Investing in commercial real estate has become an increasingly popular choice for investors seeking stable long-term returns. There are several reasons why commercial properties can offer a more secure and profitable investment compared to other asset classes.

Here are five key reasons why investing in commercial real estate can lead to stable long-term returns:

1. Cash Flow and Current Income: Commercial real estate investments typically offer regular income that can be higher than the yields on dividend stocks and bonds. This stable income can provide protection and diversification against the volatility of financial markets, as commercial real estate historically does not move in sync with stocks and bonds.

2. Tax Benefits: Commercial real estate investments can potentially provide an array of tax benefits to investors. Deductions related to depreciation, interest expense, and other items can potentially shelter or defer taxes on cash distributions, making commercial properties an attractive option for tax-conscious investors.

3. Inflation Hedge: Commercial real estate can serve as a hedge against inflation, as property rents and values tend to rise along with inflation rates. This means that investing in commercial properties can help protect your portfolio from the long-term impact of inflation, ensuring that your investment maintains its purchasing power over time.

4. Leverage: One of the main advantages of investing in commercial real estate is the ability to use leverage to increase your purchasing power. By using debt to finance a portion of the property’s purchase price, investors can achieve higher returns on their equity investment. This increased potential for returns also comes with increased risk, but when managed properly, leverage can be a powerful tool for boosting long-term returns in commercial real estate.

5. Diversification: Investing in commercial real estate allows investors to diversify their portfolios by adding a different asset class that is not directly correlated with stocks and bonds. This diversification can help reduce overall portfolio risk and improve long-term returns, as different asset classes tend to perform differently under various market conditions.

Investing in commercial real estate can offer stable long-term returns due to its potential for regular income, tax benefits, inflation hedging, leverage, and diversification. By carefully selecting and managing commercial properties, investors can enjoy the benefits of this asset class while mitigating the associated risks, making it an attractive option for those seeking stable long-term returns.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …

Jayson Ang – May 24, 2024 – Share

Singapore, known for its modern architecture and vibrant culture, has a thriving art scene that showcases the best of contemporary...

Read More

Jayson Ang – August 15, 2023 – Share

TLDR When it comes to navigating the Additional Buyers Stamp Duty (ABSD) in Singapore, there are legal strategies available to...

Read More

Jayson Ang – August 1, 2024 – Share

Investing in a property with a good view in Singapore can be a profitable move for several reasons. Here are...

Read More

Jayson Ang – December 19, 2024 – Share

Singapore has long been a preferred destination for foreign real estate investors, particularly in the luxury condo market. The city-state's...

Read More

Jayson Ang – October 9, 2025 – Share

TLDR Freehold properties in Singapore offer indefinite ownership but come with a 15–25% premium over 99-year leasehold units. Despite common...

Read More

Jayson Ang – April 1, 2024 – Share

Investing in Singapore property can be a lucrative venture for investors, but it's important to avoid common mistakes that can...

Read More

Jayson Ang – June 4, 2023 – Share

The Top 5 Myths About Buying Property in Singapore – Debunked! Here are the top 5 myths about buying property...

Read More

Jayson Ang – August 2, 2025 – Share

TLDR En-bloc sales—where owners collectively sell an entire property for redevelopment—have become a key feature of Singapore’s private property market,...

Read More

Jayson Ang – April 27, 2023 – Share

TLDR The impending rise in ABSD (Additional Buyer's Stamp Duty) is expected to suppress investment demand, allowing local homebuyers to...

Read More

Jayson Ang – June 13, 2025 – Share

TLDR Singapore’s property market is set for significant transformation over the next five years, driven by rapid proptech adoption, growing...

Read More

Jayson Ang – September 28, 2025 – Share

TLDR Singapore’s housing debate is fueled by headlines about million-dollar flats, but most resale 4-room flats in over 10 estates...

Read More

Jayson Ang – November 21, 2025 – Share

TLDR While some agents may discourage resale condos due to personal incentives, the difference in profits between resale and new...

Read More

Jayson Ang – May 4, 2024 – Share

Real estate investing has always been a popular way to grow wealth and secure financial stability. In Singapore, the love...

Read More

Jayson Ang – February 3, 2025 – Share

Investing in properties has long been considered a reliable and profitable venture, and Singapore, with its robust real estate market,...

Read More

Jayson Ang – May 28, 2024 – Share

Durian, often referred to as the "King of Fruits," is a unique and polarizing delicacy in Southeast Asia. With its...

Read More

Jayson Ang – April 16, 2023 – Share

TLDR Setting up utilities in Singapore for a new home is hassle-free. Contact SP Services for electricity and water accounts,...

Read More

Jayson Ang – August 22, 2025 – Share

TLDR The 2025 Singapore property market faces distinct challenges, including a shift toward Core Central Region (CCR) new launches, limited...

Read More

Jayson Ang – March 27, 2023 – Share

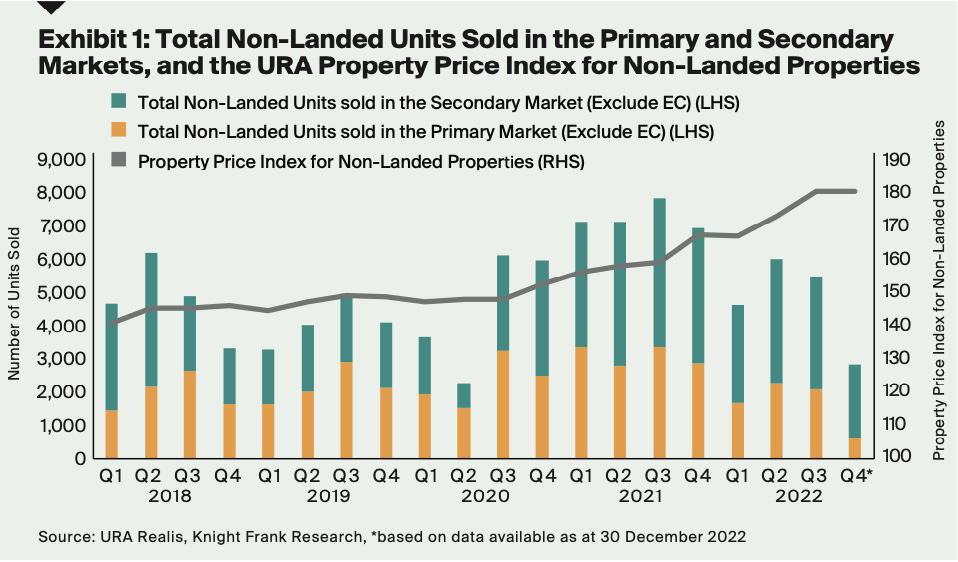

TLDR The Urban Redevelopment Authority (URA) Flash Estimates for Q4 2022 show a 0.1% increase in non-landed private home prices...

Read More

Jayson Ang – October 15, 2024 – Share

TLDR Despite a 20% Additional Buyer’s Stamp Duty (ABSD) for second properties in Singapore, Yang chose to hold onto his...

Read More

Jayson Ang – February 5, 2023 – Share

TLDR When buying a resale flat in Singapore, make sure to walk around the neighborhood to assess actual distances, check...

Read More