TLDR

When it comes to real estate investments in Singapore amidst rising inflation rates, consider strategies such as capitalizing on property price increases, adjusting rental rates, opting for fixed-rate mortgages, and investing in revenue-producing properties for retirement savings. Focus on properties with short-term leases, passable price increases to tenants, and those in desirable locations. With the current market conditions and potential future scenarios, it might be the right time to make a well-thought-out plunge into real estate investment.

Inflation rates have risen 2.5% to 3.5% this year, and bank loan rates surpassed HDB’s 2.6% rate. In light of these increasing figures, how can you use real estate to protect yourself against inflation?

Singapore’s core inflation has been on the upswing, with projections suggesting it will peak in the first quarter of 2023 – surpassing its previous forecast range of 2.5% to 3.5%. Meanwhile, supply chain disruptions, restrictive labour market conditions, and higher commodity prices have all contributed to a marked spike in consumer prices. It’s no wonder our wallets feel a bit lighter than usual – and it looks like they’ll stay that way for a while!

Are you worrying about inflation taking a toll on your finances? I’ve found a great solution: investing in real estate to counteract the rising costs of mortgage rates!

What Real Estate Inflation Hedging Strategies Can Benefit You?

The Rise Of Inflation Spurs A Rise In Property Prices

With raw material costs on the rise, property prices are bound to go up. Real estate and rental income have a tendency to remain steady even with inflation, and investors have the potential to reap greater rewards than the market when it comes to inflation.

Rising Inflation Has A Tendency To Push Up Rental Costs

It’s clear that as property prices rise, so does rent. Taking advantage of this, why not charge a higher rent on your property to make your monthly repayments more manageable and cover the cost of upkeep? Even better, if your rental costs exceed inflation, you’ll be earning a steady stream of passive income!

Your Mortgage Payments Will Decrease With Time

When it comes to buying a property, if you opt for a fixed-rate loan, the cost will be based on the property’s value at the time of purchase. On the other hand, if you decide to rent, your costs could rise with the value of the property, but you could save in the long run if you go for a fixed-interest mortgage, as inflation will take its toll.

Your Retirement Funds Can Be Safeguarded From The Adverse Consequences Of Inflation

In a few years, your retirement funds won’t be worth nearly as much as it is today due to inflation; hence, your purchasing power will be hindered. To protect your retirement savings from inflation, owning a revenue-producing property could be a helpful solution.

The Range Between The Bid And Breakeven Prices For New Launches Will Be Greater

As labour costs and raw material prices rise, the difference between the breakeven/launch price and the bidding price of new launches will widen significantly.

Property Values Are Often Seen To Rise In The Long-Run

Property prices in Singapore are expected to keep soaring as residential properties tend to appreciate over time due to population growth, land demand, infrastructure upgrades and other contributing factors. Many investors have identified real estate investments as an ideal way to protect themselves against inflation.

During Inflation, What Kind Of Real Estate Investment Should I Seek Out?

Properties With A Short-Term Lease

Rather than long-term property leases that could miss out on the rewards of inflation, short-term leases have the advantage of often resetting rental rates to prevailing market levels.

Property Owners Can Pass On Price Increases To Their Tenants

Investing in residential properties or any other asset that enables you to capitalize on rising rental rates during periods of inflation is a lucrative endeavour. Conversely, investing in a commercial space in a shopping mall could result in little reward if retailers opt to shut down shop.

Properties Highly Sought-After In Desirable Locations

Having tenants that bring in income, especially on a short-term lease, is essential; and properties located in desirable locations generally don’t have difficulty attracting interested tenants. Therefore, it’s critical to pay attention to the location and durability of your property. It’s a great idea to keep an eye out for the following:

- Where upcoming MRT stations are being located

- Future projects within an area

- The government’s infrastructure plans

Is Now The Ideal Moment To Make A Plunge Into Real Estate Investment?

Due to inflation, those wishing to own a home may now be required to allocate more money for mortgage payments as some banks have raised their fixed-interest rates.

But, when you opt for a fixed-rate loan to purchase a home, it won’t be affected by inflation for the duration of the fixed-period. This could be quite beneficial for you, since you’ll be paying for the value of the home at the time of purchase rather than its potentially inflated cost.

Additionally, you may wish to research other mortgage loan options that feature fixed-interest rates that remain consistent.

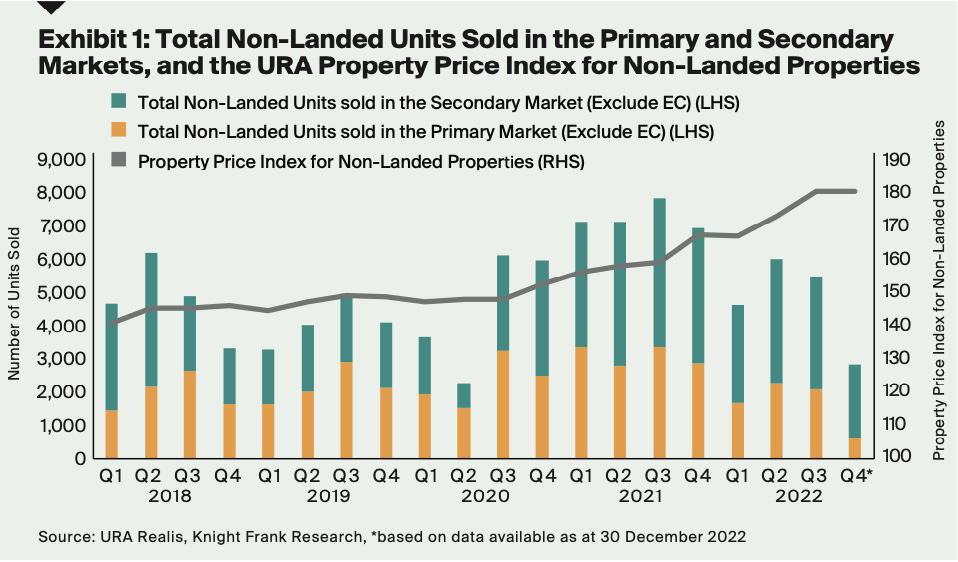

Data.gov.sg has highlighted a significant increase in the private property market in the past 10 years, increasing from 53.6% in 2010 to 2020. With such a rise, investors can anticipate the value of their home investments to appreciate.

Even during the pandemic, the property market remained resilient, resulting in the government introducing stricter measures, such as higher ABSD rates, tighter TDSR ceilings and a decrease in the LTV limit for HDB loans.

Necessary steps must be taken to avoid the risk of a destabilising correction in the future. Consequently, borrowers should anticipate a rise in interest rates in the coming years. However, as a buyer, you reap the rewards of investing in a home right now, with many condo developments offering early bird discounts, allowing you to gain even more.

In the long run, investing in real estate is typically a safe bet despite inflation. The key is to select an income-producing property strategically, and be in a financial position to make this a long-term commitment. This could prove rewarding with rental and capital value growth, thereby strengthening your buying power until retirement.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …