TLDR

The article discusses the challenges of investing in a second property for retirement amidst Singapore’s real estate market conditions. Rising property prices and limited rental income may make this traditional strategy less viable. Instead, diversifying investments into income-generating assets like bonds or REITs is recommended. Another option is right-sizing, not downsizing, to release cash from your current property for retirement savings. Considering government cooling measures and market uncertainties, exploring alternative strategies beyond owning a second property may be more prudent for securing a comfortable retirement.

As you may have heard, the retirement age was bumped up to 63 – yet no need to be surprised, as the amended Retirement and Re-employment Act is going to have us working until 65 by the end of the decade.

With the worry of having to slave away for your retirement, you’ve probably pondered over how to ensure your golden years without the exhausting toil of labour.

Investing in property can lighten the burden of those preparing for their retirement. Yet, for many people, “property investment” is simply a means to gain rental income or capital gain. This may have been a suitable strategy for generations past, yet this is becoming increasingly unrealistic in today’s real estate market.

In today’s real estate market, with property prices at an all-time high and prospective tenants in short supply, a second property venture may no longer be the way to go for your retirement plans. So, what are your other options for securing a comfortable retirement?

This article will explore the potential of investing in a second property and what other real estate choices you have to ensure a golden retirement.

Should You Own a Second Property?

For many, our home is often the largest investment of our money. Indeed, the property owned by Singaporean homeowners makes up a substantial 42% of their total assets, and this percentage is anticipated to grow with the ever-changing market.

In recent years, real estate prices have seen a tremendous appreciation, thanks to the high cost of land and the strong demand for properties. It’s no wonder why people are so eager to purchase a home; real estate acts as an effective hedge against inflation, considering land scarcity in Singapore.

When combined with our booming economy, it’s easy to see why property values are constantly on the rise. While this trend can be quite appealing, it can also be quite disheartening for some…

Worrisome Price-to-Income Ratio

No mistake about it: strong economic growth is definitely a good thing; however, it may not be ideal if you’re looking to purchase another property (unless you have the means to do so).

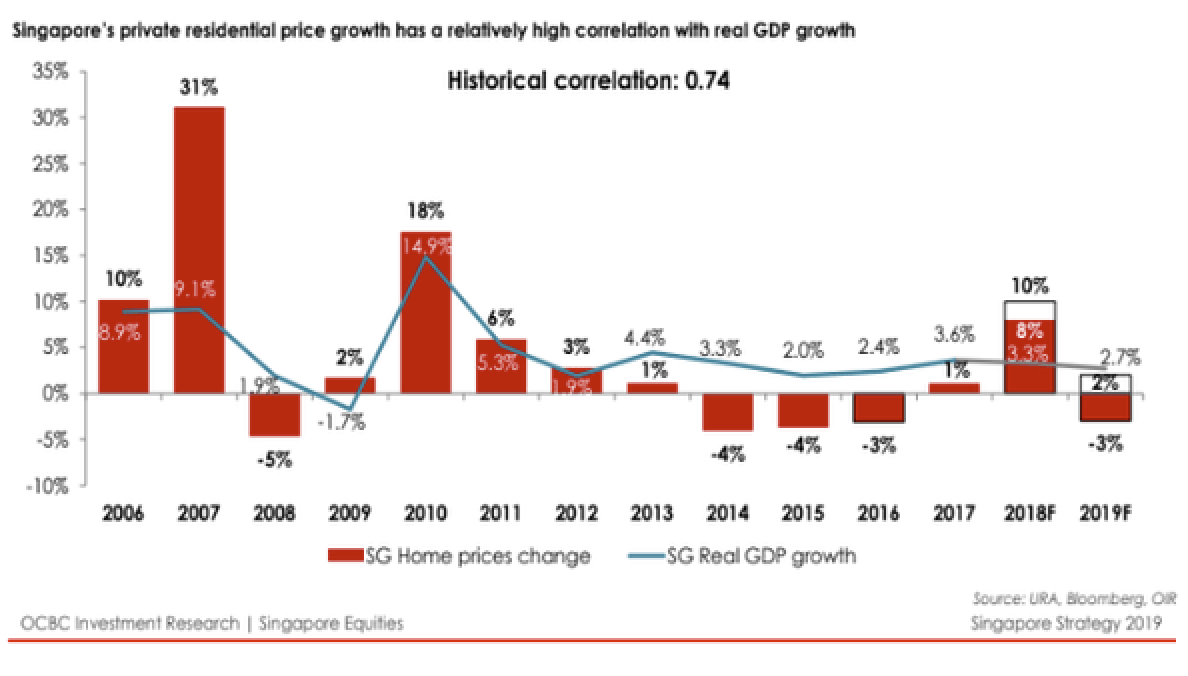

As illustrated in the chart above, there is a direct correlation between GDP and property prices: slower economic growth tends to have a dampening effect on real estate prices, whereas robust economic growth leads to a surge in property prices.

Singapore’s economy has been showing remarkable resilience, even amidst the pandemic, and is expected to further expand in the years ahead. With bolstered demand for new Build-to-Order (BTO) units, and upgraders keen to upgrade, the property market is all but destined to experience a price hike.

The soaring prices of housing have been further exacerbated by an insufficient rise in income. In our last report, we conducted an in-depth analysis of the price-to-income ratio of Singapore’s property market to assess if a housing bubble was imminent. Sadly, we concluded that, without proper government regulation, housing costs will eventually overtake income growth.

The price-to-income ratio gauges the affordability of properties in the long-term, depending on the cost and income. Unfortunately, if the ratio is high, you may need to budget your money carefully in order to buy the home you desire. Unsurprisingly, the price-to-income ratio for non-landed private residences has grown from 14.7 in 2019 to 15.4 in 2020.

Due to the rapidly increasing cost of property, “buy low, sell high” may not be a viable retirement strategy anymore.

What alternatives are there to make sure you have a comfortable retirement?

What are your Options?

Having a second property can certainly up the risk factor when it comes to planning for your retirement funds, as capital appreciation and rental yields become much more unpredictable.

Despite the expectation of rising property prices, the money invested is not readily accessible, making it largely dependent on the government’s decisions.

With the ever-increasing demand and scarce housing supply, the government has been implementing cooling measures to manage the situation.

For example, December saw the imposition of taxes and lowered loan limits, in a bid to bring the property market under control. Nevertheless, should prices continue to climb, the government may need to take a firmer stance and make some tough decisions that could put a dent in your wallet.

Perhaps it would be wise to reconsider the purchase of a second property, given the various restrictions at play, and explore the alternate suggestions we have provided.

Income Generating Assets

Investing your entire nest egg in an increasingly pricey second home could be a bad move – even worse is investing all your money in an asset that relies on long-term capital growth.

It’s unlikely that you’d have enough years in your twilight years to wait for the asset to appreciate, so a wiser choice might be to diversify your investments and put your money into income-generating assets such as bonds or REITs.

These investment strategies provide a more dependable return and give you quick access to your cash in an emergency.

Aside from the added bonus of not having to worry about selling your property in a down market when you really need the cash, investing in income-generating assets can make all the difference in your financial security.

However, it’s still recommended that you consult your financial advisor for professional advice. Ultimately, this article aims to provide an alternative way of attaining financial security without having to rely on a predetermined exit strategy.

Right-sizing

Are you finding that your house is too big for just you and your partner now your children have moved out? It may be time to consider right-sizing, not to be confused with down-sizing.

This means shifting into a space that more closely fits your current needs, such as a smaller home with better facilities. Doing so can help to release cash proceeds from your previous property, converting it into savings for retirement.

HDB flats are typically designed with the elderly in mind – they feature mandatory ramps and railings both in the flats and around the neighbourhood. To help seniors make the move to right-sizing, various government schemes with various terms and conditions exist to finance their perfect home.

When it comes to finding your perfect home, size isn’t the only thing to consider.

Are medical facilities close by? Do you have to ascend several flights of stairs to get to your front door? How much longer is your lease? These often neglected inquiries should be addressed before making a commitment, as relocating in your later years could be quite a nuisance.

Closing Thoughts

Considering the current state of the real estate market, investing in a second property may not be the most cost-effective choice for retirement planning.

Fortunately, there are plenty of other alternatives to the traditional “buy low, sell high” strategy. From alternate forms of property investments to a review of your current home, this article has suggested ways to help you prepare for retirement.

If you’re unsure of the best path to take, I am here to assist – just contact me and we’ll be happy to guide you through your housing options.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …