TLDR

In 2022, the real estate market saw significant interest rate hikes affecting home loan rates. Despite concerns, the market remained stable with limited supply and consistent demand, leading to a potential increase in prices in 2023. For investors, resale properties offer a more budget-friendly option compared to new launches. In 2023, new condominium projects are expected to drive housing options with prices likely to gradually rise. Potential risks include global economic challenges, making thorough financial planning crucial. Advanced tools like RAM financial assessment and mobile apps provide valuable insights for informed property decisions.

At the start of 2021, many foresaw property cooling measures on the horizon, yet few knew precisely when or how they would take effect. Fast forward to September 2022 and the Singapore government stepped in with additional regulations, aiming to prevent homebuyers from overextending their budgets in a rising interest rate environment.

Indeed, the persistent increase of interest rates over the next two years has been a popular topic of discussion. One can’t help but wonder: will higher financing costs hinder property demand, resulting in lower prices?

Don’t Wait For The Perfect Time To Buy – Home Prices Won’t Be Decreasing In 2023!

What Has Been The Most Significant Development In The Real Estate Market In 2022, And Why?

The year 2022 was marked by a rapidly increasing pace of interest rate hikes as central banks all over the world, led by the US Federal Reserve, sought to curb rampant inflation. These hikes had a drastic effect on the Singapore Overnight Rate Average (SORA) used for pricing home loans, skyrocketing from 0.195% per annum in January to 3.095% by December. On top of that, numerous banks repeatedly revised their fixed home loan rates as interest rates rose higher and higher.

For first-time homebuyers and homeowners alike, the prospect of soaring home loan interest rates – with many never having experienced such a high rate before – can be a daunting one. After enjoying low rates below 2% for many years following the global financial crisis, some are now confronted with fixed package rates of over 4%, prompting worry, uncertainty, and second-guessing for those looking to purchase their first home, upgrade, or invest in a second property.

Amid the rising interest rate climate, the government has taken steps to promote caution among home buyers by introducing new cooling measures at the end of September 2022. Although we’ve seen dramatic increases in the Federal Reserve’s rates this year, it is likely they will dial back the magnitude of their hikes as we move into 2023. This may create a slower rise in home loan rates which could reach a plateau in the second half of 2023.

Although high interest rates may discourage some people from buying, upgrading, or investing, the truth is you can’t time the market perfectly. If you find a property that suits your budget and needs, there is still no reason to hold back – all that is needed is proper financial analysis, which I can help you with. So, don’t be afraid to take the plunge – even in high-interest times!

Are you in the market for a property? Let me be your guide! With my proprietary digital tools, I can help you make smart decisions – from assessing your financial capability to evaluating the potential capital appreciation of the property to finding out if it’s the perfect fit for you.

It Is Speculated That Come 2023, The Housing Market May Take A Downturn, Prices May Decline, And Demand May Be Hindered Due To A Potential Recession Or High Interest Rates

My outlook is that home prices won’t experience a drop in 2023. How so? A few different factors will serve to bolster prices;

As the market for new sales rapidly changes, it’s no surprise that selling price is a reflection of land and construction costs. In recent years, the cost of construction has increased by a staggering 30%, while Government Land Sales prices have stayed consistent, leaving slim margins for developers to lower prices. Additionally, there is a small inventory of unsold new homes with only 15,000 units (ex. ECs) awaiting approval as of Q3 2022. Assuming conservative annual sales forecasts of 7,500 units, this inventory will be gone within two years.

Observing an evident supply discrepancy in the OCR, developers don’t feel the urge to lower prices despite tight supply and undiminished demand.

There is a scarcity of properties available for resale in the market, a lack of supply. Homeowners are hesitant to put their property on the market due to three main factors:

1) The potential for a steady income through renting;

2) The high cost of replacing their home; and

3) The impact of government policy.

The implementation of the additional buyer’s stamp duty (ABSD) for second and subsequent home purchases has deterred those who own multiple properties from selling them, as the hefty ABSD will have to be paid in order to buy a new home in the future. The 15-month wait-out period introduced as part of the cooling measures in September is also leading private home owners to rethink their plans to sell and downgrade to an HDB resale flat. Thus, the limited supply in comparison to the consistent demand can only lead to one thing – a increase in prices.

Despite the fact that economic downturn and global headwinds may negatively affect consumer buying sentiment, I firmly believe that there are various factors that will keep driving the housing demand. These include an influx of new families, first-time buyers, foreign investors, and HDB upgraders. The job market is still tight and the majority of Singaporean households still possess robust buying power. Additionally, the Singapore property market is quite stable and the level of speculation is low. Thus, in my opinion, while home prices are not expected to decrease, the pace of increase may be slower in 2023.

What Are Some Potential Areas Of Growth Or Investment Opportunities To Consider In 2023?

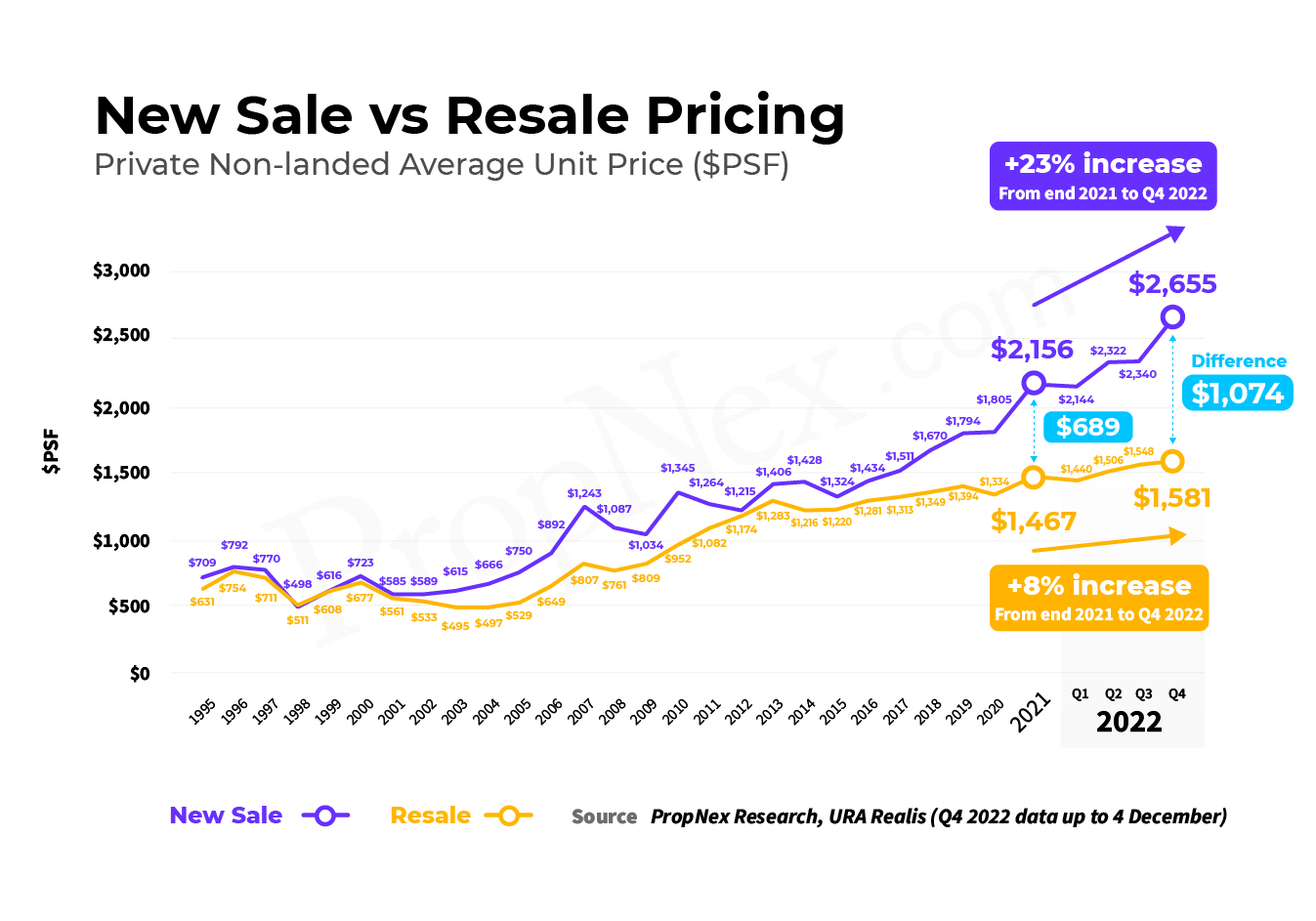

If you are working within a tight budget for housing, you might consider the resale condo market. Over the past year, resale prices have increased more slowly compared to new launch prices. From 2021 till December 4, 2022, the average price of new launches jumped 23%, while the price of resale properties only rose 8%, as recorded by the caveats lodged (see Chart 1).

The contrast between new sales and resale transactions has created a large price gap, evidenced by Chart 1. In Q4, the difference in the average prices of non-landed resale properties and new launches was staggering, amounting to $1,074 psf. Specifically, new launch transactions had an average price of $2,655 psf, while resale properties averaged $1,581 psf. This was an immense increase from the $689 psf of 2021. Though resale prices may continue to climb in 2023, they likely won’t outpace new launches.

When it comes to buying a resale property, there are a few things to consider. It’s important to remember that resale prices tend to rise more slowly or even plateau over time. This is due to the fact that the value of a resale unit is usually determined by recent transactions in the same area, so it’s unlikely that a unit can fetch a price far above the market rate. In any case, an overpriced resale unit can be difficult to sell, as buyers will be drawn to other units within the same project or neighbourhood that are more reasonably priced.

If you’re considering investing in a 99-year leasehold property that’s been around for a while, bear in mind that maintenance costs and a declining lease balance should be taken into account.

A Glimpse of Average Unit Prices: Comparing Resale and New Sale Non-Landed Private Homes (S$ PSF)

By 2023, it is anticipated that an array of new condominium projects will be unveiled, bringing a greater variety of housing options to those struggling to find their perfect home in the current market due to the diminishing unsold stock. Developers will likely be mindful of prices in light of recent cooling measures and external economic pressures, yet it is forecasted that prices will remain on a gradual incline in the upcoming year.

By 2023, it is anticipated that an array of new condominium projects will be unveiled, bringing a greater variety of housing options to those struggling to find their perfect home in the current market due to the diminishing unsold stock. Developers will likely be mindful of prices in light of recent cooling measures and external economic pressures, yet it is forecasted that prices will remain on a gradual incline in the upcoming year.

It is probable that home prices in the Rest of Central Region (RCR) and Core Central Region (CCR) will escalate more than in the Outside Central Region (OCR). The prices of RCR are likely to be buoyed by projects that achieved land prices of above $1,300 psf ppr (such as Dunman Road, Jalan Tembusu, and Pine Grove), while CCR prices will be elevated by the launch of redevelopments from the city, including the former Maxwell House, AXA Tower, Fuji Xerox Towers, and the Marina View GLS site.

Despite the firm pricing, buyers will still be highly interested in new launches. Many are willing to pay a premium for these new properties, be it for the modern facilities and a new lease, or the first-mover advantage and potential capital growth it offers.

At the beginning of a launch, developers typically price their units competitively to attract buyers, but once sales reach a certain level, prices may start to climb – so if you purchased a unit during the launch weekend, you could already be in for a paper gain before the project is even finished!

Next year, regardless of your budget, there will be buying options available to you – be it in the private property market or the HDB resale segment. I can present you with potential options and offer thorough insight. If you are eager to learn more about property investment and financial planning, I strongly advise you to join my GROW Method Masterclass.

What Are The Potential Risks Or Challenges In The Residential Real Estate Market That Buyers And Investors Should Be Aware Of In 2023?

Next year brings a host of challenges, including the possibility of a global recession, geopolitical tension/conflict, and high inflation. With these issues, the risks could mean job insecurity or losses, a higher cost of living, and weak market sentiment. Home buyers and owners must take into account their financial capability – if a recession occurs, do they have the means to survive it?

When making a long-term commitment such as purchasing a home, it’s important to consider all factors: a home loan tenure could be anywhere from 20 years or even longer. To ensure you make an informed decision, evaluate your financial standing and determine your current and future goals. How much can you afford now? Think about any expenses you might incur or plans for the future – for instance, will you have more kids, take a break for schooling, buy a car, or start your own business? Whatever the case may be, it’s vital to be as thorough and knowledgeable as possible.

What amount should you put away for a rainy day, in case of a sudden interest rate surge, job loss, or family emergency? Are you considering buying a new property after a few years? What are the chances of re-selling the property you have your eye on?

The more meticulous your preparation is prior to the purchase of a property, the more assurance you can have that you have the financial capability to face market fluctuations. I am highly skilled to evaluate your monetary position and accompany you in your property investment venture. Do reach out to me for a consultation!

What Advancements In Data Analytics, Proptech Or Innovations Can We Expect In The Realm Of These Technologies In 2023?

I am equipped with the RAM financial assessment tool to assist clients with planning ahead, assessing their financial position and risk tolerance, setting buffer funds and reviewing their portfolio. This tool provides a thorough risk analysis and generates a tailored report for each client – an essential step to avoid exposing oneself to uncertainties and to effectively manage one’s risk exposure in any investment.

My clients can rest assured that their property purchase decisions are informed and secure, thanks to the RAM tool which ensures that all financial factors are taken into account; no stone is left unturned, and no risk is left unchecked!

In 2022, Investment Suite – a dynamic mobile app providing the ultimate real estate experience on the go. My clients will be able to access transaction data and trends from anywhere, as well as find out the transaction history for residential properties in Singapore, plot the transacted price trend over time and even filter data by number of bedrooms – all within the app!

My clients can gain invaluable insight into sales trends of condo projects with our stack view feature. If they wish to find out about the amenities, schools, and SORA rate of a particular property, my digital tool provides them with all of the information they need – making it a true asset to their experience.

You May Also Like …