TLDR

Decoupling in Singapore’s real estate refers to the process of separating property ownership to avoid Additional Buyer’s Stamp Duty (ABSD). It allows couples to transfer ownership without needing a divorce, but careful consideration is crucial due to potential costs like legal fees, Buyer Stamp Duty (BSD), Seller Stamp Duty (SSD), CPF refunds, pre-payment penalties, and other expenses. Decoupling may not always lead to savings, especially for foreigners or when buying a cheaper second property. Consulting a real estate professional is advised to navigate the process effectively and make informed decisions.

You and your partner have set out to find another home, and you’re determined to keep away from the intimidating Additional Buyer’s Stamp Duty. During this search, you’ve come across the term “decoupling”, which is commonly used when talking about property ownership, but do you know what it really means?

This comprehensive guide gives you a complete breakdown of decoupling and serves as your one-stop source of information. You’ll learn the following:

- What exactly is decoupling?

- Why do people decouple?

- And, key points to keep in mind when you do decouple.

What Exactly is Decoupling?

Have you heard the word “decouple” before and wondered what it means? To decouple is to separate, disengage, or dissociate (something) from something else. So, many people mistakenly think that it has something to do with divorce. But here’s the good news – no marital breakup is needed for you to decouple!

Rather than holding joint ownership, couples can opt for the legal process of ‘decoupling’ their property. This entails selling one’s share to the other co-owner, and thus transferring full ownership and responsibility for mortgage payments. To ensure the process runs smoothly, lawyers need to be consulted to ensure the relevant forms are completed and submitted to the Singapore Land Authority.

Married couples cannot decouple their HDB flats, unlike private properties which can be jointly owned and decoupled. Decoupling for HDB flats is only possible through buy over from an ex-spouse or the transfer of the flat between family members.

In 2016, the HDB ownership transfer rule was tightened, thus allowing transfers in only six specific scenarios: marriage, divorce, death of an owner, financial hardship, renunciation of citizenship, and medical reasons.

Why Do People Decouple?

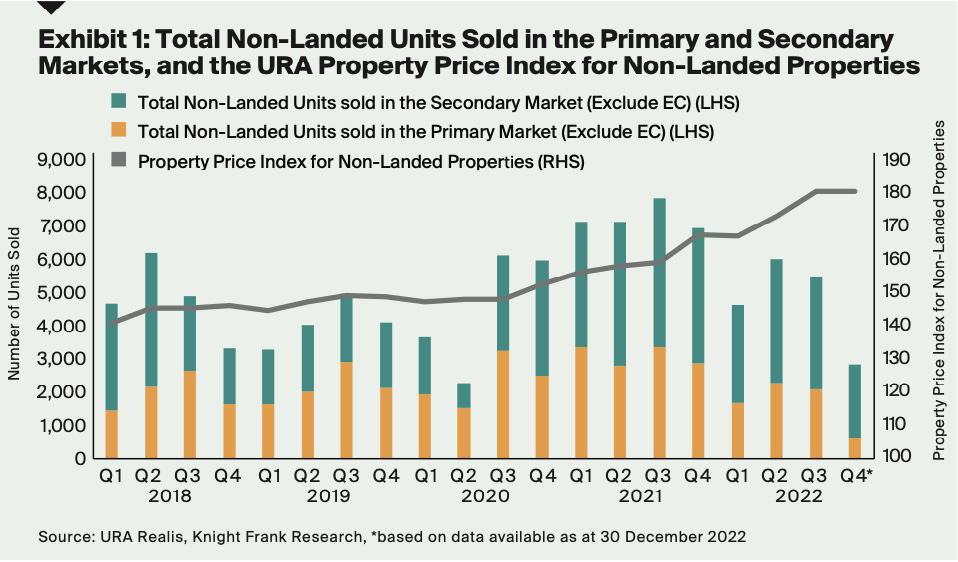

Earlier, we briefly touched upon the reasoning behind those wishing to decouple; their motivation stems from not having to pay additional fees such as ABSD, an additional tax which property purchasers must pay in addition to Buyer’s Stamp Duty. This levy is determined by the higher of either the valuation or selling price of the property and it was initiated in 2011 to control the surge of demand for housing and to keep property costs affordable for Singaporeans.

- Residents of Singapore are subject to ABSD when purchasing their second (17%) and subsequent properties,

- Permanent Residents (PRs) will be levied ABSD on all purchases, with the first purchase being 5% and second/subsequent purchases being 25%,

- whereas Foreigners will be faced with a 30% ABSD for each property purchase,

- and Companies/Associations will be faced with a 35% ABSD for every property.

For instance, if you are a Singaporean citizen wanting to purchase a $2 million property, you would be required to pay 17% ABSD, which amounts to a total of $340,000. Thus, decoupling is a desirable option for those seeking to save from ABSD, and allows them to acquire the property as their ‘first’ one again.

Key Points To Keep In Mind When You Do Decouple

You may be asking yourself, “What’s the catch?” – and rightly so! If decoupling just brought advantages, then everyone would do it. Unfortunately, the decoupling process isn’t quite so simple. Consider all the details before you take the leap!

Legal Fees

To successfully purchase and own a property, legal paperwork must be completed. The buyer will incur conveyancing costs while the seller must hire a lawyer to oversee the transfer and sale of their share of the property. Usually, the two sets of attorneys will cost approximately $6,000 to $7,000.

Buyer Stamp Duty – BSD

When it comes to purchasing a property, Buyer Stamp Duty is a tax that must be paid upon acceptance of the Option to Purchase (OTP). This fee is applicable during the process of decoupling, where a share of the property is being transferred between two parties.

Seller Stamp Duty – SSD

If you embark on the process of decoupling within the first three years of purchasing a property, you may need to pay Seller Stamp Duty, with a rate of 12% in the first year, 8% in the second, and 4% in the third. To save yourself from these additional charges, wait for at least three full years before decoupling. Remember that when a property is “sold” as part of decoupling, the Seller Stamp Duty period will reset.

CPF Refund

When you sell a property, you’re required to pay back the amount you took from CPF with interest. Unfortunately, this can leave some with absolutely no cash left, as their funds are completely locked up in CPF and they don’t have the necessary funds to invest in their next property.

In summary, when it comes to decoupling, thorough financial preparation is an absolute must. Whoever is taking over the property must make sure they have the sufficient funds to take on the mortgage. Moreover, if bank loans are necessary, the purchaser must guarantee that they can secure the necessary loan from the bank, allowing them to take on the whole mortgage of the property.

Pre-Payment Penalties

Did you know that if you try to pay off your home loan early, you could be subject to a pre-payment penalty fee? Yes, it’s true – many people find it quite a surprise! Generally, this fee is around 1.5% of the amount being prepaid, so make sure you review the terms and conditions of your home loan to ensure you don’t have to pay this fee.

You Could Find Yourself Spending More Than You’re Saving

Sometimes, decoupling may not be the best choice from a financial standpoint. This is especially true if one of the spouses is a foreigner, or the second property you are purchasing is cheaper than the first – in such scenarios, it may be wiser to pay ABSD. Moreover, for individuals who possess multiple assets, it may be wiser to forgo decoupling.

Scenario A : If you and your partner decide to split the $2 million cost of the condo, your portion would be $1 million. That would come with some costs, including BSD of $24,600, ABSD of $300,000, legal fees of $6,000, and additional conveyancing and administrative fees of $3,000. All in all, the total cost would be more than $333,600.

Scenario B : Let’s explore what might occur when you decide to purchase the 2nd property under your own name and pay the ABSD of 17% on the $850,000. You’ll be paying a hefty sum of $144,500, but if the purpose of decoupling is to avoid the ABSD, this solution will be much more beneficial in the long run.

Mistakes Can Happen

It’s easy to make errors while taking Math tests, and the same goes for calculating ABSD and other fees. Furthermore, the amounts and percentages you’ll have to pay can be different depending on your residential status and nationality, only adding to the potential for confusion.

Consulting an experienced real estate consultant can be a great help to make the process of decoupling less intimidating. They can work out your finances, settle the calculations, and provide you with advice based on your individual circumstances. Moreover, the professionals can give you the best insight on how to decouple your properties for optimum returns.

To Decouple Or Not To Decouple?

Wondering if decoupling is the right choice? While it is certainly a popular strategy used by couples to save money, the cons of decoupling may outweigh the pros in some cases, leading to higher costs. To avoid real estate regrets and mountains of paperwork for nothing, make sure to consult a professional before taking the plunge!

You May Also Like …