TLDR

When it comes to the choice between leasehold and freehold properties in Singapore, several factors must be considered. Leasehold properties are typically cheaper, offer higher rental yields, and can be appreciating investments, while freehold properties provide a sense of legacy and stability. The location and amenities of the property, developer reputation, future developments, and market trends also play crucial roles in decision-making. Understanding these factors is essential for making informed decisions in the real estate market.

When it comes to purchasing a private property, there is often the question of Leasehold Vs. Freehold to consider. It appears to be a divisive topic, with some buyers indifferent to the choice and others offended when asked if they would consider a leasehold condo.

Even amidst all the other factors that come into play when buying a home, the issue of tenure continually resurfaces, particularly as it can be such an emotional investment.

Considering whether to opt for a freehold or leasehold property?

For some homebuyers, the extra cost of a freehold property outweighs any potential benefit; they prefer to focus their attention on other important factors, such as location or amenities.

Whatever side of the argument you fall on, it’s critical to maintain an objective and logical approach to the pros and cons of freehold and leasehold.

Check out this article for more guidance :

A Brief Background On Property Tenure In Singapore

Let’s begin by clearly defining the terms leasehold and freehold land before we explore the advantages and drawbacks.

Condominium Tenures In Singapore

99-year Leasehold

- Building interest and ownership reverts back to the state once the tenure expires.

999-year Leasehold

- Largely considered freehold properties due to the similarity in value of freehold and 999-year leasehold land

Freehold

- Buildings indefinitely owned by the owner – Until he decides to sell it.

In Singapore, you can find different types of condominium tenures, such as the freehold, 99-year leasehold and 999-year leasehold.

These properties are highly valued and viewed similarly to freehold properties, which often lends them their equivalent value.

Granted in the pre-independence era, freehold estates confer ownership to the proprietor, who is the rightful owner of the land and the building until it is sold.

Thus, freehold tenures are a great investment for those looking for long-term ownership.

It is essential to bear in mind the Land Acquisition Act (1966) in Singapore, which allows the state to reclaim even freehold properties in extraordinary situations.

Though these events are rare, they could still take place if the land is intended for future development like infrastructure projects.

Therefore, if the government acquires the land, proprietors will receive market rate compensation for their property.

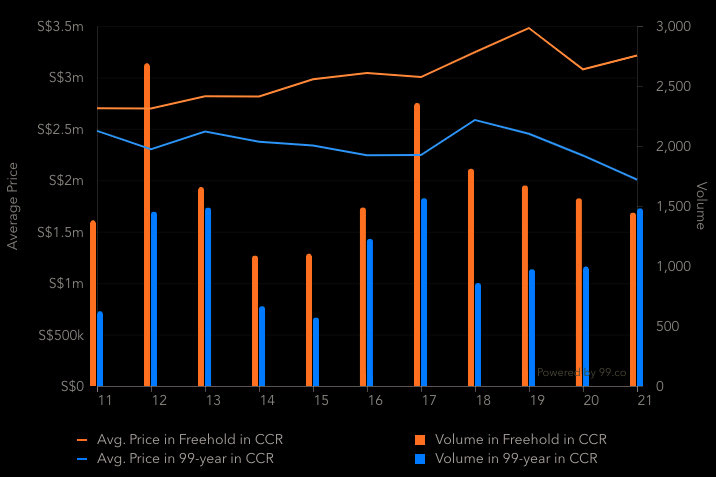

En bloc potential is clearly seen in the 2016-2017 period, where out of 41 sold projects, 76% were freehold and 24% were leasehold.

While all Government Land Sales sites are 99-year leasehold, subsidiary proprietors are given a share in the land rather than the whole, and when the tenure expires, ownership reverts to the state.

What Are The Districts With The Most Freehold Properties And Why?

It’s no surprise that the closer you are to the center of Singapore, the more likely you are to find freehold properties. Most of Singapore’s freehold properties date back to its colonial times, before Government Land Sales became the norm and prevented the distribution of freehold titles for new buildings, which have all been given leasehold status since.

As expected, the affluent neighborhoods of central Singapore, where the city’s prime districts lie, contain the majority of Singapore’s freehold properties.

99-Year Leasehold Property Pros And Cons:

Pros:

#1 Significantly Cheaper

- Leasehold properties usually come with a discount of 10-15% compared to freehold properties of similar location, age, and amenities.

- Leasehold properties usually come with a reduced price tag compared to freehold properties of the same location, age and features; freehold properties tend to receive a premium, even when all other factors remain the same. In other words, you can expect to pay a little extra if you want to own a freehold property.

#2 Higher Rental Yield

- Tenants typically don’t take the tenure of the property into consideration, meaning the annual rental income remains the same regardless of the purchase price.

- Investing in a leasehold property offers a higher rental yield than freehold properties – calculated by the annual rental income divided by the total cost of the property. The fact that tenants don’t really care about the tenure of the property means the annual rental income stays the same while the purchase price varies. It’s especially worth noting for those investing in the property solely for profit and not for personal use.

#3 Appreciating Investment

- In a 2019 CNA report, it was found that leasehold condominiums experienced a remarkable 86.7 percent appreciation in value over the past decade, while freehold condominiums lagged behind at a comparatively meager 60.8 percent.

- In 2019, a CNA report revealed that leasehold properties have long been a reliable investment, with condominiums appreciating by 86.7% over the past decade, compared to the 60.8% of freehold properties. This proves that when it comes to real estate, leasehold properties have often outstripped freehold properties in terms of price appreciation.

Cons

#1 Finite ownership

- When the 99-year lease is finally up, the land on which the property stands reverts to the state, thus reducing its value to nothing.

- The initial 20 years of a leasehold condo are the golden years, during which the owner may be pleased to see the value of their property steadily increasing. But, as the lease begins to shorten, it becomes more difficult to sustain a high selling price. Finally, when the 99-year lease runs out, like the HDB flats at Geylang Lorong 3, the land reverts back to the state, and the value of the property plummets to nothing.

- Still, there is a possibility for leasehold owners to make an en bloc sale and liquidate their properties. Developers who intend to redevelop the land can approach URA to top up the leasehold to 99 years, which eliminates the above-mentioned disadvantage. During the en bloc fever in 2017, Business Times reported that the trend had shifted and leasehold properties were being preferred instead of freehold — even if it was supposed to be freehold in theory.

#2 Loan restrictions

- In 2019, the introduction of new laws governing housing loans for leasehold properties complicated things – with their finite duration of ownership, owners may have difficulty accessing their loans and CPF funds, particularly if the building’s remaining lease won’t last till 95 years.

#3 Concentrated in particular locations

- Previously mentioned, freehold properties are commonly found in specific areas in Singapore. If you are merely looking at purchasing a property in an area without any freehold properties (e.g. Punggol), the debate of leasehold or freehold may be made irrelevant.

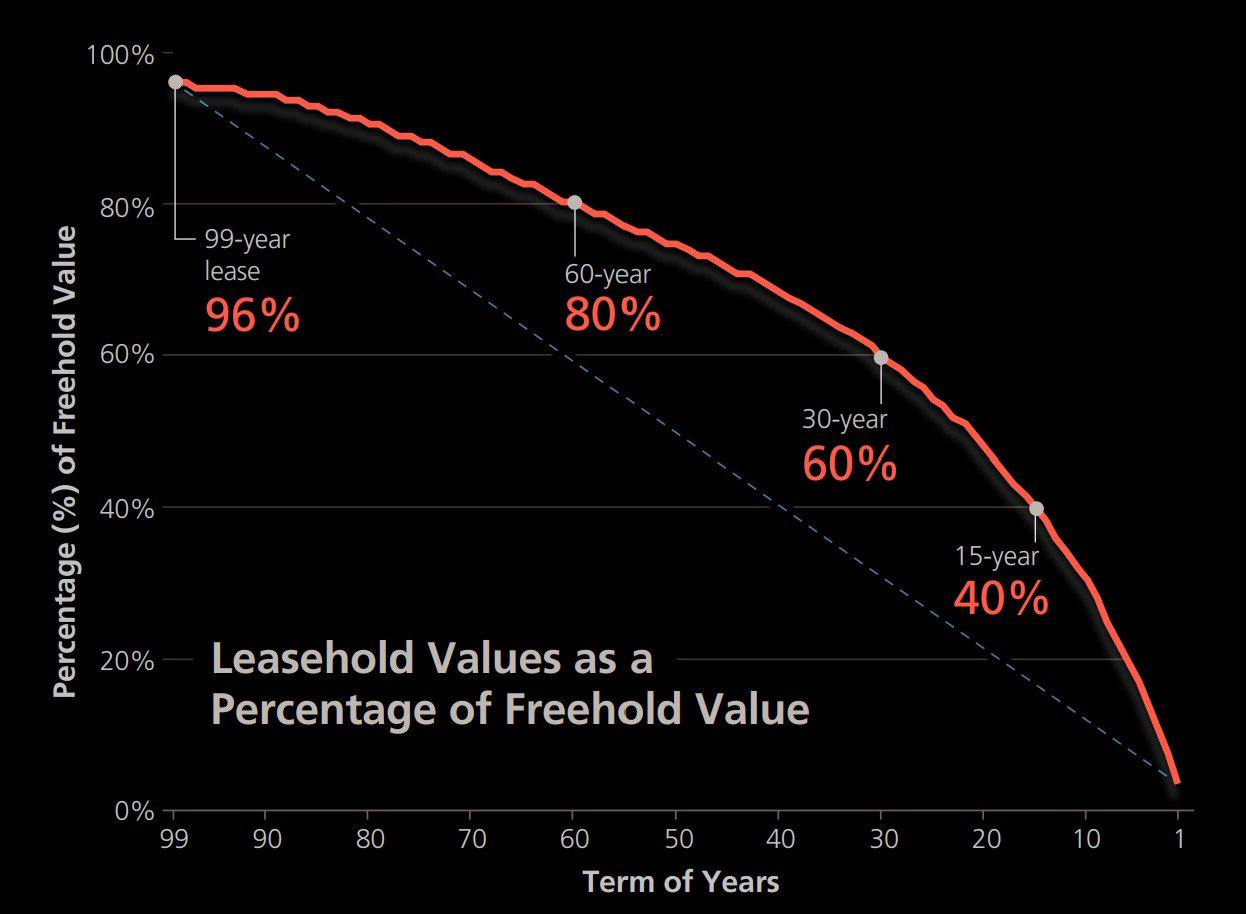

#4 Lease Decay

- As the Bala curve indicates, projects coming to the end of their lease can be a major cause of worry, for the value of the property tends to drastically depreciate over the years.

- Not all of the 99 years are in line with the trend; however, there are some remarkable outliers such as Mandarin Gardens, Neptune Court, Pine Grove, Arcadia, and Hillcrest Arcadia that defy this pattern – a subject we’ll delve into in greater detail later on.

Freehold/999-Year Leasehold Property Pros And Cons:

Pros

#1 The Legacy

The potential of freehold properties to serve as a legacy, even to the next generation, may be its biggest draw. In Singapore, where land is a precious commodity, these investments have proven to hold their value, and even grow over time. For those who embrace this idea, freehold properties are viewed as a legacy for their family and a stepping stone to secure their financial future.

#2 Higher Enbloc Prices

Freehold properties themselves reach better prices when sold enbloc, which is obvious since the owners ultimately give up “more” than their leased counterparts. In addition, freehold properties can be shielded from depreciation due to a shorter lease term, although the material value of the property itself may decrease depending on the age and wear of the building.

