TLDR

- Affordability of HDB Market: Government is focused on ensuring affordable public housing and may increase supply if needed. Long-term investment in private property is seen as offering more freedom.

- Seizing Opportunities: HDB prices have fluctuated, presenting opportunities for profit, especially for downgraders from private property. Recent measures aim to address challenges faced by first-time buyers.

- Property Market Cycle: Uncertainty looms with rumors of a recession and rising interest rates affecting property financing. Staying informed and strategic is key for success.

- Property for Retirement: Government recognizes private property ownership as crucial for retirement, exempting those aged 55 and above from certain restrictions.

- Multi-Million Dollar HDB Transactions: Data suggests downsizing from private property has influenced significant transactions, with older buyers making up a notable portion. Recent measures aim to balance the market.

- Current Market Outlook: Transactions are expected to decrease due to cautious approach, impacting sellers and buyers differently. Smart decisions are crucial in the current climate.

Since the 30th of September 2022, the cooling measures have been in effect for over a month, and as a real estate agent in the field, I’ve been inundated with queries from my readers regarding the immediate impact of these measures and their available options. Of particular significance is the 15-month waiting period required of former private property owners who are looking to purchase in the HDB market.

If someone desired to buy a HDB flat after selling their private property, they would need to find alternative housing for at least 18 months, plus an additional 3-4 months of paperwork, prior to being eligible to enter the HDB market. This waiting period seemed to be especially designed to lower the number of million-dollar HDB deals on the resale market.

I am thankful that my clients followed my intuition, especially considering how the property prices have fluctuated in recent years.

As the first month since the implementation of the 2022 cooling measures has passed, here are some of my musings and observations.

#1 The affordability of the HDB market is an enduring necessity.

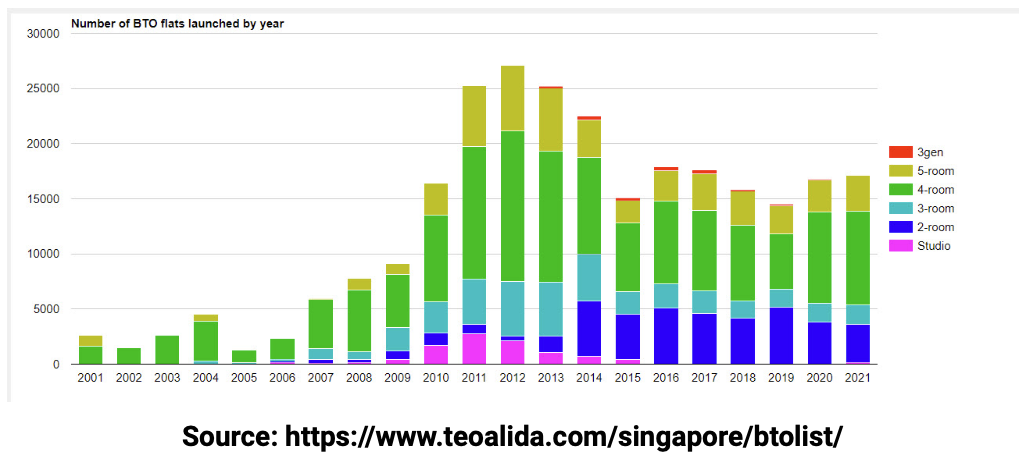

The recent cooling measures have caused much speculation – and the government has been quick to assure the public that it will ramp up the supply of HDB flats by as many as 100,000 units, if needed.

This message has been repeated to us time and time again in various subtle ways – showing just how important affordable public housing is. However, for long-term planning, it is much better to invest in private property, where there is greater “freedom” – though HDB prices will continue to grow, it will always remain a pressing concern for the government should this growth become too unrestrained.

#2 Seize the moment! Don’t let opportunities pass you by – cash in on profits when you can!

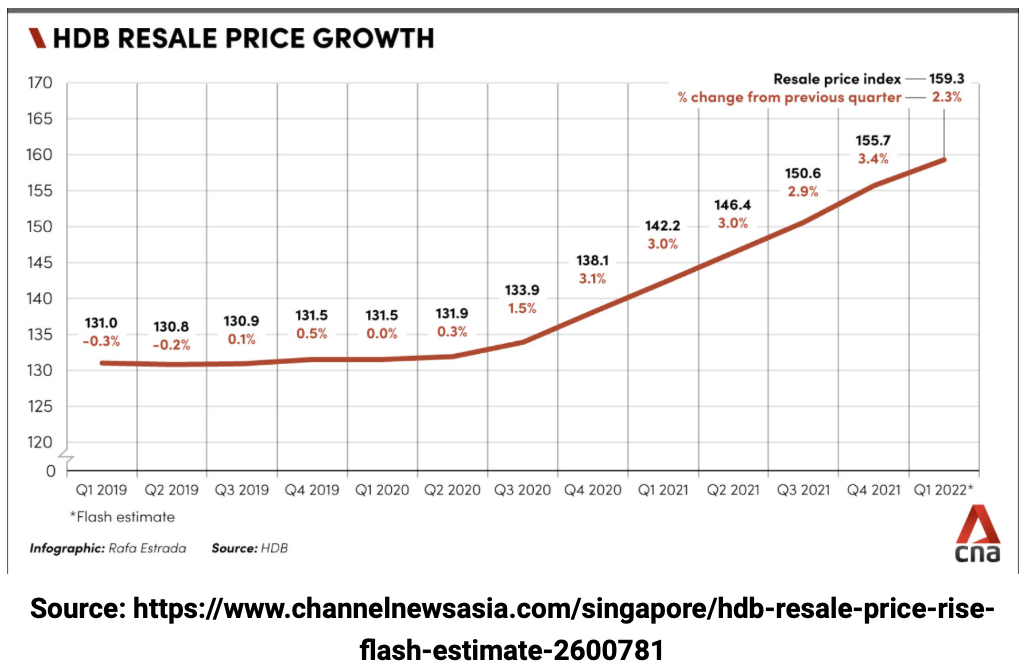

Back in 2019, the talk of the town was all about the HDB prices that had been decreasing for the sixth consecutive year – news headlines declared, “HDB resale prices drop for sixth straight year”. But then, the pandemic of 2020 occurred, and as we come to the end of 2022, we can observe a remarkable shift in the trend, with HDB prices rising rapidly during the past two years.

The pandemic has presented both advantages and disadvantages, particularly for HDB owners with aging flats. For them, this was an excellent opportunity to make some gains, which might not have been possible in the past. Even if they didn’t make a large profit from the sale of their unit, it was still not as financially challenging as it could have been. This resulted in these big and old HDB units becoming highly desirable for private property downgraders.

The pandemic has been a huge setback for first-time buyers; there’s limited supply of resale units, delayed BTO flat completions, and cash-rich buyers pricing them out of the resale market. Understandably, this prompted the government to take action with their most recent cooling measures, which have hopefully put a stop to these struggles. Even still, 4-room HDB flat owners are still enjoying the benefits – such as downgrading retirees having access to that segment.

My clients’ decisive action in taking my advice was a reminder that, while we may not be able to control our environment, we can certainly control our choices and the outcomes of those decisions. Those who took action early on are now rejoicing in their lower purchase prices, while those who sold are celebrating their gains, proving that decisiveness can indeed be rewarded!

#3: The property market is a cycle

Rumors of an impending recession in 2023, coupled with rising interest rates making financing a property more expensive, have many asking if we’re on the verge of exiting this high-stakes real estate cycle. This uncertainty, combined with the recent cooling measures, has led to fewer sellers putting their properties up for sale, leaving private property owners worried about the value of their investments, HDB owners second-guessing their plans to upgrade, and landlords seeing a surge in demand in the rental market.

It won’t be a walk in the park, but the key to success is to stay informed and ensure that you are positioned at the optimum point of the property cycle.

#4 Recognizing property as one of the major building blocks of retirement is a crucial step in securing a comfortable future.

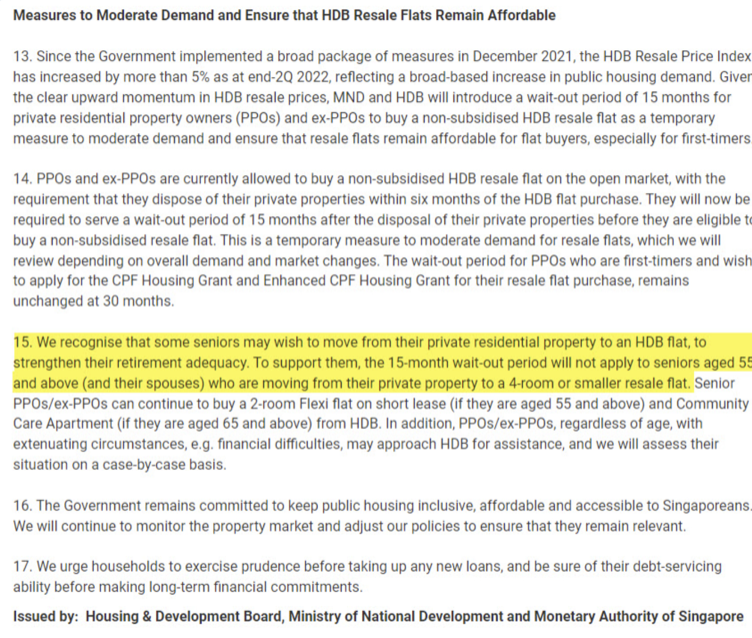

Check out the latest cooling measures captured in the screenshot from the press release below

It is fascinating to recognize that the government has acknowledged the importance of private property ownership in providing a stable retirement by exempting those aged 55 and above from the 15-month wait out period. As a result, these individuals are allowed to downgrade from their private property to a 4-room or smaller HDB flat. Previously, I had written about the advantages of downgrading from private property for retirement, which provides an additional source of income for individuals.

#5 The Mystery Behind Who Purchased the Multi-Million Dollar HDB Flats Unveiled!

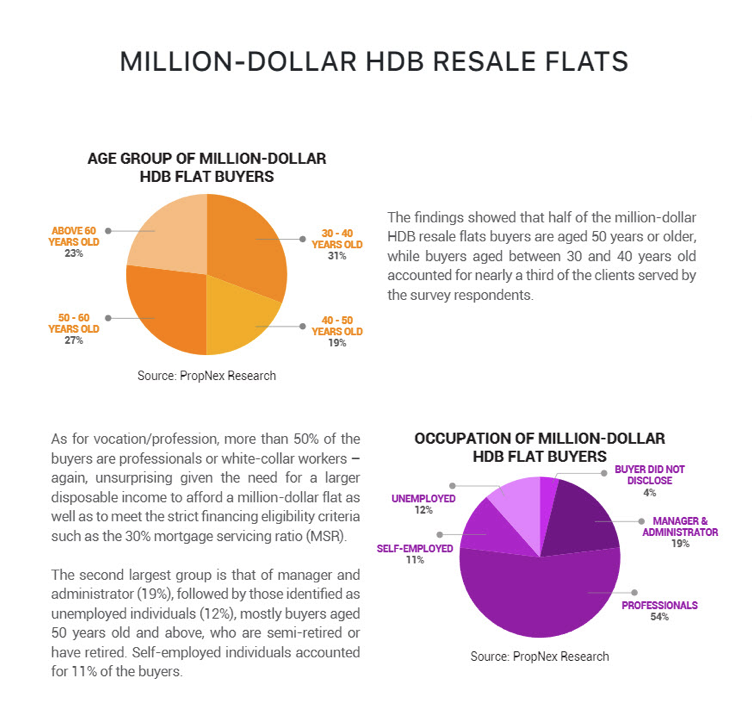

The latest report from PropNex appears to indicate that the majority of people purchasing million-dollar flats are those who are under 55 years old and have downsized from private property, likely in light of the 15-month wait period the government has put in place.

Propnex data reveals a remarkable statistic – nearly half of all HDB resale flat buyers who paid more than one million dollars were 50 years old and above. This data serves to emphasize the financial capability of this age group to purchase these large flats. Interestingly, the introduction of a wait-out period appears to have greatly diminished the number of million-dollar HDB flat transactions in the news.

Conclusion

At present, people are adopting a “wait-and-see” approach, meaning that transactions will be reduced in order to calm the heated property market. For sellers of 5-room HDB flats and larger units, the number of potential buyers has dwindled due to the restriction of private property downgraders. On the other hand, buyers now have less competition and an interesting opportunity in the current climate. I did not discuss the new Loan-To-Value ratio as I believe it is relatively moderate.

After years of low interest rates, I believe it’s high time for interest rates to increase and temper inflation. To make the wisest decisions for the long-term, when buying a property, ensure that it has the potential for greater upside than downside, and when selling a property, make sure you capture the necessary gains to safeguard your next purchase.

With all the transactions I’ve seen, I’m confident that if we make smart decisions now, we’ll be well-prepared for what lies ahead.

Thanks to the amount of experience I have in the market – from the frequency of transactions and negotiations I’m involved in – I’m able to identify patterns and foresee outcomes better than the average person. With a yearly average of 120 – 150 families that I meet, which is multiple times more than what most agents do, I can confidently provide solutions and property options for anyone seeking assistance. Should you have any queries, feel free to drop me a WhatsApp message – no obligation, of course.

You May Also Like …