TLDR

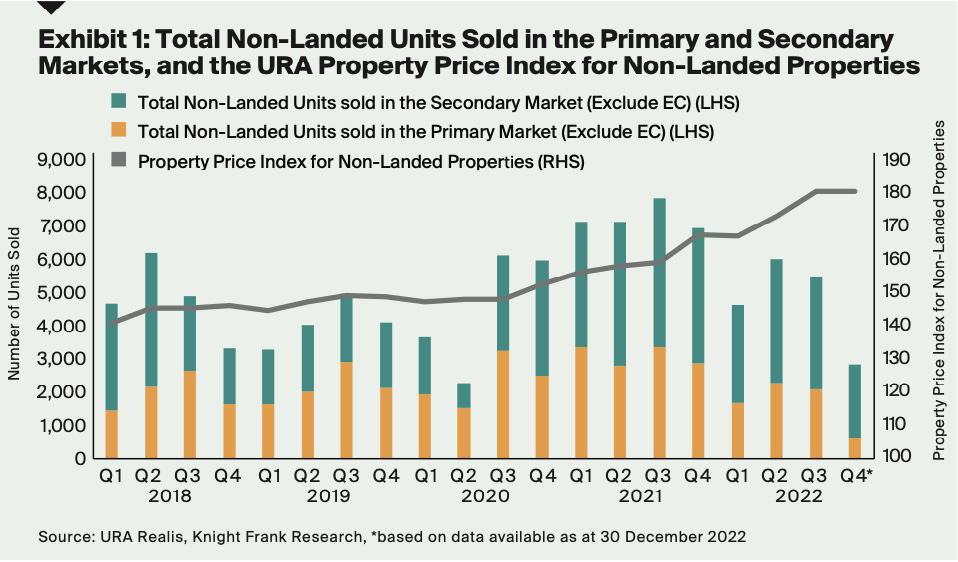

The Singapore property market is experiencing shifts with Morgan Stanley adjusting its outlook on major developers. A forecast predicts a 3% drop in housing prices in 2024 due to various factors. Massive developments completed in 2023 have impacted property prices, averaging between $2,100 to $2,300 per square foot. Challenges include HDB owners hesitating to upgrade and the high cost of new properties. The market sees the return of Deferred Payment Schemes and a decline in foreign investment due to taxes. With an increase in HDB completions and developers’ cautious bids, the supply crunch is easing. The impact of escalating interest rates and previous cooling measures remains uncertain. Government interventions aim to stabilize prices, but the market response is unpredictable. Real estate agents are adapting to market changes, emphasizing strategic advice and effective property presentation strategies for buyers and sellers.

Singapore’s property scene is getting quite some attention from market watchers and estate dealers.

Here’s a curveball: Morgan Stanley has adjusted its stance on two major developers, switching from a positive to a negative outlook.

But what’s really intriguing is their forecast of a 3% drop in housing prices in 2024 due to factors like empty houses and sales performance.

Just think about it:

This year, we’ve seen the completion of big projects like Normanton Park with 1,862 units, Treasure at Tampines with 2,203 units, and Parc Clematis with 1,468 units. All these massive developments wrapped up in the same year!

Prices for new properties average between $2,100 to $2,300 psf, and agents are having a hard time as HDB owners are hesitant to upgrade. Even if you sell your 5-room flat for $700,000, what type of property can you realistically upgrade to? The average cost of a new launch three-bedroom unit is now topping $2.1 million!

We’re also seeing more Deferred Payment Schemes (DPS) making a comeback. This usually signals that developers are struggling to sell off their remaining units and are trying to make their payment options more tempting.

A whopping 60% Additional Buyer’s Stamp Duty (ABSD) for foreign buyers and decreased taxes in competing markets like Hong Kong could lead to a decrease in foreign investment, especially in high-end condos and luxury homes in central region.

In the HDB market, there’s been a surge in completions, with 23,782 finished in 2022 – the highest in half a decade! And even more will be done this year.

Even developers are sensing the shift, becoming more cautious in their bids, despite the last batch of collective sale properties being fully redeveloped since 2017. The recent closing of Pine Grove (Parcel B) with a top bid of $1,223 psf ppr that is lower than the $1,318 UOL had paid for Parcel A is indicative.

The supply crunch seems to be easing up, and the new challenge is the combo of escalating interest rates and the sky-high property prices. Plus, it’s too soon to determine the effect of the April 2023 cooling measures, but we should start seeing results next year.

Hopefully, HDB upgraders will once again be able to afford new condos or at least sizable resale ones.

Fingers crossed, folks upgrading their HDBs might soon be able to snag brand new condos, or at the very least, some spacious pre-loved ones. I’ve noticed that real estate agents are rooting for them, scrambling to find properties to offer up for sale.

(Quick heads up, brace yourselves for an influx of pamphlets and phone calls, claiming your humble home could fund a retirement filled with thrice-weekly servings of bird’s nest soup. So, you know, call them to sell, and all that jazz.)

Either way, we can’t overlook the fact that the Government still has plenty of tricks up its sleeve (all those cool-off rules) – especially if there are hints that property prices might tumble more drastically than we thought.

Remember, snapping up a property when prices are low isn’t worth much if you don’t sell it off at the right moment.

I used to believe that the government could lend a hand by slashing land prices, but wiser souls quickly set me straight.

Why doesn’t the government simply reduce Land Betterment Charges, or let the floor price of Government Land Sales plummet? Wouldn’t that make new properties more affordable?

Sounds reasonable, right? But a chat with a real estate agent and a former executive from a development company quickly dispelled my naïve idea.

Imagine if the government did decide to cut land prices, and a lucky few developers manage to grab the land on the cheap.

The going rate for new properties is roughly $2,100 psf. Now, would these developers lower their prices because they scored cheaper land? Or would they stick to selling at $2,100 psf because that’s what the market dictates?

Considering that developers aren’t running charities and have shareholders to satisfy, they’ll probably opt for the latter. Even if the government did unload land for less, the developers would likely keep their prices steady and pocket the extra profit.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …