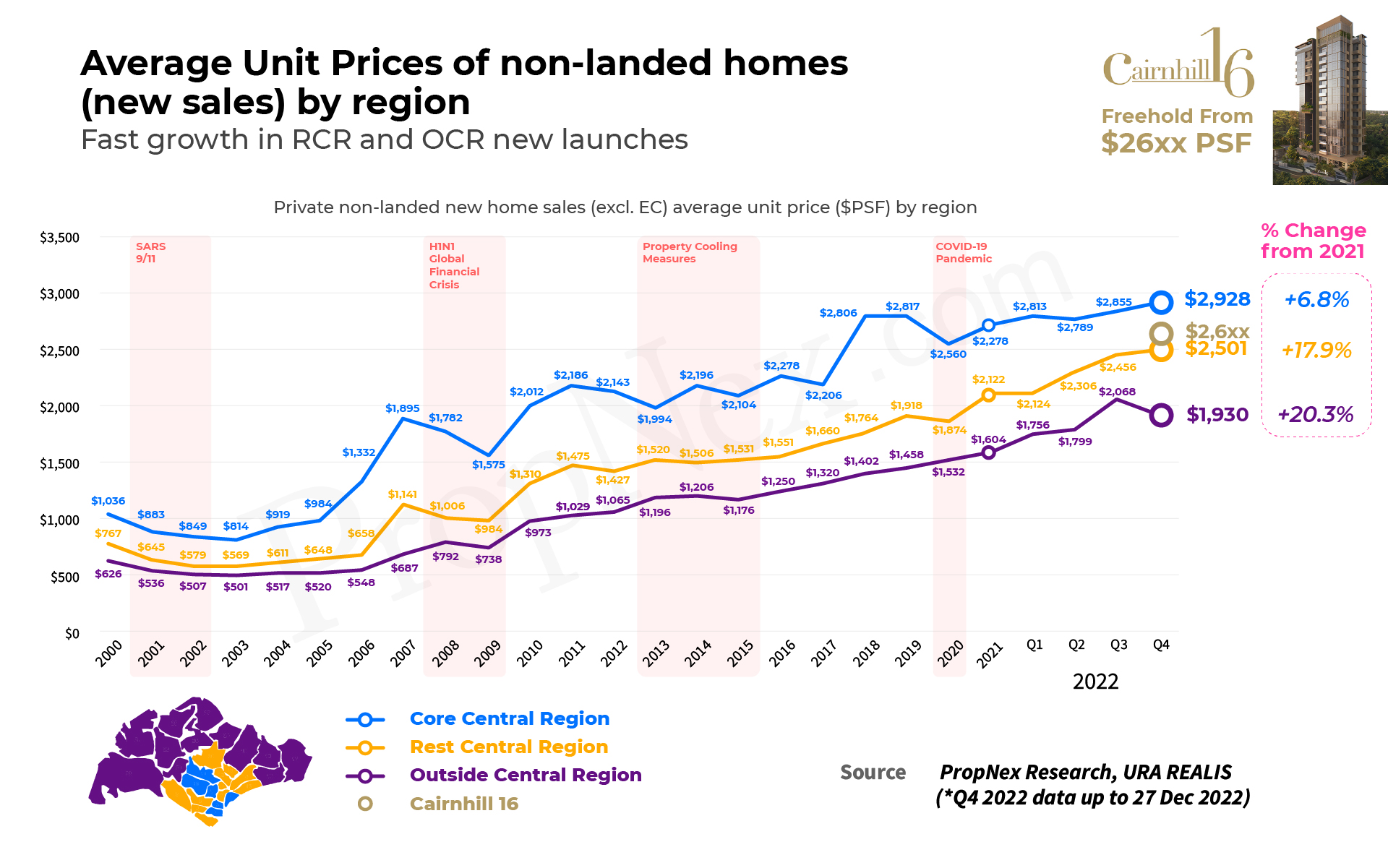

It’s already quite clear that Cairnhill 16, as a freehold property, offers a relatively secure entry point at $2,6XX psf – an attractive proposition compared to 99-year leaseholds in the Outside Central Region (OCR) and Rest of Central Region (RCR), starting from $2,1XX and $2,4XX psf respectively, and with Core Central Region (CCR) properties averaging $2,8XX.

Determining A Safe Entry Price

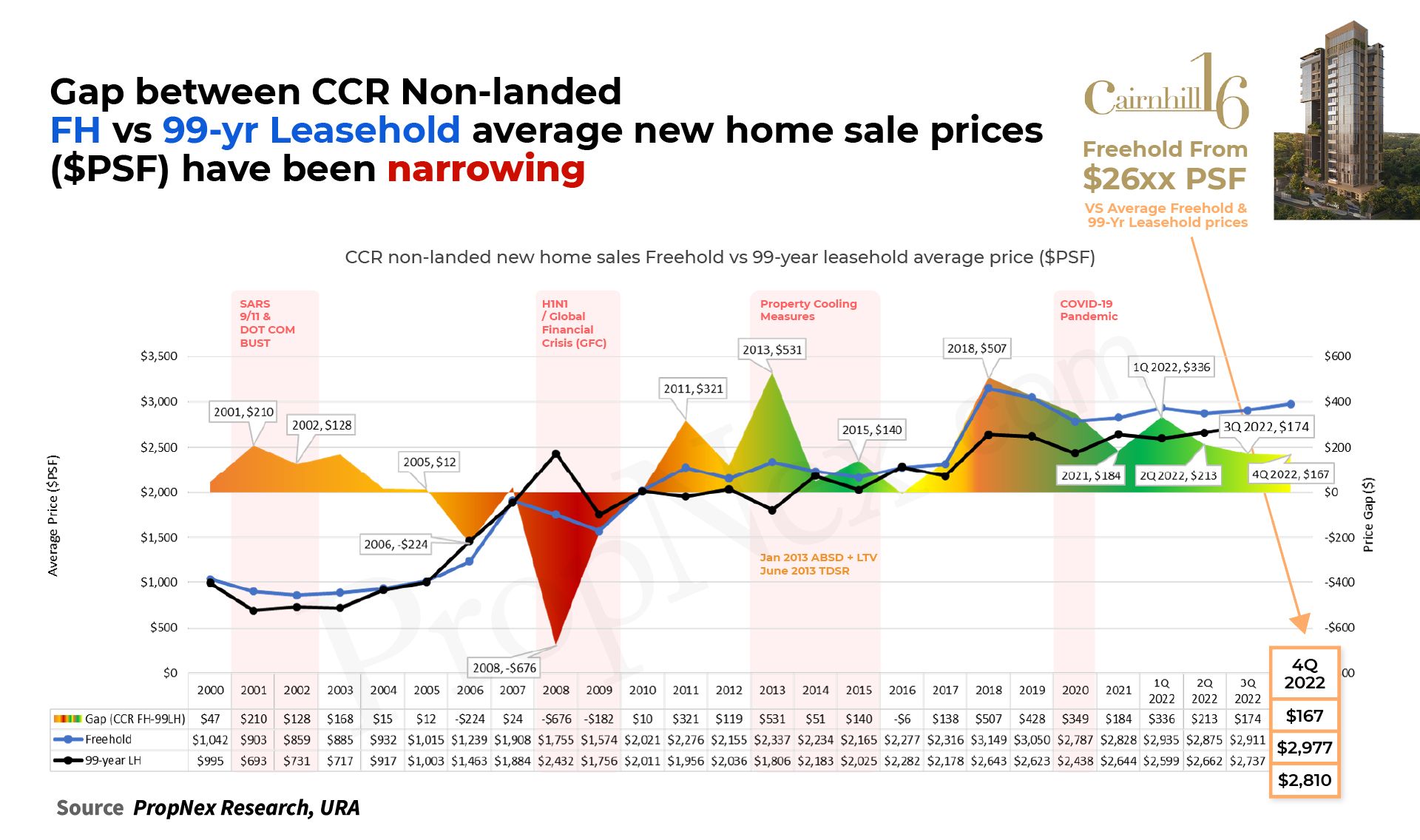

It’s clear from Figure 1 that the entry price for Cairnhill 16 is below the average for new sales in the CCR – the price gap between RCR and CCR properties has narrowed significantly. This makes Cairnhill 16 a smart choice for entry, as the rising prices of homes in the OCR and RCR have shrunk the difference between them.

Price Gap Between RCR & CCR Narrowing

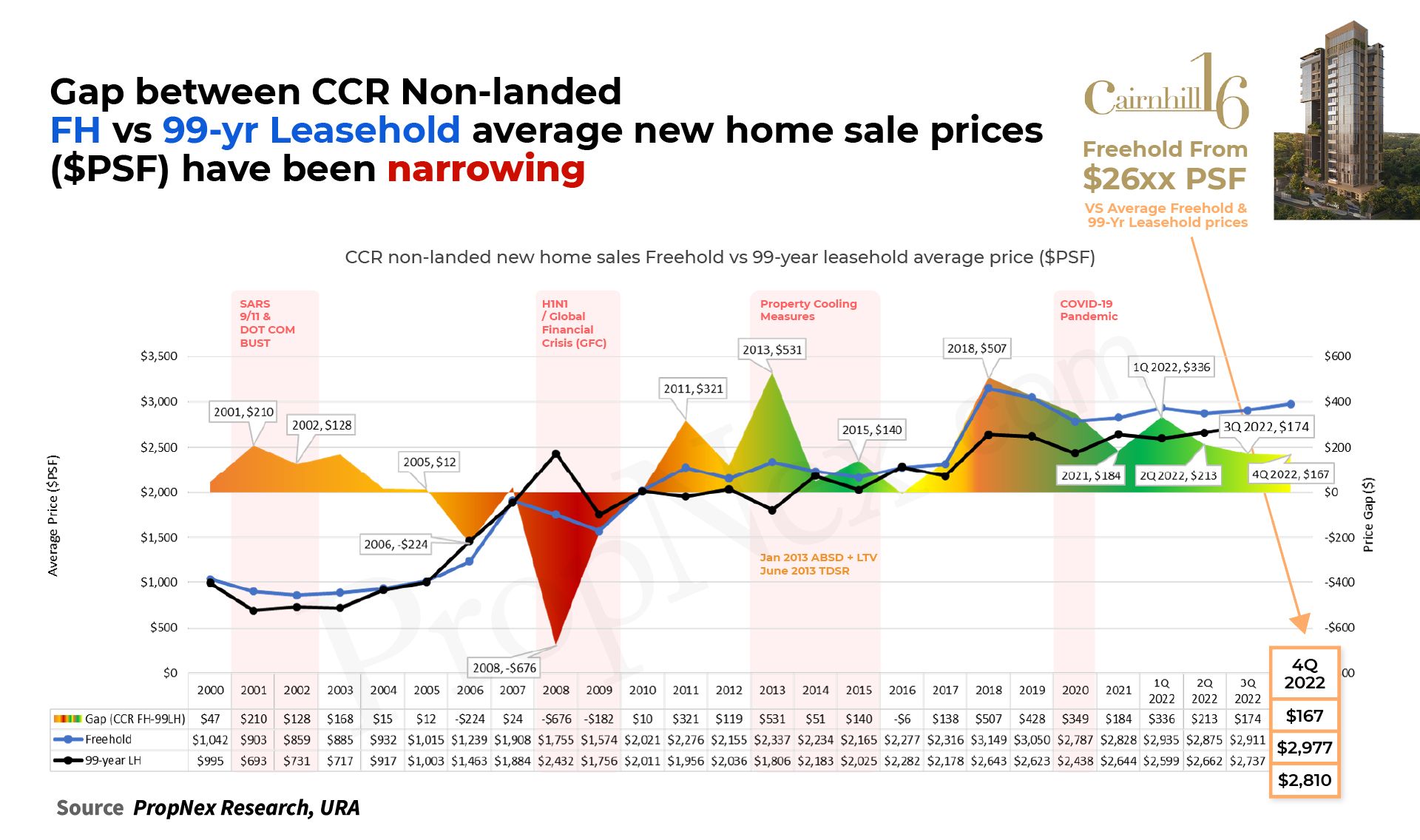

Imagine being able to buy a luxurious freehold CCR project for the same price as the average RCR home!

From Figure 2, we can see that the average price of a new home sale in the RCR and CCR has been narrowing throughout the years. In particular, 4Q 2022 saw the average price of a new home sale in RCR reach $2,659 – approximately the entry price of Cairnhill 16 at $2,6XX psf. What an incredible opportunity!

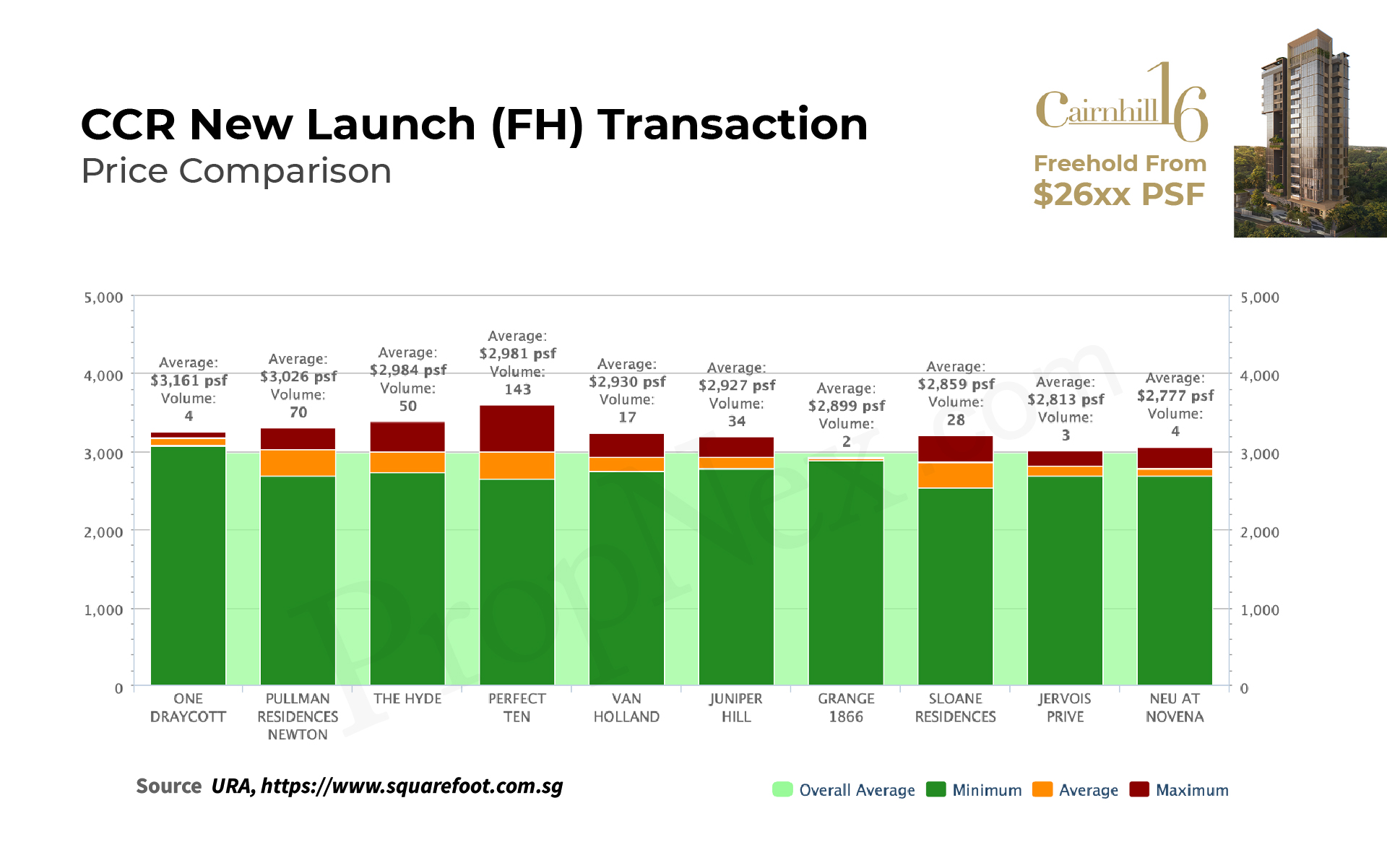

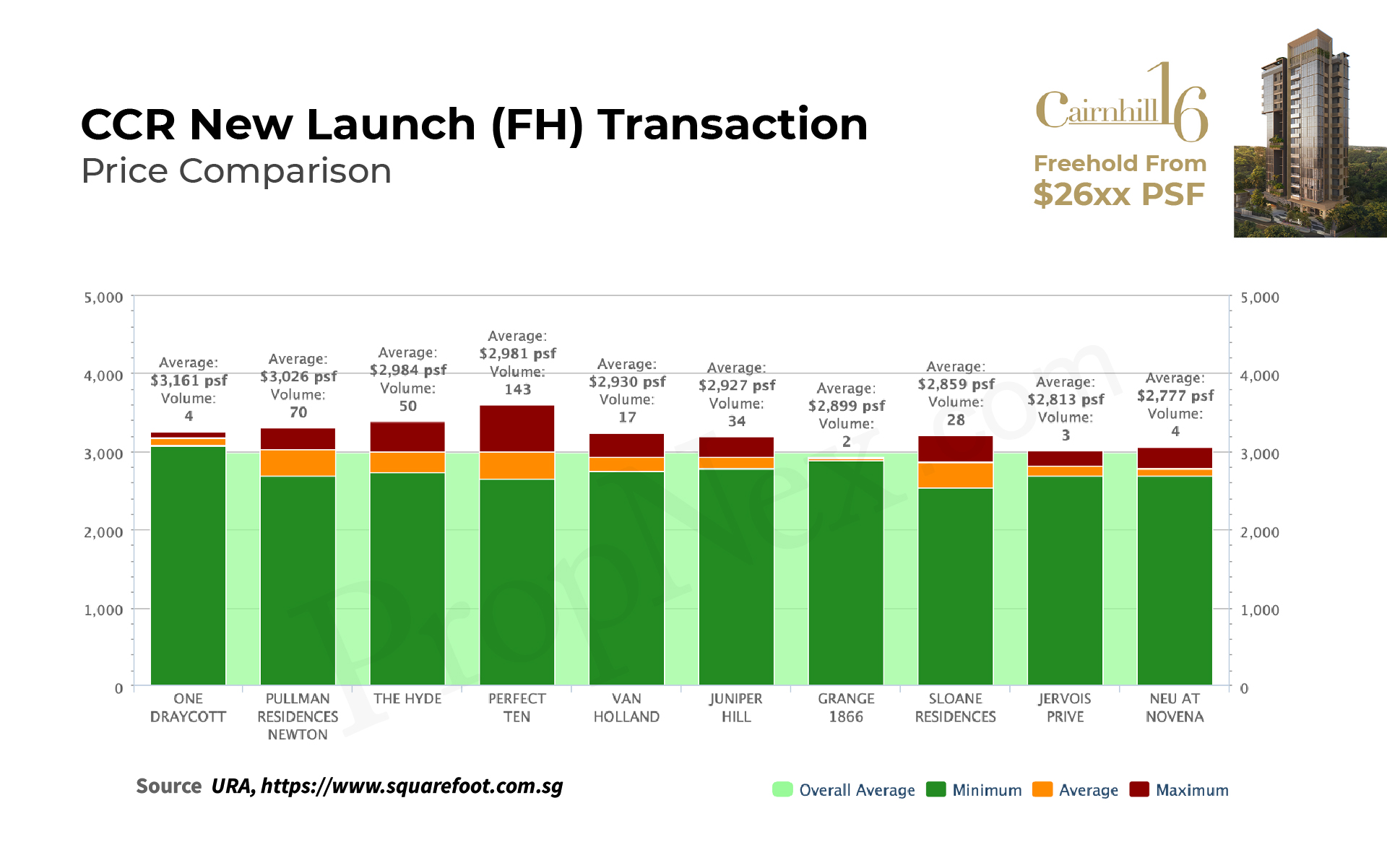

Finally, let us analyze Figure 3, demonstrating the cost of freehold new launches in the CCR; the price range runs from $2,777 to $3,161, doesn’t it make Cairnhill 16 a wise choice for investment?

This year is set to be a exciting time for Core Central Region, with its price offering an attractive alternative investment opportunity to Rest of Central Region.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …

Jayson Ang – May 7, 2024 – Share

Singapore's property scene has always been a powerhouse, effortlessly combining the new with the old. It's a real estate playground...

Read More

Jayson Ang – February 25, 2024 – Share

Singapore's real estate market is a complex and dynamic market that can be difficult to navigate for new investors. With...

Read More

Jayson Ang – April 11, 2024 – Share

TLDR The Singapore housing market is a rollercoaster of unpredictable changes. Three homebuyers share their experiences: Tristan waited too long...

Read More

Jayson Ang – November 1, 2024 – Share

The Singapore real estate market has experienced significant growth in recent years, attracting investors from around the world. As the...

Read More

Jayson Ang – July 9, 2024 – Share

TLDR When it comes to the real estate market, familiarity plays a crucial role in the success of larger condo...

Read More

Jayson Ang – March 18, 2023 – Share

TLDR When deciding between a recently MOP-ed HDB property and an older resale HDB property in Singapore, various factors come...

Read More

Jayson Ang – November 23, 2024 – Share

TLDR While freehold condos might seem like a solid investment, the rise of new developments and aging buildings cast doubt...

Read More

Jayson Ang – April 5, 2025 – Share

Investing in Singapore property can be a lucrative venture, given the country's stable economy, strategic location, and high demand for...

Read More

Jayson Ang – March 13, 2024 – Share

With a highly competitive property market, it's crucial to choose a property developer that you can trust to deliver quality...

Read More

Jayson Ang – December 17, 2022 – Share

Lately, there has been an increase in scams related to real estate. Scammers are pretending to be real estate agents...

Read More

Jayson Ang – December 11, 2024 – Share

TLDR When selling your first home, be aware of CPF accrued interest, which is the interest that would have accumulated...

Read More

Jayson Ang – March 28, 2024 – Share

Property investing is a popular and lucrative option in Singapore due to several reasons. Firstly, Singapore's stable and growing economy...

Read More

Jayson Ang – July 3, 2023 – Share

TLDR The article delves into the intricacies of property asset progression in Singapore's real estate market. It highlights the risks...

Read More

Jayson Ang – May 23, 2024 – Share

TLDR The Residences at W Singapore Sentosa Cove has slashed prices by over 40%, but there are important details to...

Read More

Jayson Ang – May 17, 2023 – Share

The top 5 overlooked features that buyers are looking for in the Singapore real estate market. These are the overlooked...

Read More

Jayson Ang – February 9, 2025 – Share

Singapore's property market has always been a topic of interest for both local and international investors. The city-state's real estate...

Read More

Jayson Ang – August 25, 2023 – Share

TLDR The blog post discusses the impact of the 15-month wait-out period cooling measure on private property owners in Singapore....

Read More

Jayson Ang – October 3, 2024 – Share

Singapore, a vibrant city-state known for its iconic landmarks and bustling urban landscape, is also home to numerous hidden gems...

Read More

Jayson Ang – April 23, 2024 – Share

TLDR The Lease Buyback Scheme (LBS) trend among older Singaporeans is slowly gaining momentum, despite initial reluctance. The scheme allows...

Read More

Jayson Ang – July 4, 2024 – Share

The vibrant property market in Singapore has attracted numerous investors and speculators looking to profit from the nation's thriving conditions....

Read More