TLDR

When considering investing in a private property in Singapore, it’s important to understand your borrowing capacity. Financial experts recommend that your monthly mortgage repayment should not exceed 30% of your gross monthly income. To determine the estimated monthly income needed to buy a new condo, factors such as location and type of property must be considered. Median income figures from the Ministry of Manpower can provide insights into affordability. Dual-income couples have higher potential for condo financing. Property market trends and measures implemented affect condo prices, making it essential to make informed decisions regarding property purchases. Consulting with real estate experts can provide valuable guidance on whether to buy, sell, or wait, ensuring a strategic and data-driven approach for your real estate journey.

Are you planning to invest in a private property but uncertain about your affordability? Don’t worry, I am here to assist you in making informed decisions regarding properties and more!

Being cautious while determining your borrowing capacity is crucial while purchasing a property. This will prevent you from making a costly mistake.

Eligibility versus affordability

Eligibility for a home loan should not be confused with the ability to afford a property. To afford a condo in Singapore, financial experts suggest that your monthly mortgage repayment, including principal and interest, should not exceed 30% of your gross monthly income. This is also known as the Mortgage Servicing Ratio (MSR) for HDB flats and new ECs. However, some experts believe that this requirement is too strict. While opinions may vary on what constitutes an ideal mortgage-to-income ratio, it is crucial to prioritize financial sustainability when making significant purchases such as property. This will prevent you from compromising other financial goals or resorting to a diet of instant noodles and bread every day.

How much do you need to earn to buy a condo?

In order to assist those looking for properties in Singapore, we have analyzed data to determine the approximate income required to afford a condominium. The price of the condominium will vary based on factors such as whether it is newly built or its location in the Core Central Region (CCR), which tends to be more expensive. Our estimates are based on the ability to make mortgage repayments and take into account certain assumptions.

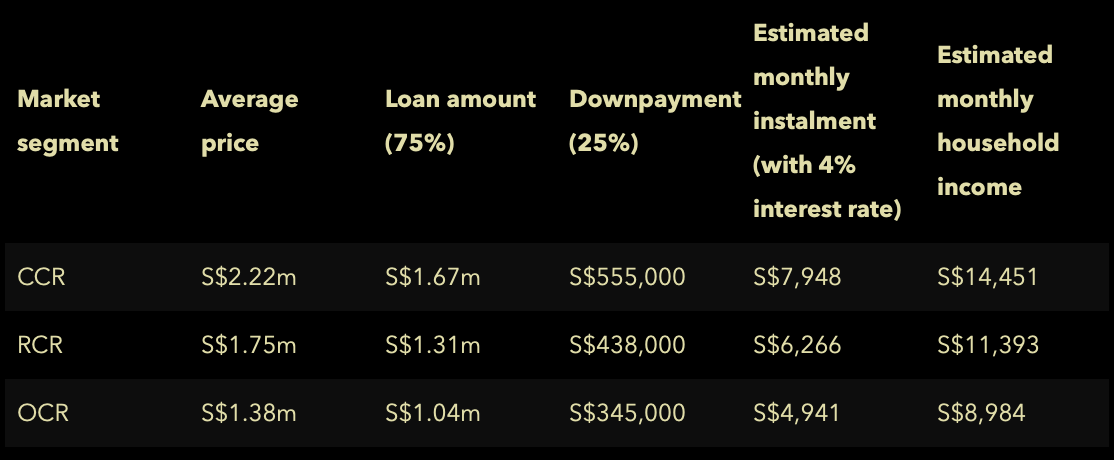

- As a Singaporean citizen, if you do not own any other residential properties in the country, you are exempted from paying a 17% Additional Buyer’s Stamp Duty (ABSD).

- You will be required to make a down payment of 25%, which will allow you to take advantage of the maximum 75% loan-to-value (LTV) limit. The loan tenure will be for a period of 30 years.

- We have implemented a 4% interest rate for the medium-term, in accordance with the guidance provided by the Monetary Authority of Singapore.

- It is confirmed that you have no other outstanding loans to attend to, this includes loans for properties, vehicles, personal purposes, and education.

- The Total Debt Servicing Ratio (TDSR) framework sets a limit to the total amount of loans an individual can service in a month. This limit should not exceed 55% of their gross monthly income. It is important to adhere to this framework to ensure financial stability and avoid overburdening oneself with debt.

The estimated monthly income you need to buy a new condo

*Please be aware that the figures provided are based on average pricing and may not reflect the actual cost. It is advisable to utilize my mortgage calculator, based on the exact price, to determine if it aligns with your financial capacity.

Rest of Central Region (RCR):

Outside Central Region (OCR):

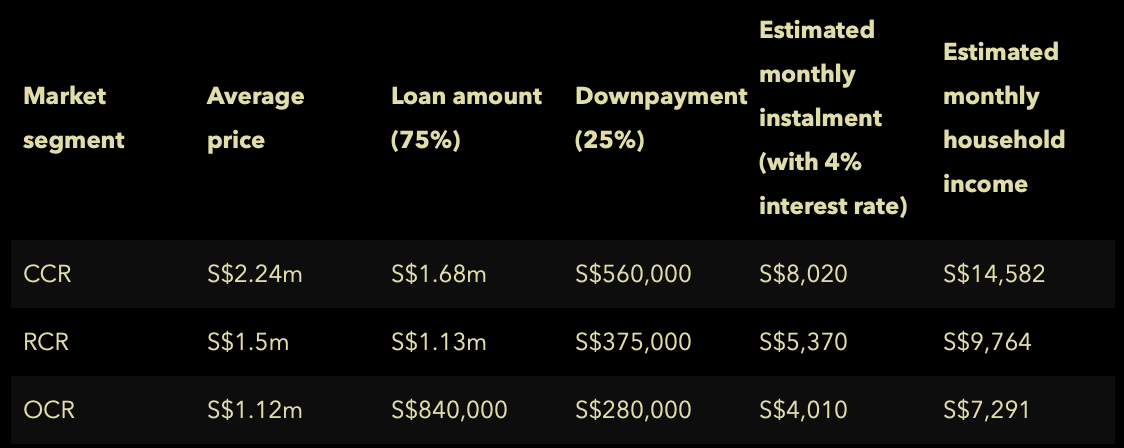

The estimated monthly income you need to buy a resale condo

Despite the implementation of two rounds of measures aimed at reducing the overheating of the property market in December 2021 and September 2022, the prices of condominiums have gone up by 8.1% in 2022. The price increase was highest among RCR condos at 9.7%, followed by OCR condos at 9.3% and CCR condos at 4.8%. To find reasonably priced condos, it may be worthwhile to consider purchasing resale condos.

*Please be aware that the figures provided are based on an average price and may not reflect the actual cost. To accurately determine if the property is affordable for you, we suggest utilizing my mortgage calculator with the actual price in mind.

Median salary in Singapore: Can I afford a condo?

After learning about the cost of new and resale condos in Singapore, you may be wondering if purchasing a condo is feasible for you. To answer this question, we will examine the income figures published by the Ministry of Manpower’s Research and Statistics Department.

As per their data, the median gross monthly income from work, including employer CPF contributions, for full-time employed residents in 2022 is S$5,070, which is an 8.33% increase from the previous year. The median indicates that half of the workers earn less than this amount, while the other half earns more.

If you and your partner are a dual-income couple, you will have double the earning potential to finance a condo purchase. With your combined income, you will be able to afford condos situated in OCR and RCR regions.

After working and saving up for a few years, you and your partner can pay the substantial downpayment and purchase your dream condo.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …