TLDR

Singapore’s property market presents challenges with high prices, particularly in private housing, while public housing remains relatively more affordable. As the retirement age increases, considerations about HDB flats as a retirement asset come into question. Factors such as rental income, CPF savings supplementation through schemes like Lease Buyback, and potential future policy changes by HDB all impact the value of HDB flats for retirement planning. Upgrading to private property or downsizing may offer more promising retirement prospects. The need for a comprehensive plan tailored to individual circumstances and a data-driven approach to real estate decisions is emphasized.

Homeownership, Or Retirement Asset?

An increasing number of people are voicing the opinion that HDB must make a decision between two directives.

- Provide affordable housing

- Provide profitable housing

For resale flats to remain a viable retirement asset, HDB would need to take a number of steps that run counter to what they have done in the past; for instance, they would need to build fewer flats and avoid implementing measures such as the Mortgage Servicing Ratio or the removal of Cash Over Valuation in 2013 – steps which ultimately caused a continuous decline in resale flat prices for almost seven years.

What Might Be Deemed “Valuable” Is Open To Interpretation

Despite my aversion to definitional disputes, they all too often devolve into fruitless semantics. Here, it ultimately boils down to what the government exactly defines as ‘valuable’.

One thing is certain – valuable does not necessarily equate to the ability to be sold for two or three times the initial value of the flat. Likewise, there is no specific dollar amount that makes up an adequate “nest egg”.

Renting out rooms for additional income, taking advantage of the Lease Buyback Scheme to supplement your CPF savings, or even investing in a VERS could all be ways of taking a valuable asset and using it to add a substantial amount to your retirement funds – it’s a great way to ensure a more comfortable retirement!

These opportunities may not guarantee all your retirement goals, but it’s undeniable that flats are a valuable asset. There could have been a balance here – we could have expressed the value of flats without referring to them as a retirement nest egg.

Singaporeans, accustomed to a high standard of living, can find security in real estate investments for their retirement; even after 30 or 40 years have elapsed from the lease, flats can serve as a valuable nest egg and supplement incomes.

This is an empirically observable fact – not an over-promise.

If One Were To Forget The Technicalities, Could HDB Flats Bring About Wealth And Comfort In Retirement?

My honest response: Highly unlikely.

As Singapore’s population ages, the previous generation will eventually move on, leaving a surplus of HDB flats in their wake – remember, only Singapore citizens and certain Permanent Residents can purchase HDB flats and can only own one property.

HDB will most likely modify their policies when the time comes, yet there’s no denying that the value of resale flats may suffer in this eventuality.

It is undeniable that for those who have upgraded to private property and can downsize their retirement prospects are far more promising.

Thus, the query lies not in the value of your flat, but whether it is substantial enough to grant you the retirement that brings you joy.

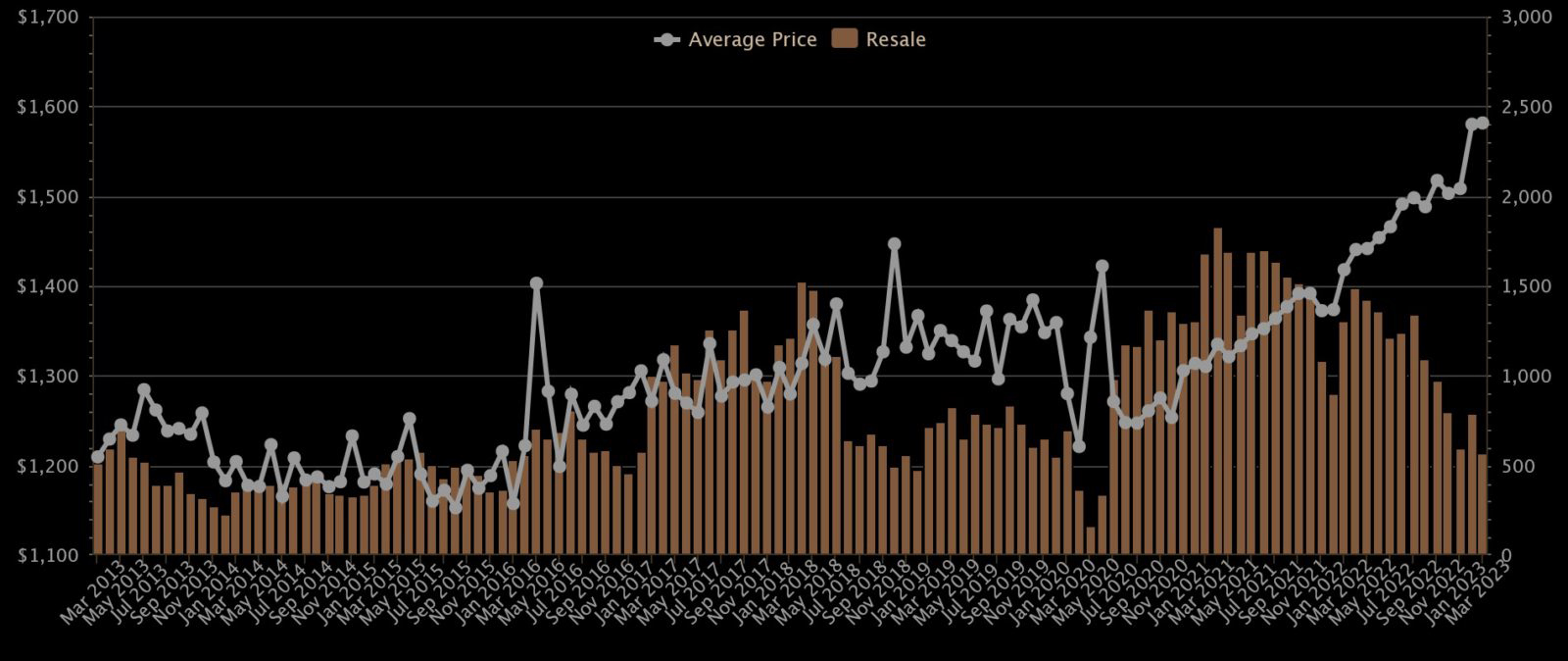

HDB Prices

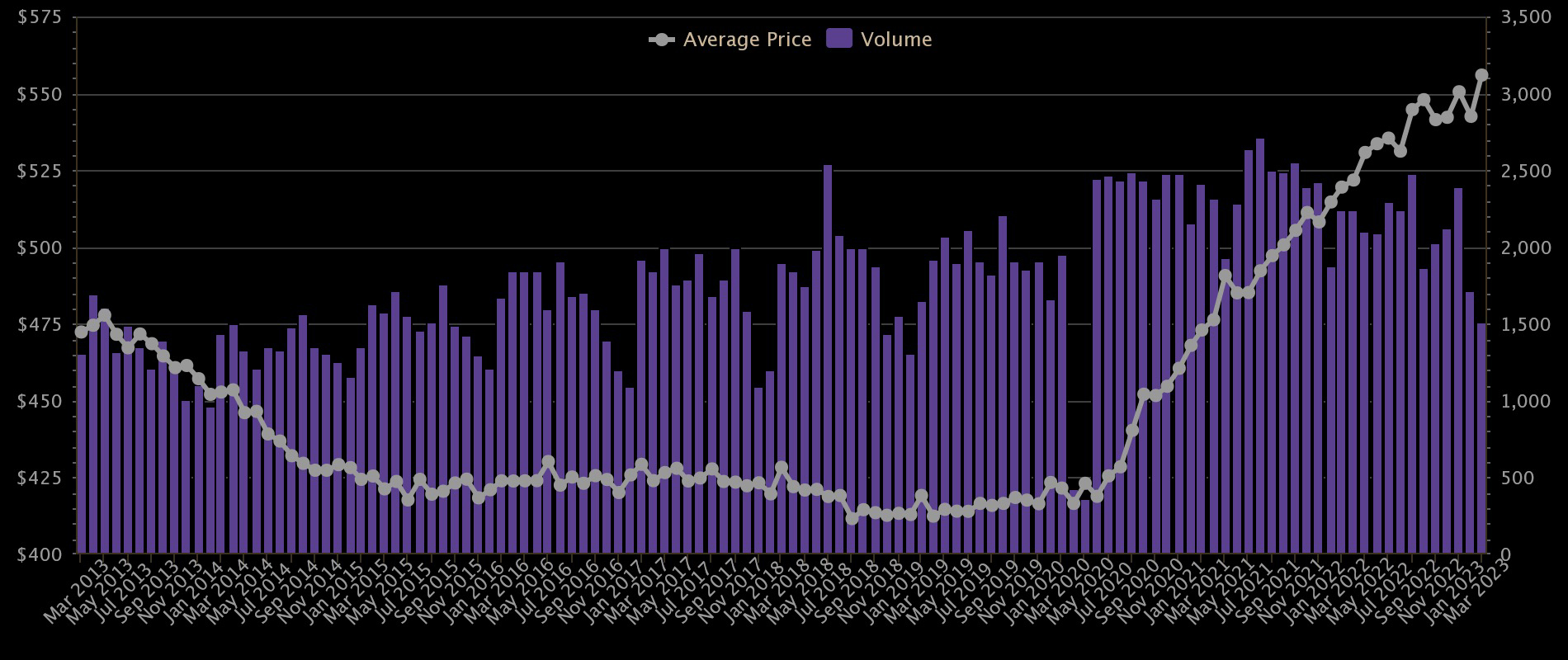

Private Property Prices

No matter the situation, using overly positive words can create tension, especially when it comes to current controversial topics like housing and home prices that are currently higher than ever.

Your flat may be quite valuable, but you still need to think about investing elsewhere or upgrading.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …