TLDR

When selling your house, be prepared to cover expenses such as outstanding home loans, legal fees, property agent commissions, CPF savings refund, Seller’s Stamp Duty, property tax, and maintenance fees. For HDB flat sellers, additional costs may include resale application admin fees, resale levies, and HDB upgrading costs. Remember to negotiate property agent commission rates and understand the payment options for various fees. Consider factors like SSD exemptions, property tax rates, and resale levy timings. Ensure all necessary payments are settled before completing the resale transaction.

Your family is more than ready to take the leap and move to a new home. You have made a decision – you are going to put your current house up for sale in exchange for a bigger, more luxurious one.

But one issue stands in your way: you’re unsure of the costs you must pay before you can successfully sell your house.

Here are the expenses that need to be taken care of before you can sell your home:

- Outstanding home loan

- Legal fees (also known as conveyancing fees)

- Property agent commission

- CPF savings plus accrued interest (to be paid back into your own account)

- Seller’s Stamp Duty (if applicable)

- Property tax

- Maintenance fee

If you’re selling your HDB flat, you may also have to pay for the following:

- Resale application admin fee

- Resale levy

- HDB upgrading costs

Fees And Costs To Pay Before Selling Your House

1. Outstanding Home Loan

If you’re still in the middle of paying off your home loan, you must first clear the remaining balance to either HDB or the bank before you can put your house up for sale.

What’s more, if you’re selling your property within the home loan’s lock-in period, you’ll need to pay the bank an early redemption fee.

2. Legal Fees

Legal fees, also referred to as conveyancing fees, are necessary for the process of transferring the property title from seller to buyer.

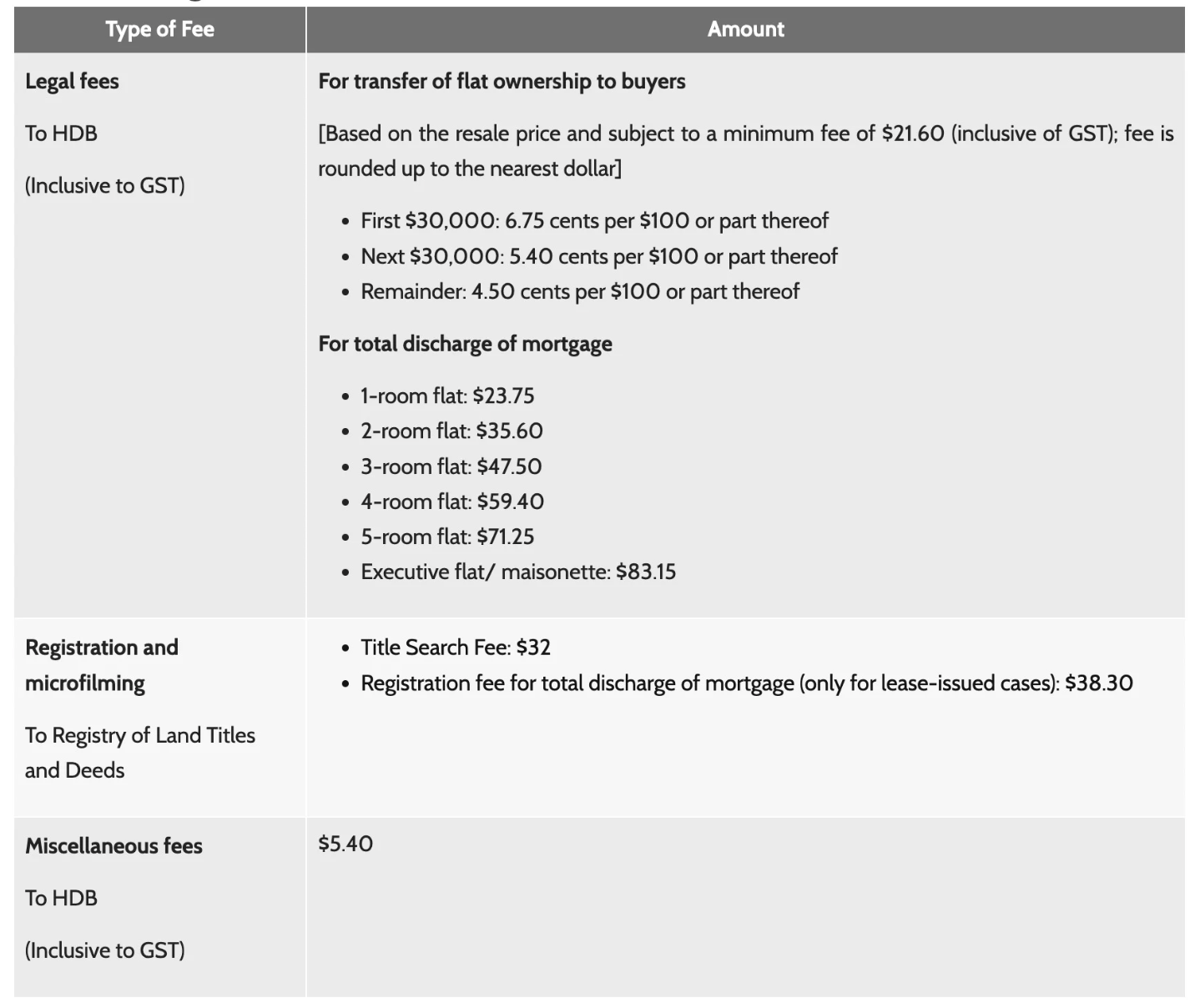

For HDB flat

Once HDB has obtained the resale application from both buyer and seller, it’s time for you to officially approve the resale documents via the HDB Resale Portal.

That’s when you need to pay the legal fees. You have the choice to engage HDB’s lawyer to represent you or opt to hire a private attorney to do the paperwork. The cost depends on your decision.

Source: HDB

To get an immediate assessment of the legal costs, you can use the HDB’s Legal Fees Enquiry Facility.

When you opt to hire a private attorney, the conveyancing fee for discharging a HDB loan will stay the same, however, the remaining costs may vary depending on the lawyer you choose.

Before appointing someone to act on your behalf, make sure to discuss their fees.

There are three main payment methods accepted: credit card, AXS and PayNow. You can even use your CPF savings to cover the legal fees (excluding Title Search Fee, Registration fee and Miscellaneous fees).

For Private Property

The conveyancing fee can range from S$2,500 to S$3,000, with some law firms allowing you to pay using your CPF!

3. Property Agent Commission

When engaging the services of a property agent to sell your house, you will be subject to a commission fee. While there is no one-size-fits-all rate, the customary practice is a percentage of the selling price.

- HDB flat: 2%

- Condo: 2% – 4%

- Landed: 2% (or more)

Before you appoint a property agent to help you sell your house, it’s essential to negotiate the commission rate. There is no set guideline for commission rates, so don’t hesitate to discuss it with your agent – especially if they are GST-registered, as you’ll then be liable to pay GST on the commission rate.

4. CPF Savings Plus Accrued Interest

When you sell your house, you’ll need to refund your CPF account for the savings you used to buy it. This includes the downpayment and any monthly installments.

You may also have to return any CPF grants you took to your account, and pay back the 2.5% interest on the withdrawn CPF savings you would have earned.

Put it all together, and you’re refunding your CPF account for your home purchase.

You can turn your refunded amount (principal + accrued interest) into a new house – so although it may feel like a cost at first, this could be a blessing in disguise!

5. Seller’s Stamp Duty (SSD)

For those buying properties from 11 March 2017 onward, Seller’s Stamp Duty (SSD) is payable if the property is sold or transferred within three years, however, most HDB owners are exempt from this due to the five-year MOP.

Should the property be transferred due to divorce or within the HDB family, remission may be available. To learn more, visit IRAS’ page on SSD.

There are several ways of paying the Seller’s Stamp Duty. This includes:

- GIRO

- PayNow

- AXS

- Internet Banking

- SingPost

- Cheque/Cashier’s Order

6. Property Tax

The property tax for the entire year is usually paid in January. If you sell your flat in June, you’ve pre-paid the buyer’s part of the property tax.

But don’t worry, you can always get the buyer to reimburse you! During the flat sale completion appointment, your lawyer or HDB officer (for HDB flats) will help divide the current year tax between you and the buyer.

For HDB flats, you’ll need to show your tax payment receipt.

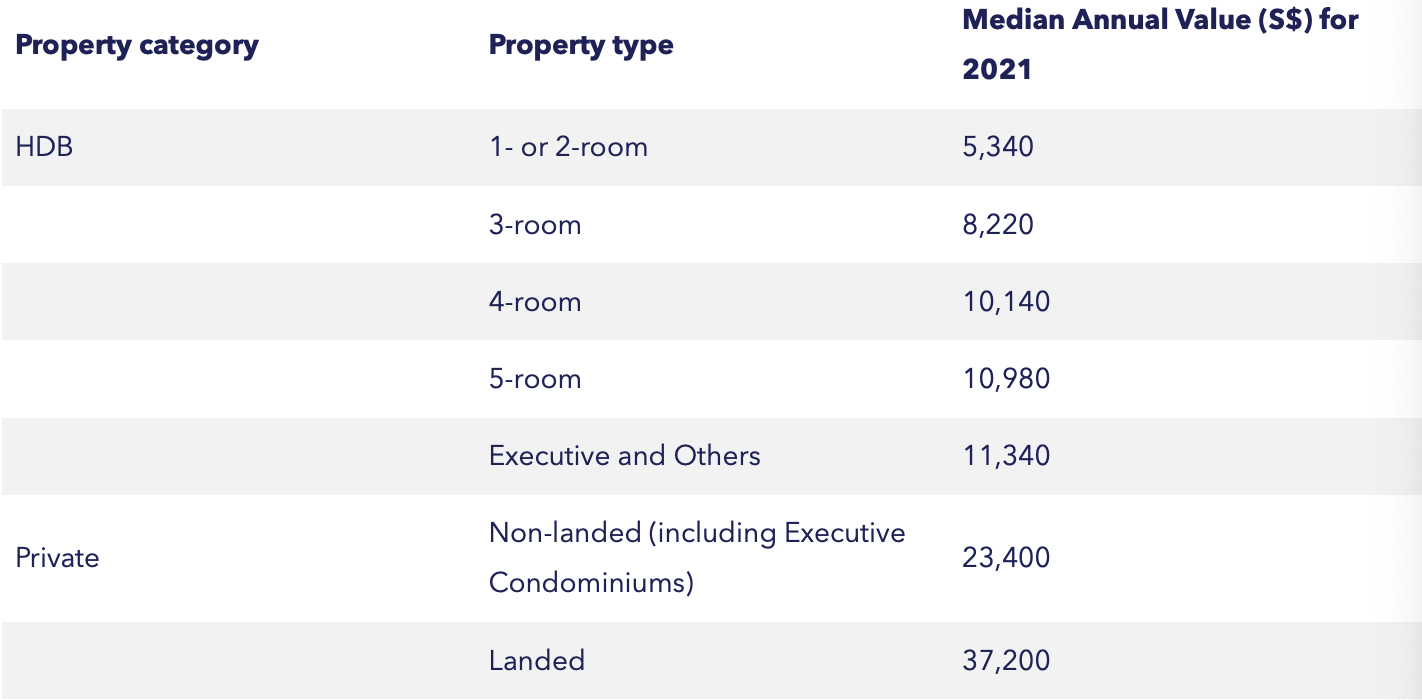

Figuring out your property tax? Multiply your flat’s Annual Value (AV) with the appropriate rate – your AV is an estimated annual rent your flat would fetch if you leased it out, determined by IRAS based on the prevailing market rates.

Take a look at the median AVs for HDB flats and private residential properties for 2021 – though, unfortunately, the figures for 2022 are yet to be published!

For Owner-Occupied Homes

Owning your own home has its perks – including a reduced tax rate! As of January 1st, 2023, homes with an Annual Value of between S$8,000 and S$30,000 are subject to a 4% tax rate, while those with a higher Annual Value may pay up to a 23% rate on the excess.

And from January 1st, 2024, the tax rate on the excess can be as high as 32%. Enjoy the benefits of owning your own home today!

For Non-Owner-Occupied Homes

Find out how much tax you’ll be paying on non-owner-occupied residential properties, starting from 11-27% as of January 1, 2023 and increasing to 12-36% in January 1, 2024.

With IRAS Interactive Property Tax Calculators, you’ll easily know the amount you need to pay!

The preferred method of payment for property tax is GIRO. Other acceptable payment modes include:

- PayNow

- AXS

- Internet banking

- SingPost

7. Maintenance Fee

Before you complete the resale of your HDB flat, remember to settle the Service and Conservancy Charges (S&CC).

When it comes to condos, the buyer will likely need to reimburse you for the quarterly maintenance fee. So be sure to factor that into your resale plan.

Selling Your HDB Flat? Here Are The Fees You May Need To Pay

In addition to the fees mentioned above, you could be subject to charges like the resale levy when you put your HDB flat up for sale.

1. Resale Application Administrative Fee

Both the buyer and seller must pay the administrative fee when they submit their part of the resale application on the HDB Resale Portal.

- 1 Room or 2 Room Flat : $40

- 3 Room Flat or Larger : $80

There are three accepted payment methods for the administrative fee. Via the HDB Resale Portal, you can pay with either

- Credit card (Mastercard or Visa)

- PayNow

- AXS

Engaging a licensed property agent can make submitting your application a breeze with the help of their Estate Agent Toolkit!

2. Resale Levy

If you’re planning to purchase a second subsidised flat, don’t forget to include the resale levy in your budget – here are a few situations in which this applies:

The timing of your resale levy payment depends on when you sell your first subsidised flat. For instance, if you offload it before taking possession of the second one, you’ll have to settle the levy with cash upon key collection.

On the other hand, if you already got the keys to your second subsidised flat before selling the first, your resale levy will be deducted from the sale proceeds, with any shortage to be covered in cash.

3. HDB Upgrading Costs

If your flat has gone through any of these upgrading programs, you’ll be responsible for covering the associated upgrade expenses.

- Home Improvement Programme (HIP)

- Lift Upgrading Programme (LUP)

When it comes to the resale of your flat, you’ll need to pay the full cost of upgrading before the transaction can be completed. This amount can be deducted from the cash proceeds of selling the flat, provided you take into account any existing mortgage, HDB charges, and CPF refund.

If not, you’ll have to pay it in cash. And, if the invoice is issued after the resale completion, the buyer will be responsible for it.

For more information, just visit HDB’s website!

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …