TLDR

The Singapore property market faces challenges with the ongoing en bloc stalemate. Lower success rates, higher development risks, and elevated seller expectations characterize the current cycle. To break the deadlock, focusing on smaller sites with attractive features is key. Opportunities in the Core Central Region and the East offer potential for developers. Collective sales can benefit both owners and developers, but success requires collaboration and understanding market dynamics. Understanding motives is crucial when deciding to buy or sell in the current market. For personalized advice and effective property marketing, seek professional guidance.

It appears that the market trends established in 2022 will likely remain unchanged.

The Stalemate

In December 2022, The Business Times predicted in an article with the headline “En bloc deadlock to continue in 2023″ that many residential collective sale sites would remain unsold due to a price mismatch between buyers and sellers in 2023. It is likely that the characteristics of the market that dominated 2022 will remain in a more challenging situation – pessimistic changes in sentiment and interest rates.”

By 2021, the unsold stock of private residential homes dwindled to 21,612 units, prompting the commencement of the 2017/2018 en bloc cycle. In comparison, the inventory had already hit a low of 28,557 units at the conclusion of 2016.

2020 saw a significant undersupply of private homes due to the COVID-19 pandemic, with developers being distant to purchase land in the midst of lockdown and recession. Construction delays exacerbated the issue, and there was almost no acquisition of land parcels that year. Nevertheless, demand for housing stayed strong throughout the virus, prompting developers to make up for lost time by participating in government land sales tenders.

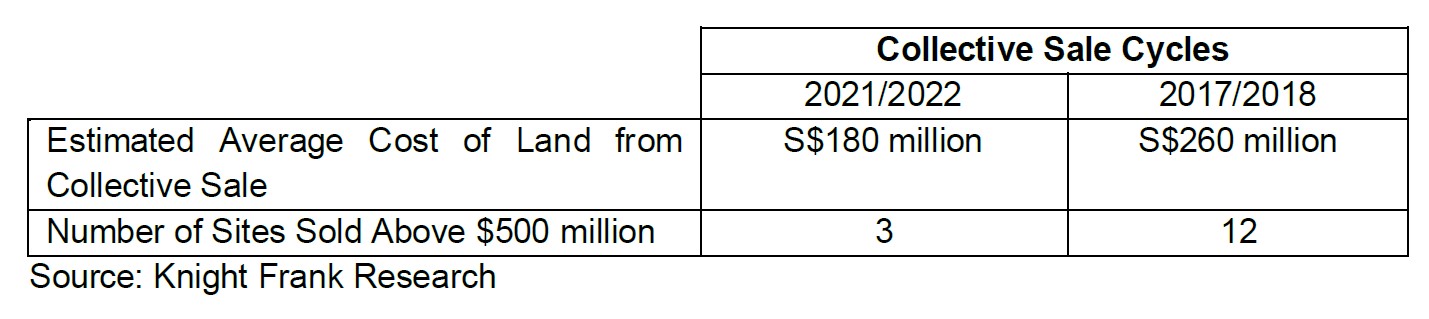

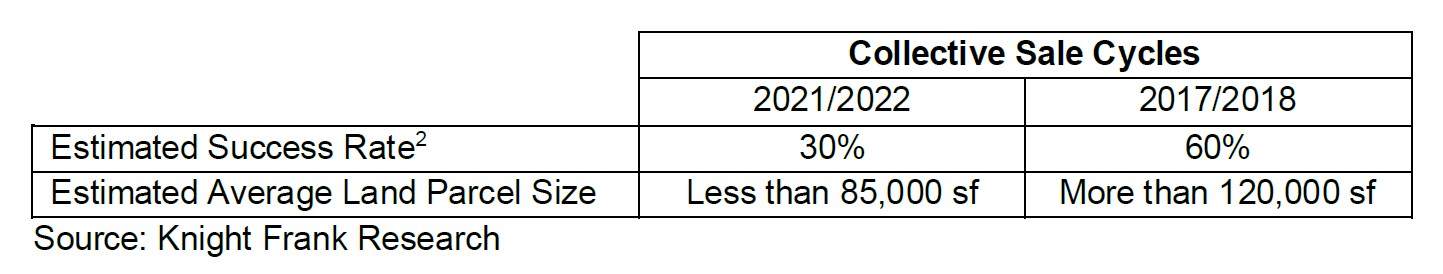

The development land demand of developers remains, yet the collective sale cycle of 2021/2022 through 2023 was unlike that of 2017/2018, due to its lower success rate, elevated development risks, and higher seller expectations.

Lower Success Rate

The 2021/2022 cycle saw a significant decrease in success rate for private residential site sales, with an estimated 30%, as opposed to the 60% estimated in the 2017/2018 cycle. Furthermore, the average size of sites sold in 2017/2018 was above 120,000 square feet (sf), whereas those sold in 2021/2022 dipped below 85,000 sf.

Higher Development Risks

It’s evident that the risks associated with development have amplified in the post-pandemic era, with developers facing an array of additional challenges. These include soaring construction costs, strict government cooling measures, payment of the non-refundable Additional Buyer’s Stamp Duties (ABSD), and the requirement to sell out projects within five years or risk further ABSD.

The introduction of a revised definition of gross floor area that included air-conditioner ledges and the subsequent impact on developers’ saleable area and margins was a real dampener.

Moreover, with interest rates on the rise, there was a fear that some potential buyers would stay on the sidelines and wait out the economic uncertainties.

This added to the risk profile of larger sites and developers began to show a preference for more manageable capital outlays on smaller sites due to the compressed profit margins.

Higher Sellers’ Expectations

As private housing prices reach new heights, sellers’ expectations remain high: according to the URA Price Index, prices have increased by 8.6% year-on-year in 2022, representing a cumulative increase of 24.0% from the pandemic era’s most recent trough in Q1 2020 to Q4 2022.

Sellers are also having difficulty finding replacements for their old homes due to the limited number of new products on the market and the overall increase in private housing prices.

This challenge for sellers is further compounded by the fact that there are fewer buyers in the market, as potential buyers are unable to keep up with the rising prices.

Given the ever-growing disparity between developers wanting to buy land for development and projects that have gotten more than an 80% approval from the condo residents, it is essential to ask: how can this deadlock be broken?

Smaller Sweet Spot

To take on the obstacles of today’s collective sale market, it requires several pieces to come together so that the potential of success goes from an “unattainable” to an “achievable” reality.

A collective sale site must have attractive features to attract potential buyers, such as being a desirable neighbourhood, nearby access to Mass Rapid Transit (MRT) station and breathtaking views.

Being situated in an existing residential area would be an added bonus for buyers who are already familiar with the locale, especially if there are new products available. The size and cost of the existing residential project should be taken into account as well.

The average selling quantum among sites sold during the 2021/2022 cycle was significantly lower than the S$260 million in the 2017/2018 cycle; yet, sites with a development potential of S$200 million or less, boasting up to 200 new units and attractive attributes, remain just as alluring to developers.

With one exception – the collective sale of Chuan Park, the only sizeable property to be sold in 2022 – currently awaiting the court’s verdict – all other transactions have been concluded.

Given the restrictions placed by GLS sites, developers can take advantage of the private collective sale market for greater variety in terms of location, tenure and size; especially those large parcels that possess remarkable features that are otherwise unavailable. Moreover, a collective sale site situated in a location that has not seen the development of private housing for quite some time can be an excellent option for developers.

En Bloc Opportunities in Core Central Region (CCR)

Despite the majority of collective sale sites sold in 2022 located in suburban areas, developers can consider the CCR’s potential en bloc options – appealing to wealthy foreign buyers relocating to Singapore.

Prime higher-end collective sale parcels could be a tempting prospect as the foreign high-net-worth buyer population in Singapore rises. As global travel rules become more relaxed, the prime residential market could be poised to take off.

En Bloc Opportunities in the East

The eastern parts of Singapore possess an undeniable allure, with the possibility of more than 3,000 new units being rolled out in the year 2023. Substantial projects can be found in Marine Parade Planning Area, for example Amber Gardens, Jalan Tembusu, and Dunman Road. Further east, in the Bedok Planning Area, the grandiose Sceneca Residence on New Upper Changi Road/Tanah Merah Kechil Link is the only noteworthy launch at the moment, with a total of 268 units.

Bedok is one of Singapore’s most populous Planning Areas, home to an estimated 278,000 people by 2022. The majority of Bedok households live in HDB flats, but there are also those who have upgraded to private condominiums or apartments – with a new development along the popular Tanah Merah stretch close to Tanah Merah MRT Station being particularly attractive.

Given the demographic makeup of Bedok Planning Area, it was no surprise that on the first day of 2023, an impressive 3,000 people gathered at the Sceneca Residence sales gallery preview, with 16% of those in attendance being retired individuals looking to downsize to a more manageable living space for their golden years.

The Key Lies with Sellers/Owners

Collective sales in Singapore allow for more land development options than what the GLS programme provides, and can be beneficial to both owners and developers, buyers and sellers. For the current cycle of collective sales to be successful, would-be owners must collaborate together in order to make the sale happen. Despite this, the many intricate parts of a collective sale must come together in perfect harmony to achieve a successful outcome.

Back in the day, a collective sale was seen as hitting the jackpot, as it often yielded substantial gains for sellers. This was especially true during the first few years of the mid-1990s, when plot ratios in the five-yearly Master Plan were increased, thus enhancing the value of private land plots.

In the past 15 years, adjustments to the Master Plan have been scarce, leaving the primary benefit of private land plots to be the expansion of nearby infrastructure (like the emergence of MRT lines and stations) and an increase in the value of private homes as the nation’s wealth rises.

For those who have purchased properties in the past at lower prices, collective sales provide a much more rewarding return on investment compared to selling individually – it’s almost like winning the lottery! Particularly for those who bought before each period of skyrocketing real estate prices.

Residents of Watten Estate Condominium who purchased their units between 1995 and 2020 gained an average of 300% from their investment, with the collective sale price being around 80% higher than other non-landed homes in the same postal code when it was sold in October 2021. Truly, a worthwhile investment!

Flynn Park building was successfully en bloc sold in October 2021, which was purchased from 1995 to 2020 and is expected to generate up to 270% profit. Meanwhile, the sale of the new project Normanton Park in the same postal district further boosted the psf profit of Flynn Park owners, approximately 35% higher than other non-residential properties in the area.

Certainly, not all residential developments that start the collective sale process will make a profit in the same manner; rewards fluctuate and there are a lot of contributing factors, from the standard and features of the area, restorations to the area, future development opportunities because of government programs such as the transformation of Paya Lebar Air Base, and plans for the Bayshore precinct.

The success of a collective sale site and the ability to reach an 80% agreement for launch hinges upon both the private and public home markets – their dynamics can either be an empowering force or an obstacle. But perhaps there is hope: it lies in the very idea of collective. Aristotle stated that the whole is greater than the sum of its parts; perhaps this is the key to unlocking a higher housing value for individual sellers, even in the current private home market.

The power of many should never be underestimated. Although it may not be the same as striking it lucky in today’s market, a great reward is still attainable and beckons those who are sensible and take into account the risk profile of developers when setting their expectations.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …