TLDR

When deciding between an HDB loan or a bank loan for purchasing a property in Singapore, consider key factors such as down payment requirements, interest rates, stability of payments, loan-to-value ratios, early repayment penalties, forgiveness in case of late payments, and refinancing options. HDB loans offer lower down payments payable by CPF, stability in monthly payments, and no early repayment penalties. On the other hand, bank loans come with lower interest rates but may have fluctuating rates, early repayment penalties, and limited refinancing options. Assess your financial situation and preferences to make an informed decision on whether to choose an HDB loan or a bank loan.

Choosing between an HDB loan or bank loan is never a straightforward decision. Your financial situation and personal preference will almost invariably play a big part in helping you and your partner decide on the loan that suits your requirements.

Congrats on making the decision to apply for an HDB flat! Now comes the tough part: deciding whether you should go for the HDB loan with more flexibility, smaller down payments but higher interest rates, or a bank loan with lower interest rates but more restrictions and a higher down payment?

We totally understand the difficulty in making this choice!

Here’s all the important details you need to know about HDB and Bank Loans – their benefits and drawbacks, laid out clearly.

What is an HDB Loan?

If you’re looking to buy a HDB flat, an HDB loan from the Housing and Development Board is a great option. But if you plan to purchase a private property, this loan won’t be applicable.

HDB loan at a glance:

- Interest rate: 2.6% p.a. (pegged at 0.1% above the prevailing CPF OA interest rate which stands at 2.5%).

- Loan-to-Value limit (LTV): After September 30th, 2022, new flats may be purchased with up to 80% of their purchase price, while the same applies to resale flats, with up to 80% of the resale price or value (whichever is lower). However, if the remaining flat lease cannot cover the youngest buyer to the age of 95 when the flat application is submitted, the loan-to-value ratio will be adjusted from the maximum 80%.

- Downpayment: Up to 20% (full amount can be paid using cash, CPF, or a combination of both)

- Early repayment will not incur a penalty

- Couples combined income has to be less than S$14,000

The amount of the HDB loan offered is depending upon the age, income and financial stability of the buyer. If you choose to purchase a Build-To-Order (BTO) flat from HDB, your financial situation will be assessed in the lead-up to flat completion, allowing for the timely disbursement of a housing loan.

HDB Loan Eligibility Criteria

Before making a decision on a HDB loan, it’s important to first check if you meet the eligibility requirements.

Here’s a handy guide to the criteria you must fulfil in order to apply for a HDB loan in Singapore.

Citizenship

- At least 1 buyer must be a Singapore citizen

Monthly income ceiling*

- S$14,000 for families

- S$21,000 for extended families

- S$7,000 for singles buying a resale 5-room (or smaller) flat or a new 2-room Flexi flat in a non-mature estate

Private property ownership

- Buyer must not have owned or disposed of any private residential property in the 30 months preceding the date of application for an HDB Loan Eligibility (HLE) letter.

- If you’re a buyer and you own a single market/hawker stall or commercial/industrial property, you must be actively running the business there and not have any other sources of income.

Household status

- Buyers cannot have taken 2 or more housing loans from HDB. In short, you may not apply for a third HDB loan

- Buyers who have taken one HDB housing loan, the last owned property cannot be a private residential property.

*The gross monthly income average is determined while you are applying for HLE. For those who applied before September 11th, 2019, the income caps are S$12,000 for families, S$18,000 for extended families and S$6,000 for singles.

Pros & Cons Of Choosing An HDB Loan

Pros of choosing HDB loan

- Smaller downpayment amount to pay: A 20% down payment is all that’s needed to purchase the item, and that can be paid with your CPF OA funds, cash, or a combo of both!

- Interest rates less prone to fluctuations: In comparison to bank loans, the interest rates for HDB loans remain relatively stable, linked as they are to the CPF Ordinary Account interest rate.

- Flexible refinance options: No lock-in period and can be refinanced to a bank loan.

- No penalty for early repayment: If you settle your HDB loan before the due date, you can significantly minimize the amount of interest you pay out in the long run – without any additional costs or penalties!

- Higher LTV: You can loan up to 80% of the purchase price

Cons of choosing HDB loan

- Higher interest rate: HDB loans are currently at a rate of 2.6% per annum, with a 0.1% edge over CPF Ordinary Account interest rate, while bank loans offer lower rates.

- Higher accumulated payable amount: An increased interest rate and loan-to-value ratio would result in a higher payment, leading to fewer savings in the long run.

Despite the fact that HDB loans may appear to be the ideal choice with the table alone, one must consider the higher interest rates before making a decision, for it ultimately leads to greater savings over time.

What Is A Bank Loan For Housing?

If you’re looking for a private housing loan, you can get a bank loan from any financial institution regulated by the Monetary Authority of Singapore. For your convenience, here’s a quick glimpse of bank loans :

- Interest rate: Variable interest rate packages; typically ranges between 1.2% to 3% p.a.

- Loan-to-Value limit (LTV): Up to 75%

- Downpayment: Up to 25% (whereby at least 5% must be paid using cash)

- Early repayment will incur penalty

- Minimum loan amount required

If you’re in need of a loan, there are various types of bank loans available. From fixed rate packages, floating rate packages to a combination of both – the choice is yours! It is important to remember that interest rates for bank loans are often tied to SIBOR or SOR (Singapore Swap Offer Rate) or based on the Fixed Deposit Home Rate (FHR).

Fixed Rate Packages offer a set interest rate over a pre-determined timeframe – usually ranging from one to five years. Say you wanted to lock in your rate for two, three, or five years – no problem! Just keep in mind that if you repay the loan before the period ends, you may incur a penalty.

Floating Rate Package, you can expect fluctuating interest rates, a range of lock-in periods and loan amounts tailored to your needs.

Pros And Cons Of Choosing A Bank Loan

Pros of Choosing Bank Loan

Lower interest rate: Generally lower than the 2.6% p.a. for HDB loans.

Eligibility criteria is easier to meet: Lower restrictions like the lack of an income ceiling.

Refinance or reprice your home loan: Enjoy the lowest interest rates in the market by refinancing or repricing your home loan

Cons of Choosing Bank Loan

Early repayment penalty: The lock-in period for bank loans restricts you to repay your loan early, and penalty is usually 1.5% of the loan amount.

Interest rate fluctuates: Interest rates are according to market fluctuations and are inconsistent.

Higher downpayment required: You need to fork out 25% for downpayment, and at least 5% must be paid in cash.

Limited refinancing options: You cannot change to an HDB loan during the mortgage period.

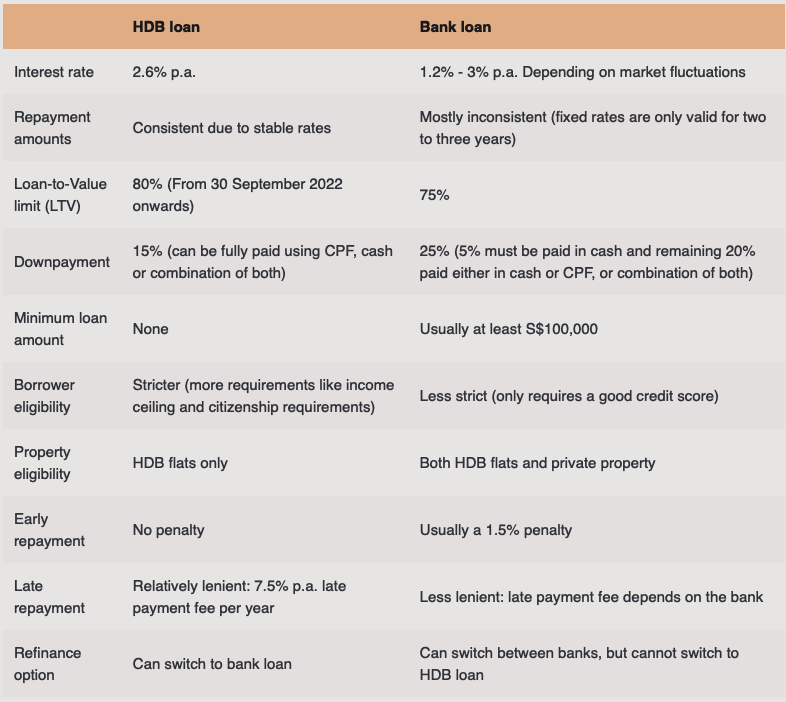

HDB Loan vs Bank Loan: A Summary

Now that you have a better understanding of the HDB and bank loans, let’s take a look at a side-by-side comparison of these two housing loan types. And if you need help to calculate your monthly instalment, you can use the handy calculator from CPF.

What Key Differences Should I Take Note Of?

Are you wondering whether an HDB loan or a bank loan is the right option for you?

Consider these key factors to help you decide.

1. HDB Loan Down Payments Are Lesser And Payable By CPF

For couples with limited funds, HDB loans are a more feasible option. The downpayment is a much more reasonable 20% (or even 5%, if eligible for staggered payments), compared to the hefty 25% you’d have to put down with a bank loan.

HDB loans provide an advantage in that you can pay in full from your CPF Ordinary Account, meaning you won’t need to dip too deep into your pocket. In comparison, bank loans require a minimum of 5% of the downpayment be paid in cash – that could come to around S$20,000 for a regular four-room flat. This leaves more money to spend on other expenses such as renovations or investments.

2. Bank Loans Come With Lower Interest Rates

Believe it or not, HDB loans come with a slightly higher interest rate than your CPF OA interest rate. Currently, the HDB loan rate is 2.6% per annum, while bank loan rates usually range from 1.2% to 3% p.a.

Despite the cap set at 3% p.a., bank loans don’t often reach such high interest rates. Rather, they are pegged to the Singapore Interbank Offered Rate (SIBOR) or fixed deposit home rates and fluctuate depending on the market. So if you want to save up on interest in the long run, bank loans would be the better option.

3. But HDB Loans Are More Stable

Opting for bank loans may be tempting due to their lower interest rates, yet those in need of consistent monthly payments may find HDB loans more appealing.

HDB loans provide stability with a fixed rate of 2.6% p.a., meaning predictable monthly repayments and better budget planning. On the other hand, bank loans can have varying interest rates, with fixed rates that are only guaranteed for a few years – so although you may benefit from a lower rate initially, it may increase in the future without warning.

4. HDB Loans Have A Higher LTV, Which Means More Interest

Young people looking to purchase their first home may take advantage of an HDB loan with 80% LTV, subject to CPF balance, as it may give them access to larger loan amounts due to their lower incomes.

Although this could be beneficial in the short term, it should be kept in mind that a larger loan amount also translates to more interest payments in the long run.

Alternatively, bank loans offer up to 75% of the house purchase price but require a higher down payment. Despite this, the smaller loan size and lower interest rates could potentially save more in the long run.

5. There Is An Early Repayment Penalty For Bank Loans

Have you ever thought that paying off your loan early would be a beneficial solution for everyone involved? After all, you would be paying less interest in total and the bank would get their money sooner.

Unfortunately, that is not the case – in fact, the bank is losing out on the interest that they would have gained over the entire repayment period. This is why there is typically a 1.5% early repayment penalty for bank loans during the lock-in period.

With HDB loans, you’re never locked in – you can always pay off your loan before its due date, penalty-free. Whether it’s thanks to a sudden windfall of cash or you want to cut the total interest you owe, you’re free to repay your HDB loan early with no extra cost.

6. Bank Loans Are Less Forgiving

If you often find yourself running late with payments, don’t expect banks to be so forgiving – generally, their penalty charges are quite strict. However, when it comes to HDB loans, it’s much easier to negotiate; you can appeal for a fee waiver or reduction, particularly if it’s a one-off incident.

Just bear in mind that, if you’re a repeat offender, the chances of getting off with a lighter penalty are slim – a standard late fee of 7.5% of the amount due usually applies.

7. You Can Refinance Only From An HDB Loan To A Bank Loan

If you opt for an HDB loan, you can switch to a bank loan if you so desire as there’s no lock-in period. However, if you go for a bank loan, there’s no way to refinance to an HDB loan – the only options are to either reprice from the same bank or refinance with other banks.

So, Should You Get An HDB Loan Or A Bank Loan?

For those who have a bit more cash to put down as a downpayment, taking out a bank loan could be a great option! Not only will you benefit from lower interest rates, but the 75% Loan-to-Value ratio will mean you have less to pay off in the long run. Just make sure to make those payments on time to avoid any penalty fees.

Are you and your partner a younger couple who’ve just entered the workforce? If so, chances are you won’t have much extra money to spare.

Why not take advantage of an HDB loan? With a down payment of only 20% of the purchase price, you can even pay in full with your CPF!

Plus, the fixed rate allows for more consistent payments, making it much easier to plan ahead for those big milestones like a wedding or a car in the near future.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …