Singapore’s property market has always been a hot topic among investors, both local and international. With its strong economy, stable political climate, and attractive investment opportunities, it’s no wonder that many people are drawn to invest in the city-state’s real estate sector.

However, there are certain misconceptions and dangerous ideas that some property investors hold, which could potentially lead to poor investment decisions and financial losses.

We will explore five of these dangerous ideas and debunk them to help you make informed choices when investing in Singapore’s property market.

1. Property prices will always go up

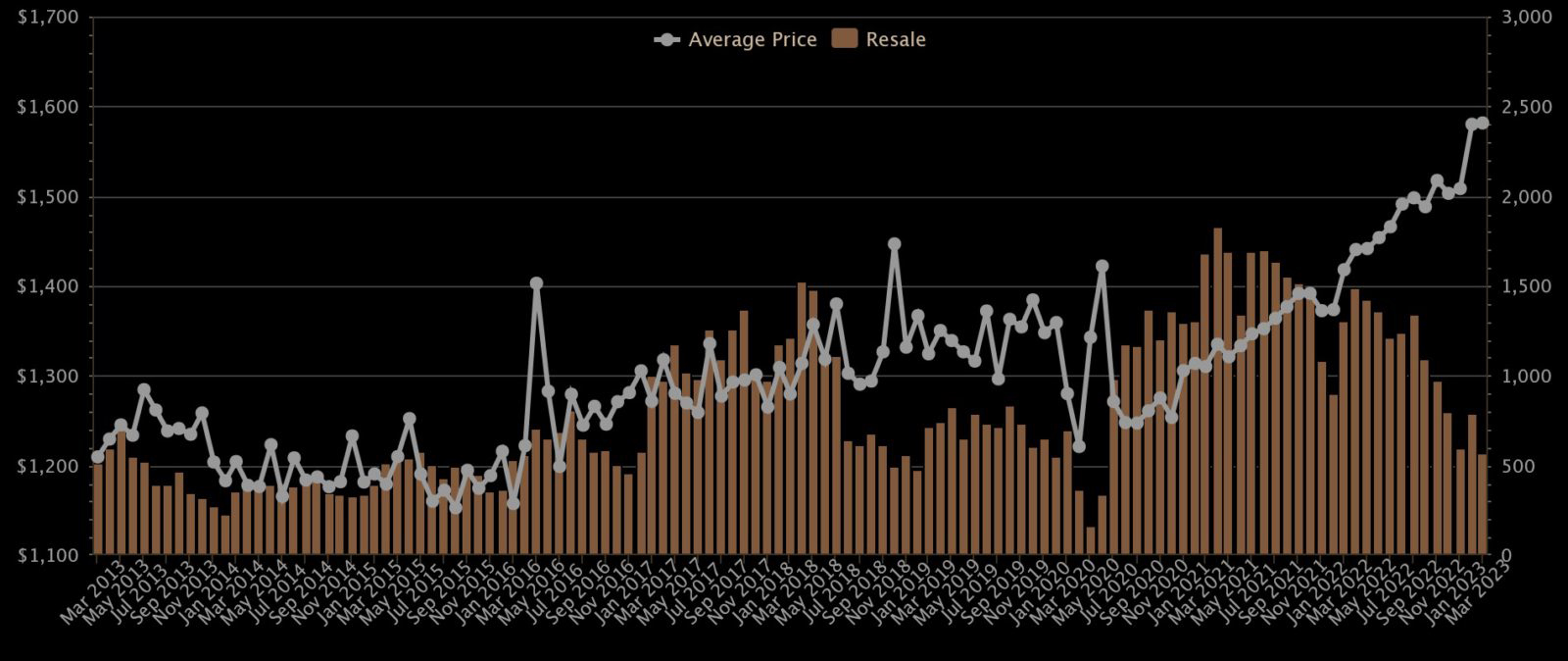

One of the most common misconceptions is that property prices in Singapore will always rise. While it’s true that the country has experienced significant growth over the past few decades, it’s important to remember that no market can sustain perpetual growth. There will be periods of stagnation or even decline. Assuming that property prices will always go up can lead to overconfidence and poor investment decisions.

2. Rental income guarantees positive cash flow

Another dangerous idea is that rental income from a property will always cover its mortgage payments and other expenses, ensuring a positive cash flow. However, this is not always the case. Factors such as vacancy rates, maintenance costs, and changes in rental demand can affect the profitability of a rental property. Investors should carefully analyze these factors before making an investment decision.

3. Buying a property during a downturn is always a good deal

Some investors believe that purchasing a property during a market downturn guarantees a good deal. While it’s true that property prices tend to be lower during a downturn, it doesn’t necessarily mean that it’s the best time to buy. Market conditions, interest rates, and the overall economic climate should also be considered when determining the right time to invest.

4. Investing in prime districts guarantees high returns

While properties in prime districts tend to command higher prices and rental rates, it doesn’t automatically guarantee high returns. Investors should consider factors such as the property’s age, potential for capital appreciation, and rental yield before making a decision. Additionally, prime districts can also experience market fluctuations, so it’s essential to have a diversified investment portfolio.

5. Leverage is always good

Leverage, or using borrowed money to invest in property, can be a powerful tool when used correctly. However, some investors mistakenly believe that more leverage is always better. Excessive leverage can lead to financial difficulties if property prices decline or if there are sudden changes in interest rates. It’s crucial to maintain a healthy balance between leverage and equity to minimize risk.

Investing in Singapore’s property market can be a rewarding endeavor, but it’s essential to approach it with a clear understanding of the risks and challenges involved. By debunking these five dangerous ideas, investors can make more informed decisions and avoid common pitfalls. Remember to conduct thorough research, consider market conditions, and maintain a diversified portfolio to maximize your chances of success in the Singapore property market.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …