The Singapore government has implemented several cooling measures over the years to regulate the property market and prevent it from overheating. The measures are aimed at controlling property prices, curbing speculative activity, and promoting a sustainable approach to property investing.

We will explore in detail the impacts of the Singapore government’s cooling measures on property investing.

Impacts of the Cooling Measures:

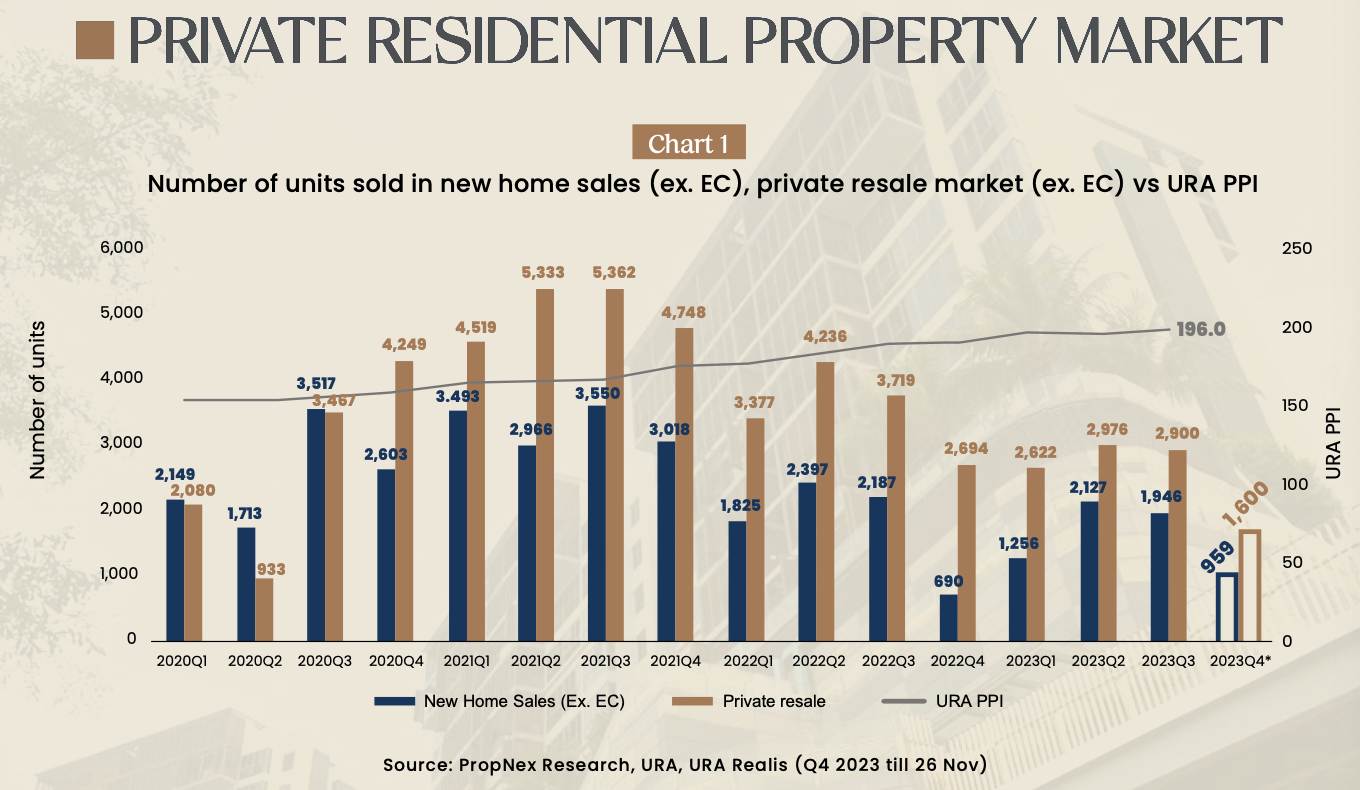

- Increase in Property Prices: One of the key impacts of the cooling measures is that they have led to an increase in property prices. The measures, such as the Additional Buyer’s Stamp Duty (ABSD), have made it more expensive for investors to purchase properties in Singapore. This has resulted in a decrease in demand from investors and an increase in prices, as fewer properties are being sold.

- Decreased Demand: The cooling measures have also led to a decrease in demand for properties, especially among investors. The ABSD, for example, has made it more difficult for investors to purchase multiple properties, and this has resulted in a decrease in demand from this group. This, in turn, has led to a decrease in prices as there are fewer buyers in the market.

- Greater Affordability for Homebuyers: On the other hand, the cooling measures have made properties more affordable for homebuyers, especially first-time buyers. The government has implemented measures such as the Total Debt Servicing Ratio (TDSR) to ensure that homebuyers do not overextend themselves financially when purchasing properties. This has made it easier for homebuyers to purchase properties and has helped to stabilize the property market.

- Focus on Long-Term Investment: The cooling measures have also led to a greater focus on long-term investment in properties. Investors are now more likely to hold onto their properties for longer periods rather than flipping them quickly for a profit. This has helped to create a more stable property market in Singapore and has reduced speculation.

- More Stable Property Market: Overall, the cooling measures have helped to create a more stable property market in Singapore. The measures have reduced speculation and encouraged a more sustainable approach to property investing, which has helped to avoid the kind of property bubbles that have caused problems in other countries. The measures have also made it easier for homebuyers to purchase properties, which has helped to stimulate the property market and create a more balanced supply and demand dynamic.

The Singapore government’s cooling measures have had a significant impact on property investing in the country. The measures have helped to regulate the property market, control prices, and promote a more sustainable approach to property investing. While the measures have led to an increase in property prices and a decrease in demand from investors, they have also made properties more affordable for homebuyers and created a more stable property market. Ultimately, the cooling measures have helped to create a more balanced and sustainable property market in Singapore.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …