TL;DR Summary:

- Timing of Property Sale: Selling high and buying high may seem counterintuitive, but understanding market dynamics can yield substantial profits.

- Wealth Multiplication: Early sale post-Temporary Occupation Permit (TOP) helps in maximizing profits and expanding investment portfolios.

- Market Insights: Lack of knowledge leads to missed opportunities and stagnant financial growth.

- Property Investment: Right timing for property transactions can significantly impact wealth accumulation.

- Avoid Speculation: Making informed decisions based on facts rather than speculation is crucial for financial success.

- Systemic Growth: Property investment offers a reliable avenue for wealth growth compared to traditional savings options.

- Upcoming Session: Join a session to learn about strategic property investment approaches and wealth accumulation techniques.

Often times when sellers are advised of the ideal time to sell their property and acquire another one, most of the time they would question the notion of selling high, because they feel that by doing so, won’t they be buying high as well?

Many would feel that it is more prudent to stay put for a lifetime, since property prices are continuously going up anyway, there is no such need.

And many of them bought their properties at a relatively lower price, surely they can’t find anything similar in that low price bracket in any given market, let alone this sizzling hot market.

What if there is a way to generate decent or massive profits regardless of if you sell high followed by buying high.

As always, we know that any investment carries some form of risk, so prudence has always been part of my own investment principle.

End of the day, profit is what we sought after but our financial security should take precedence over other factors.

Sadly, due to the lack of knowledge and/or market insights, many people have been stuck in limbo as their minds are overly clouded by market noise, monetary concerns and misconceptions. And it happened to some of my close friends too! Therefore, I am compelled to share my research and insights to allow everyone to make better informed decisions for themselves.

Reality is, the rich will get richer. Why? Reason is simple – they will continue to multiply their wealth by selling and buying properties and particularly at the early stages of the property tenure.

So why do they do that?

It is simply because they understand this significant notion – that generally a property’s price will hit its peak upon obtaining the Temporary Occupation Permit (TOP). Hence, they will need to capitalise on the rippen opportunity for maximum profit and compound their investment pot in order to grow their assets allowing them to acquire more properties and expand their investment portfolio and personal wealth.

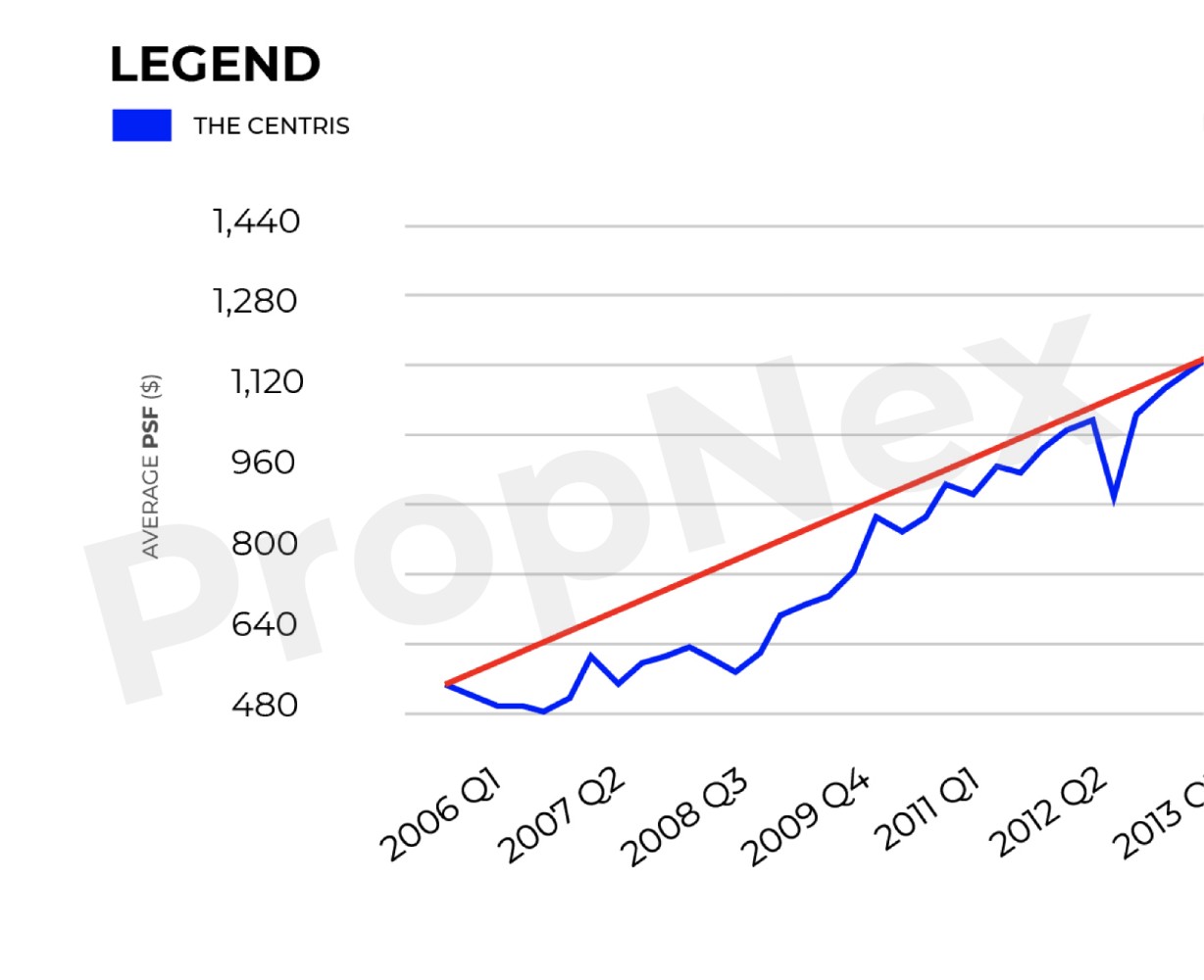

Let’s take a look at the price chart in Figure 1 for The Centris Condominium in the West. Notice that property prices for this project have been appreciating over time even way past the TOP stage. So do I sell or wait further at this point?

Figure 1: Average transaction price (psf) for The Centris (2006-2013)

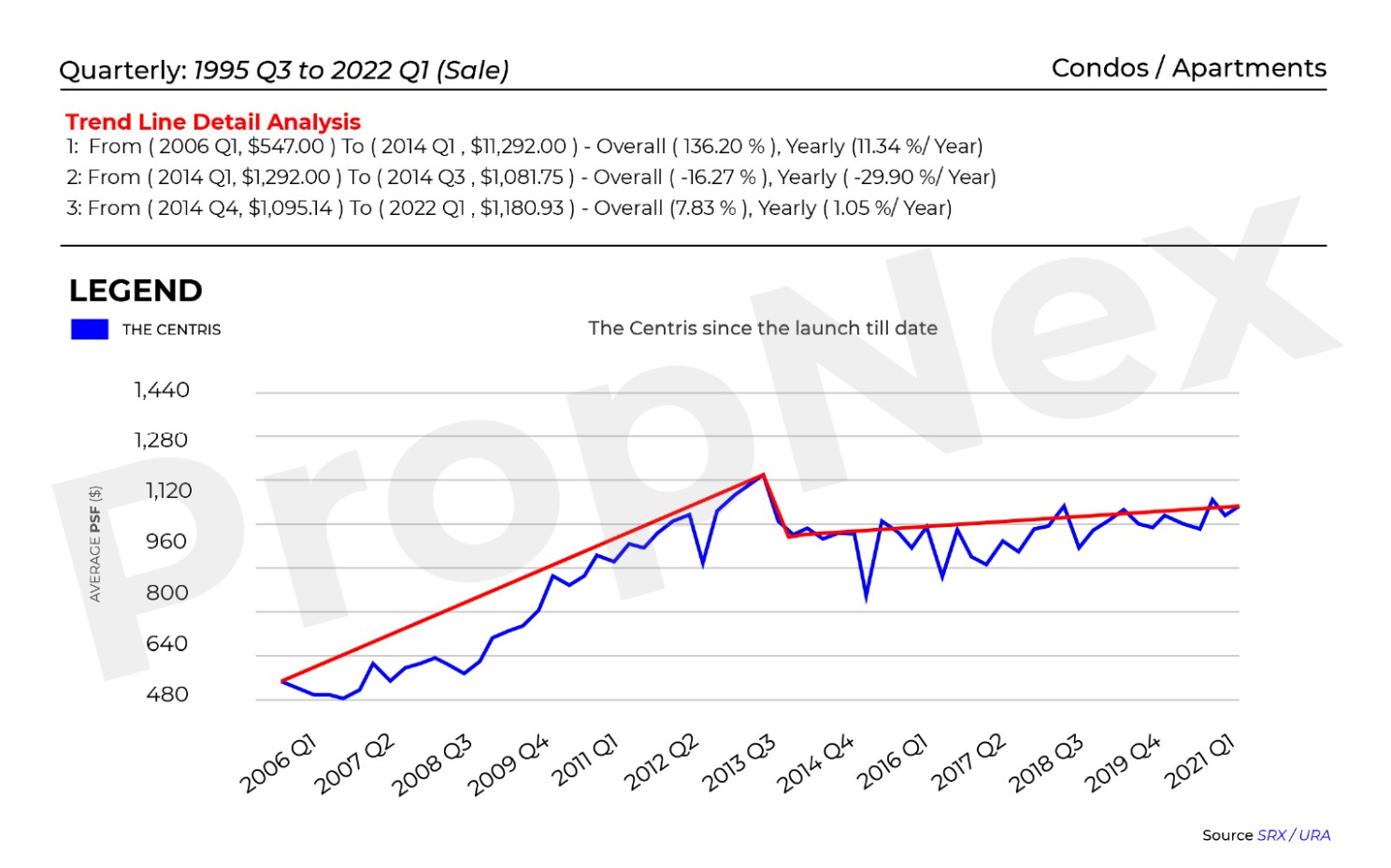

Assuming the early buyers of this development did not take action and realise the massive profits of at least $500,000 (for a 1,066sqft unit) in 2012-2013 and waited until today.

What would the numbers be like in today’s sizzling hot market?

Figure 2: Average transaction price (psf) for The Centris (2006-2021)

You could see that the price momentum eventually lost its steam. The profit they will be looking at in today’s bullish market will be about the same as if they sold it 8 to 10 years ago! They would probably be consoling themselves that the price is finally crawling back to its past glory.

What most people do not see is the inflation over the past decade and those missed opportunities to multiply their realised $500,000 profit.

I cannot stress enough the importance of knowing when to enter and exit for those looking to grow their wealth.

