Singapore’s property market offers a plethora of investment opportunities for both local and foreign investors.

To spot a good investment opportunity in this vibrant market, consider the following 5 tips:

1. Location and Infrastructure: The value of a property is significantly influenced by its proximity to major expressways, MRT stations, business hubs, recreational areas, and renowned educational institutions. Properties located near these amenities often command a premium and are in high demand among buyers and renters. Keep an eye on upcoming infrastructure developments that could enhance the desirability of a particular area.

2. Property Type and Condition: Different types of properties, such as residential, commercial, industrial, and land, offer varying potential for profit generation. Assess the state and condition of the property, as older properties may require extensive renovation, while newly upgraded ones may have higher asking prices. Consider the lease duration, as freehold properties tend to maintain their value better over time but come with heftier price tags.

3. Market Trends and Economic Climate: Stay informed about the latest market trends and economic conditions in Singapore. This will help you anticipate property cycle phases and make sound investment decisions. Be aware of government policies, such as cooling measures or incentives like the Global Investor Programme (GIP), which can impact property prices and investment opportunities.

4. Financing and Leverage: Understand how leveraging works and take advantage of the large leverage provided by banks when purchasing a property. A mix of available cash, and bank loans can be utilized to acquire a property without needing a huge chunk of money upfront. Ensure that you have sufficient financial reserves to cover at least six months of expenses in case of unforeseen circumstances.

5. Professional Assistance: Engage a reliable property agent to help you find the ideal property that meets your requirements. Agents are trained to identify suitable properties and can provide valuable insights into the market. However, be mindful of the agent’s commission, which is typically around 1-2% and may be collected from either the buyer or the seller.

By considering these factors and conducting thorough research, you can spot promising investment opportunities in Singapore’s property market and make well-informed decisions to maximize your returns.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …

Jayson Ang – February 17, 2024 – Share

TLDR Luxury freehold properties in Singapore may not always be the lucrative investment opportunities they appear to be. High-end properties...

Read More

Jayson Ang – June 12, 2023 – Share

TLDR When upgrading your property, consider factors like rental rates, Buyer's Stamp Duty adjustments, higher interest rates for bank loans,...

Read More

Jayson Ang – July 2, 2023 – Share

5 Hidden Expenses to Watch Out for When Buying a Home in Singapore Buying a property in Singapore can be...

Read More

Jayson Ang – March 3, 2024 – Share

TLDR Integrated developments in Singapore offer a one-stop solution for residents by combining residential, commercial, and transport elements in one...

Read More

Jayson Ang – August 27, 2024 – Share

Singapore, a melting pot of cultures and traditions, is not only known for its breathtaking cityscape, delectable food, and shopping...

Read More

Jayson Ang – August 7, 2024 – Share

Singapore, a thriving hub of business and commerce in Southeast Asia, boasts a highly developed economy and a robust real...

Read More

Jayson Ang – December 17, 2022 – Share

Lately, there has been an increase in scams related to real estate. Scammers are pretending to be real estate agents...

Read More

Jayson Ang – December 14, 2023 – Share

TLDR The blog post delves into the complexities of real estate investments using Bob's experiences as examples. It highlights the...

Read More

Jayson Ang – June 28, 2024 – Share

Investing in a property with good access to healthcare facilities in Singapore offers numerous benefits for both homeowners and investors....

Read More

Jayson Ang – February 20, 2024 – Share

Singapore is a small island city-state with a population of over 5 million people. Its urban landscape is constantly evolving,...

Read More

Jayson Ang – January 4, 2024 – Share

TLDR This blog post delves into various aspects of the Singapore property market, including topics such as decoupling, 99-1 property...

Read More

Jayson Ang – February 17, 2023 – Share

Navigating the complexities of purchasing a resale HDB flat requires honing negotiation skills and market awareness. Understanding property valuations, seller...

Read More

Jayson Ang – September 26, 2024 – Share

Singapore's property market has long been a magnet for high net worth investors, both local and international. The city-state's strategic...

Read More

Jayson Ang – September 12, 2024 – Share

In the fast-paced and ever-evolving property market of Singapore, making a timely decision to purchase a property can make all...

Read More

Jayson Ang – August 11, 2024 – Share

Investing in Singapore property has long been considered a lucrative and stable way to build wealth. However, like any investment,...

Read More

Jayson Ang – July 27, 2023 – Share

TLDR The blog post discusses the increased demand for HDB resale flats and the impact on prices. It emphasizes the...

Read More

Jayson Ang – March 27, 2023 – Share

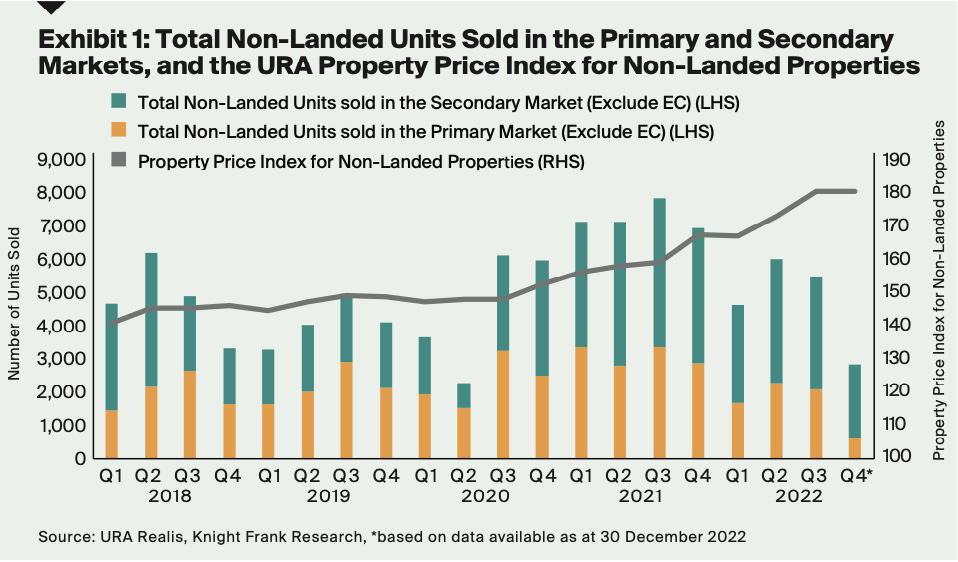

TLDR The Urban Redevelopment Authority (URA) Flash Estimates for Q4 2022 show a 0.1% increase in non-landed private home prices...

Read More

Jayson Ang – June 16, 2024 – Share

TLDR The 2024 Budget introduces changes to property tax bands, aiming to ensure fair taxation based on Annual Value (AV)...

Read More

Jayson Ang – August 25, 2023 – Share

TLDR The blog post discusses the impact of the 15-month wait-out period cooling measure on private property owners in Singapore....

Read More

Jayson Ang – July 20, 2024 – Share

When investing in Singapore property, it is essential to be aware of the various tax implications and considerations. Here are...

Read More