#3 Scarcity Value

Due to the limited availability of freehold land, freehold property owners hold a unique advantage when reselling their units. As a result, the prices of freehold properties are far more resilient and stable than those of resale condos.

To illustrate this point, let’s look at the comparison between Twin Regency, a freehold condo, and Meraprime, a leasehold condo with similar attributes and amenities. Since 2004, the Twin Regency has experienced greater price growth than Meraprime.

Cons

#1 Emotional Buying

When it comes to ownership and legacy, many of our parents’ generations and those before them are drawn to the idea of owning a property that they can pass down through the generations. Nevertheless, with the ever-changing social norms, living arrangements and globalization, ownership of a property may no longer be essential.

Beware of emotional buying when it comes to purchasing a freehold property with the idea of passing it down to future generations. It’s an attractive notion, but the harsh reality is that it has been a failed dream for many families in the past.

#2 Enbloc is not a Given

Despite the fact that freehold condos often present a “simpler” en bloc potential, the appeal of a particular development to developers is influenced by a multitude of factors, such as zoning regulations that control the future usage of the land and the condition of the economy at the time.

For instance, freehold properties in low-density zoned lands may not have as high of an en bloc possibility compared to leasehold property close to a transit hub.

Developers may also realize it’s more economical to make an offer for leasehold property and pay to top up the lease, as we observed many of those cases throughout the latest en bloc wave in 2017 and 2018.

Additionally, if your goal is to hope for an en bloc sale in a freehold building, you should be ready to face strong opposition from your neighbours when the collective sale motion is proposed. After all, a lot of owners don’t feel the need to part with their freehold asset, especially if the property is well-kept.

#3 Unforeseeable Future

If one is planning to own a home for the long-term, it may not remain a viable option as the landscape around it can change quickly.

Take for instance a freehold property located in the River Valley area that was considered unparalleled in the past, yet now faces stiff competition from other condominiums situated near the Great World MRTs and Great World City such as Riviere.

Furthermore, newer condos boast the latest technologies which an older freehold might not have, thereby giving them an edge over the latter.

#4 Maintenance over an Ageing Condo

Remember, any costs for repair and maintenance incurred by the Management Corporation Strata Title (MCST) will be split among the occupants. With older condominiums, it is likely that you will have to pay out additional funds for maintenance, repair and possibly some improvements.

All of these expenses will be shared between homeowners.

Consider Buying 99-Year Leasehold Property When …

Buying a leasehold property can be a great choice for those seeking a little extra flexibility and don’t mind navigating market volatility.

Unlike their parents, who sought to purchase a home they could live in for years to come, many modern buyers prefer not to stay in one place for too long and thus find that leasehold property meets their needs better.

Leasehold properties often have a great appeal to buyers who are looking to make a profitable investment, as their lower outlay provides a higher rental yield.

Additionally, there are several other factors that take precedence over tenure, such as the price difference between freehold and leasehold. Therefore, if the price disparity between the two widens, it could be wise to choose the cheaper leasehold option.

Consider Buying Freehold Property When …

If you’re looking for an investment that can be passed on as a generational asset, a freehold property might just be the answer.

An extra premium may be worth paying for the assurance that you can call it home, forever. Compared to a leasehold property with limited tenure, a freehold property is a far more attractive option.

Those seeking the freedom to design their home, rent it out, and obtain loan approval with ease will be enticed by freehold properties.

Plus, owning land in a city where it’s so hard to come by is a great investment, especially for those looking to retire.

When it comes down to cost, the difference between a freehold and a leasehold is usually only $100,000 to $200,000 – making freehold the obvious choice.

Not All 99-Year Leasehold Properties Are Equal

Not all leasehold properties are created equal. Whilst many are issued by the state, certain developers like Far East Organisation may also hold the leaseholds.

In particular, properties like Greenwood Mews, The Alana and The Shore Residences all belong to FEO, who in turn hold a freehold/ 999 year tenure on the land and issue 99 year leases to the owners.

Be wary of the en bloc potential of these buildings in this instance. With the developers likely to take back the land’s interest eventually, buyers may never witness the enormous gains from en bloc windfalls.

There May Also Be Bigger Considerations Than Tenure

After weighing up all the advantages and disadvantages of each type of tenure, let’s take a step back and put things into perspective. We can see that certain other factors may be more important and should be given priority when considering properties.

1. Location and Accessibility

The saying “location is king” is timeless; when searching for a place to live or invest in, its location always remains the top priority. For example, properties situated in sought-after neighbourhoods or conveniently close to an MRT station will invariably appeal to buyers.

2. Amenities within the Neighbourhood

Living near amenities such as schools, supermarkets, gyms, and parks can drastically improve one’s quality of life – and buyers are always eager to pay a premium for this privilege. Even the amenities within the condo itself can determine the success of a property deal.

3. Master Plans and Future Developments

Armed with the up-to-date URA Master Plan and insight into upcoming developments, we can strategize effectively when it comes to purchasing a property.

Don’t forget that future developments can drastically affect a property’s resale value, so it is essential to familiarize yourself with the zoning of the vacant land surrounding a potential home.

Keep in mind the plot ratio as well – it establishes the elevation and density of potential developments.

4. Purpose of Purchase

Previously, when it comes to buying property, there can be different considerations depending on whether you are purchasing to live in or as an investment.

If you are searching for a family asset, then a freehold property may be the more desirable choice; however, if you’re after a shorter-term asset, a leasehold property may be the more cost-effective option, granting you greater flexibility.

5. Reputation of Developer

Surprisingly, developer reputation can be just as influential as the general factors when it comes to buying a condominium – since buyers believe it reflects the craftsmanship and quality of the finished project.

A reputable developer might even encourage people to choose a leasehold over a freehold, while a developer with a history of problems could have difficulty selling units in a freehold development.

6. Overall Real Estate Market

The economic climate and external factors like cooling measures can really cause prices to fluctuate in the real estate market. Even if we always aim to buy low and sell high, the market prices change daily and the statistics may not be dependable.

Although the buyer may be tempted to keep an eye on prices, we recommend that they stay informed and act cautiously when making such huge decisions.

Grasping these elements allows us to get a feel for the complexity of the real estate market – the fact that each and every development is distinctive and distinct.

While the data provides insight into market trends and buyer inclinations, it may not accurately characterize the key characteristics of a single development that raise its intrinsic value.

Thus, decisions about leasehold versus freehold properties call for a more intensive assessment of specific properties.

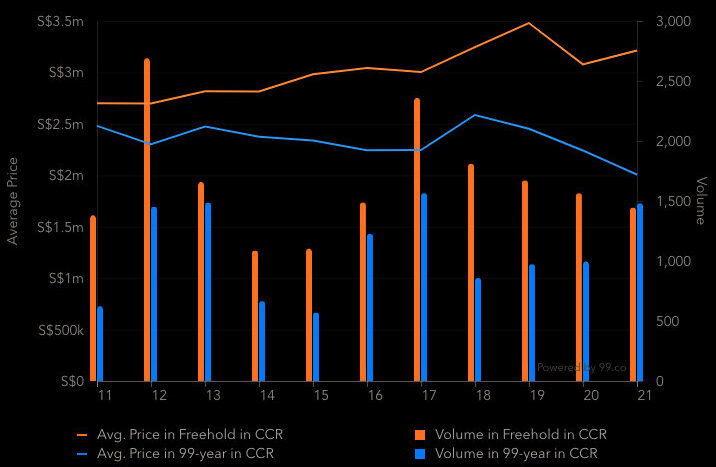

7. Volume of Transactions

No matter whether the property is a freehold or leasehold, the transaction volume is the deciding factor for its pricing behaviour.

Conclusion

When investing in property, tenure is an important factor to keep in mind; however, it is not wise to rely solely on this one factor.

Purchasing a property is a big decision, thus it is essential to gather all the important information and perspectives before deciding.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …