TLDR

When deciding whether to repay your HDB flat loan early, consider the limitations of not being able to obtain a home equity loan and the decreased cash reserve. Repaying early may limit lifestyle flexibility and yield subpar returns compared to potential investments. However, it can provide peace of mind, a guaranteed return, and potential CPF benefits. Ultimately, weigh your unique situation and goals before making a decision.

You might find yourself shifting your liquid assets into CPF savings.

In Singapore, the majority of residents – roughly around 80% – live in HDB flats. These folks aren’t just tenants; about 90% of them own these properties. Even though HDB flats are generally more affordable than private properties, their price tags can still be hefty. Furthermore, since the onset of the pandemic, housing prices, including those of HDB flats, have been steadily climbing.

Consequently, securing a long-term home loan, often maxing out at 80% for an HDB concessionary loan or 75% for a bank loan, has become a common strategy for those aspiring to own a home in this city-state.

Additionally, we believe there’s a financial advantage in holding off on repaying our home loan – whether it’s an HDB home loan or a bank loan – for HDB flats, even when we’re fully capable of doing so.

#1 It Is Not Possible To Obtain A Home Equity Loan For Your HDB Flat

The biggest point to consider is that no matter if we go with an HDB home loan or a bank loan, it’s out of the question to get a home equity loan on our HDB flat.

This implies any cash we funnel into early repayments for our HDB flat is locked in – we can’t retrieve it, even if we’re in a bind and need it badly for something. The only loophole to regain access to these funds is by selling off the property.

This limitation may corner us into a financial tight spot.

#2 Your Available Cash Reserve Has Decreased

Not having the option to take up a home loan for our HDB flat could put us in a tight spot if we ever face financial hurdles. We won’t have this reserve to help with our monthly mortgage or daily living costs.

This is a different ball game when you compare it to owning private property. There, getting a home equity loan is on the table. And so is channeling our cash into the stock market or putting it into T-bills or fixed deposits – these options offer the flexibility to cash out anytime.

Yet, settling your HDB flat dues early might still trump pumping money into our CPF. That’s because we can always sell our home as a final measure to free up some much-needed cash. But remember, the cash you’ll walk away with might not be as much as you thought, depending on what we need to pay back into our CPF Ordinary Account.

Letting go of a financial safety net for our housing and living needs could be a dicey move, especially if we haven’t set up any backup plans. This risk could intensify if we bought our house under the assumption that both we and our partner would keep working throughout the loan period to meet our monthly mortgage payments or if we’ve overstretched our finances to buy the house from the get-go.

#3 Losing The Flexibility Of Your Cashflow Can Limit Your Ability To Adapt Your Lifestyle

We can’t go back on our choice to settle the mortgage of our HDB flat, which might tie up some of our cash and limit how we want to live our lives.

Professionally, we may have dreams of forging our own path and launching a business we’ve always envisioned. With the right connections and enough know-how, this could be a super rewarding and satisfying journey. But sinking all our money into our homes might leave us without the necessary cash cushion to start our venture, or to initially take a pay cut or even recoup if the business doesn’t pan out.

On a personal note, we may also let go of the liberty of either ourselves or our partner taking a break from work for any reason – like a gap year, becoming a full-time parent for our newborn, caring for a family member in distress, or opting for a less lucrative but more fulfilling job.

Without enough cash in hand to strengthen our financial position, we may be restricting the lifestyle choices we wish to make.

#4 Your Repayments Yield Subpar Returns, Relatively Speaking

Even though the current interest rate climate is a bit steep, we’re still looking at a 2.6% per annum interest for an HDB loan. Opting for a bank home loan, however, might see us shelling out anywhere from 3% to 3.5% each year, at least for now.

If we get ahead by making some early repayments, we could be stashing away yearly interest payments ranging from 2.6% (HDB loan) to maybe even 3.5% (bank loan). It’s not exactly a stretch to think that we could put those savings to work elsewhere for a better return. Starting off, just popping this amount into our CPF Special Account would net us an annual return of 4.0%. Or, if we’re feeling a bit bolder, we could put our money into blue chip companies or country indexes like Singapore’s STI ETF or the S&P500 ETF. These could give us a handsome return, almost touching 6%, over the long haul.

Now, with the economy being a bit rocky, we might want to keep our distance from the markets. That doesn’t mean we can’t play it safe and invest in things like government T-bills, which are dishing out a nice 3.74% (as of the most recent issue on 12th December 2023).

Another plus side of investing, rather than settling our home loan early, is that we have the option to cash in our investments to cover our home costs if we ever hit a cash crunch. Not to mention, selling off investments is usually smoother and doesn’t mean we’d have to risk losing our home when we need big bucks for stuff like university fees for our kids.

#5 We Face The Possibility Of Needing To Reimburse Funds From our Central Provident Fund (CPF) Ordinary Account (OA)

Remember, parting ways with our home means settling the dues we owe to our CPF Ordinary Account. This includes firstly, any amount used for the initial downpayment or other charges; secondly, all those monthly mortgage payments made via the CPF OA; thirdly, any housing grants received from the government upon buying the house; and lastly, the accumulated interest on the above three.

Now, here’s the tricky bit. The CPF OA refund is always the first cab off the rank, even before any cash-in-hand. So, if it turns out that we sell our HDB at a not-so-great price, we might find ourselves with a lot less cash in our pockets than we thought we would.

In this case, while we might still have enough dough to buy a new place, what we’ve basically done is swapped our hard-earned cash savings for CPF savings.

And there’s one more thing to bear in mind. If we’re past the big 5-5 when we sell our HDB flat, there are pretty tight rules about using the money that’s gone into our CPF to buy another property. We’ll need to keep aside either the Full Retirement Sum (FRS) or at the very least, the Basic Retirement Sum (BRS) in our Retirement Account.

#6 Unable To Refinance Or Reprice Bank Loan

Applying this info is key when we’re dealing with a bank loan instead of an HDB home loan. We can’t exactly pull cash out of our HDB flat, but what we can do is either refinance or reprice our bank loan to snag a better rate.

When it comes to bank loans, it’s smart to consider refinancing or repricing our home loan every three years or so. This way, we can make the most of the lowest interest rates on offer. Just remember, most banks won’t let us reprice or refinance unless we have a minimum outstanding home loan amount of $100,000.

By paying off our outstanding HDB flat amount, we can hit that $100,000 target quicker. But then, we might end up stuck with a less-than-ideal bank home loan rate until we’ve cleared the whole home loan. If we’re talking private properties, there’s another option. We can also take out a home equity loan if the outstanding home loan dips below $100,000.

You May Have Valid Reasons To Repay Your Home Loan On Your HDB

Every choice we face has its upsides and downsides. Even though the points mentioned earlier hold water, we’re aware that everyone’s situation is unique. Some folks might have solid reasons to pay off their HDB flat loans early. Heck, we’ve even whipped up an article on why it’s cool to settle your home loan ASAP.

A few reasons? How about less worry about meeting loan payments for a quarter of a century? Less stress means more mental bandwidth for other smart choices.

Instead of trying to score a better interest by investing our hard-earned money, paying down the loan on our HDB flats gives us a surefire return of about 2.6% or roughly 3.5% on our HDB or bank loan respectively. Sure, it might be level or slightly less than current sure-shot investments, but that hasn’t always been the case.

With interest rates on the rise, paying off our home loans can double these rewards. Given the unpredictable nature of financial markets, it might actually be smarter (at least in the short run) to pay off our home loan rather than gamble it in the stock market.

Embracing a plan of steadily chipping away at your home loan annually can lead to an increase in your CPF OA balances and potentially save you a significant amount on accrued interest as time goes by.

Ultimately, the decision to make early repayments or not is entirely up to you. It’s crucial to evaluate your unique situation to determine if this approach aligns with your goals.

If you’re considering the possibility of obtaining a bank loan or contemplating refinancing, feel free to contact me for a quote without any obligations.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …

How Can Decoupling Help You in Buying a Second Property?

Unlock the Potential of Your Home: 5 Reasons to Start Selling Now

Top 5 Considerations : Uncover the Secrets of Buying Older Properties – What They Won’t Tell You!

5 Must-Know Questions Before Investing in Real Estate

7 Essential Considerations to Keep in Mind When Assessing a Floor Plan for a New Condominium Development

How Can You Prepare for Retirement in an Expensive Real Estate Market? Discover Your Options Now!

Uncover the Secrets of Buying Older Properties – What They Won’t Tell You!

Discover the Best Breakfast in Singapore: Top 5 Must-Try Spots!

5 Techniques for Identifying Undervalued Properties in Singapore 2023

Don’t Miss Out: Take Control of Your Life in Your 30s and 40s

Discovering the Response of Private Property Owners towards the 15-Month Wait-Out Phase

Singapore Living: 5 Must-Know Factors for Choosing the Perfect Neighborhood

Should You Keep Your Resale HDB Flat When Buying a Private Property? 5 Key Factors to Consider

5 Tips To Spot Winning Investment Properties In Singapore

The Significance of Choosing the Right Condo: A Real-Life Tale of Two $1.8 Million Investments with Significantly Different Results.

3 Things You Need to Know if You Are Buying a Second Property

Top 5 Places to Learn About Singapore’s History

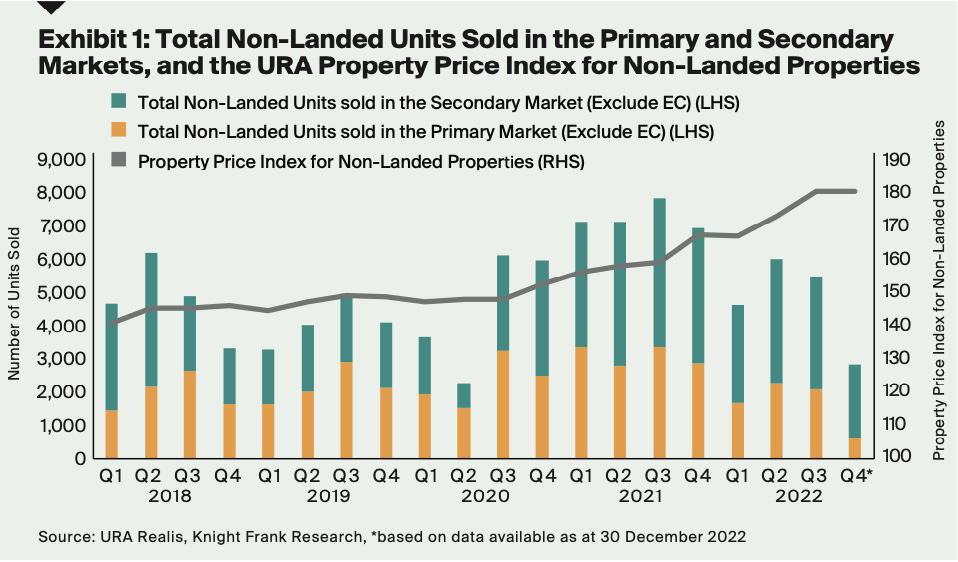

Transaction Volumes Remained Subdued Due To The Dearth Of Inventory In Q4 2022

Top 5 Reasons : Why Developers Seem Hesitant To Commit To New Projects In Singapore