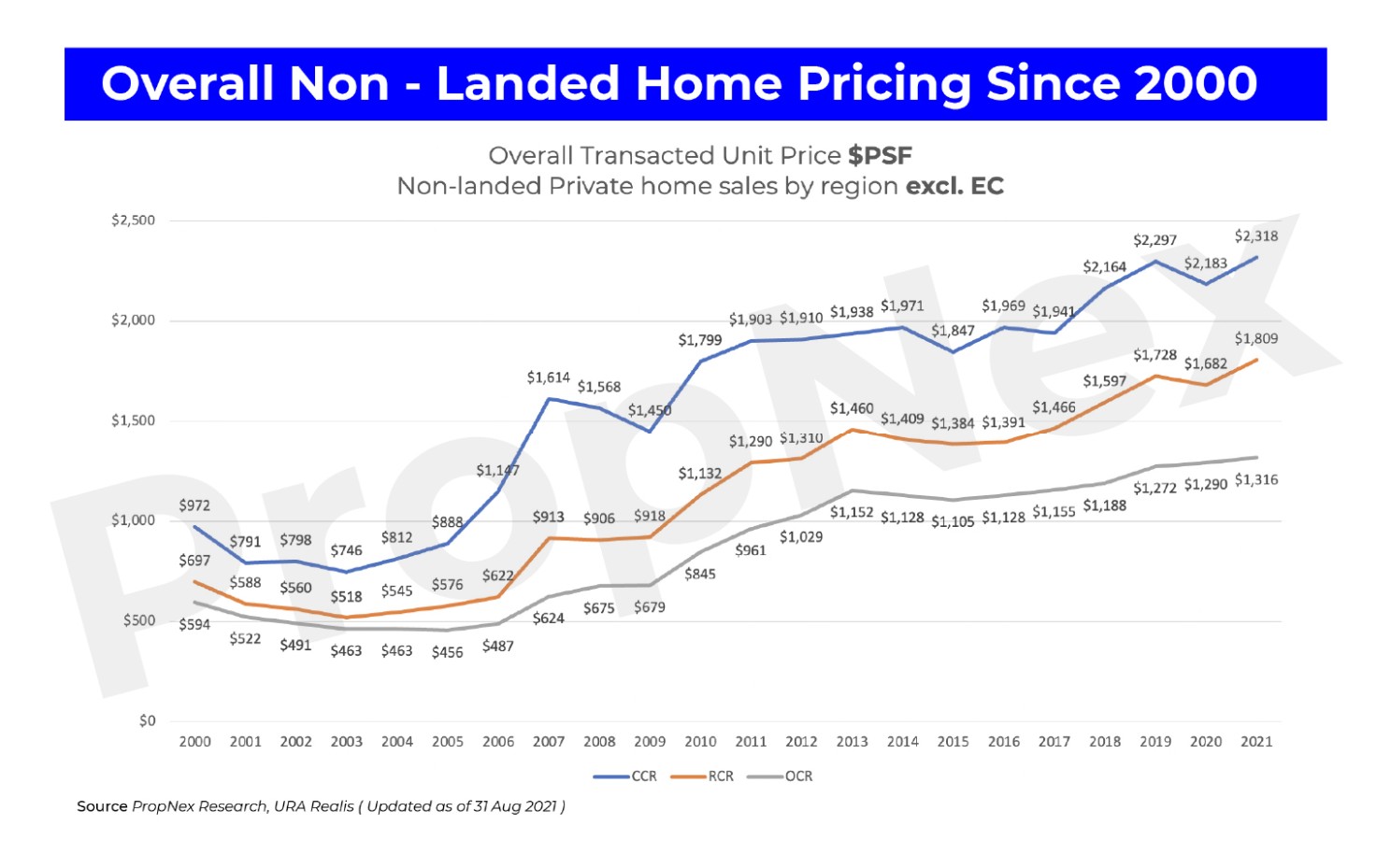

Moving on to the next chart (Figure 2) below, there are those out there crying over spilled milk, questioning their indecision of not investing in any property in the early stages of their lives. A closer look at the charts and you can tell that the prices keep driving upward despite the several rounds of cooling measures and crisis we had to brave through the years.

Many were apprehensive and failed to take action when the market is slow, and believe that the uptrend will have a sharp reversal that will bring the property prices down. Sadly for those waiting did not see that day come.

When the market picks up they feel that the opportunity to take action has already slipped by them. This is an endless cyclic process of inaction that will cost you dearly with the abundant opportunities that are wasted.

It is mostly due to the lack of understanding in property investment and also the undeniable uncertainty of how to take the first step even if they wanted to.

It is always good to keep an open mind and understand investment concepts or strategies that can actually benefit you and your family. Stop believing that investment is only for the rich. Many fall into the trap of ‘Investment is not for me’, ‘I already know’ or ‘this doesn’t concern me’ and end up getting into a rut. You can avoid these mistakes!

Figure 3: Overall transactions (psf) of Non-landed residential (2000-2021)

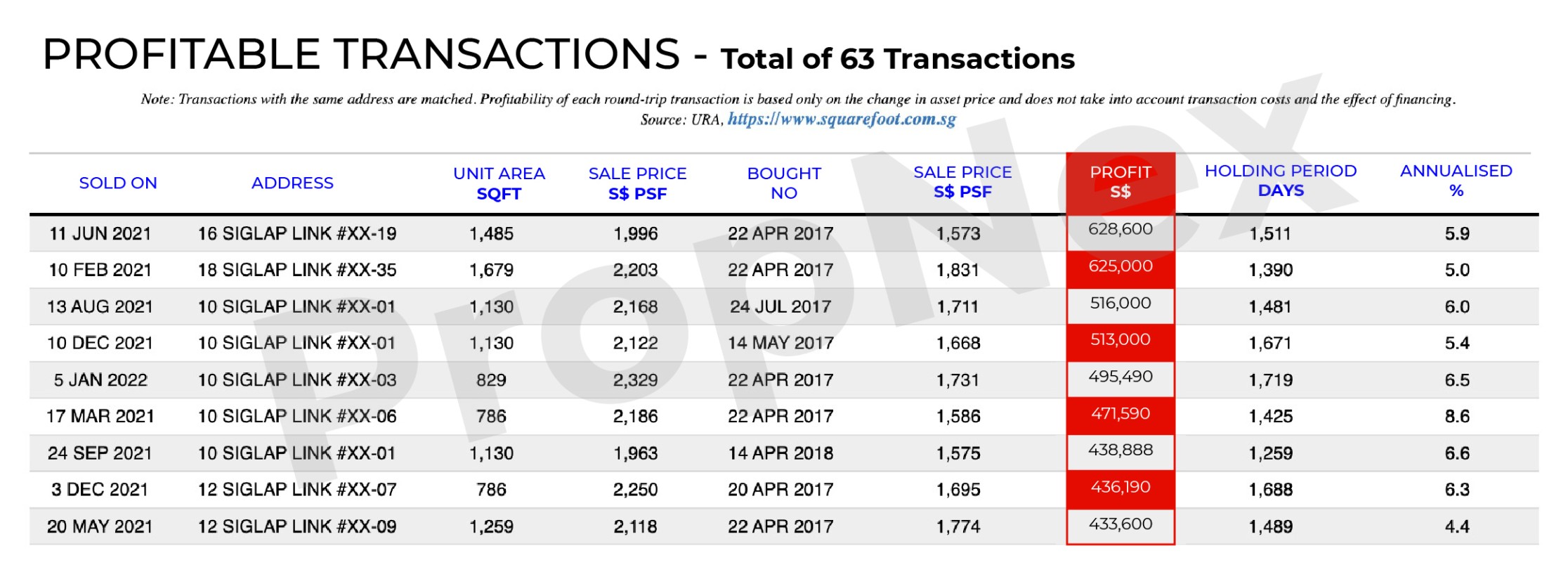

Looking at transaction data (Figure 3) below of leasehold 99-year (LH99) Seaside Residences, units were transacted at an average of $1,573 psf in 2017 – which many would consider overpriced for a LH99 property in that area during those times. In contrast, a freehold property in the area cost around $1,000 psf. Looks like this is a bad purchase, isn’t it?

The investment of Seaside Residences for many turned out to be a blessing in disguise!

Few people in the market were confident that the market could have enjoyed a momentous upswing where units are transacted in the region of $2,000psf – this is considered record-breaking for a 99-year leasehold development in District 16! Selling would allow one to bring home a fabulous score of over $600 grand!

This goes to show that buying high does not mean you will not make money, it is more important to get the facts right and NOT speculate.

Speculation puts you at risk, clarity through proper guidance helps you make discerning choices that go on to earn you good money.

Figure 4: Transactions records of Seaside Residences

An article to share with everyone below, the point that I have been driving this entire time – growing your wealth through investing in stable assets. The interest rates of your savings account and rate of your income growth does not allow you the comfort of hedging against rising cost of living and inflation, none of these can beat the growth of property prices.

What you need is systemic growth in terms of wealth accumulation. Learn how to let your money work hard for you apart from working hard for money.

Source: Me & My Property, The Straits Times

If you’d like to find out more about tackling these challenges and finding your way to start, join me at my upcoming zoom session; where I will be sharing with you on how you can grow your wealth in a systematic way with adequate safety measures in place.

Learn about right timing to sell & buy properties and determining the best time to exit. Attain the ability to find assets with the right entry price and potential for growth!

You May Also Like …