TLDR

Jayson Ang discusses the essential factors to consider when seeking a property for investment. By analyzing the safe entry price and price gap, clients can make informed decisions. The case study of Cairnhill 16 highlights its attractive entry point compared to other regions, positioning it as a smart investment choice. With the narrowing price gap between different regions and the potential for high returns, investing in freehold properties like Cairnhill 16 in the Core Central Region could be a wise move. Jayson also offers personalized advice, data-driven insights, and strategic real estate solutions tailored to individual needs, guiding investors through their property journey effectively.

What two factors should clients consider when seeking a property to purchase, in order to decide if it is a worthwhile investment?

Safe Entry Price & Price Gap

Let’s make use of Cairnhill 16 as a case study to determine these two key factors.

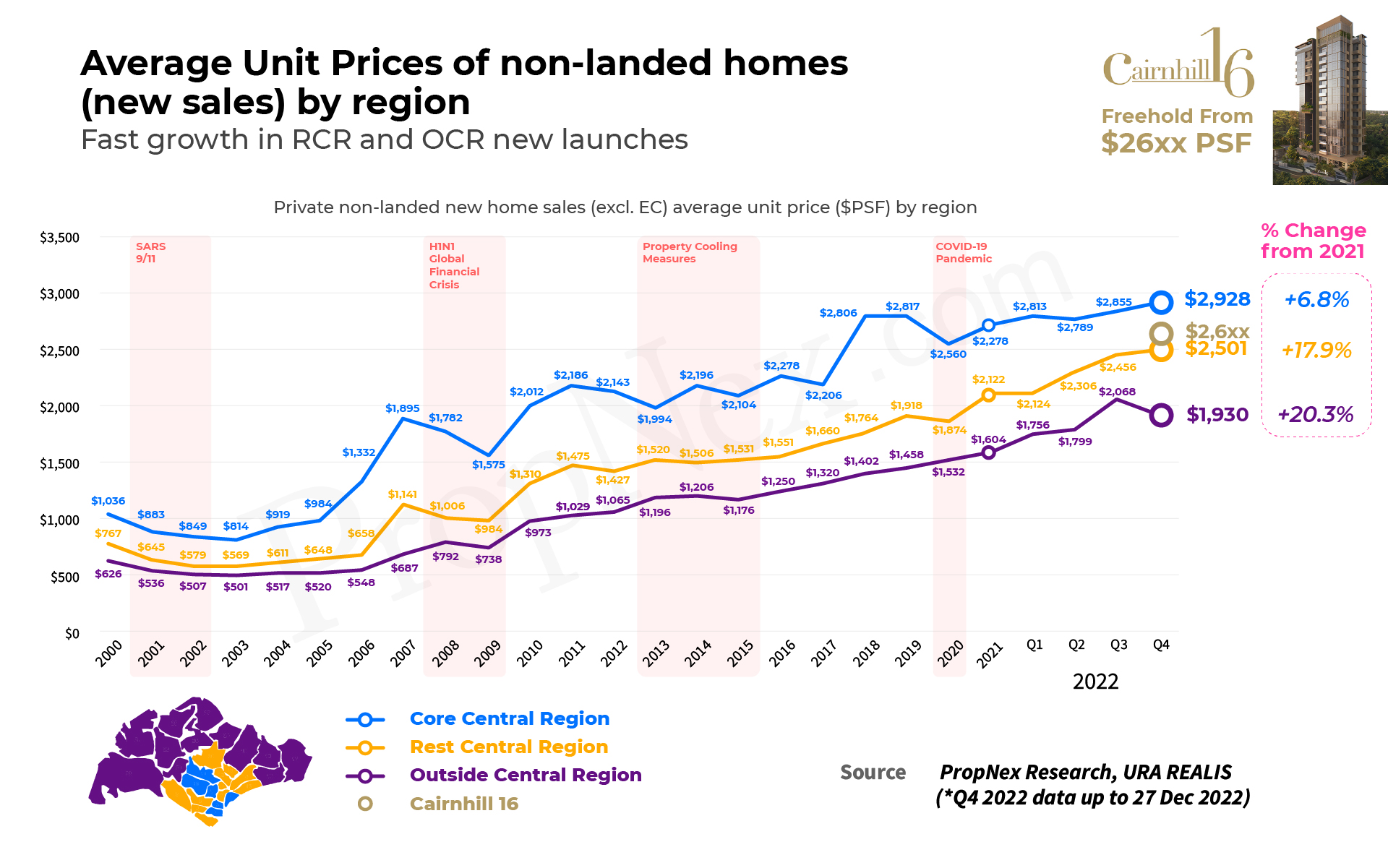

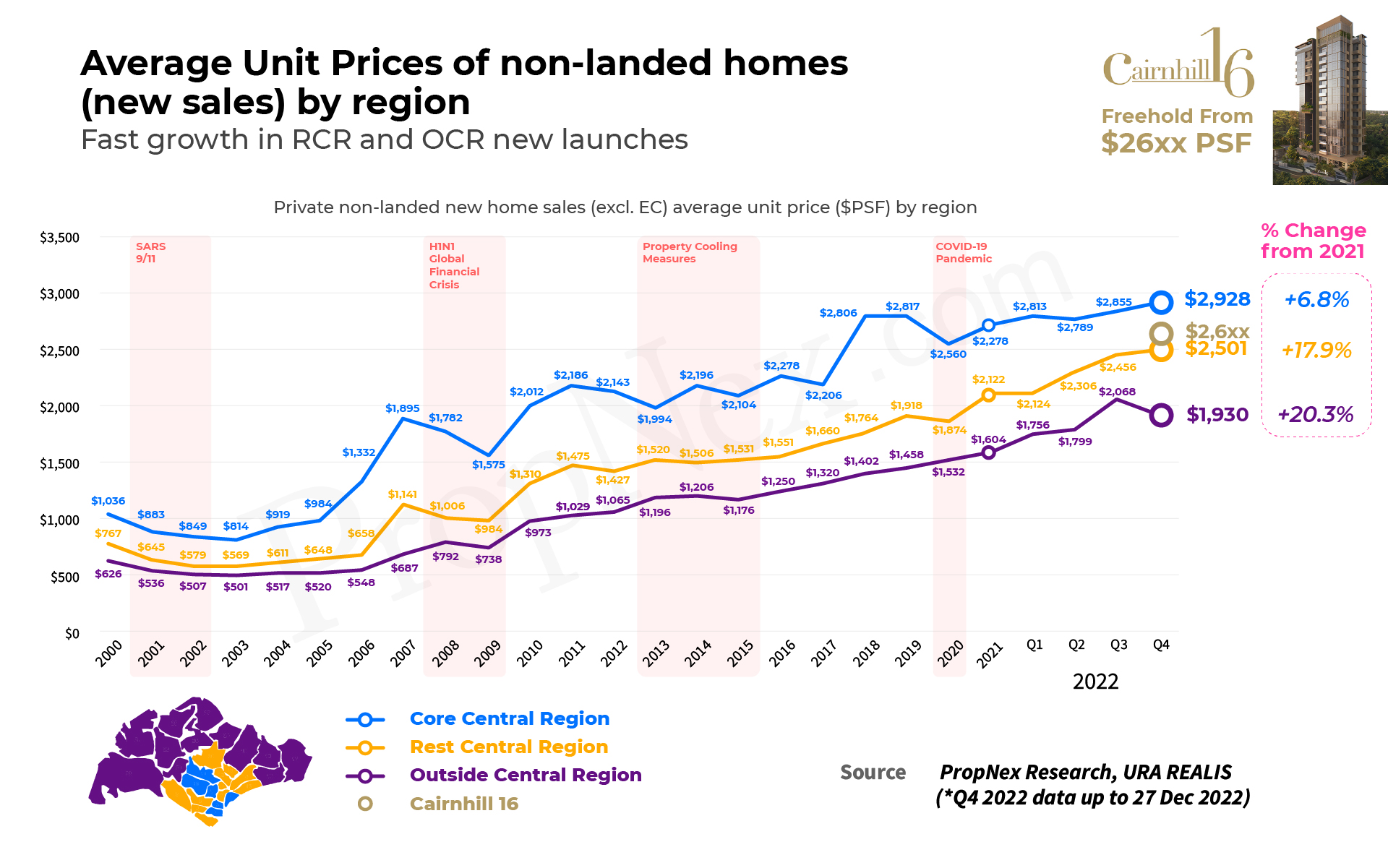

It’s already quite clear that Cairnhill 16, as a freehold property, offers a relatively secure entry point at $2,6XX psf – an attractive proposition compared to 99-year leaseholds in the Outside Central Region (OCR) and Rest of Central Region (RCR), starting from $2,1XX and $2,4XX psf respectively, and with Core Central Region (CCR) properties averaging $2,8XX.

Determining A Safe Entry Price

It’s clear from Figure 1 that the entry price for Cairnhill 16 is below the average for new sales in the CCR – the price gap between RCR and CCR properties has narrowed significantly. This makes Cairnhill 16 a smart choice for entry, as the rising prices of homes in the OCR and RCR have shrunk the difference between them.

Price Gap Between RCR & CCR Narrowing

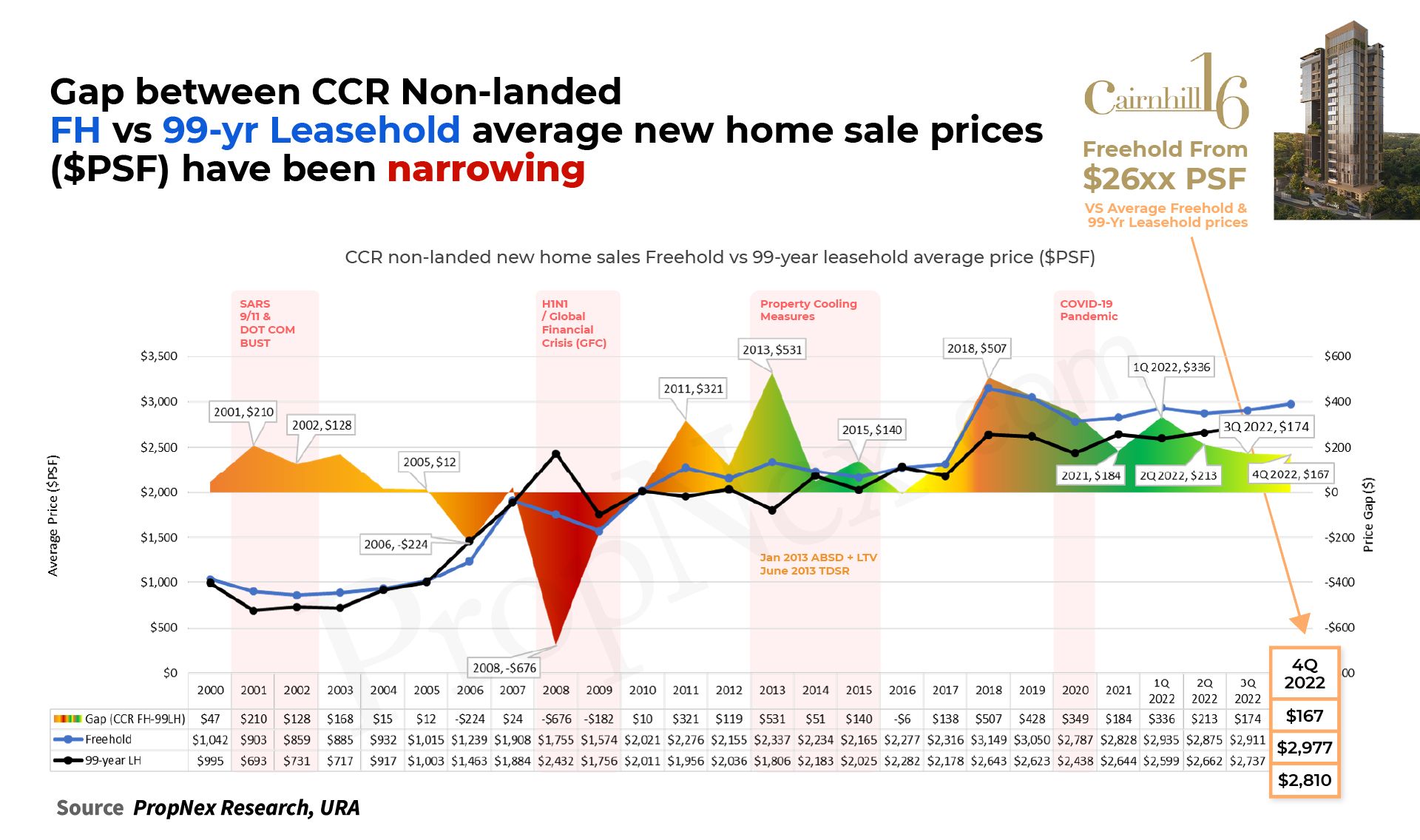

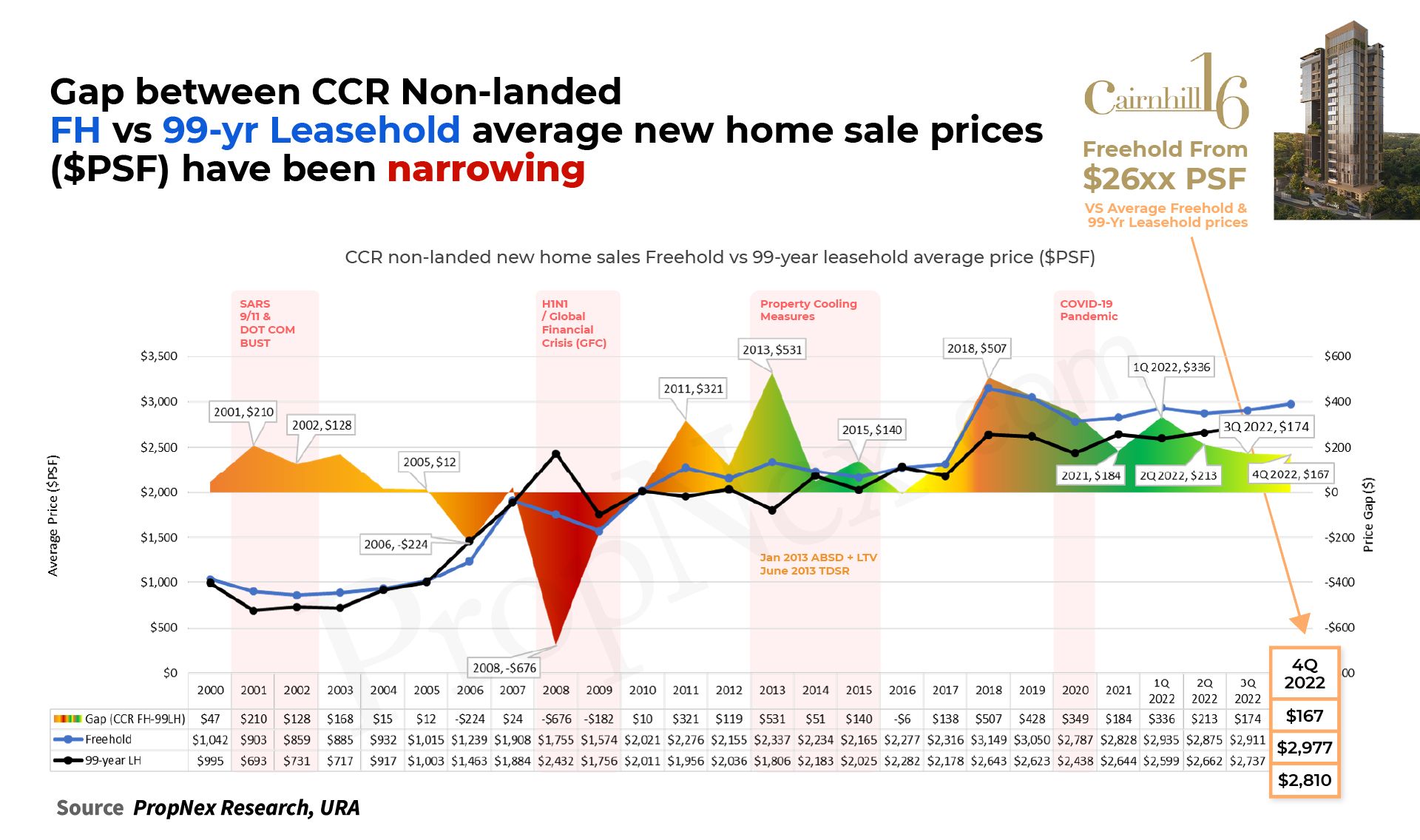

Imagine being able to buy a luxurious freehold CCR project for the same price as the average RCR home!

From Figure 2, we can see that the average price of a new home sale in the RCR and CCR has been narrowing throughout the years. In particular, 4Q 2022 saw the average price of a new home sale in RCR reach $2,659 – approximately the entry price of Cairnhill 16 at $2,6XX psf. What an incredible opportunity!

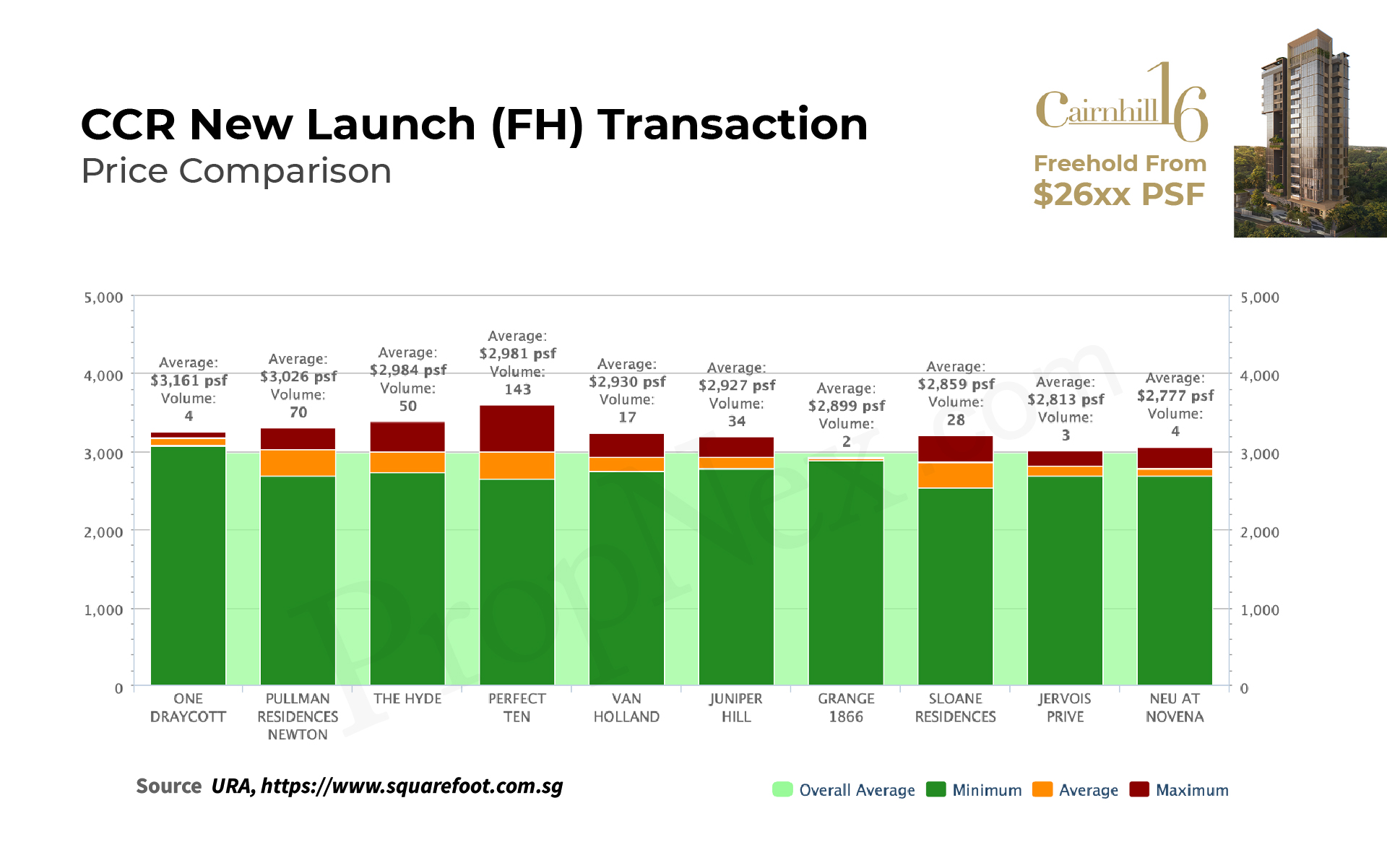

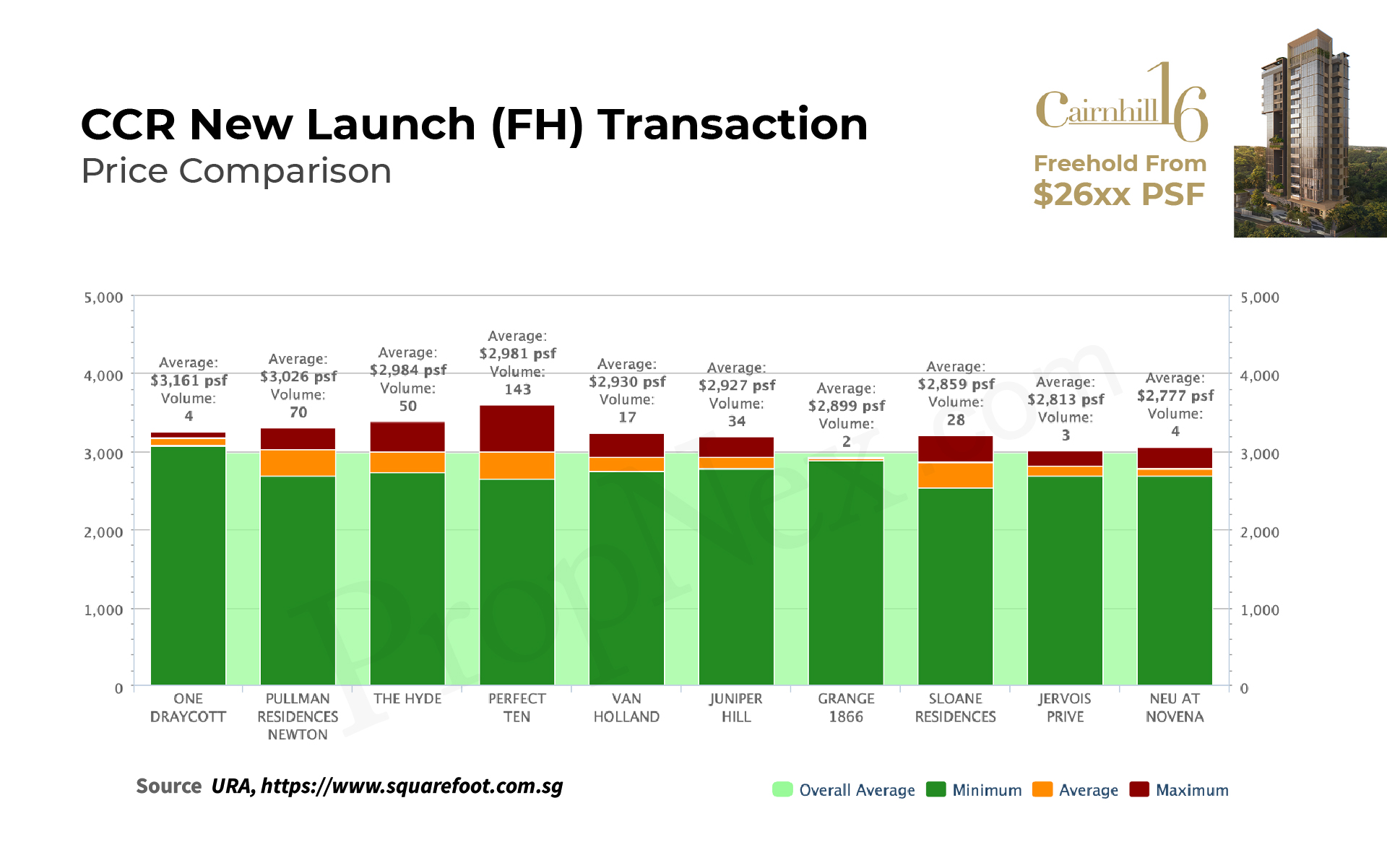

Finally, let us analyze Figure 3, demonstrating the cost of freehold new launches in the CCR; the price range runs from $2,777 to $3,161, doesn’t it make Cairnhill 16 a wise choice for investment?

This year is set to be a exciting time for Core Central Region, with its price offering an attractive alternative investment opportunity to Rest of Central Region.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …

Jayson Ang – April 28, 2024 – Share

Investing in property is a popular way to build wealth and achieve financial freedom in Singapore. With the right strategies...

Read More

Jayson Ang – June 16, 2024 – Share

TLDR The 2024 Budget introduces changes to property tax bands, aiming to ensure fair taxation based on Annual Value (AV)...

Read More

Jayson Ang – September 16, 2024 – Share

In today's uncertain global economic climate, investors are constantly on the lookout for safe havens to park their wealth. Amidst...

Read More

Jayson Ang – February 23, 2024 – Share

Here are my top 5 picks for districts in Singapore that offer easy access to some of the best shopping...

Read More

Jayson Ang – June 2, 2024 – Share

Singapore is known for being one of the most expensive cities in the world, particularly when it comes to property...

Read More

Jayson Ang – September 22, 2024 – Share

Singapore, a thriving financial hub and one of the world's wealthiest nations, has become an attractive destination for luxury property...

Read More

Jayson Ang – July 10, 2024 – Share

The future of Singapore's property market is shaped by several emerging trends that reflect cautious optimism, enviable locations, and sociable...

Read More

Jayson Ang – February 11, 2024 – Share

Madam Tan voiced that approximately two years ago, when her apartment hit its minimum occupation period, she and her spouse...

Read More

Jayson Ang – July 27, 2023 – Share

TLDR The blog post discusses the increased demand for HDB resale flats and the impact on prices. It emphasizes the...

Read More

Jayson Ang – May 4, 2024 – Share

TLDR When deciding on buying or selling property in Bayshore, consider the recent developments and potential future growth. With a...

Read More

Jayson Ang – May 18, 2024 – Share

Investing in Singapore property can be a profitable venture, but investors must choose the right strategy to maximize their returns....

Read More

Jayson Ang – September 28, 2024 – Share

Singapore, a bustling city-state known for its modern architecture and vibrant culture, is also a haven for runners seeking scenic...

Read More

Jayson Ang – August 25, 2024 – Share

Singapore, a thriving city-state with a robust economy and a strong demand for real estate, has always been an attractive...

Read More

Jayson Ang – May 7, 2024 – Share

Singapore's property scene has always been a powerhouse, effortlessly combining the new with the old. It's a real estate playground...

Read More

Jayson Ang – December 10, 2023 – Share

TLDR When it comes to navigating the ups and downs of the Singapore property market, timing is crucial. Three real-life...

Read More

Jayson Ang – October 23, 2023 – Share

TLDR Understanding property valuations is crucial for both buyers and sellers in the real estate market. Property valuations involve two...

Read More

Jayson Ang – December 18, 2022 – Share

TLDR When it comes to property transactions, understanding the factors influencing rising prices is crucial. The pandemic has driven up...

Read More

Jayson Ang – December 31, 2022 – Share

TLDR When deciding to sell your house in Singapore's competitive real estate market, timing is crucial. Selling during a seller's...

Read More

Jayson Ang – August 13, 2024 – Share

Singapore, a small island nation with a thriving economy, has long been considered an attractive destination for property investment. The...

Read More

Jayson Ang – February 2, 2024 – Share

TLDR The blog post discusses the recent relaxation of real estate restrictions in Hong Kong, contrasting with Singapore's stricter regulations....

Read More