TLDR

Despite a 20% Additional Buyer’s Stamp Duty (ABSD) for second properties in Singapore, Yang chose to hold onto his HDB flat and purchase a two-bedroom condo. Yang downsized from his 5-room flat in Tampines to a 4-room in Bedok, driven by practicality after his wife’s passing and his daughter’s growing independence. He picked a unit in One-North, close to NUS and amenities his daughter enjoys, prioritizing her comfort over rental income. Yang opted to pay the ABSD to ensure his daughter’s financial security and provide her with long-term benefits, believing it would instill valuable life skills. His decision reflects concerns about future housing affordability and emphasizes the importance of buying property that brings personal value beyond financial gain.

Despite the staggering 20 percent Additional Buyer’s Stamp Duty (ABSD) for a second property, brave Singapore Citizens like our reader Yang still choose to hold on to their HDB flats. Against all odds, Yang made the bold move of purchasing a two-bedroom condo last April, with no plans of residing in it. But why did he make this unconventional decision, especially when he doesn’t even identify as a property investor? Let’s delve into Yang’s fascinating story.

Moving On From The Previous Home

Once the proud owner of a spacious 5-room home in Tampines, Yang reminisces about the early ’00s when he and his beloved late wife purchased the flat. However, after her passing, the once bustling home became too large for just him and his daughter. In a move to downsize and free up some much-needed space, Yang traded in his lavish flat for a more modest 4-room in Bedok.

With his daughter approaching adulthood and expressing her desire for her own future dwelling, Yang saw no reason to hold onto such a grandiose residence. “It’s simply impractical to maintain such a large space,” he explains.

And so, with the help of a trusted realtor friend, Yang strategically downsized to maximize his financial assets, making his daughter’s dreams of independence a tangible reality.

But don’t be fooled, for Yang sees no sacrifice in his move. “I still live comfortably in this charming East side neighborhood,” he says with a smile. “I have no regrets.”

Deciding On The Right Home

Amidst the hustle and bustle of condo hunting, Yang and his daughter explored various options, but with NUS as their ultimate destination, they settled on a charming two-bedroom unit in the vibrant One-North district, conveniently situated near Kent Ridge. Yang explains, “Not only is it close to Kent Ridge, but also Buona Vista and Holland V, giving her a perfect balance of hangout spots. And she can easily commute to NUS. Plus, with her love for digital art and anime, there are plenty of studios in the vicinity, making it an ideal location for her.”

Initially, Yang was advised to go for a smaller unit, a “mickey-mouse house” (one-bedroom), for its lower price and potential rental income after his daughter moved out. However, he was adamant to provide her with a comfortable long-term home, rather than just a temporary abode. As he puts it, “I don’t want to be a landlord collecting money. This is for her, not for my pocket.”

Prior to settling on One-North, the father-daughter duo explored options as far-flung as Sixteeen35 in Paya Lebar and Trilinq in Clementi. However, these didn’t meet their expectations in terms of price or location and layout. Yang adds, “The biggest challenge was our attachment to the East. We were unfamiliar with the areas near NUS. Thankfully, my army buddy, who lived in the vicinity for seven years, was a great help.

A Strong Urge To Hold Onto The ABSD Funds

As Yang broke the news of his plans to his parents, their initial response was to graciously offer him the option of moving back into his childhood bedroom. Despite the tempting thought of saving a substantial amount of Additional Buyer’s Stamp Duty (ABSD), Yang couldn’t deny the appeal of having his own space. After all, he often stayed over at his parents’ place anyway.

Caught in a dilemma, Yang contemplated reaching out to his real estate agent and requesting a change of plans – perhaps selling his current flat first before searching for a more desirable condominium. However, the moment his eyes met with the perfect home, one that even his daughter approved of, his resolve weakened.

But the thought of moving into his parents’ humble 3-room flat, after years of enjoying his own independence, didn’t exactly excite Yang. He confessed, “It’s the little things that matter. Like being able to eat out whenever I want. But my mother insists on cooking every meal at home, unless it’s a special occasion. I just don’t want to constantly hear her nagging me about eating out.”

For one whole weekend, Yang let the decision simmer in his mind. But as Monday afternoon rolled around, he found himself on the phone with his property agent, ready to take the plunge and make the purchase.

Explaining His Purpose To His Daughter

Yang’s daughter eagerly listened as he revealed the motivations behind gifting her the condo unit that would one day bear her name. “I want you to earn your inheritance,” he explained, “instead of simply being handed a pile of money while you’re still young and unprepared. Plus, this old flat will be worthless by the time I’m gone, just like your grandparents’.”

Yang believed that owning and managing her own property would instill invaluable life skills and independence in his daughter, especially since he was her sole parent and she would be left to fend for herself if anything were to happen to him.

The plan was for Yang to slowly relinquish his responsibilities as her guardian and allow her to take on more responsibilities, such as contributing to monthly maintenance fees and property taxes as she climbed the career ladder.

Through this gradual process, Yang hoped to guide his daughter towards a future of self-sufficiency and success.

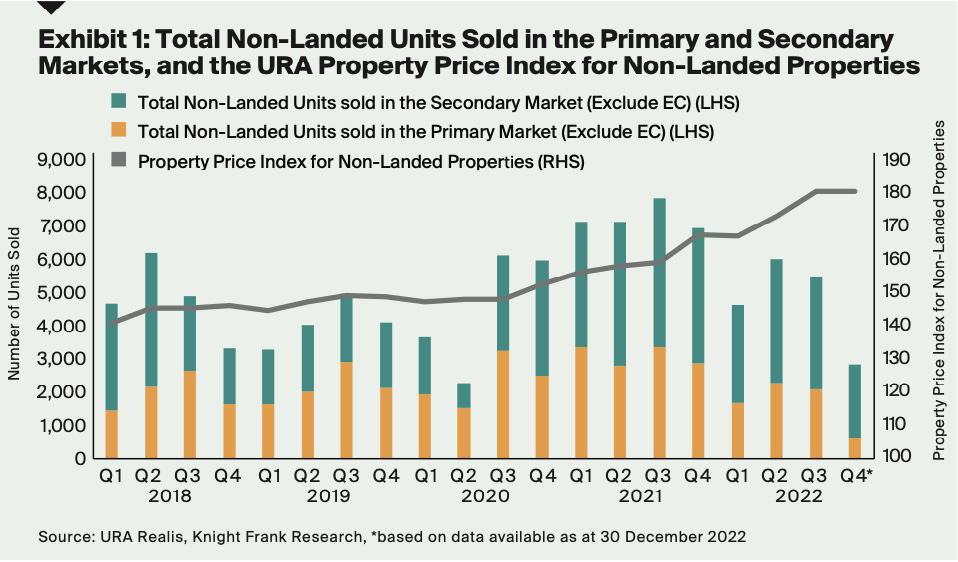

People Are Increasingly Worried About How Affordable Homes Will Be For Future Generations

Yang voices his top concern as he envisions a future where housing prices continue to skyrocket without any hope of a downturn. With current times favoring homeowners, he worries about the ability of future generations to afford their own homes. He ponders on the possibility of his daughter graduating, finding a job, and getting married only to face unattainable housing prices.

It’s a fear that fuels his decision to pay the Additional Buyer’s Stamp Duty, knowing it will bring him a sense of security. As for those eyeing a second property, Yang advises, “Invest in a home that holds more value than just rent money – one that brings joy and serves a purpose, be it for yourself, your children, or your parents. That way, even if it doesn’t prove profitable, it will still enrich your life in other ways.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …